Global HVDC Transmission Market Size, Share, Growth, and Industry Analysis, By HVDC Links (Monopolar Link, Bipolar Link, and Homopolar Link), By Technology (Line Commutated Converter, and Voltage Source Converter), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa) and Forecast to 2033

Industry: Energy & PowerGlobal HVDC Transmission Market HVDC Transmission Forecasts to 2033

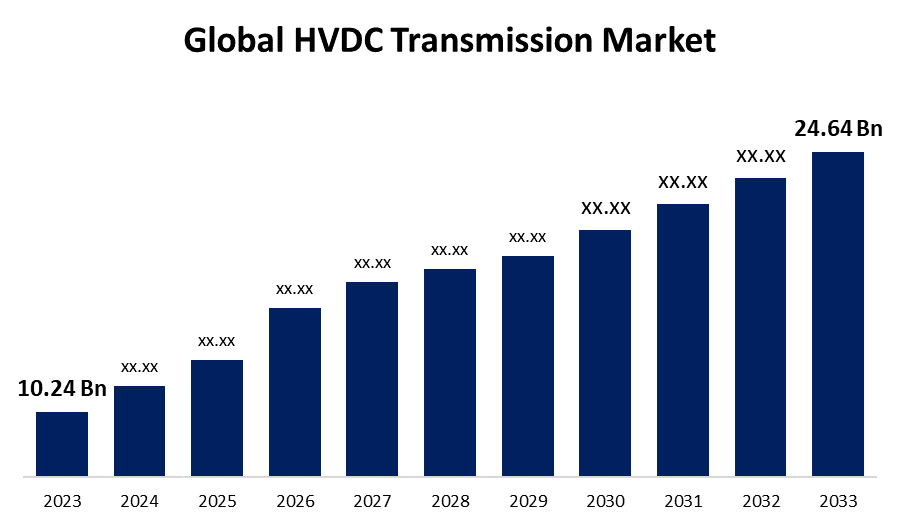

- The Global HVDC Transmission Market Size was Valued at USD 10.24 Billion in 2023

- The Market Size is Growing at a CAGR of 9.18% from 2023 to 2033

- The Worldwide HVDC Transmission Market Size is Expected to Reach USD 24.64 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The HVDC Transmission Market Size is Anticipated to Exceed USD 24.64 Billion by 2033, Growing at a CAGR of 9.18% from 2023 to 2033.

HVDC TRANSMISSION MARKET REPORT OVERVIEW

High voltage-direct current transmission is a technique for sending direct current electricity across great distances via overhead wires or undersea cables. Inverters and rectifiers are used in the high voltage-direct current transmission system to convert AC to DC and vice versa. Harmonic filters and smoothing reactors are included to maintain stability and minimize interference. HVDC technology is perfect for subterranean and underwater cables because it makes it possible to connect various power systems efficiently and get around geographical obstacles. Transmission systems for high-voltage direct current are becoming more and more crucial in an energy landscape marked by growing decarbonization, distributed generation, and digitization. The most effective way to send a lot of electricity across long distances, integrate renewable energy sources into the grid and stabilize three-phase systems by using HVDC technology.

The increased initiative of government support is expected to boost the market growth. For instance, the Government of Canada has granted Hitachi Energy Canada a sizeable $30 million (CAD) investment to support sustainable energy infrastructure. The purpose of this investment is to support the upgrading of its power transformer manufacturing located in Varennes, Quebec, as well as the creation of an HVDC simulation center in Montreal.

Report Coverage

This research report categorizes the market for the global HVDC transmission market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global HVDC transmission market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global HVDC transmission market.

Global HVDC Transmission Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 10.24 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 9.18% |

| 2033 Value Projection: | USD 24.64 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 260 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By HVDC Links, By Technology, By Region |

| Companies covered:: | Hitachi Energy, General Electric Co., Mitsubishi Electric Corporation, Alstom, NKT A/S, Nexans, Siemens, Toshiba Corporation, General Electric Co., Prysmian SpA, TransGrid Solutions Inc., Abengoa S.A., ATCO LTD., LS Industrial Systems Co., Ltd., Others, and |

| Growth Drivers: | The rising acceptance of voltage source converter technology can boost market growth. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, and Analysis |

Get more details on this report -

DRIVING FACTORS:

The rising acceptance of voltage source converter technology can boost market growth.

VSC-based HVDC has been chosen as the preferred technology by developers and grid operators to expedite bulk power transmission projects. The VSC-based HVDC is intended to transfer massive power over long distances using overhead, subterranean, and/or underwater technologies, or a combination of them. Moreover, VSC-based converter stations are small and require less land than other approaches. This makes it possible to quickly and independently adjust reactive and active power as well as have black start capabilities.

RESTRAINING FACTORS

The expensive price of the HVDC transmission system could hinder market growth.

