India Hair Care Products Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Hair Colorants, Hair Sprays, Conditioners, Styling Gels, Hair Oils, Shampoos, and Others) and By Distribution Channel (Hypermarket/Supermarkets, Specialty Stores, Online Retail Stores, Pharmacies/Health Stores, and Others), and India Hair Care Products Market Insights, Industry Trend, Forecasts to 2033.

Industry: Consumer GoodsIndia Hair Care Products Market Insights Forecasts to 2033

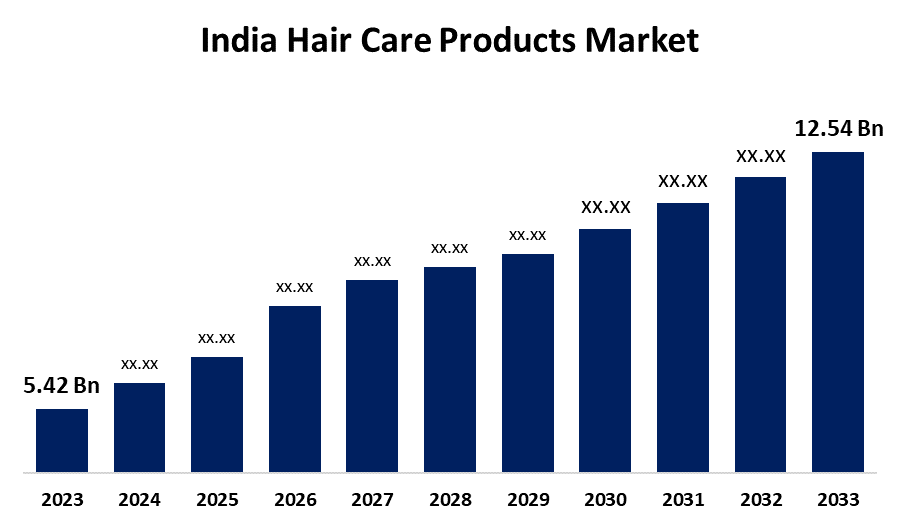

- The India Hair Care Products Market Size was valued at USD 5.42 Billion in 2023.

- The Market is Growing at a CAGR of 8.75% from 2023 to 2033

- The India Hair Care Products Market Size is Expected to Reach USD 12.54 Billion by 2033

Get more details on this report -

The India Hair Care Products Market is Anticipated to Reach USD 12.54 Billion by 2033, growing at a CAGR of 8.75% from 2023 to 2033

Market Overview

The India hair care products market is a growing industry that manufactures, distributes, and consumes various hair care products, including shampoos, conditioners, hair oils, colorants, styling gels, and treatments. The market caters to diverse consumer needs, from basic hygiene to premium and specialized solutions. Key drivers include rising demand for premium products, social media influence, urbanization, middle-class population, and increased spending on personal care. Government initiatives, such as incentives for domestic manufacturing and foreign investments, have also contributed to the market's expansion. The "Make in India" initiative has fostered innovation in hair care products and led to the development of local brands. Regulations ensuring product safety and quality have established a more organized market, enhanced consumer trust and boosting the market's growth. Overall, the market is thriving due to changing consumer preferences, increasing awareness about personal grooming, and growing disposable incomes.

Report Coverage

This research report categorizes the market for the India hair care products market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India hair care products market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India hair care products market.

Driving Factors

The market for hair care products in India is driven by a number of causes, but one of the most important ones is the rising awareness of hair health and personal grooming. Demand for high-quality hair care products has increased as a result of rising disposable incomes and a trend for premium and organic products. Rapid urbanization, shifting lifestyles, and the impact of social media and beauty gurus have all contributed to the market's growth. There is a strong need for certain goods like anti-hair fall shampoos, hair serums, and treatments because of the developing issues with hair at its roots, such as dandruff, damaged hair, and hair loss. Time-saving initiatives have expanded since the number of working professionals, particularly women, is growing daily.

India Hair Care Products Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.42 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.75% |

| 2033 Value Projection: | USD 12.54 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Product Type, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Dabur India Ltd, Marico Limited, Procter and Gamble, Unilever PLC, L’Oreal, and Others Key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Restraining Factors

The market for hair care products faces challenges such as high prices, counterfeit products, intense competition, and uncertainty for newcomers. Price-sensitive consumers in smaller cities and rural areas may struggle to access premium products, while concerns about product quality and safety arise from the prevalence of counterfeit and substandard products. The fluctuating nature of raw materials and complexities in ensuring product safety within regulatory limits also hinder market development.

Market Segmentation

The India hair care products market share is classified into product type and distribution channel.

- The shampoos segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The India hair care products market is segmented by product type into hair colorants, hair sprays, conditioners, styling gels, hair oils, shampoos, and others. Among these, the shampoos segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. Shampoo is a popular daily hair care product, used by various consumer groups due to increased awareness about hair health and the availability of various types like anti-dandruff, moisture-building, and herbal shampoos. Factors contributing to the high market share of shampoos include disposable incomes, urbanization, and preference for high-quality products.

- The hypermarkets/supermarkets segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the India hair care products market is divided into hypermarket/supermarkets, specialty stores, online retail stores, pharmacies/health stores, and others. Among these, the hypermarkets/supermarkets segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period. Retail outlets, such as hypermarkets and supermarkets, are becoming popular destinations for consumers due to their convenience, wide product range, and competitive pricing, making them the preferred choice for hair care products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India hair care products market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dabur India Ltd

- Marico Limited

- Procter and Gamble

- Unilever PLC

- L'Oreal

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2025, the new Rice Water and Hyaluronic Acid Haircare Range was introduced by Nykaa Naturals in India. Hyaluronic acid and rice water's moisturizing qualities are combined in this line to cure, wash, and nourish hair for smooth, frizz-free results. Products are offered online and at Nykaa locations around India.

Market Segment

This study forecasts revenue at India, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the India hair care products market based on the below-mentioned segments:

India Hair Care Products Market, By Product Type

- Hair Colorants

- Hair Sprays

- Conditioners

- Styling Gels

- Hair Oils

- Shampoos

- Others

India Hair Care Products Market, By Distribution Channel

- Hypermarket/Supermarkets

- Specialty Stores

- Online Retail Stores

- Pharmacies/Health Stores

- Others

Need help to buy this report?