India Isopropyl Alcohol Market Size, Share, and COVID-19 Impact Analysis, By Application (Antiseptic and Astringent, Cleaning Agent, Solvent, and Chemical Intermediate), By End-Use (Cosmetics and Personal Care, Pharmaceutical, Food and Beverages, Paints and Coatings, Chemical, and Other), and India Isopropyl Alcohol Market Insights, Industry Trend, Forecasts to 2033

Industry: Chemicals & MaterialsIndia Isopropyl Alcohol Market Insights Forecasts to 2033

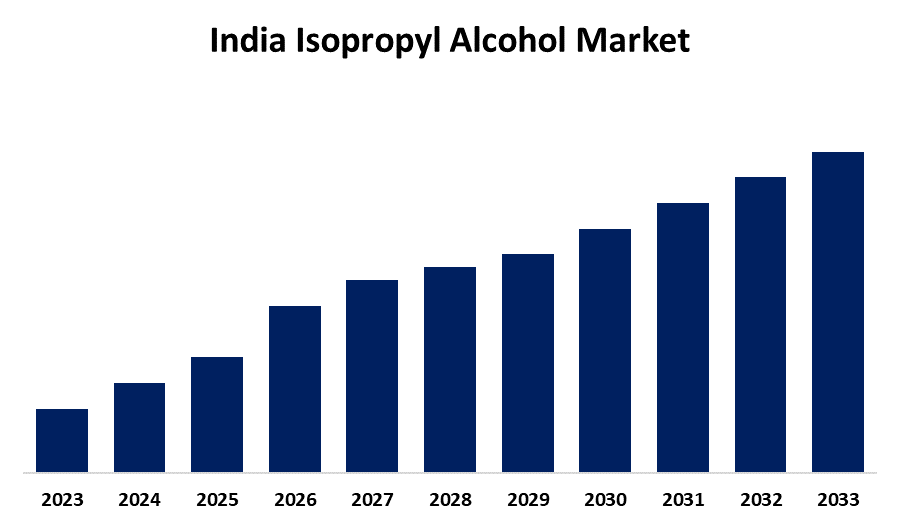

- The India Isopropyl Alcohol Market Size is Growing at a CAGR of 2.95% from 2023 to 2033

- The India Isopropyl Alcohol Market Size is Expected to Hold a Significant Share By 2033

Get more details on this report -

The India Isopropyl Alcohol Market Size is Anticipated to Hold a Significant Share By 2033, Growing at a CAGR of 2.95% from 2023 to 2033.

Market Overview

The India isopropyl alcohol market involves the production, distribution, and consumption of isopropyl alcohol, a versatile solvent widely used across industries such as pharmaceuticals, cosmetics, cleaning, automotive, and chemical manufacturing, known for its disinfectant properties, is utilized in applications ranging from medical antiseptics to industrial cleaning agents. It is a crucial ingredient in hand sanitizers, surface disinfectants, and various household products. Several factors drive the markets growth, including the increasing demand for cleaning products. The rise in healthcare awareness, coupled with the growth of the pharmaceutical and cosmetic industries, further supports market expansion. Additionally, the automotive sector’s demand for in cleaning and degreasing applications plays a significant role in the markets development. Government initiatives also contribute to the growth of the isopropyl alcohol market. The Indian government’s support for the healthcare and pharmaceutical sectors through programs like the National Health Mission and the Make in India initiative boosts local manufacturing and consumption of. Moreover, regulations related to hygiene standards and sanitization, especially in public spaces, increase the demand for disinfectants containing, driving further market growth.

Report Coverage

This research report categorizes the market for the India isopropyl alcohol market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India isopropyl alcohol market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the India isopropyl alcohol market.

India Isopropyl Alcohol Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.95% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 255 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Application, By End-Use |

| Companies covered:: | Dow Chemical, Mistral Industrial Chemicals, INEOS Corporation, ReAgent Chemicals Ltd., LyondellBasell Industries, Linde Gas, Ecolab, Royal Dutch Shell, ExxonMobil Corporation, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The India isopropyl alcohol market is driven by the increasing demand for cleaning and disinfectant products. The rise in healthcare awareness, coupled with the growing pharmaceutical, cosmetic, and personal care industries, further fuels market expansion. Additionally, the automotive industry’s need for IPA in cleaning, degreasing, and surface preparation applications contributes to market growth. The growing focus on hygiene and sanitization standards in public and commercial spaces boosts the demand for IPA-based disinfectants. Government initiatives such as the Make in India program and support for the healthcare sector also promote the production and consumption of IPA.

Restraining Factors

The India isopropyl alcohol market faces restraints such as fluctuating raw material prices, supply chain disruptions, and stringent environmental regulations on chemical production. Additionally, the high production cost of IPA and competition from alternative solvents hinder market growth.

Market segmentation

The India isopropyl alcohol market share is classified into application and end-use.

- The solvent segment is expected to hold the largest market share through the forecast period.

The India isopropyl alcohol market is segmented by application into antiseptic & astringent, cleaning agent, solvent, and chemical intermediate. Among these, the solvent segment is expected to hold the largest market share through the forecast period. IPA's efficacy as a solvent makes it indispensable in various applications, including pharmaceuticals, cosmetics, and chemical manufacturing. The solvent segment's prominence is further bolstered by the expanding pharmaceutical and cosmetic industries in India, which rely heavily on IPA for formulation and processing.

- The pharmaceutical segment is expected to hold the largest market share through the forecast period.

The India isopropyl alcohol market is segmented by end-use into cosmetics & personal care, pharmaceutical, food & beverages, paints & coatings, chemical, and other. Among these, the pharmaceutical segment is expected to hold the largest market share through the forecast period. IPA's widespread use in the pharmaceutical industry includes applications such as the production of ear drops, hand sanitizers, disinfectants, alcohol swabs, and wipes for wound cleaning. Additionally, IPA is utilized in manufacturing capsules and tablets in precise and safe dosages. This extensive utilization underscores the pharmaceutical industry's dominance in the IPA market within India.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India isopropyl alcohol market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dow Chemical

- Mistral Industrial Chemicals

- INEOS Corporation

- ReAgent Chemicals Ltd.

- LyondellBasell Industries

- Linde Gas

- Ecolab

- Royal Dutch Shell

- ExxonMobil Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at India, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the India isopropyl alcohol market based on the below-mentioned segments:

India Isopropyl Alcohol Market, By Application

- Antiseptic & Astringent

- Cleaning Agent

- Solvent

- Chemical Intermediate

India Isopropyl Alcohol Market, By End-Use

- Cosmetics & Personal Care

- Pharmaceutical

- Food & Beverages

- Paints & Coatings

- Chemical

- Other

Need help to buy this report?