Global Home Laundry Appliances Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Washing Machine, Dryers, Electric Smoothing Irons, Steamers, and Others), By Technology (Automatic, Semi-automatic, and Others), By Distribution Channel (Supermarket and Hypermarket, Specialty Stores, E-Commerce, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Consumer GoodsGlobal Home Laundry Appliances Market Insights Forecasts to 2033

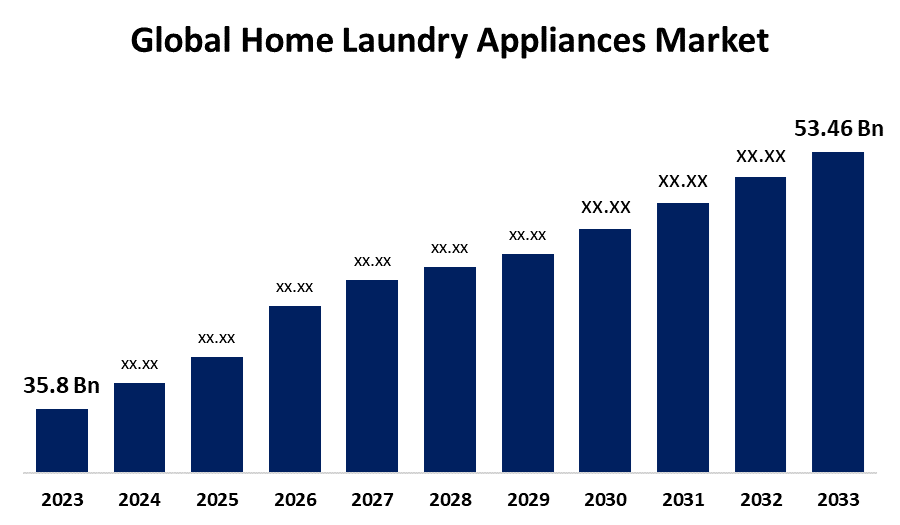

- The Global Home Laundry Appliances Market Size was Valued at USD 35.8 Billion in 2023

- The Market Size is Growing at a CAGR of 4.09% from 2023 to 2033

- The Worldwide Home Laundry Appliances Market Size is Expected to Reach USD 53.46 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Home Laundry Appliances Market Size is Anticipated to Exceed USD 53.46 Billion by 2033, Growing at a CAGR of 4.09% from 2023 to 2033. The incorporation of smart technology is a key trend propelling the market for home laundry appliances. As smart home systems become increasingly common, consumers are searching for appliances with cutting-edge features and connection.

Market Overview

Washing machines, such as washers and dryers, are instances of home laundry appliances. Because it takes up less room than separate machines, dryer and washer combinations are popular in smaller urban areas. It is portable and has the ability to wash and dry clothing simultaneously. The laundry machines are made to wash a variety of textiles and clothing. A completely functional separate washer and dryer machine is more efficient and effective than a washer and dryer combo. The market for home laundry equipment is greatly influenced by the expansion of e-commerce, which gives customers easy access to a greater selection of products and a comfortable shopping experience. Platforms including Amazon and Best Buy, for instance provide a wide range of washing machines and dryers with thorough ratings and affordable prices, making it simpler for customers to compare and buy. Individual increasing desire for smart home equipment is one of the main market trends propelling the industry forward.

Opportunities

The market for home laundry appliances offers a number of opportunities for expansion and creativity. The growth of linked and intelligent appliances presents a big potential. Smart home solutions are becoming growing more popular as customers depend increasingly and more on technology for convenience.

Challenges

The market for home laundry appliances may be severely restricted by worries about energy consumption. Even with improvements in energy efficiency, some customers remain concerned about the possibility of expensive electricity bills. These worries are exacerbated in areas with high electricity costs, which make people hesitant to purchase new appliances.

Report Coverage

This research report categorizes the market for the home laundry appliances market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Home Laundry Appliances Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the home laundry appliances market.

Home Laundry Appliances Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 35.8 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.09% |

| 2033 Value Projection: | USD 53.46 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 270 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Technology, By Distribution Channel, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Godrej, Midea Group, Electrolux, Haier Group, Koninklijke Philips N.V., Hitachi, Inc., Samsung, Whirlpool Corporation, IFB Industries Limited, LG Electronics, BSH Home Appliances Group, Candy Group S.p.A., Miele & Cie. KG, SHARP CORPORATION, Panasonic Corporation and Others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for home laundry equipment is driven by rising homeownership rates and house renovations, which raise demand for cutting-edge and effective laundry solutions. Those that are renovating their houses go for cutting-edge models to improve practicality and aesthetics, while new homeowners frequently purchase appliances to match their upgraded decor.

