Global Hydrogen Fueling Station Market Size, Share, and COVID-19 Impact Analysis, By Type (Fixed Station and Mobile Station), By Size (Small & Medium Size and Large Size), By End User (Railways, Marine, Commercial Vehicle and Aviation), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Energy & PowerGlobal Hydrogen Fueling Station Market Insights Forecasts to 2033

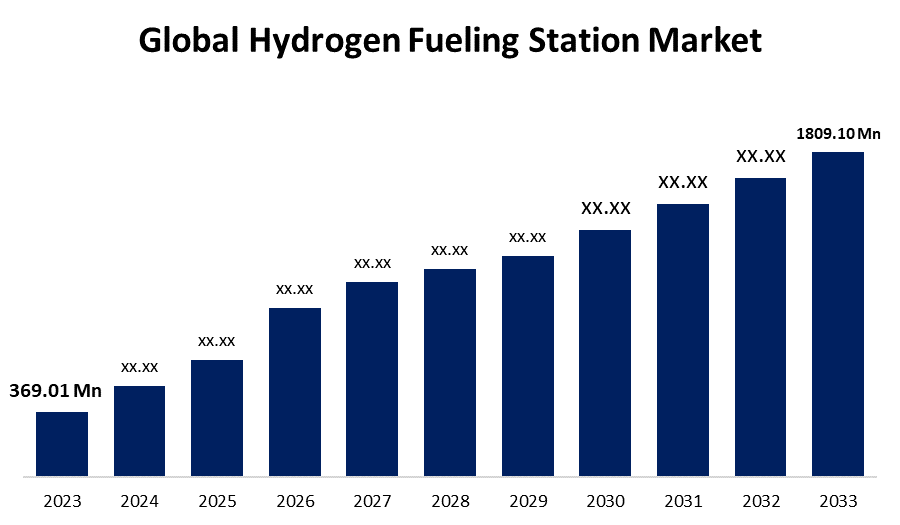

- The Global Hydrogen Fueling Station Market Size was Valued at USD 369.01 Million in 2023

- The Market Size is Growing at a CAGR of 17.23% from 2023 to 2033

- The Worldwide Hydrogen Fueling Station Market Size is Expected to Reach USD 1809.10 Million by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Hydrogen Fueling Station Market Size is Anticipated to Exceed USD 1809.10 Million by 2033, Growing at a CAGR of 17.23% from 2023 to 2033.

Market Overview

A hydrogen fueling station is the station to refill the hydrogen in hydrogen-powered fuel cell vehicles. These stations are the most important fragment of the structure essential to broadly accept hydrogen fuel cell vehicles. Hydrogen-powered vehicles are best suited for heavy-duty transportation and long-distance travel as hydrogen is gaining acknowledgment as a pliable and environmental alternative to conventional fuels. Hydrogen fueling stations play an important role in empowering fresh and maintainable transportation and hydrogen fueling stations are of several types. Storage tanks, hydrogen dispensers, compression systems, and safety features are the main components of hydrogen fueling stations which are similar to traditional gasoline dispensers. Various factors contribute to the evolution and enlargement of the hydrogen fueling station market. To expand the efficiency of hydrogen fueling stations, numerous research and development activities are conducted to develop innovative machineries mounted in the hydrogen fueling station such as electrolyzers based on onsite hydrogen refueling stations. Also, government laws, rules, and subsidies that inspire the expansion of hydrogen fueling infrastructure are important. Governments may offer aids, duties, or recognitions to arouse isolated investment in the building and operation of hydrogen fueling stations.

Report Coverage

This research report categorizes the market for the hydrogen fueling station market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the hydrogen fueling station market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the hydrogen fueling station market.

Global Hydrogen Fueling Station Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 369.01 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 17.23% |

| 2033 Value Projection: | USD 1809.10 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Size, By End User, By Region |

| Companies covered:: | Air Liquide, China Petrochemical Corporation, H2ENERGY SOLUTIONS LTD, Cummins Inc., Air Products and Chemicals, FuelCell Energy, Inc., ITM Power PLC, Ballard Power Systems, NEL ASA, TotalEnergies, Linde plc, McPhy Energy, Refueling Solutions, PERIC Hydrogen Technologies Co., Ltd, Powertech Labs Inc., and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

Air pollution is an important problem faced by everyone. Air pollution is caused by the emission of hydrocarbons, nitrogen oxides, and particulate matter from gasoline and diesel vehicles. Governments are trying to concentrate on low or zero-emission machinery and resources, like solar, wind, fossil fuels, and nuclear energy. Mobile hydrogen applications, stationary power generation, and transportation are the several applications of hydrogen fuel that increase its reliability. It lessens greenhouse gas emissions mainly in the transportation sector, including heavy-duty transportation sector applications such as haul trucks, locomotives, ships, etc. Vehicles that are hydrogen-powered are more efficient than conventional vehicles and do not produce harmful gases like CO, CO2, and others. The fuel source of hydrogen provides a stable, clean, and extremely energy-efficient way to fulfill the growing need for electricity. Because of this, the market for hydrogen fueling stations is anticipated to develop significantly during the projected period as zero-emission systems and increased fuel economy become the norm.

