India Smartphone Market Size, Share, and COVID-19 Impact Analysis, By Operating System (Android, iOS, and Others), By RAM Capacity (Below 4GB, 4GB-8GB, and Over 8GB), and India Smartphone Market Insights, Industry Trend, Forecasts to 2033.

Industry: Information & TechnologyIndia Smartphone Market Insights Forecasts to 2033

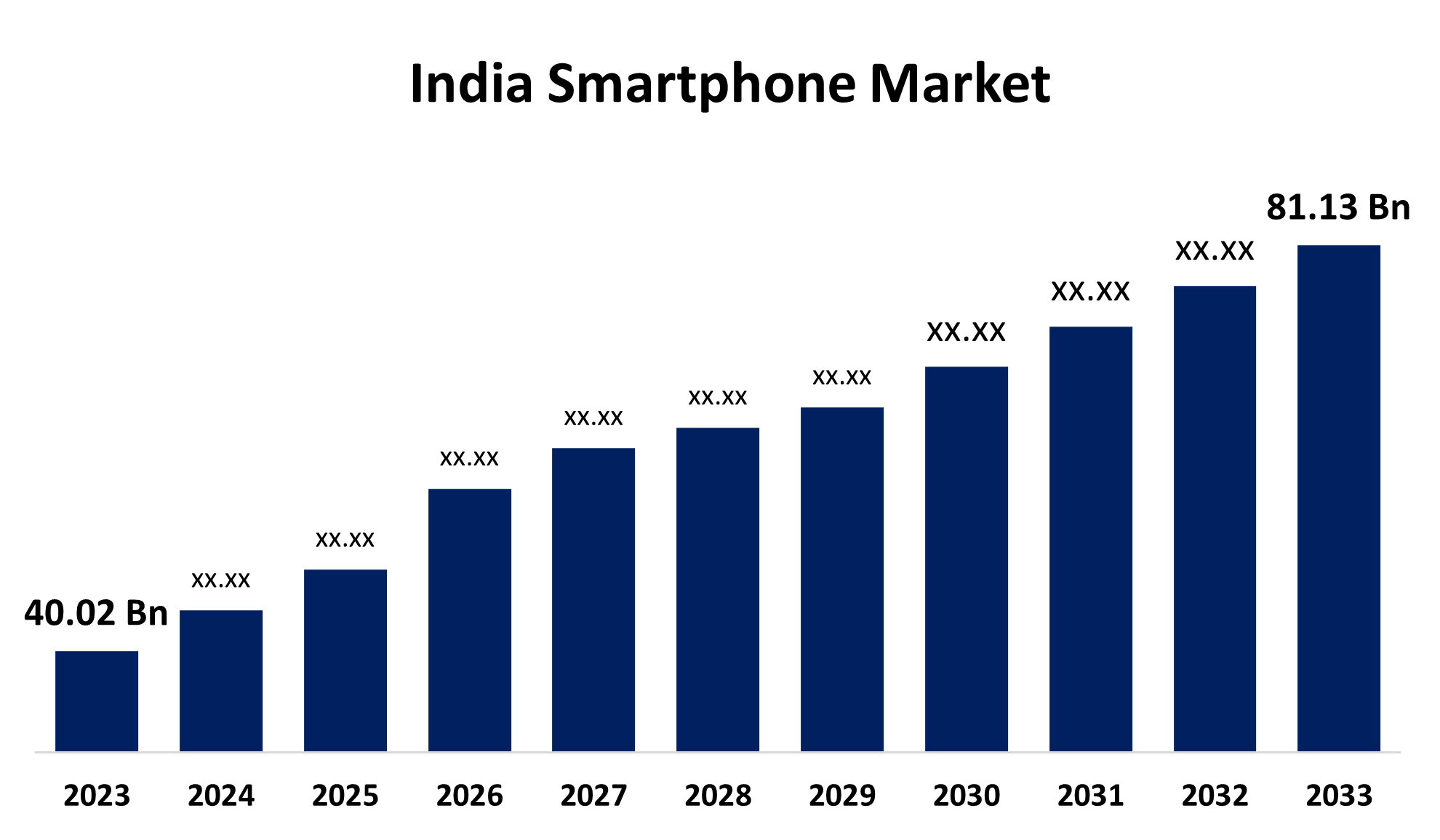

- The India Smartphone Market Size was valued at USD 40.02 Billion in 2023.

