Global Hydrophobic Coatings Market Size, Share, and COVID-19 Impact, By Property (Anti-Microbial, Anti-Icing/Wetting, Anti-Fouling, Anti-Corrosion, Self-Cleaning), By Application (Aerospace, Automotive, Construction, Medical, Optical), by Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032.

Industry: Chemicals & MaterialsGlobal Hydrophobic Coatings Market Insights Forecasts to 2032

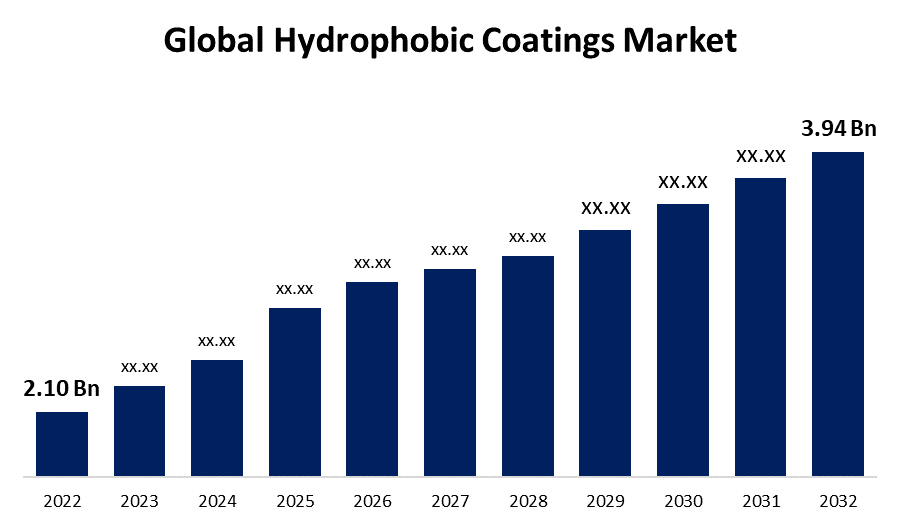

- The Hydrophobic Coatings Market Size was valued at USD 2.10 Billion in 2022.

- The Market Size is Growing at a CAGR of 5.49% from 2022 to 2032

- The Worldwide Hydrophobic Coatings Market Size is expected to reach USD 3.94 Billion by 2032

- Asia Pacific is expected To Grow the fastest during the forecast period

Get more details on this report -

The Global Hydrophobic Coatings Market Size is expected to reach USD 3.94 Billion by 2032, at a CAGR of 5.49% during the forecast period 2022 to 2032.

Water and other liquids are repelled by hydrophobic coating, a sort of surface treatment. The word "hydrophobic" derives from the Greek words "hydro" for water and "phobos" for aversion or fear. In essence, hydrophobic coatings make it so that water beads up and rolls off the surface instead of spreading out and saturating it. In order to increase visibility in rainy conditions, hydrophobic coatings are frequently applied to automotive windscreens, windows, and mirrors. The requirement for windscreen wipers is decreased by these coatings, which encourage precipitation to swiftly bead up and roll off. Hydrophobic coatings can serve as anti-corrosion barriers in industrial settings, keeping water from coming into touch with metal surfaces and lowering the likelihood of rust development.

Impact of COVID 19 On Global Hydrophobic Coatings Market

The epidemic caused global supply chains to break down, which had an impact on the supply of the raw materials and finished goods needed to make hydrophobic coatings. Production and distribution delays might have occurred as a result. Lockdown procedures and limitations caused delays or temporary halts in a number of industries and construction projects, which decreased demand for hydrophobic coatings in such fields. The uncertainty brought on by the pandemic forced many businesses to delay their investment and expansion plans, which had an effect on the demand for hydrophobic coatings in new projects. On the other hand, the pandemic raised the demand for specific hydrophobic coatings used in protective and medical gear, including face shields, hospital gowns, and personal protective equipment (PPE).

Global Hydrophobic Coatings Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 2.10 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 5.49% |

| 2032 Value Projection: | USD 3.94 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Property, By Application, by Region |

| Companies covered:: | BASF SE (Germany), AkzoNobel N.V. (Netherlands), PPG Industries (U.S.), 3M (U.S.), Nippon Paint Company Limited (India), Akzo Nobel N.V. (Netherland), DuPont (U.S.), Corning Incorporated (U.S.), GVD Corporation (U.S.), P2i Ltd. (U.K.), Aculon (U.S.), NEI Corporation. (U.S.), CYTONIX (U.S.), Lotus Leaf Coatings, Inc (U.S.), Abrisa Technologies (U.S.), Endura Manufacturing Company Ltd (Canada), Kansai Paint Co., and Ltd.(Japan) |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Key Market Drivers

More efficient and long-lasting hydrophobic coating formulations have been created as a result of ongoing materials science research and development. These developments have increased the functionality of hydrophobic coatings overall and broadened their scope of applications. The market for hydrophobic coatings has been significantly fueled by the automotive industry. In order to improve vision in bad weather and boost driver safety and convenience, hydrophobic coatings are applied to automotive windscreens, windows, and mirrors. Hydrophobic coatings are applied to a variety of surfaces in the construction sector to protect them from moisture, corrosion, and stains. The demand for these coatings has increased as infrastructure development projects expand across the globe. The use of harsh chemical cleaners and the conservation of water during cleaning processes are only two examples of how hydrophobic coatings can be environmentally friendly. The use of such coatings in a variety of industries has been prompted by the increased focus on sustainability and eco-friendly practises.

