India Metal Carboxylates Market Size, Share, and COVID-19 Impact Analysis, By Technology (Primary Drier Metals, Through Drier Metals, and Auxiliary Drier Metals), By End-Use (Catalyst, Lubricant Additives, Driers, and Plastic Stabilizers), and India Metal Carboxylates Market Insights, Industry Trend, Forecasts to 2033

Industry: Advanced MaterialsIndia Metal Carboxylates Market Size Insights Forecasts to 2033

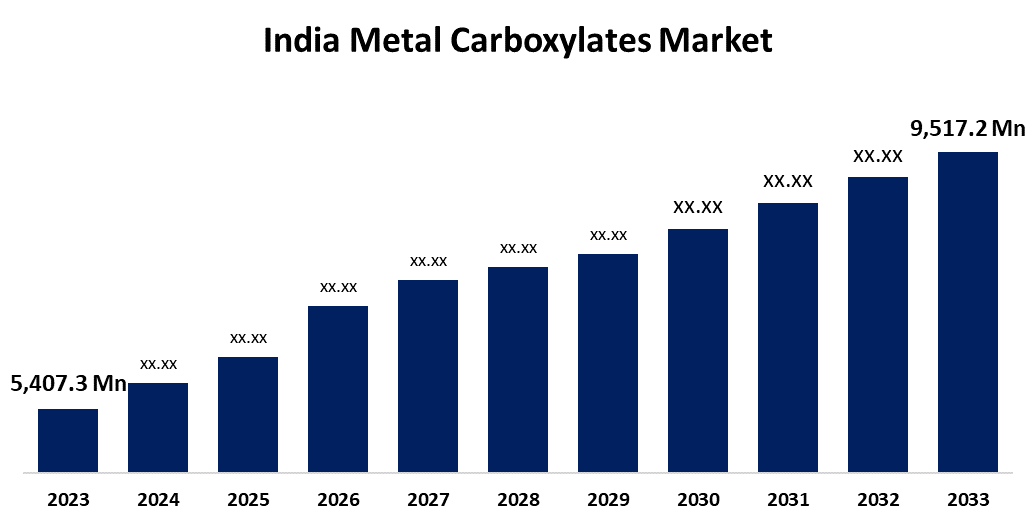

- The India Metal Carboxylates Market Size was valued at USD 5,407.3 Million in 2023.

- The Market Size is Growing at a CAGR of 5.82% from 2023 to 2033

- The India Metal Carboxylates Market Size is Expected to reach USD 9,517.2 Million by 2033

Get more details on this report -

The India Metal Carboxylates Market Size is Anticipated to Exceed USD 9,517.2 Million by 2033, Growing at a CAGR of 5.82% from 2023 to 2033.

Market Overview

The India metal carboxylates market encompasses the production, distribution, and consumption of metal carboxylates, which are metal salts of fatty acids. These compounds are widely used as catalysts, stabilizers, lubricants, and in the production of various chemicals and coatings. The market has seen notable growth due to the increasing demand for metal carboxylates in industries such as automotive, agriculture, paints and coatings, and plastics. Key driving factors include the rapid industrialization and expanding manufacturing sector in India, alongside the growing need for high-performance lubricants and stabilizers in various applications. The rise in agricultural activities and demand for metal carboxylates in fertilizers further supports market growth. Additionally, the increasing focus on sustainable and eco-friendly solutions has led to a shift toward the adoption of bio-based metal carboxylates, which are seen as a safer alternative to traditional chemicals. Government initiatives such as "Make in India" and "Atmanirbhar Bharat" have further stimulated the domestic production of chemical compounds, including metal carboxylates. These initiatives aim to reduce dependence on imports, foster innovation, and promote the development of local manufacturing capabilities. The growing focus on infrastructure development and investments in the automotive and construction sectors also positively impact the demand for metal carboxylates in the country.

Report Coverage

This research report categorizes the market for the India metal carboxylates market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India metal carboxylates market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the India metal carboxylates market.

India Metal Carboxylates Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5,407.3 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.82% |

| 2033 Value Projection: | USD 9,517.2 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 114 |

| Segments covered: | By Technology, By End-Use and COVID-19 Impact Analysis |

| Companies covered:: | BASF SE, Dow, Elementis plc, Organometals, Arkema Group, PMC Group, Inc., Valtris Specialty Chemicals, Penta Manufacturing Company, DIC Corporation, Ege Kimya San. ve Tic. A.S, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The India metal carboxylates market is driven by several factors, including rapid industrialization, urbanization, and the expansion of key sectors like automotive, agriculture, and coatings. The increasing demand for high-performance lubricants, stabilizers, and catalysts across various industries boosts market growth. Furthermore, the growing emphasis on sustainable and eco-friendly solutions has spurred interest in bio-based metal carboxylates. The rise in agricultural activities and the need for metal carboxylates in fertilizers also contribute to market expansion. Government initiatives like "Make in India" and "Atmanirbhar Bharat" promote domestic manufacturing, reducing reliance on imports and further driving market demand.

Restraining Factors

The India metal carboxylates market faces challenges such as fluctuating raw material prices, limited awareness of the benefits of metal carboxylates in some industries, and high production costs. Additionally, regulatory hurdles and environmental concerns related to chemical usage may hinder market growth.

Market segmentation

The India metal carboxylates market share is classified into technology and end-use.

- The primary drier metals segment is expected to hold the largest market share through the forecast period.

The India metal carboxylates market is segmented by technology into primary drier metals, through drier metals, and auxiliary drier metals. Among these, the primary drier metals segment is expected to hold the largest market share through the forecast period. Primary drier metals, such as cobalt, manganese, and zirconium, are widely used as essential drying agents in coatings, paints, and varnishes. These metals enhance the curing process of paints and coatings, making them highly sought after in industries like automotive, construction, and industrial coatings.

- The driers segment is expected to hold the largest market share through the forecast period.

The India metal carboxylates market is segmented by end-use into catalysts, lubricant additives, driers, and plastic stabilizers. Among these, the driers segment is expected to hold the largest market share through the forecast period. Metal carboxylates, particularly those used as driers in paints, coatings, and varnishes, are critical for accelerating the curing process and improving the durability of finished products. The growing demand for high-performance coatings in industries such as automotive, construction, and manufacturing is driving the demand for metal carboxylates in driers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India metal carboxylates market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- Dow

- Elementis plc

- Organometals

- Arkema Group

- PMC Group, Inc.

- Valtris Specialty Chemicals

- Penta Manufacturing Company

- DIC Corporation

- Ege Kimya San. ve Tic. A.S

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at India, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the India metal carboxylates market based on the below-mentioned segments:

India Metal Carboxylates Market, By Technology

- Primary Drier Metals

- Through Drier Metals

- Auxiliary Drier Metals

India Metal Carboxylates Market, By End-Use

- Catalyst

- Lubricant Additives

- Driers

- Plastic Stabilizers

Need help to buy this report?