Restraining Factors

High initial prices can be a major deterrent for advanced home laundry appliances, particularly ones with energy-efficient features and smart technologies. The market's potential for growth may be constrained by these higher price tags, which may discourage consumers on a tight budget from adopting.

Market Segmentation

The home laundry appliances market share is classified into product type, technology, and distribution channel.

- The washing machine segment is estimated to hold the largest market share through the forecast period.

Based on the product type, the home laundry appliances market is categorized into washing machine, dryers, electric smoothing irons, steamers, and others. Among these, the washing machine segment is estimated to hold the largest market share through the forecast period. This is because of the expanding trend of smart residences washing machines are becoming increasingly common. The market is expanding as a result of washing machines with integrated functions. Mobile applications make it simple to operate washing machines, which improves user comfort. The market for washing machines is expanding as a result of the rising desire to do away with the necessity of manually changing washing settings.

- The automatic segment is expected to grow the biggest market share through the estimated period.

Based on the technology, the home laundry appliances market is categorized into automatic, semi-automatic, and others. Among these, the automatic segment is expected to grow the biggest market share through the estimated period. The automatic machine has novel features including defined wash settings and water level detection, which removes the need for user intervention in different wash cycles. This element saves the user's work and time, resulting in product adoption.

- The e-commerce segment is estimated to grow at the highest CAGR during the forecast period.

Based on the distribution channel, the home laundry appliances market is categorized into supermarket and hypermarket, specialty stores, e-commerce, and others. Among these, the e-commerce segment is estimated to grow at the highest CAGR during the forecast period. Online dealers have grown rapidly in recent years, owing to the growing acceptance of e-commerce and the convenience it provides. Customers may simply compare costs, read reviews, and make informed purchasing selections from the convenience of their own homes.

Regional Segment Analysis of the Home Laundry Appliances Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the home laundry appliances market over the predicted timeframe.

Get more details on this report -

Asia Pacific is projected to hold the largest share of the home laundry appliances market over the predicted timeframe. This dominance is due to rapid growth in cities and growing disposable incomes in China, India, and Southeast Asia have resulted in increased formation of households and demand for contemporary amenities such as household appliances. A large consumer base is produced by this demographic transition for a variety of products, including air conditioners, refrigerators, washing machines, and kitchen equipment.

North America is expected to grow at the fastest CAGR growth in the home laundry appliances market during the forecast period. There are significant water and electricity consumption difficulties in developed countries. Despite this, the growth rate in this area is higher than in other regions, where developing nations are expanding faster as adoption and technology advance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the home laundry appliances market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Godrej

- Midea Group

- Electrolux

- Haier Group

- Koninklijke Philips N.V.

- Hitachi, Inc.

- Samsung

- Whirlpool Corporation

- IFB Industries Limited

- LG Electronics

- BSH Home Appliances Group

- Candy Group S.p.A.

- Miele & Cie. KG

- SHARP CORPORATION

- Panasonic Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2023, LG Electronics introduced the Signature Washer-drier, a revolutionary device that combines a large-capacity washer and an inverter heat pump drier into a single unit. With a washing capacity of 25 kg and an air drying capacity of 13 kg, it also includes a 4 kilogram mini-wash option for extra convenience.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the home laundry appliances market based on the below-mentioned segments:

Global Home Laundry Appliances Market, By Product type

- Washing Machine

- Dryers

- Electric Smoothing Irons

- Steamers

- Others

Global Home Laundry Appliances Market, By Technology

- Automatic

- Semi-automatic

- Others

Global Home Laundry Appliances Market, By Distribution Channel

- Supermarket and Hypermarket

- Specialty Stores

- E-Commerce

- Others

Global Home Laundry Appliances Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global home laundry appliances market over the forecast period?The global home laundry appliances market is to expand at 4.09% during the forecast period.

-

1. What is the CAGR of the global home laundry appliances market over the forecast period?The Asia Pacific region is expected to hold the largest share of the global home laundry appliances market.

-

3. What is the market size of the home laundry appliances market?The Home Laundry Appliances Market Size is Expected to Grow from USD 35.8 Billion in 2023 to USD 53.46 Billion by 2033, at a CAGR of 4.09% during the forecast period 2023-2033.

Need help to buy this report?