India Energy Drinks Market Size, Share, and COVID-19 Impact Analysis, By Soft Drink Type (Energy Shots, Natural/Organic Energy Drinks, Sugar-Free or Low-Calories Energy Drinks, and Traditional Energy Drinks), By Packaging Type (Glass Bottles, Metal Cans, and PET Bottles), and India Energy Drinks Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesIndia Energy Drinks Market Insights Forecasts to 2033

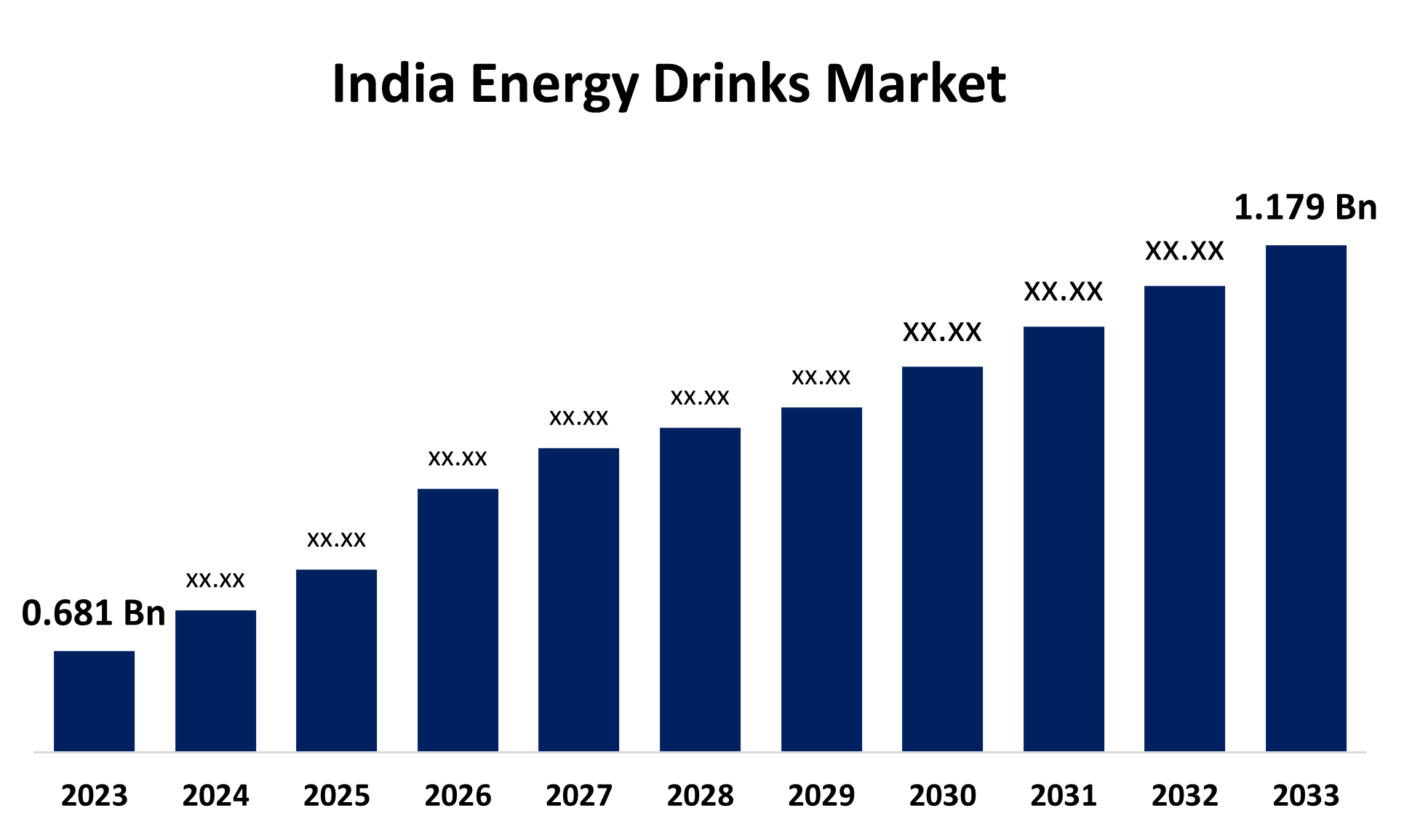

- The India Energy Drinks Market Size was valued at USD 0.681 Billion in 2023.

