India Kitchen Appliances Market Size, Share, and COVID-19 Impact Analysis, By Product (Food Processors, Mixers & Grinders, Microwave Ovens, Grills & Toasters, Water Purifiers, Refrigerators, Dishwashers, and Others), By Application (Residential and Commercial), and India Kitchen Appliances Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsIndia Kitchen Appliances Market Insights Forecasts to 2033

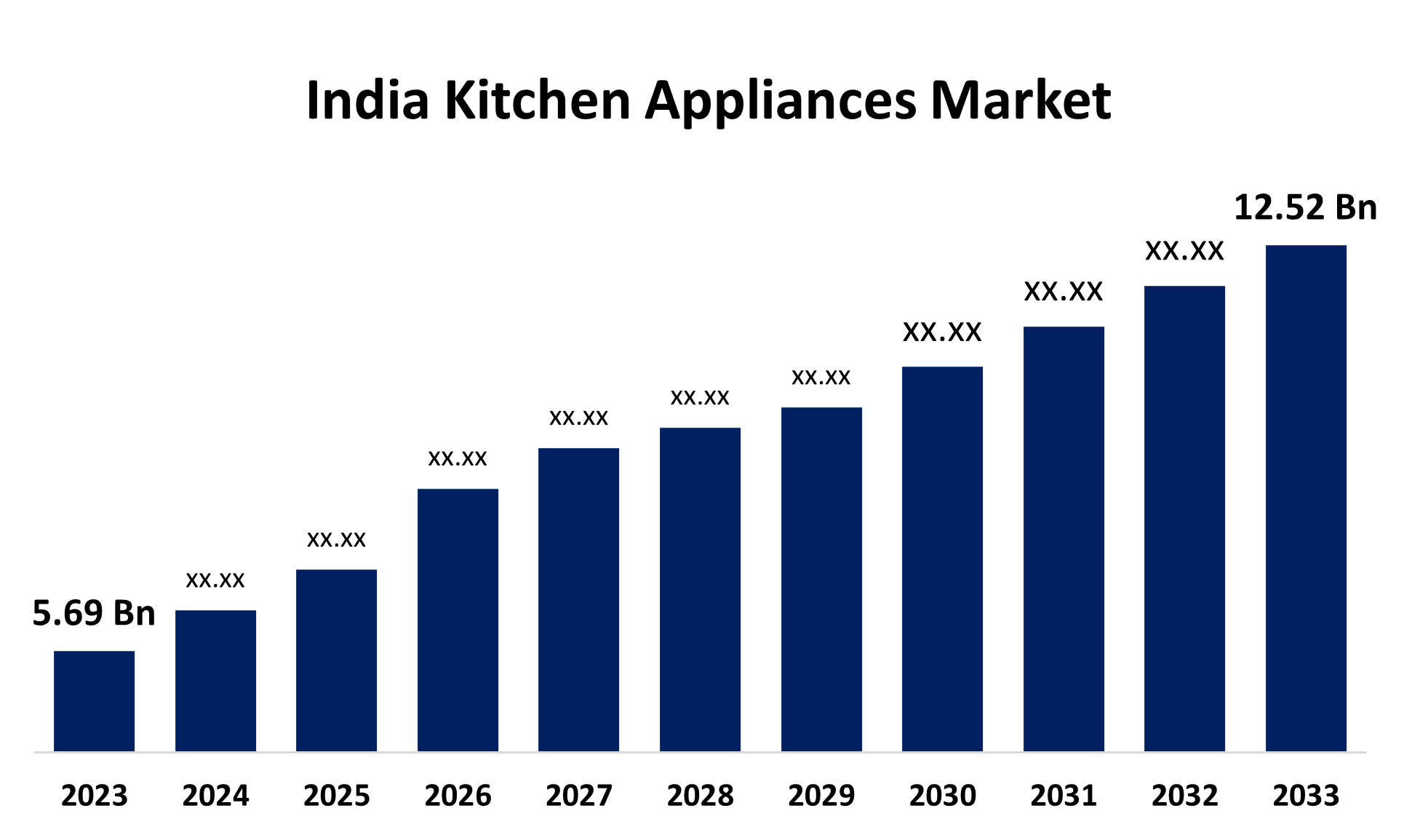

- The India Kitchen Appliances Market Size was valued at USD 5.69 Billion in 2023.

- The Market is Growing at a CAGR of 8.21% from 2023 to 2033

- The India Kitchen Appliances Market Size is Expected to Reach USD 12.52 Billion by 2033

Get more details on this report -

The India Kitchen Appliances Market is Anticipated to Reach USD 12.52 Billion by 2033, Growing at a CAGR of 8.21% from 2023 to 2033.

