India Ammunition Market Size, Share, and COVID-19 Impact Analysis, By Application (Defense and Civil & Commercial), By Product (Bullets, Aerial Bombs, Grenade, Artillery Shells, and Mortars), and India Ammunition Market Insights, Industry Trend, Forecasts to 2033

Industry: Aerospace & DefenseIndia Ammunition Market Insights Forecasts to 2033

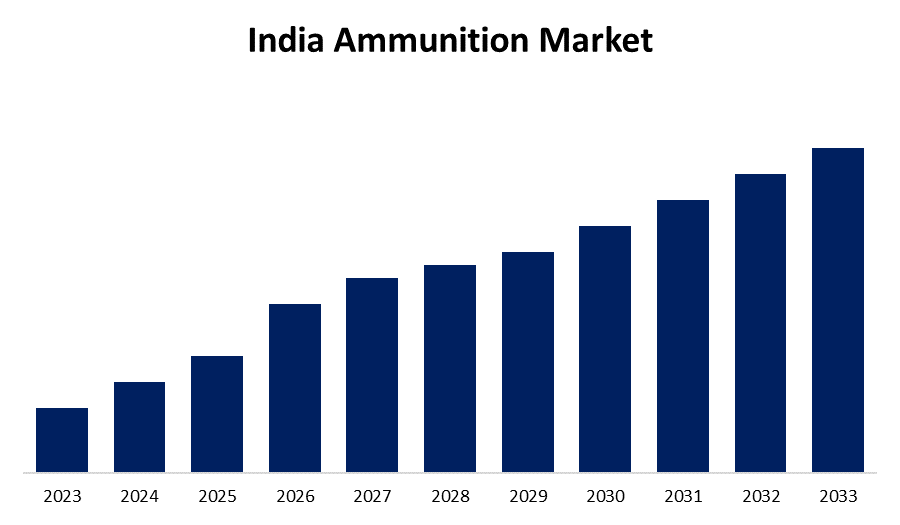

- The Market is growing at a CAGR of 3.4% from 2023 to 2033

- The India Ammunition Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The India Ammunition Market is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of 3.4% from 2023 to 2033.

Market Overview

Ammunition includes different types of materials that are meant to be used in guns, cannons, and other devices that shoot objects. In modern arms, it plays a crucial part by providing the necessary elements to propel projectiles such as bullets, shells, or pellets, with the required accuracy and power. Ammo usually includes important components, such as cartridge or shell casing, primer, propellant, and projectile. The cartridge or casing acts as a container for these parts, offering support and aiding the smooth loading and firing of the ammunition. Precision is crucial in the production of ammunition to guarantee dependability, security, and suitability for particular firearm types. Ammunition has been crucial in military history and remains a fundamental element in both military and civilian firearm uses. Its use covers a wide range of activities like self-defence, target shooting, hunting, and law enforcement, showing its lasting importance in different situations. The Indian Army intends to cease importing ammunition by 2025-26. India is positioning itself as a major global supplier of ammunition by sourcing locally for nearly 150 of the 175 types it utilizes. This shift will not only enhance the security of the nation but also empower India to secure a share of the worldwide ammunition market.

Report Coverage

This research report categorizes the market for the India ammunition market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India ammunition market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India ammunition market.

India Ammunition Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.4% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Application, By Product |

| Companies covered:: | Ordnance Factory Board (OFB), Bharat Electronics Limited (BEL), Defence Research and Development Organisation (DRDO), and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

India's defense budget is instrumental in fueling the expansion of its ammunition market. During the fiscal year 2024-25, the defense budget has increased to INR 6,21,540 crore (approximately USD 72.1 billion). This rise represents a 4.72% increase from the previous year and showcases India's commitment to enhancing its defense capabilities, including ammunition stockpiles. Additionally, with the ongoing economic and technological advancements in the country, the India ammunition market is expected to grow in the foreseeable future. India's commitment to self-reliance is shown by a major agreement signed on December 15, 2023. The Defence Department of the government sealed a deal worth RS 5,336.25 crore with Bharat Electronics Limited (BEL) to produce electronic fuzes.

Restraining Factors

Disarming civilians significantly hinders the expansion of the ammunition market by directly affecting the consumer base and demand for firearm-related items.

Market Segmentation

The India ammunition market share is classified into application and product.

- The defense segment is expected to hold the largest market share through the forecast period.

The India ammunition market is segmented, by application into defense and civil & commercial. Among these, the defense segment is expected to hold the largest market share through the forecast period. The increase in terrorism and armed conflicts is driving the expansion of the military industry in the marketplace. Growing international tensions and conflicts have led to a notable rise in the need for large-caliber ammunition, artillery, and mortars.

- The bullets segment dominates the market with the largest market share over the predicted period.

The India ammunition market is segmented by product into bullets, aerial bombs, grenade, artillery shells, and mortars. Among these, the bullets segment dominates the market with the largest market share over the predicted period. In the past few years, it has become increasingly crucial to modernize the military equipment of both land and air forces due to reasons such as air force operations and geopolitical risks.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India ammunition market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ordnance Factory Board (OFB)

- Bharat Electronics Limited (BEL)

- Defence Research and Development Organisation (DRDO)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, Bharat Electronics Ltd signed an MoU with Rosoboronexport, Russia, and MSK Business Solutions Pvt. Ltd. on July 23 for joint production and supply of indigenised ammunition like 30 mm ammunition (HEI & HET), 40 mm ammunition (VOG-25), and 30 mm grenade ammunition (VOG-30 D).

Market Segment

This study forecasts revenue at India, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the India Ammunition Market based on the below-mentioned segments:

India Ammunition Market, By Application

- Defense

- Civil & Commercial

India Ammunition Market, By Product

- Bullets

- Aerial Bombs

- Grenade

- Artillery Shells

- Mortars

Need help to buy this report?