Global Home Care Testing Market Size, Share, and COVID-19 Impact Analysis, By Product (Strip, Cassette, Test Panel, Midstream, Dip Card, and Others), By Age (Pediatric, Adult, and Geriatric), By Sample (Urine, Saliva, Blood, and Others), By Test Type (HIV Test Kit, Diabetes & Glucose Tests, Cholesterol & Triglycerides Tests, Pregnancy Tests, Infectious Diseases Tests, Urinary Tract Infection Tests, and Others), By Distribution Channel (Retail Pharmacies, Supermarket/Hypermarket, and Online Pharmacies), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2032

Industry: HealthcareGlobal Home Care Testing Market Insights Forecasts to 2032

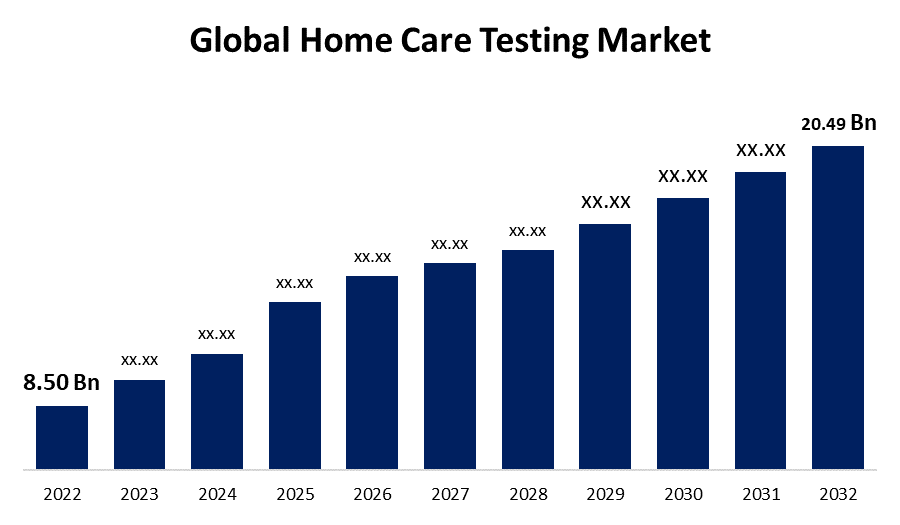

- The Global Home Care Testing Market Size was valued at USD 8.50 Billion in 2022.

- The Market is growing at a CAGR of 9.2% from 2023 to 2032

- The Worldwide Home Care Testing Market Size is expected to reach USD 20.49 Billion by 2032

- Asia-Pacific is expected to grow higher during the forecast period

Get more details on this report -

The Global Home Care Testing Market Size is expected to reach USD 20.49 Billion by 2032, at a CAGR of 9.2% during the forecast period 2023 to 2032.

Market Overview

Home care testing refers to medical tests and diagnostic procedures that can be performed by individuals in the comfort of their own homes. This approach offers convenience, privacy, and accessibility to a wide range of health assessments. Home care testing typically involves the use of test kits that are designed for self-administration, allowing individuals to collect samples such as blood, urine, or saliva, and then send them to a laboratory for analysis. Common home care tests include pregnancy tests, blood glucose monitoring for diabetes, cholesterol checks, and genetic testing. These tests enable individuals to monitor their health conditions, detect certain diseases or conditions early, and make informed decisions about their well-being. While home care testing can be a valuable tool, it's important to consult healthcare professionals for accurate interpretation and guidance based on the test results.

Report Coverage

This research report categorizes the market for home care testing market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the home care testing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the home care testing market.

Global Home Care Testing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 8.50 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 9.2% |

| 2032 Value Projection: | USD 20.49 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Product, By Age, By Sample, By Test Type, By Distribution Channel, By Region, and COVID-19 Impact Analysis |

| Companies covered:: | Abbott, BD, Quidel Corp., BioSure, F. Hoffmann-La Roche Ltd., Nova Biomedical, Siemens Healthcare GmbH, ACON Laboratories, Inc., OraSure Technologies, Inc., Chembio Diagnostics, Inc. |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Driving Factors

The home care testing market is driven by several key factors, the growing demand for convenient and accessible healthcare options fuels the adoption of home care testing. Individuals seek the flexibility to conduct medical tests from the comfort of their homes, saving time and reducing the need for frequent clinic visits. Additionally, advancements in technology and the development of user-friendly test kits have made home testing more accurate and reliable, further driving market growth. The rising prevalence of chronic diseases, such as diabetes and cardiovascular conditions, also contributes to the increased demand for home care testing. Furthermore, the COVID-19 pandemic has highlighted the importance of remote testing, leading to a surge in demand for at-home diagnostic solutions. Overall, these drivers are expected to continue propelling the growth of the home care testing market in the foreseeable future.

Restraining Factors

While the home care testing market exhibits significant growth potential, there are also certain restraints that need to be considered. One key restraint is the potential for misinterpretation or mismanagement of test results by individuals without proper medical expertise. Without professional guidance, there is a risk of incorrect diagnoses or inadequate follow-up care. Additionally, reimbursement policies and insurance coverage may pose a challenge, as some insurers may not fully cover home care testing expenses. Moreover, regulatory compliance and quality assurance standards must be upheld to ensure the accuracy and reliability of home testing kits. These restraints emphasize the need for proper education, guidance, and regulation to ensure the safe and effective use of home care testing.