Market Overview

The Indian kitchen appliances market includes a wide range of goods for cooking, preserving, and preparing food. With an emphasis on modernization and convenience in kitchen operations, they include a wide range of categories, including cooking appliances, such as refrigerators, microwaves, ovens, blenders, and dishwashers, and are designed to serve both urban and rural populations. The need for intelligent, energy-efficient, and technologically sophisticated kitchen appliances is being driven by rising disposable incomes, fast urbanization, and shifting lifestyles. Smart elements like automation and IoT connectivity are becoming more and more popular due to a younger, tech-savvy populace. Additionally, the market for appliances aimed at health-conscious consumers is expanding. The market for modern kitchen solutions is experiencing steady growth due to the middle class's rapid growth, increased homeownership, and a preference for energy-efficient appliances. E-commerce has expanded product options, allowing consumers to access vast options from domestic and international brands. Manufacturers are introducing effective and sustainable products to meet consumer preferences. Government initiatives like Make in India, Pradhan Mantri Ujjwala Yojana, and energy-efficient regulations are driving demand for kitchen appliances in India. These initiatives aim to increase domestic appliance manufacturing, reduce imports, and promote domestic production, while also encouraging product innovation through energy-efficient regulations.

Report Coverage

This research report categorizes the market for the India kitchen appliances market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India kitchen appliances market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India kitchen appliances market.

India Kitchen Appliances Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.69 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 8.21% |

| 023 – 2033 Value Projection: | USD 12.52 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 257 |

| Tables, Charts & Figures: | 82 |

| Segments covered: | By Product, By Application |

| Companies covered:: | Philips India Limited, Bajaj Electricals Ltd., LG Electronics India Pvt. Ltd., Samsung India Electronics Pvt Ltd, TTK Prestige Limited, Electrolux India, Bosch India, Haier Appliances India Pvt. Ltd., IFB Appliances, Whirlpool of India Ltd., and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The India kitchen appliances market is driven by factors such as rapid urbanization, increased incomes, and the adoption of energy-efficient appliances like smart fridges, microwaves, and air fryers. The demand for healthier cooking appliances like blenders and steamers is also rising. The market's growth is further fueled by widespread accessibility through e-commerce portals, which cater to larger consumer bases, thereby driving the demand for modern kitchen solutions.

Restraining Factors

The market for modern kitchen appliances faces challenges due to high initial investment, lack of consumer awareness about energy-efficient and technologically advanced appliances, and competition from unorganized sectors and locals who manufacture at lower costs. Rural customers still rely on traditional cooking methods, making it difficult to effectively market these products. Additionally, competition from unorganized sectors and locals may challenge the growth of premium and branded kitchen appliances.

Market Segmentation

The India kitchen appliances market share is classified into product and application.

- The refrigerators segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The India kitchen appliances market is segmented by product into food processors, mixers & grinders, microwave ovens, grills & toasters, water purifiers, refrigerators, dishwashers, and others. Among these, the refrigerators segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. Refrigerators are among the most crucial household appliances. Their demand has been growing as a result of increasing disposable incomes, urbanization, and the growing concern over food preservation. With better living standards, modern refrigerators with energy efficiency and smart connectivity are being bought by more and more households in urban and rural areas.

- The residential segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the India kitchen appliances market is divided into residential and commercial. Among these, the residential segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The demand for kitchen appliances is primarily from residential consumers, as over half of the Indian population lives in houses. With urbanization and income growth, households are increasingly investing in modern appliances for convenience, efficiency, and improved cooking experiences. Advanced solutions like microwaves, refrigerators, blenders, air fryers, and smart devices are being used extensively in urban areas.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India kitchen appliances market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Philips India Limited

- Bajaj Electricals Ltd.

- LG Electronics India Pvt. Ltd.

- Samsung India Electronics Pvt Ltd

- TTK Prestige Limited

- Electrolux India

- Bosch India

- Haier Appliances India Pvt. Ltd.

- IFB Appliances

- Whirlpool of India Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2024, Samsung's Custom AI Household Appliances, Air conditioners, microwaves, refrigerators, and washing machines with AI built in are part of this portfolio, which was introduced. Advanced power-saving technologies, integrated Wi-Fi, and SmartThings AI Energy Mode for optimal power efficiency are all included with these products.

Market Segment

This study forecasts revenue at India, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the India kitchen appliances market based on the below-mentioned segments:

India Kitchen Appliances Market, By Product

- Food Processors

- Mixers & Grinders

- Microwave Ovens

- Grills & Toasters

- Water Purifiers

- Refrigerators

- Dishwashers

- Others

India Kitchen Appliances Market, By Application

- Residential

- Commercial

Need help to buy this report?