India Military Transport Aircraft Market Size, Share, and COVID-19 Impact Analysis, By Aircraft Type (Fixed-Wing and Rotary Blade), By End User (Military Forces, Government Agencies, and Defense Contractors), and India Military Transport Aircraft Market Insights, Industry Trend, Forecasts to 2033.

Industry: Aerospace & DefenseIndia Military Transport Aircraft Market Insights Forecasts to 2033

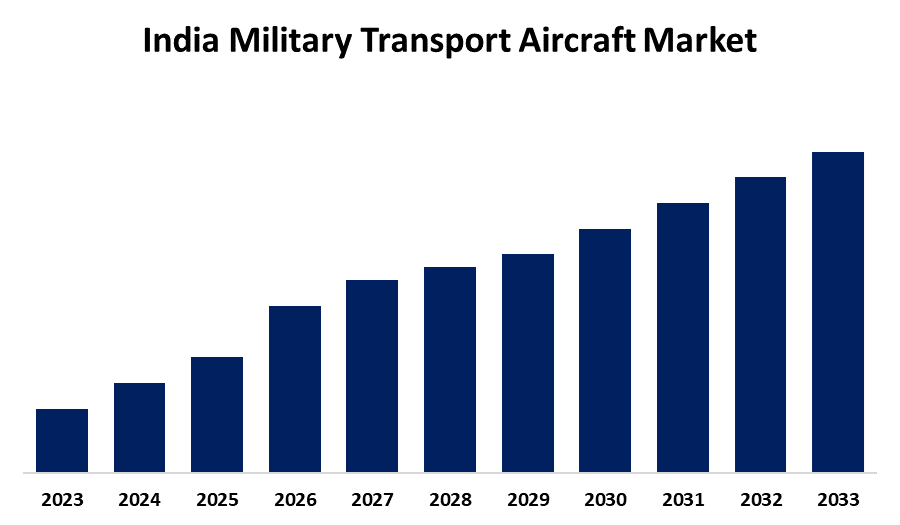

- The Market is Growing at a CAGR of 3.1% from 2023 to 2033

- The India Military Transport Aircraft Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The India Military Transport Aircraft Market is Expected to Hold a Significant Share by 2033, growing at a CAGR of 3.1% from 2023 to 2033.

Market Overview

Delivering personnel, weapons, vehicles, and other defense-related supplies is accomplished by specially built fixed and rotary-wing cargo aircraft known as military transport aircraft. They carry out multi-role tasks like information gathering, search and rescue missions, and aerial refueling to support military operations. During military operations, military transport planes are also utilized to move troops and supplies because of their large cargo storage capacity. They can be used for both strategic and tactical actions, and they are essential in preserving supply lines to advanced sites that are inaccessible by land or water. Consequently, India uses military transport aircraft extensively for observation, reconnaissance, emergency services, transportation, and combat activities. Additionally, India's border disputes with its neighbors are the main source of its need for military hardware. Bangladesh, Pakistan, and China have all used force to suffocate India in various ways. Furthermore, India has had to acquire large-caliber ammunition due to the ongoing military struggle with China at the Line of Actual Control (LAC) and a comparable conflict with Pakistan.

Report Coverage

This research report categorizes the market for the India military transport aircraft market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India military transport aircraft market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India military transport aircraft market.

India Military Transport Aircraft Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.1% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Aircraft Type, By End User and COVID-19 Impact Analysis |

| Companies covered:: | Hindustan Aeronautics Limited (HAL), Tata Advanced Systems Limited (TASL), Airbus SE, Bharat Electronics Limited (BEL), Reliance Defence and Engineering Limited, Defense Research and Development Organisation (DRDO) and Others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

India has set a defense budget of INR 5.93 trillion for the fiscal year 2023–2024, up from INR 5.13 trillion for FY 2022–2023. The market for India's military transport aircraft is being further stimulated by the government's increased expenditure on the defense industry. In recent years, India's defense ecosystem has experienced significant changes, with important institutional and regulatory adjustments promoting exports, indigenization, and the purchase of indigenous capital. The government's Atmanirbhar Bharat and Make in India initiatives have sparked significant changes in the industry, particularly the market for military transport aircraft. By encouraging the creation and acquisition of domestic military transport aircraft, these programs are boosting India's independence and fortifying its defense capabilities. Additionally, in certain regions of India with undulating topography, such as the northeastern states and the Himalayas, road transportation is not practical. Transporting defensive supplies in that specific location is made difficult by this. This difficulty propels the market for India's military transport planes, emphasizing their function in effectively transporting supplies to remote locations.

Restraining Factors

India must rely on foreign vendors for essential components due to its poor domestic defense technological capabilities. This dependence may lead to supply chain weaknesses, which could jeopardize procurement schedules and security. These obstacles impede the expansion of the market.

Market Segmentation

The India military transport aircraft market share is classified into aircraft type and end user.

- The fixed-wing segment is expected to hold a significant market share through the forecast period.

The India military transport aircraft market is segmented by aircraft type into fixed-wing and rotary blade. Among these, the fixed-wing segment is expected to hold a significant market share through the forecast period. The increased payload capacity and extended flying duration of fixed-wing aircraft make them the favored choice. The creation of innovative engine designs that increase thrust-to-weight ratio and fuel efficiency is what propels the growth of the fixed-wing market.

- The military forces segment is expected to dominate the India military transport aircraft market during the forecast period.

Based on the end user, the India military transport aircraft market is divided into military forces, government agencies, and defense contractors. Among these, the military forces segment is expected to dominate the India military transport aircraft market during the forecast period. In this sector, military forces are crucial because they need dependable transport aircraft for equipment transportation, personnel transportation, and logistical purposes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India military transport aircraft market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hindustan Aeronautics Limited (HAL)

- Tata Advanced Systems Limited (TASL)

- Airbus SE

- Bharat Electronics Limited (BEL)

- Reliance Defence and Engineering Limited

- Defense Research and Development Organisation (DRDO)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2023, for USD 388.5 million, the Indian Defense Ministry authorized the purchase of 70 domestically produced HTT-40 primary trainer aircraft. The new aircraft will join the Indian Air Force's key training fleet of Swiss-built PC-12 Mark II planes.

Market Segment

This study forecasts revenue at India, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the India Military Transport Aircraft Market based on the below-mentioned segments:

India Military Transport Aircraft Market, By Aircraft Type

- Fixed-Wing

- Rotary Blade

India Military Transport Aircraft Market, By End User

- Military Forces

- Government Agencies

- Defense Contractors

Need help to buy this report?