Global Home Insurance Market Size, Share, and COVID-19 Impact Analysis, By Coverage (Dwelling Coverage, Content Coverage, and Liability Coverage), By End User (Landlords and Tenants), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Banking & FinancialGlobal Home Insurance Market Insights Forecasts to 2033

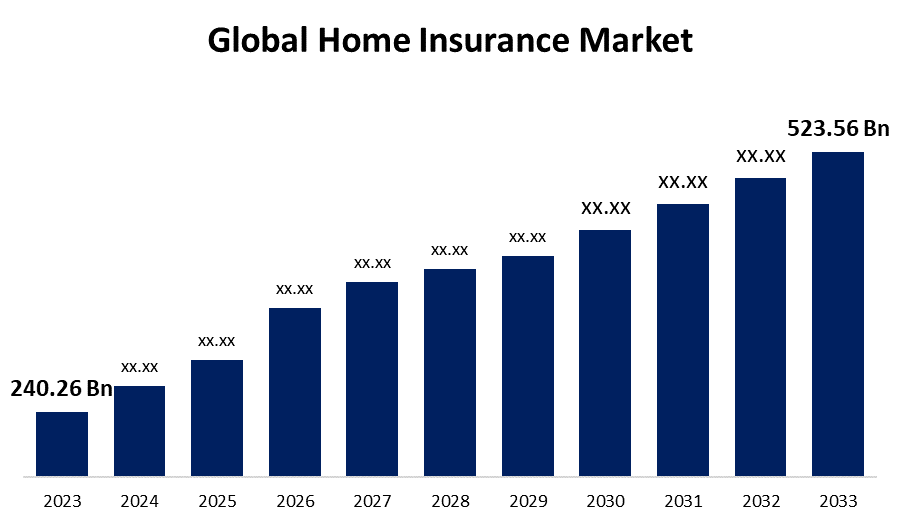

- The Global Home Insurance Market Size was Valued at USD 240.26 Billion in 2023

- The Market Size is Growing at a CAGR of 8.10% from 2023 to 2033

- The Worldwide Home Insurance Market Size is Expected to Reach USD 523.56 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Home Insurance Market Size is Anticipated to Exceed USD 523.56 Billion by 2033, Growing at a CAGR of 8.10% from 2023 to 2033.

Market Overview

Home insurance is an insurance policy that covers the expenses and damage to the home or any insured property. It is a form of property insurance and one of the several types of general insurance products. Another name for home insurance is homeowner's insurance. It protects the built-home, owned home, rental apartment, bungalow, and apartment from potential dangers. It settles for the expenses of losses brought on by unfortunate circumstances. Liability for harm to policyholders' property and injuries is another feature of home insurance. This includes incidents like fire, theft, vandalism, and damage from family pets. Since most homes own numerous valuables, it makes sense to have insurance that covers these valuables. These homeowner's insurance plans support policyholders with property-related legal obligations and processes in addition to offering risk coverage for damage to the house. Furthermore, losses and damages commonly brought on by man-made or natural disasters are covered by home insurance. The main factors propelling the global home insurance market's growth are the rise in households worldwide, the extension of government initiatives, and the frequency of natural and man-made calamities.

Report Coverage

This research report categorizes the market for the global home insurance market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global home insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global home insurance market.

Global Home Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 240.26 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 8.10% |

| 023 – 2033 Value Projection: | USD 523.56 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Coverage, By End User, By Region |

| Companies covered:: | AXA, American International Group, Allianz, Admiral, Allstate Insurance Company, Auto-Owners Insurance Group, Assurant, Chubb, CNA Financial Corporation, Erie Insurance Group, Farmers Insurance, Hanover Insurance Group, HCI Group, Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

Globally, a variety of insurance companies are implementing advanced techniques to raise their market worth, enhance client satisfaction, and generate more revenue. As a result, some house insurance companies offered their clients apps and other advanced services to keep them safe during this global epidemic. Additionally, the need for home insurance is growing due to incidents like fire, theft, damage to the home's exterior or interior, injury, and asset loss. This is putting pressure on insurance companies to develop and invest in less common products that offer high coverage, financial security in the event of injury or other damages, and less proliferation.