- The Market is Growing at a CAGR of 5.64% from 2023 to 2033

- The India Energy Drinks Market Size is Expected to Reach USD 1.179 Billion by 2033

Get more details on this report -

The India Energy Drinks Market is Anticipated to Reach USD 1.179 Billion by 2033, growing at a CAGR of 5.64% from 2023 to 2033.

Market Overview

The India energy drinks market refers to the production and consumption of drinks that are made to enhance energy and mental alertness. They contain ingredients like caffeine, taurine, vitamins, and sugar, meant to provide instant energy, enhance physical performance, and improve concentration. Energy drinks are in demand among active people, including students, working professionals, athletes, and fitness enthusiasts. The market has seen rapid growth because of increasing urbanization, growing disposable incomes, and rising health and fitness awareness. The market is further fueled by the demand for convenient, ready-to-consumer products because busy consumers look for quick and effective energy solutions. There is also a significant shift towards sugar-free, organic, and health-conscious energy drink options, which responds to evolving consumer preferences for healthier alternatives. The India energy drinks market is governed by government policies, with regulatory bodies like FSSAI providing standards for labeling, ingredients, and safety. This ensures product quality and safety, boosting consumer confidence. The government supports the beverage industry by initiating food processing and encouraging local production, which, along with the growth of indigenous and international brands, has contributed to the market's growth and development. For instance, the Make in India initiative's National Manufacturing Mission seeks to increase domestic production and draw in foreign capital. This might spur more innovation and manufacturing in the energy drink industry.

Report Coverage

This research report categorizes the market for the India energy drinks market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India energy drinks market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India energy drinks market.

India Energy Drinks Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 0.681 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 5.64% |

| 023 – 2033 Value Projection: | USD 1.179 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 246 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Soft Drink Type, By Packaging Type |

| Companies covered:: | Anheuser-Busch InBev SA/NV, Monster Beverage Corporation, PepsiCo, Inc., Red Bull GmbH, The Coca-Cola Company, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The India energy drinks market is driven by increasing consumer awareness of fitness, health, and wellness, an increase in active lifestyles, and the growing middle-class population. The demand for energy drinks is driven by the quick solution for energy and a focus on health. The market also benefits from the changing portfolio of sugar-free, organic, and health-conscious products, catering to health-conscious consumers. Aggressive marketing and sponsorship of sporting events and fitness activities by energy drink brands also contribute to the market growth.

Restraining Factors

The energy drink market faces challenges due to health concerns about excessive caffeine and sugar content, stricter labeling and safety regulations, growing competition from other beverage categories, and concerns about the long-term effects of regular consumption. These factors could limit sales and shift towards healthier alternatives, potentially affecting the market's growth.

Market Segmentation

The India energy drinks market share is classified into soft drink type and packaging type.

- The traditional energy drinks segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The India energy drinks market is segmented by soft drink type into energy shots, natural/organic energy drinks, sugar-free or low-calories energy drinks, and traditional energy drinks. Among these, the traditional energy drinks segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. This is due to their established brand, consumer familiarity, and core ingredients like caffeine, taurine, and sugar. These drinks are popular among students, professionals, and athletes, providing instant energy and enhancing physical and cognitive performance, appealing to India's dynamic population.

- The PET bottles segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the packaging type, the India energy drinks market is divided into glass bottles, metal cans, and PET bottles. Among these, the PET bottles segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period. PET bottles are the most valued segment in the India energy drinks market due to their convenience, cost-effectiveness, and portability. These lightweight, shatterproof, and durable packaging are ideal for on-the-go consumption, making them the preferred choice for those seeking quick energy boosts.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India energy drinks market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Anheuser-Busch InBev SA/NV

- Monster Beverage Corporation

- PepsiCo, Inc.

- Red Bull GmbH

- The Coca-Cola Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2023, the limited-edition flavor Sting Blue Current was introduced by PepsiCo India. A humorous brand campaign with the phrase Sting Blue Current, Kamaal ka Current" preceded the debut, urging customers to feel the thrill of Sting Blue Current for themselves.

Market Segment

This study forecasts revenue at India, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the India energy drinks market based on the below-mentioned segments:

India Energy Drinks Market, By Soft Drink Type

- Energy Shots

- Natural/Organic Energy Drinks

- Sugar-Free or Low-Calories Energy Drinks

- Traditional Energy Drinks

India Energy Drinks Market, By Packaging Type

- Glass Bottles

- Metal Cans

- PET Bottles

Need help to buy this report?