Global Image Sensor Market Size, Share, and COVID-19 Impact Analysis, By Technology (CMOS Image Sensors, CCD Image Sensors, and Others), By Processing Technique (2D Image Sensors and 3D Image Sensors), By Spectrum (Visible spectrum and Non-visible spectrum), By Array Type (Area Image Sensors and Linear Image Sensors), By Resolution (VGA, 1.3 MP to 3 MP, 5 MP to 10 MP, 12 MP to 16 MP, and More than 16 MP), By End-User (Aerospace, Defense, & Homeland Security, Automotive, Consumer Electronics, Medical & Life Sciences, Industrial, and Commercial), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032.

Industry: Semiconductors & ElectronicsGlobal Image Sensor Market Insights Forecasts to 2032

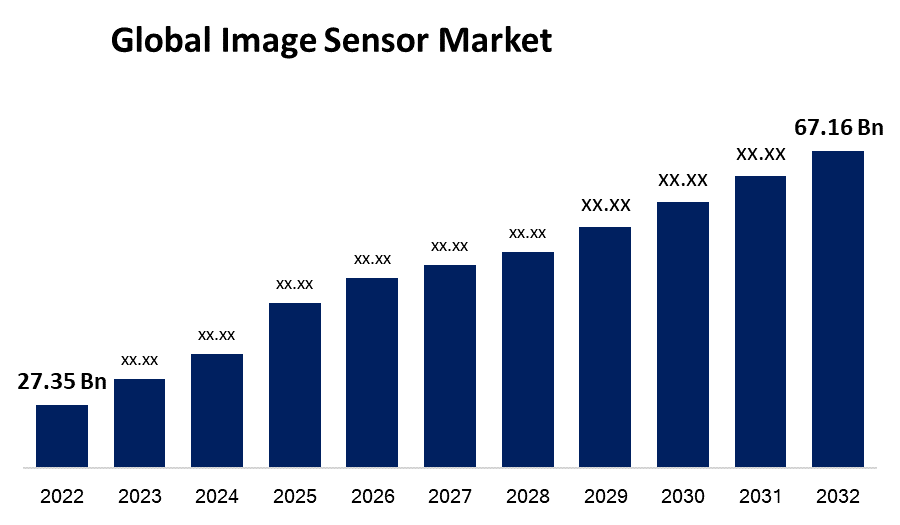

- The Image Sensor Market Size was valued at USD 27.35 Billion in 2022.

- The Market is Growing at a CAGR of 9.4% from 2022 to 2032

- The Worldwide image sensor Market Size is expected to reach USD 67.16 Billion by 2032

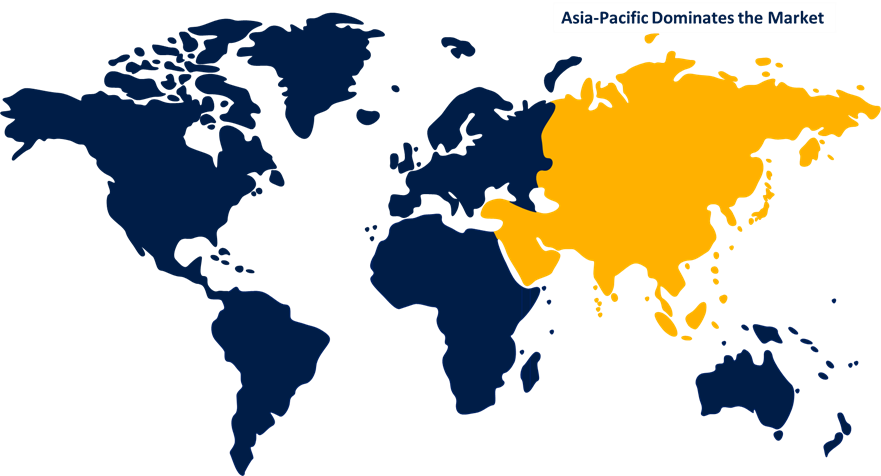

- Asia-Pacific is expected To Grow the fastest during the forecast period

Get more details on this report -

The Global Image Sensor Market Size is expected to reach USD 67.16 Billion by 2032, at a CAGR of 9.4% during the forecast period 2022 to 2032.

Market Overview

An image sensor is a device used to convert an optical image into an electronic signal. It is a crucial component in digital cameras, smartphones, and other imaging devices. Image sensors consist of millions of pixels, each of which captures a tiny portion of the image. The two main types of image sensors are Charge-Coupled Devices (CCDs) and Complementary Metal-Oxide-Semiconductor (CMOS) sensors. CCD sensors are known for their high image quality, low noise, and excellent color accuracy, making them suitable for professional-grade cameras. On the other hand, CMOS sensors are more affordable, consume less power, and offer faster readout speeds, making them ideal for consumer-grade cameras and smartphones. Image sensors are continuously improving in terms of resolution, dynamic range, and sensitivity, allowing for better image quality even in low-light conditions. As a result, they are essential for capturing and processing digital images in modern devices.

Report Coverage

This research report categorizes the market for image sensor market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the image sensor market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the image sensor market.