Restraining Factors

The growth of the global hydrogen fueling station market may be hindered by the various implementation investments required for the purchase of high-quality instruments and machinery. Small-scale production and delivery of hydrogen fuel at gas stations are costly, and the complex administration of large-scale gas station operations may limit the market's expansion. Large sums of money are also needed for planning and building new stations, and these rely on numerous variables that affect consumer patterns.

Market Segmentation

The hydrogen fueling station market share is classified into type, size, and end user.

- The fixed station is anticipated to dominate the market during the forecast period.

Based on the type, the hydrogen fueling station market is divided into fixed station and mobile station. Among these, the fixed station is anticipated to dominate the market during the forecast period. The demand for fixed station is increasing because of the increasing demand for hydrogen-based vehicles. The fixed station can be a reliable source of hydrogen, attracting a customer base.

- The small & medium size segment is anticipated to dominate the hydrogen fueling station market during a forecast period.

Based on the size, the hydrogen fueling station market is divided into small & medium size and large size. Among these, the small & medium size segment is anticipated to dominate the hydrogen fueling station market during a forecast period. This market share is explained by the increasing number of vehicles powered by hydrogen being adopted, which has increased the demand for suitable refueling infrastructure in cities. For this kind of demand, small and medium-sized stations are appropriate.

- The commercial vehicle segment is anticipated to dominate the market during the forecast period.

Based on the end user, the hydrogen fueling station market is divided into railways, marine, commercial vehicle, and aviation. Among these, the commercial vehicle segment is anticipated to dominate the market during the forecast period. The increase in demand for hydrogen-powered electric cars, which are thought to be ideal substitutes for gasoline-powered vehicles because of their greater drive range and quick refilling time, is responsible for this market share. Because of its role in the net zero movement, the mobility sector is the one that uses hydrogen the most.

Regional Segment Analysis of the Hydrogen Fueling Station Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