- The Market is Growing at a CAGR of 7.32% from 2023 to 2033

- The India Smartphone Market Size is Expected to Reach USD 81.13 Billion by 2033

Get more details on this report -

The India Smartphone Market Size is Anticipated to Exceed USD 81.13 Billion by 2033, growing at a CAGR of 7.32% from 2023 to 2033.

Market Overview

A smartphone is a device that combines the capabilities of a cell phone with extra functionality that are usually found in computers, like email, internet surfing, multimedia playing, and a variety of applications (apps). Users may install and run apps, change settings, and interact with digital material on smartphones due to their sophisticated operating systems (like iOS, Android, or Windows). Additionally, smartphones can be used as remote controls for air conditioners and televisions, among other household items. These days, smartphones are being used more and more for business and education, which helps the industry expand. Furthermore, in India, internet penetration was 52.4 percent at the beginning of 2024, with 751.5 million internet users. The advent of 5G technology dramatically reduced data costs, lowering the cost of internet access for the typical customer. As more people need gadgets that can effectively access the internet, smartphone adoption has been directly impacted by this increase in internet penetration.

Report Coverage

This research report categorizes the market for the India smartphone based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India smartphone market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India smartphone market.

India Smartphone Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 40.02 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 7.32% |

| 023 – 2033 Value Projection: | USD 81.13 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 248 |

| Tables, Charts & Figures: | 107 |

| Segments covered: | By Operating System, By RAM Capacity |

| Companies covered:: | Samsung, Jio, Realme, Vivo, Nokia, Intex, Karbonn, Celkon Mobiles, iBall, and LOther Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The digital revolution in India is a major factor propelling the smartphone market. Due to the government's push for a digital economy, rising internet usage, and emerging digital services, the nation has seen a significant movement towards digitalization. India's internet user population has increased dramatically over the past ten years, primarily due to internet services being widely accessible and reasonably priced. In early 2024, there were 1.12 billion active cellular mobile connections in India, which is equal to 78.0 percent of the country's total population. India's smartphone market has been further stimulated by the country's notable rise in smartphone users. Additionally, the International Data Corporation's (IDC) Worldwide Quarterly Mobile Phone Tracker reports that 34 million smartphones were shipped in India in 1Q24, representing an 11.5% YoY (year-over-year) gain in shipments for the third consecutive quarter. The growing availability of reasonably priced 5G smartphones, which has prompted many customers to upgrade their handsets, is responsible for this notable development.

Restraining Factors

Price sensitivity and manufacturing competitiveness are two issues that the market faces and that hinder its expansion. However, the need for increasingly sophisticated and high-end gadgets is anticipated to be driven by the increasing middle class, the growth of its digital facilities and the increasing need for 5G smartphones.

Market Segmentation

The India smartphone market share is classified into operating system and RAM capacity.

- The android segment is expected to hold a significant market share through the forecast period.

The India smartphone market is segmented by operating system into android, iOS, and others. Among these, the android segment is expected to hold a significant market share through the forecast period. There are many different device alternatives available with the Android operating system at different price points. As it is open-source, several manufacturers are able to provide cellphones that meet the needs and budgets of various customers. Tech enthusiasts also like android's regular upgrades, customization options, and interoperability with a wide range of apps and services.

- The 4GB-8GB segment is expected to dominate the India smartphone market during the forecast period.

Based on the RAM capacity, the India smartphone market is divided into below 4GB, 4GB-8GB, and over 8GB. Among these, the 4GB-8GB segment is expected to dominate the India smartphone market during the forecast period. A wide range of customers who are looking for a balance between price and performance are drawn to smartphones with 4GB to 8GB of RAM. For customers who need better gaming performance, seamless multitasking, and the capacity to run a variety of applications without noticeable lag, this RAM quantity is perfect.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India smartphone market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Samsung

- Jio

- Realme

- Vivo

- Nokia

- Intex

- Karbonn

- Celkon Mobiles

- iBall

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2024, Jio announced the JioBharat V3 and V4 4G feature phones at IMC 2024 to provide inexpensive access for 2G consumers. Starting from Rs. 1,099, they feature 23 different languages and provide prepaid plans with limitless talking and data, incorporating Jio services like JioTV and JioPay.

Market Segment

This study forecasts revenue at India, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the India Smartphone Market based on the below-mentioned segments:

India Smartphone Market, By Operating System

- Android

- iOS

- Others

India Smartphone Market, By RAM Capacity

- Below 4GB

- 4GB-8GB

- Over 8GB

Need help to buy this report?