Key Market Challenges

As they can be more expensive than conventional coatings, hydrophobic coatings may not be widely used, especially in sectors where costs are high or for extensive uses. Higher product pricing might result from factors such as the cost of raw materials, specialised machinery, and production techniques. Although hydrophobic coatings are made to last, they can lose some of their effectiveness over time, especially if they are subjected to abrasion or extreme climatic conditions. The effectiveness of the coating must be maintained regularly, and it may need to be reapplied, which might be difficult. A barrier to entrance for some sectors may be the need for specialised tools and labour when applying hydrophobic coatings. It might be difficult to achieve constant and uniform coating thickness, which has an effect on the coating's overall performance. Hydrophobic coatings might not be appropriate for all applications, particularly those involving dramatic temperature changes, contact with harsh chemicals, or high mechanical stress. Alternative coating treatments might be more suitable in these circumstances.

Market Segmentation

Property Insights

Anti microbial coatings segment is dominating the market over the forecast period

On the basis of property, the global hydrophobic coatings market is segmented into Anti-Microbial, Anti-Icing/Wetting, Anti-Fouling, Anti-Corrosion, Self-Cleaning. Among these, anti microbial coatings segment is dominating the market with the largest market share over the forecast period. Antimicrobial coatings are made to stop microorganisms like bacteria, viruses, and fungi from proliferating and spreading across the surfaces they are applied on. These coatings are particularly appealing for a variety of applications due to their combination of hydrophobic and antibacterial qualities, especially in sectors where hygiene and cleanliness are crucial, such healthcare, food processing, and public facilities. In public places where several people frequently touch surfaces, such as airports, public transportation, schools, and offices, antimicrobial coatings have gained popularity.

Application Insights

Automotive industry segment holds the highest market share over the forecast period

Based on the application, the global hydrophobic coatings market is segmented into Aerospace, Automotive, Construction, Medical, Optical. Among these, the automotive industry segment holds the highest market share over the forecast period. In order to increase visibility in rainy conditions, hydrophobic coatings are frequently applied to automotive windscreens, windows, and mirrors. These coatings make it so that raindrops bead up and slide off the surface, requiring less usage of windscreen wipers and improving vision for the driver—a vital factor in highway safety. Automotive surfaces with hydrophobic coatings are easier to clean since water removes dust and debris, requiring fewer car washes and requiring less maintenance from vehicle owners. The ability of automobile owners to equip their vehicles with water-repellent features thanks to the availability of hydrophobic coating solutions in the automotive aftermarket has increased demand for these coatings.

Regional Insights

North America accounted the largest market share over the forecast period

Get more details on this report -

Based on the region, North America accounted the largest market share over the forecast period. In North America, the automotive and aerospace industries were among the first to use hydrophobic coatings for windscreens, windows, and exterior surfaces. The need for greater visibility, safety, and environmental protection is what fuels demand for these coatings. One of the first industries in North America to adopt hydrophobic coatings for windscreens, windows, and exterior surfaces was the automotive and aerospace sectors. The market for these coatings is driven by the requirement for increased visibility, safety, and environmental protection.

Asia Pacific is witnessing the fastest market share over the forecast period. The Asia Pacific region has experienced fast urbanisation and industrialization, which has increased construction activity, expanded manufacturing facility growth, and developed infrastructure. The need for hydrophobic coatings in the construction and industrial sectors has been fuelled by this. A number of Asia-Pacific nations are making investments in infrastructure projects, such as airports, railroads, and office complexes. To increase longevity and lower maintenance costs, hydrophobic coatings are used in these projects.

Recent Market Developments

- Aculon Inc. has unveiled a brand-new hydrophobic coating-based multi-surface repellency solution.

List of Key Companies

- BASF SE (Germany)

- AkzoNobel N.V. (Netherlands)

- PPG Industries (U.S.)

- 3M (U.S.)

- Nippon Paint Company Limited (India)

- Akzo Nobel N.V. (Netherland)

- DuPont (U.S.)

- Corning Incorporated (U.S.)

- GVD Corporation (U.S.)

- P2i Ltd. (U.K.)

- Aculon (U.S.)

- NEI Corporation. (U.S.)

- CYTONIX (U.S.)

- Lotus Leaf Coatings, Inc (U.S.)

- Abrisa Technologies (U.S.)

- Endura Manufacturing Company Ltd (Canada)

- Kansai Paint Co., Ltd.(Japan)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global Hydrophobic Coatings Market based on the below-mentioned segments:

Hydrophobic Coatings Market, Property Analysis

- Anti-Microbial

- Anti-Icing/Wetting

- Anti-Fouling

- Anti-Corrosion

- Self-Cleaning

Hydrophobic Coatings Market, Application Analysis

- Aerospace

- Automotive

- Construction

- Medical

- Optical

Hydrophobic Coatings Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?