India Hydrogen Market Size, Share, and COVID-19 Impact Analysis, By Type (Gray, Blue, Green), By Storage (Physical, Material), By Application (Energy (Power, CHP), Mobility, Chemical & Refinery (Refinery, Ammonia, Methanol)), and India Hydrogen Market Insights Forecasts to 2032

Industry: Energy & PowerIndia Hydrogen Market Insights Forecasts to 2032

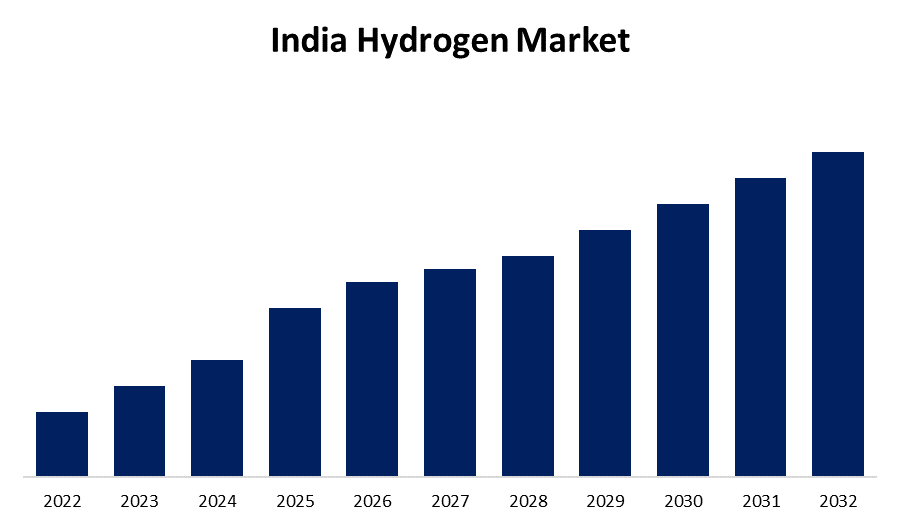

- The Market Size is Growing at a CAGR of 6.90% from 2022 to 2032.

- The India Hydrogen Market Size is Expected to Hold Substantial Share by 2032.

Get more details on this report -

The India Hydrogen Market Size is expected to Hold Substantial Share by 2032, at a CAGR of 6.90% during the forecast period 2022 to 2032.

Market Overview

In the chemical element family, hydrogen (H) is the most basic element. It is a colourless, odourless, tasteless, and flammable gaseous substance. A better option for the environment than methane, or natural gas, is hydrogen. The increase in demand for hydrogen in recent years can be attributed to the government's increasing emphasis on developing economies based on hydrogen and its investments in hydrogen infrastructure. The hydrogen market is predicted to benefit greatly from the rising acceptance of low-emission fuels. Furthermore, growing public awareness of carbon emissions and global warming has fueled the Indian hydrogen market's expansion. India is the third-biggest producer of carbon dioxide after the US and China. As a result, there has been a growing need for the use of green hydrogen. The market also offers enormous opportunities for growth and investment because of the rising demand for chemicals, advances in technology, and government backing. The Indian hydrogen market is expanding throughout the nation as a result of the widespread use of hydrogen as a coolant in power plant generators.

Report Coverage

This research report categorizes the market for India hydrogen market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India hydrogen market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India hydrogen market.

India Hydrogen Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 6.90% |

| Historical Data for: | 2020-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Storage, By Application |

| Companies covered:: | Ballard Power System, Reliance Industries Limited, Indian Oil Corporation Ltd., GAIL (India) Limited, Air Liquide, Fuel Cell Energy, Plug Power, Bloom Energy, Linde, INOX Air, Air Products, Thyssenkrupp, KBR/Johnson Matthey, Cummins, and others. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

The increase in demand for hydrogen in the end-user industry is the primary driver of the hydrogen market's growth in India. Additionally, the market has grown as a result of the use of hydrogen in power generation and rigid environmental laws that favour cleaner forms of energy. For Instance, Reliance Industries Ltd. (RIL), the biggest private oil and gas company in the nation, declared its goal to achieve carbon neutrality by 2035. Its objective is to replace fossil fuels in transportation with hydrogen and renewable energy sources. The Indian government's increasing focus on the hydrogen market and its growing investment in the sector are anticipated to propel the country's hydrogen market's growth over the projection period.

Restraining Factors

The market's expansion is hampered by the high cost of hydrogen storage and transportation as well as its stagnant price. Liquid organic hydrogen carrier (LOHC) technologies, on the other hand, are anticipated to increase market growth prospects in the future by storing and transporting hydrogen.

Market Segment

- In 2022, the green segment accounted for the largest revenue share over the forecast period.

Based on the type, the India hydrogen market is segmented into grey, blue, and green. Among these, the green segment has the largest revenue share over the forecast period. Green hydrogen can be transformed into electricity or synthetic gas and used for commercial, industrial or mobility purposes. Green hydrogen does not emit polluting gases either during combustion or during production.

- In 2022, the physical segment accounted for the largest revenue share over the forecast period.

Based on storage, the India hydrogen market is segmented into physical, and material. Among these, the physical segment has the largest revenue share over the forecast period. Hydrogen can be physically stored in both liquid and gaseous state. In general, hydrogen must be stored as a gas in high-pressure tanks. The storage of liquid hydrogen demands cryogenic temperatures. Furthermore, solids can adsorb hydrogen onto their surfaces or absorb it internally.

- In 2022, the mobility segment is expected to hold the largest share of the India hydrogen market during the forecast period.

Based on the application, the India hydrogen market is classified into energy (power, CHP), mobility, and chemical & refinery (refinery, ammonia, methanol). Among these, the mobility segment is expected to hold the largest share of the India hydrogen market during the forecast period. The increasing investments in fuel cells are expected to drive the hydrogen market. Many governments and organizations worldwide are providing funds, incentives, and support for the development, implementation, and commercialization of hydrogen fuel cells in an attempt to advance clean energy and tackle climate change.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India hydrogen market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ballard Power System

- Reliance Industries Limited

- Indian Oil Corporation Ltd.

- GAIL (India) Limited

- Air Liquide

- Fuel Cell Energy

- Plug Power

- Bloom Energy

- Linde

- INOX Air

- Air Products

- Thyssenkrupp

- KBR/Johnson Matthey

- Cummins

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2023, India and Fraunhofer ISE collaborated on clean energy and hydrogen technologies. The Fraunhofer Institute for Solar Energy Systems (Fraunhofer ISE) in Germany and the Department of Science and Technology (DST) have inked a letter of intent to establish a long-term partnership centred on clean technologies, including hydrogen.

Market Segment

This study forecasts revenue at regional, and country levels from 2021 to 2032. Spherical Insights has segmented the India hydrogen market based on the below-mentioned segments:

India Hydrogen Market, By Type

- Gray

- Blue

- Green

India Hydrogen Market, By Storage

- Physical

- Material

India Hydrogen Market, By

- Energy

- Power

- CHP

- Mobility

- Chemical & Refinery

- Refinery

- Ammonia

- Methanol

Need help to buy this report?