The high cost of the converter station and related devices could restrict the market growth throughout the projected timeframe. The investment in HVDC converter stations and related infrastructure could be more than that of AC transmission lines. The system operator/owner of the transmission line also pays extra costs to maintain an inventory of specialized HVDC assets. This would affect the overall market expansion.

Market Segmentation

The HVDC transmission market share is classified into type and technology.

The bipolar link segment accounted for the highest share of the market during the forecast period.

Based on HVDC links, the HVDC transmission is classified into monopolar link, bipolar link, and homopolar link. The capacity of the bipolar connection to function in a monopolar mode in the event that one of the conductors fails, owing to the ground return system, is one of its greatest advantages. As a result, half of the system can keep producing electricity. HVDC systems frequently use these kinds of connections. A bipolar HVDC link consists of two monopolar circuits with opposing polarity that are both running at the same voltage level. High-power transmissions of 1500–2000 MW are best served by the bipolar arrangement, which offers redundancy in the event that one monopole fails. For instance, the Rihand-Delhi HVDC bipolar transmission link, with a rated capacity of 1,500 MW at ±500 kV, and parallel 400 kV AC lines are used to carry power coming from the 3,000 MW coal-fired Rihand thermal power plant in Uttar Pradesh.

The voltage source converter technology held the largest market share over the forecast period.

Based on technology, the HVDC transmission is classified into line commutated converter, and voltage source converter. Voltage source converters, which use devices appropriate for high-power electronic applications like IGBTs, are self-commutated converters used to connect HVDC systems. They can produce alternative current voltages independently of an AC system. This enables black start capability and independent fast control of reactive and active power. For instance, a monument to PGCIL's dedication to remaining at the forefront of technological innovation in the power industry is the Pugalur Thrissur 2000 MW HVDC System. The technology used in this system are voltage source converter which is stable and highly efficient power transfer across extended distances, adding to the overall grid's stability.

Regional Segment Analysis of the Global HVDC Transmission Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific has the biggest share of the HVDC transmission market throughout the forecast period.

Get more details on this report -

The region growing acceptance by an increase in rural electrification projects, a favourable regulatory environment for the development and sales of HVDC components, and an increasing number of HVDC transmission projects in nations like China and India. Asia Pacific subterranean high voltage cables are evolving into a new generation that is more resilient, economical, and efficient due to advancements in materials science and production processes. When high-temperature superconducting materials are used in cable manufacturing, for example, power losses are minimized and less insulation is needed. To increase electrical production and enhance efficiency, regional governments are also enacting laws and regulations to encourage the adoption of subterranean high-voltage cables in place of overhead lines.

North America is the fastest-growing region during the projected timeframe.

The market is anticipated to be dominated by North America because of the region's growing reliance on renewable energy sources, a growing number of government programs aimed at lowering carbon emissions, and growing investments in transmission infrastructure. The requirement for long-distance power transmission as well as the use of renewable energy sources are further driving market expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global HVDC transmission market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hitachi Energy

- General Electric Co.

- Mitsubishi Electric Corporation

- Alstom

- NKT A/S

- Nexans

- Siemens

- Toshiba Corporation

- General Electric Co.

- Prysmian SpA

- TransGrid Solutions Inc.

- Abengoa S.A.

- ATCO LTD.

- LS Industrial Systems Co., Ltd.

- Others

Key Market Developments

- In September 2023, a $10 million funding opportunity announcement was released by the Office of Electricity (OE) and Wind Energy Technologies Office (WETO) of the U.S. Department of Energy (DOE) to support research aimed at promoting innovation and lowering the cost of voltage source converter (VSC) transmission systems that use high voltage direct current (HVDC).

- In December 2022, at its Himeji Operations, Toshiba Electronic Devices & Storage Corporation announced the opening of a new back-end power semiconductor production facility.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global HVDC transmission market based on the below-mentioned segments:

Global HVDC Transmission Market, By HVDC Links

- Monopolar Link

- Bipolar Link

- Homopolar Link

Global HVDC Transmission Market, By Technology

- Line Commutated Converter

- Voltage Source Converter

Global HVDC Transmission Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the global HVDC transmission market over the forecast period?The global HVDC transmission market size is expected to grow from USD 10.24 Billion in 2023 to USD 24.64 Billion by 2033, at a CAGR of 9.18% during the forecast period 2023-2033.

-

2.Which region is expected to hold the highest share in the global HVDC transmission market?Asia-Pacific is projected to hold the largest share of the global HVDC transmission market over the forecast period.

-

3.Who are the top key players in the HVDC transmission market?Hitachi Energy, General Electric Co, Mitsubishi Electric Corporation, Alstom, NKT A/S, Nexans, Siemens, Toshiba Corporation, General Electric Co, Prysmian SpA, TransGrid Solutions Inc, Abengoa S.A, ATCO LTD, LS Industrial Systems Co., Ltd, and Others.

Need help to buy this report?