Market Segmentation

- In 2022, the strip segment accounted for around 27.65% market share

On the basis of the product, the global home care testing market is segmented into strip, cassette, test panel, midstream, dip card, and others. The strip segment has emerged as the dominant force in the home care testing market for several reasons. Strips are widely used in various diagnostic tests, such as glucose monitoring for diabetes, pregnancy tests, and urine analysis. These tests often require the collection of bodily fluids, and strips provide a convenient and easy-to-use method for sample application and analysis. Additionally, strip-based tests are typically cost-effective compared to other testing methods, making them more accessible to a larger population. The simplicity and quick results of strip tests have also contributed to their popularity among consumers. Furthermore, advancements in strip technology, including improved accuracy and sensitivity, have further strengthened their position in the market. The availability of a wide range of strip-based testing options for different conditions and diseases has also propelled the growth of this segment. Overall, the strip segment's dominance can be attributed to its convenience, affordability, accuracy, and versatility in catering to various home testing needs.

- In 2022, the retail pharmacies segment dominated with more than 48.35% market share

Based on the distribution channel, the global home care testing market is segmented into retail pharmacies, supermarket/hypermarket, and online pharmacies. The retail pharmacies segment has emerged as the dominant force in the home care testing market for several reasons. Retail pharmacies serve as accessible and convenient points of sale for home testing kits and related products. They have a wide network of outlets, making them easily accessible to a large population, including individuals seeking home care testing solutions. Moreover, retail pharmacies often have trained pharmacists who can provide guidance and recommendations on suitable home testing kits based on the customer's needs. The retail pharmacy setting also offers a level of trust and familiarity for consumers, as they are accustomed to obtaining medications and healthcare products from these establishments. Additionally, retail pharmacies often have established relationships with healthcare providers and can facilitate referrals or collaborations for further medical guidance. The dominance of the retail pharmacies segment is further fueled by partnerships and collaborations between pharmacies and diagnostic test manufacturers, leading to increased availability and promotion of home testing kits. Overall, the strong presence, accessibility, guidance, and trust associated with retail pharmacies contribute to their dominance in the home care testing market.

Regional Segment Analysis of the Home Care Testing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America dominated the market with more than 32.65% revenue share in 2022.

Get more details on this report -

Based on region, North America has emerged as a dominant player in the Home Care Testing market, holding the largest share for several reasons, the region benefits from a well-developed healthcare infrastructure and advanced technology, which supports the growth of home care testing. The high healthcare expenditure in North America allows for significant investment in research and development, leading to the development of innovative and reliable home testing kits. Moreover, the region has a strong emphasis on patient-centric care and consumer empowerment, with a growing demand for convenient and accessible healthcare options. Additionally, the prevalence of chronic diseases, such as diabetes, obesity, and cardiovascular conditions, in North America drives the need for regular monitoring and testing, which further fuels the demand for home care testing. Furthermore, favorable reimbursement policies and insurance coverage for home testing in some countries within North America contribute to its market dominance in the industry.

Recent Developments

- In January 2023, In response to the COVID-19 epidemic, the National Institutes of Health (NIH) started a pilot project called Home Test to Treat. In order to assist patients, manage their symptoms and provide them advice on how to effectively care for themselves when they are alone, the programme seeks to offer patients at-home COVID-19 testing kits and telemedicine services.

- In February 2023, R.R. Donnelley & Sons Company (RRD) recognized the increasing demand for at-home testing and expanded its diagnostic test kit solution accordingly. By doing so, RRD aims to cater to the growing market need for convenient and accessible diagnostic solutions that can be used in the comfort of one's home. This expansion allows RRD to provide customers with reliable and user-friendly test kits, helping individuals monitor their health and detect diseases early while enjoying the benefits of at-home testing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global home care testing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Abbott

- BD

- Quidel Corp.

- BioSure

- F. Hoffmann-La Roche Ltd.

- Nova Biomedical

- Siemens Healthcare GmbH

- ACON Laboratories, Inc.

- OraSure Technologies, Inc.

- Chembio Diagnostics, Inc.

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global home care testing market based on the below-mentioned segments:

Home Care Testing Market, By Product

- Strip

- Cassette

- Test Panel

- Midstream

- Dip Card

- Others

Home Care Testing Market, By Age

- Pediatric

- Adult

- Geriatric

Home Care Testing Market, By Sample

- Urine

- Saliva

- Blood

- Others

Home Care Testing Market, By Test Type

- HIV Test Kit

- Diabetes & Glucose Tests

- Cholesterol & Triglycerides Tests

- Pregnancy Tests

- Infectious Diseases Tests

- Urinary Tract Infection Tests

- Others

Home Care Testing Market, By Distribution Channel

- Retail Pharmacies

- Supermarket/Hypermarket

- Online Pharmacies

Home Care Testing Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?