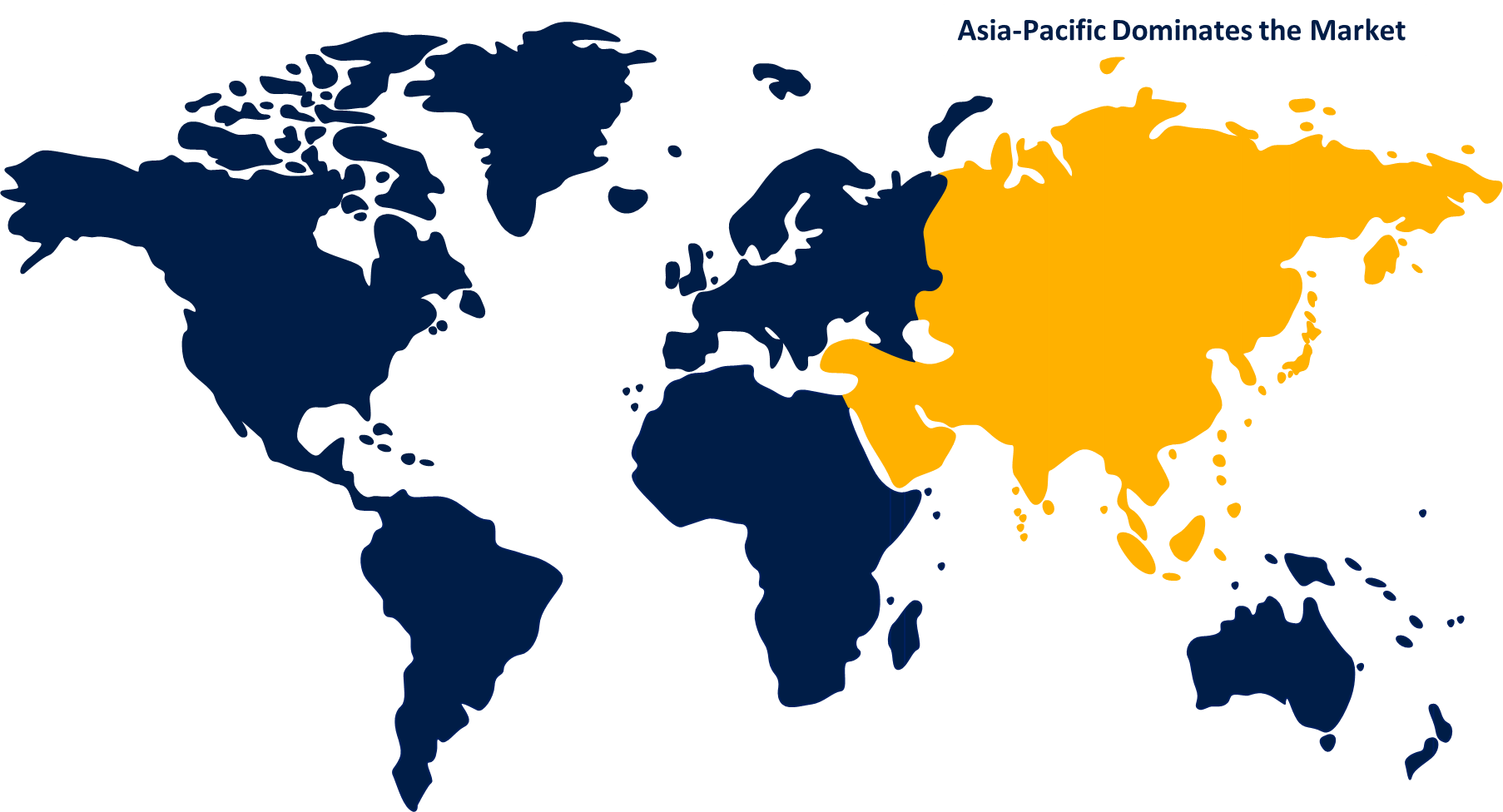

Asia Pacific is anticipated to hold the largest share of the hydrogen fueling station market over the forecast period.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the hydrogen fueling station market over the forecast period. Large-scale facilities are being built all across the Asia Pacific area as a result of the region's significant investments in infrastructure and technological development for hydrogen. The necessity to run hydrogen fueling stations has risen as a result of this aspect. To fulfill the demand for automobiles and buses in the area, emerging nations like China, Japan, and South Korea have set determined objectives for the introduction of hydrogen fuel cell cars and heavy vehicles. The governments in the Asia Pacific region are executing approaches to endorse the approval of hydrogen fuel cell vehicles, which in turn surge the demand for suitable hydrogen fueling setups. The government is investing in hydrogen manufacturing and circulation infrastructure including hydrogen fueling stations to reach carbon neutrality goals.

Europe region is anticipated to grow fastest during the forecast period. Some important reasons have contributed to the notable growth in demand for hydrogen refueling stations throughout Europe. Governments, businesses, and consumers are moving toward greener energy solutions as a result of the continent's aggressive climate targets and the necessity to decarbonize several sectors, most notably transportation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global hydrogen fueling station market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Air Liquide

- China Petrochemical Corporation

- H2ENERGY SOLUTIONS LTD

- Cummins Inc.

- Air Products and Chemicals

- FuelCell Energy, Inc.

- ITM Power PLC

- Ballard Power Systems

- NEL ASA

- TotalEnergies

- Linde plc

- McPhy Energy

- Refueling Solutions

- PERIC Hydrogen Technologies Co., Ltd

- Powertech Labs Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2023, to establish an equally owned joint venture, to build a network of hydrogen stations, Air Liquide partnered with TotalEnergies. Through the facilitation of access to hydrogen, this project greatly strengthened the hydrogen industry and allowed for the expansion of its usage for the transportation of commodities.

- In October 2022, as part of the Clean Hydrogen and Road Transport Project, Air Products and Chemicals, Inc., Schenk Tanktransport, and TNO developed hydrogen vehicles and a public hydrogen recharging station.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the hydrogen fueling station market based on the below-mentioned segments:

Global Hydrogen Fueling Station Market, By Type

- Fixed Station

- Mobile Station

Global Hydrogen Fueling Station Market, By Size

- Small & Medium Size

- Large Size

Global Hydrogen Fueling Station Market, By End User

- Railways

- Marine

- Commercial Vehicles

- Aviation

Global Hydrogen Fueling Station Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?Air Liquide, China Petrochemical Corporation, H2ENERGY SOLUTIONS LTD, Cummins Inc., Air Products and Chemicals, FuelCell Energy, Inc., ITM Power PLC, Ballard Power Systems, NEL ASA, TotalEnergies, Linde plc, McPhy Energy, Refueling Solutions, PERIC Hydrogen Technologies Co., Ltd, Powertech Labs Inc., and Others.

-

2. What is the size of the global hydrogen fueling station market?The Global Hydrogen Fueling Station Market Size is Expected to Grow from USD 369.01 Million in 2023 to USD 1809.10 Million by 2033, at a CAGR of 17.23% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?Asia Pacific is anticipated to hold the largest share of the global hydrogen fueling station market over the predicted timeframe.

Need help to buy this report?