India Online Travel Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Transportation, Travel Accommodation, Vacation Packages, and Others), By Booking Type (Online Travel Agencies, and Direct Travel Suppliers), By Tour Type (Independent Traveller, Tour Group, and Package Traveller), and India Online Travel Market Insights, Industry Trend, Forecasts to 2033.

Industry: Consumer GoodsIndia Online Travel Market Size Insights Forecasts to 2033

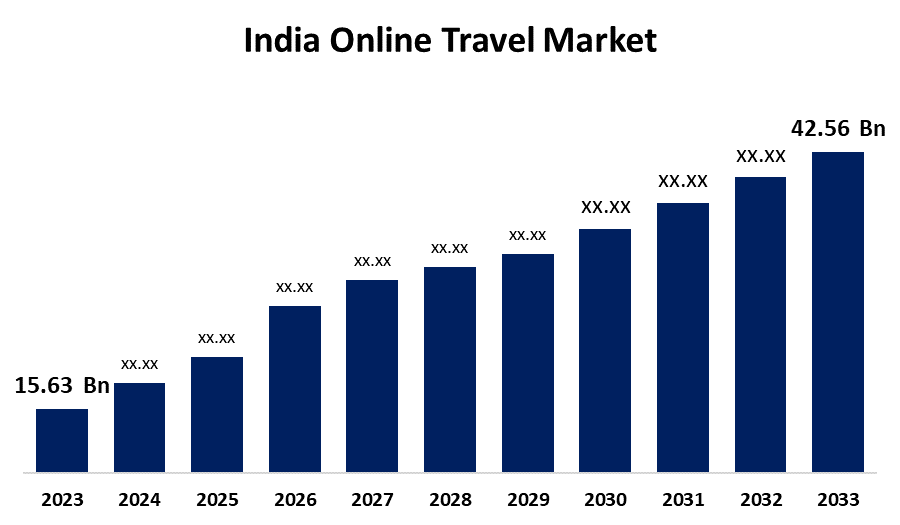

- The India Online Travel Market Size was valued at USD 15.63 Billion in 2023.

- The Market Size is Growing at a CAGR of 10.54% from 2023 to 2033

- The India Online Travel Market Size is Expected to Reach USD 42.56 Billion by 2033

Get more details on this report -

The India Online Travel Market Size is Anticipated to Reach USD 42.56 Billion by 2033, Growing at a CAGR of 10.54% from 2023 to 2033

Market Overview

The India online travel market refers to digital platforms and services that enable consumers to reserve travel-related services like flights, accommodations, holidays, transport, and activities. The market is driven by rising internet penetration, smartphone adoption, and the increasing demand for online booking due to time savings and competitive prices. The main drivers of India's online travel market growth are the widespread penetration of digital technologies, an increasing middle class, and a growing travel and tourism industry. With higher disposable incomes among young consumers, demand for both internal and external holidays has increased. The market is further boosted by the wide variety of services available, from tailor-made vacation packages to real-time travel updates. Government programs, such as the "Incredible India" campaign and the Digital India campaign, have also contributed to the growth of the market. The development of e-visa facilities for some nations has also promoted inward travel, further boosting the market.

Report Coverage

This research report categorizes the market for the India online travel market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India online travel market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India online travel market.

India Online Travel Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 15.63 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 10.54% |

| 2033 Value Projection: | USD 42.56 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 113 |

| Segments covered: | By Service Type, By Booking Type, By Tour Type and COVID-19 Impact Analysis |

| Companies covered:: | Via.com, Booking.com, MakeMyTrip, Yatra, Expedia, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The India online travel market is driven by factors such as increasing internet penetration and smartphone usage, which have made online travel sites more accessible. The growing disposable incomes and middle-class consumer base have driven demand for both international and domestic travel, particularly among younger travelers seeking convenience and value. The convenience of price comparison and the availability of tailored travel packages have also fueled online reservations. Government campaigns like "Incredible India" and e-visa facilities have further increased travel demand.

Restraining Factors

The lack of trust in online platforms, especially in rural areas with lower digital literacy, and concerns about security and fraud risk can deter potential users. The logistical challenges of providing seamless services across India can lead to inconsistencies in user experience. External factors like economic downturns and political instability can disrupt travel demand and affect market growth, limiting the full potential of India's online travel market.

Market Segmentation

The India online travel market share is classified into service type, booking type, and tour type.

- The transportation segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The India online travel market is segmented by service type into transportation, travel accommodation, vacation packages, and others. Among these, the transportation segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. This includes making reservations for the buses, trains, taxis, and airplanes that are required for both domestic and international travel. Factors including the rising demand for air travel, the ease with which reservations can be made online, and the expansion of low-cost airlines that offer affordable travel options are driving this segment's development. Furthermore, the market leadership position of this segment has been granted by the widespread usage of mobile platforms and websites for transportation service reservations.

- The online travel agencies (OTAs) segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the booking type, the India online travel market is divided into online travel agencies and direct travel suppliers. Among these, the online travel agencies (OTAs) segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period. OTAs with a wide range of products, user-friendly interfaces, and a large client base, such as MakeMyTrip, Cleartrip, Yatra, and Goibibo, have significantly increased their market share. These companies provide clients with the ease of reserving holiday, travel, and transportation packages all in one place, usually at a discounted price. OTAs are becoming the go-to choice for most travelers because of their ability to evaluate options and value-added services like customer support and easy payment methods.

- The independent traveller segment accounted for the fastest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The India online travel market is segmented by tour type into independent traveller, tour group, and package traveller. Among these, the independent traveller segment accounted for the fastest share in 2023 and is expected to grow at a significant CAGR during the forecast period. Digital channels have enabled tourists to organize and make their own travel arrangements, providing more convenience and flexibility. Improved internet penetration and smartphone usage have facilitated more customization, particularly among younger generations like millennials and Gen Z, who value independence and customization in travel.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India online travel market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Via.com

- Booking.com

- MakeMyTrip

- Yatra

- Expedia

- others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2025, Uber uses the strategy of its smaller competitors for autorickshaw rides in India to stay competitive. In India, ride-hailing company Uber (UBER.N) has implemented a zero-commission model for its autorickshaw drivers, charging them a subscription fee instead. This move is similar to what local competitors are doing as competition heats up.

Market Segment

This study forecasts revenue at India, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the India online travel market based on the below-mentioned segments:

India Online Travel Market, By Service Type

- Transportation

- Travel Accommodation

- Vacation Packages

- Others

India Online Travel Market, By Booking Type

- Online Travel Agencies

- Direct Travel Suppliers

India Online Travel Market, By Tour Type

- Independent Traveller

- Tour Group

- Package Traveller

Need help to buy this report?