Restraining Factors

A major factor impeding the expansion of the home insurance industry is the general lack of knowledge and awareness about the coverage provided by home insurance. Closing knowledge gaps in the worldwide market is necessary to address critical concerns about consumer experiences and acceptance of house insurance. The regulatory landscape, which includes state-specific building requirements and insurance regulations, can make it difficult and expensive for insurers to conduct business across numerous geographic areas.

Market Segmentation

The global home insurance market share is segmented into coverage and end user.

- The dwelling coverage segment dominates the market with the largest market share through the forecast period.

Based on the coverage, the global home insurance market is segmented into dwelling coverage, content coverage, and liability coverage. Among these, the dwelling coverage segment dominates the market with the largest market share through the forecast period. The increase in demand for dwelling coverage can be ascribed to the rise in building activities and the rising value of properties. When disasters like fires, hurricanes, vandalism, or theft cause property damage or loss, this type of coverage gives homeowners crucial financial stability. Insurance companies that provide flexible plans and ways to improve the coverage of residential buildings are well-positioned to meet different needs in this market.

- The landlords segment accounted for the largest revenue share through the forecast period.

Based on the end-user, the global home insurance market is segmented into landlords and tenants. Among these, the landlords segment accounted for the largest revenue share through the forecast period. It typically includes landlord-specific coverages including loss of rent, tenant default insurance, and property owners' liability insurance in addition to contents and building insurance. Renting offers customers sufficient financial security against their medical bills, injuries, and other expenses, making it a realistic solution. Furthermore, it obtains the right to utilize the land without having to pay a large upfront cost.

Regional Segment Analysis of the Global Home Insurance Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global home insurance market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global home insurance market over the predicted timeframe. The primary home insurance market in the United States is responsible for much of the regional market's growth. The United States has one of the highest rates of homeownership in the world. Due to the large percentage of people who own homes, there is a high need for home insurance. North America, which consists of the US and Canada, is home to a sizable population and a growing real estate industry. A significant population and a robust property market have been driving the growth of the house insurance market. Homeowners in the region usually look for full insurance coverage to safeguard their personal property, homes, and obligations. A wide range of coverage options are offered by home insurance policies in the region to meet various needs.

Asia Pacific is expected to grow at the fastest CAGR growth of the global home insurance market during the forecast period. The Asia-Pacific home insurance market will have to gain from the increased economic development and rising per capita income in Asia-Pacific nations like China, India, Vietnam, and others, which have raised living standards and raised demand for better housing services.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global home insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AXA

- American International Group

- Allianz

- Admiral

- Allstate Insurance Company

- Auto-Owners Insurance Group

- Assurant

- Chubb

- CNA Financial Corporation

- Erie Insurance Group

- Farmers Insurance

- Hanover Insurance Group

- HCI Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2022, Amazon.com Inc. launched a home insurance portal in the UK and signed up three major insurers as it expanded into financial services globally. Initially, third-party services will be provided by Ageas UK (AGES.BR), Co-op, and LV General Insurance, a division of German insurer Allianz (ALVG.DE).

- In May 2022, Voya Financial and Allianz Global Investors announced a long-term strategic alliance. A memorandum of agreement has been signed between Voya and Allianz Global Investors, which assumed a 24% ownership position in Voya Investment Management.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global home insurance market based on the below-mentioned segments:

Global Home Insurance Market, By Coverage

- Dwelling Coverage

- Content Coverage

- Liability Coverage

Global Home Insurance Market, By End User

- Landlords

- Tenants

Global Home Insurance Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?AXA, American International Group, Inc., Allianz, Admiral, Allstate Insurance Company, Auto-Owners Insurance Group, Assurant, Inc., Chubb, CNA Financial Corporation, Erie Insurance Group, Farmers Insurance, Hanover Insurance Group, HCI Group, and Others.

-

2. What is the size of the global home insurance market?The Global Home Insurance Market Size is Expected to Grow from USD 240.26 Billion in 2023 to USD 523.56 Billion by 2033, at a CAGR of 8.10% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global home insurance market over the predicted timeframe.

Need help to buy this report?