Global Image Sensor Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 27.35 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 9.4% |

| 2032 Value Projection: | USD 67.16 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By Processing Technique, By Spectrum, By Array Type, By Resolution, By End-User, By Region. |

| Companies covered:: | Sony Group, Samsung Electronics Co., Ltd, Omnivision, STMicroelectronics N.V., GalaxyCore Shanghai Limited Corporation, ON Semiconductor Corporation, Panasonic Holdings Corporation, Canon Inc, SK Hynix Inc, PixArt Imaging Inc. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The image sensor market is primarily driven by the growth of the consumer electronics industry, especially in the areas of smartphones, tablets, and digital cameras. With the increasing demand for high-quality images and videos, the need for better image sensors is growing rapidly. Additionally, the development of advanced driver-assistance systems (ADAS) in the automotive industry has led to an increased demand for image sensors for use in various applications such as parking assistance, lane departure warning, and adaptive cruise control. Other drivers of the image sensor market include the rise of smart homes, the growing demand for security cameras, and the need for medical imaging equipment. Moreover, the trend towards Industry 4.0 and the rise of IoT devices are also driving the growth of the image sensor market, as sensors are crucial for capturing data and information in various applications.

Restraining Factors

The image sensor market also faces certain restraints that can hinder its growth. One major restraint is the high cost of image sensors, especially for high-end applications, which limits their adoption in price-sensitive markets. Additionally, the complex manufacturing process and the need for specialized equipment pose challenges for new entrants in the market. Another restraint is the presence of alternatives such as software-based image enhancements and computational photography techniques, which can mitigate the need for higher-resolution sensors in some cases. Furthermore, image sensor performance can be affected by factors like noise, sensitivity, and dynamic range limitations, which can impact the overall image quality.

Market Segmentation

- More than 16MP segment accounted for around 35.6% market share in 2022

On the basis of the resolution type, the global image sensor market is segmented into VGA, 1.3 MP to 3 MP, 5 MP to 10 MP, 12 MP to 16 MP, and more than 16 MP. The more than 16MP segment is dominating with the largest market share in 2022. This can be attributed to the increasing demand for high-resolution imaging across various applications. As consumer expectations for image quality continue to rise, the need for image sensors that can capture intricate details and deliver superior image clarity has become paramount. The dominance of the more than 16MP segment is particularly evident in the consumer electronics industry, where smartphones, digital cameras, and professional-grade cameras are constantly pushing the boundaries of resolution. This segment also finds applications in areas such as surveillance, automotive, and medical imaging, where the ability to capture and analyze high-resolution images is crucial. Additionally, advancements in manufacturing technology have made it more feasible and cost-effective to produce image sensors with higher pixel counts. This has fueled the availability and adoption of more than 16MP image sensors in the market, solidifying its position as the leading segment in terms of market share.

- In 2022, the consumer electronics segment dominated with more than 24.7% market share

Based on the type of end-user, the global image sensor market is segmented into aerospace, defense, & homeland security, automotive, consumer electronics, medical & life sciences, industrial, and commercial. Out of this, the consumer electronics segment held the largest market share in 2022. This can be attributed to several factors. Firstly, the proliferation of smartphones, tablets, digital cameras, and wearable devices has significantly increased the demand for image sensors. Consumers today expect high-resolution imaging capabilities in their devices, driving the need for advanced image sensor technologies. Furthermore, the constant innovation and rapid technological advancements in the consumer electronics sector have resulted in the integration of multiple cameras and imaging capabilities in devices. This requires a higher volume of image sensors, further boosting the market share of the consumer electronics segment. Moreover, the increasing popularity of social media platforms and the rise of visual content creation have created a strong demand for high-quality images and videos. As a result, consumer electronics manufacturers are focusing on improving image sensor performance to meet growing consumer expectations.

Regional Segment Analysis of the Image Sensor Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific dominated the market with more than 46.5% revenue share in 2022.

Get more details on this report -

Based on region, the Asia-Pacific region holds the largest market share in the image sensor market. There are several factors contributing to this dominance. Firstly, the region is home to major consumer electronics manufacturers, including leading smartphone and camera producers. The high demand for smartphones, tablets, and digital cameras in countries like China, Japan, South Korea, and India drives the growth of the image sensor market in the region. Additionally, Asia-Pacific has witnessed significant advancements in automotive technology, particularly in the development of advanced driver-assistance systems (ADAS) and autonomous vehicles. The increasing adoption of image sensors for various automotive applications such as parking assistance, collision avoidance, and driver monitoring systems further boosts the market in the region.

Recent Developments

- In May 2022, STMicroelectronics N.V. introduced the VB56G4A, a next-generation automotive global-shutter image sensor designed to streamline the development of driver monitoring systems (DMS). This advanced sensor utilizes state-of-the-art 3D-chip technology, enabling a simplified and efficient DMS design.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global image sensor market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Sony Group

- Samsung Electronics Co., Ltd.

- Omnivision

- STMicroelectronics N.V.

- GalaxyCore Shanghai Limited Corporation

- ON Semiconductor Corporation

- Panasonic Holdings Corporation

- Canon Inc.

- SK Hynix Inc.

- PixArt Imaging Inc.

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global image sensor market based on the below-mentioned segments:

Image Sensor Market, By Technology

- CMOS Image Sensors

- CCD Image Sensors

- Others

Image Sensor Market, By Processing Technique

- 2D Image Sensors

- 3D Image Sensors

Image Sensor Market, By Spectrum

- Visible spectrum

- Non-visible spectrum

Image Sensor Market, By Array Type

- Area Image Sensors

- Linear Image Sensors

Image Sensor Market, By Resolution

- VGA

- 1.3 MP to 3 MP

- 5 MP to 10 MP

- 12 MP to 16 MP

- More than 16 MP

Image Sensor Market, By End-User

- Aerospace, Defense, and Homeland Security

- Automotive

- Consumer Electronics

- Medical & Life Sciences

- Industrial

- Commercial

Image Sensor Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?