India Tool Steel Market Size, Share, and COVID-19 Impact Analysis, By Material (Chromium, Molybdenum, Vanadium, and Others), By Application (Automotive, Shipbuilding, Aerospace, Manufacturing, and Others), and India Tool Steel Market Insights, Industry Trend, Forecasts to 2033

Industry: Machinery & EquipmentIndia Tool Steel Market Insights Forecasts to 2033

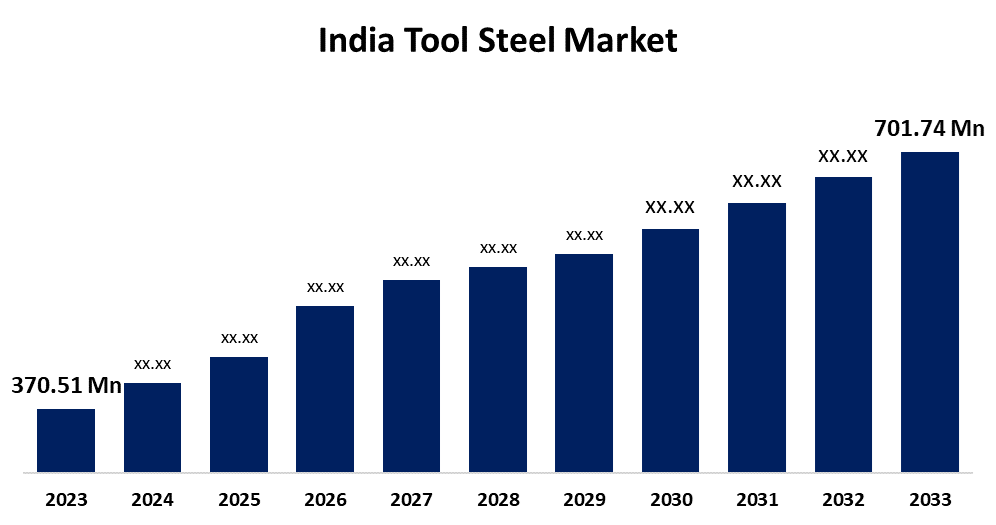

- The India Tool Steel Market Size Was Valued at USD 370.51 Million in 2023.

- The Market Size is Growing at a CAGR of 6.60% From 2023 to 2033

- The India Tool Steel Market Size is Expected to reach USD 701.74 Million By 2033

Get more details on this report -

The India Tool Steel Market Size is Anticipated to Exceed USD 701.74 Million By 2033, Growing at a CAGR of 6.60% From 2023 to 2033.

Market Overview

The India tool steel Market encompasses a wide range of high-performance carbon and alloy steels designed for cutting, shaping, and forming materials in manufacturing and industrial applications. These steels exhibit high hardness, wear resistance, and the ability to retain a sharp edge at elevated temperatures, making them essential in sectors such as automotive, aerospace, construction, and general engineering. The market is witnessing steady growth due to rising industrialization, increased infrastructure development, and advancements in manufacturing technologies. Key driving factors include the expansion of the automotive sector, where tool steel is extensively used in die-casting, forging, and stamping applications. Additionally, the growing demand for precision tools in aerospace and defense has accelerated market growth. The shift toward automation and CNC machining in manufacturing has further propelled the need for high-quality tool steels. Government initiatives such as the "Make in India" program and the Production-Linked Incentive (PLI) scheme for the manufacturing sector have bolstered domestic production and reduced dependency on imports. Investments in infrastructure projects and the push for self-reliance in key industries have further strengthened demand. Policies supporting domestic steel production, such as the National Steel Policy, are also expected to contribute to market expansion.

Report Coverage

This research report categorizes the market for the India tool steel market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India tool steel market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the India tool steel market.

India Tool Steel Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 370.51 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.60% |

| 2033 Value Projection: | USD 701.74 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Material, By Application and COVID-19 Impact Analysis |

| Companies covered:: | SCHMOLZ + BICKENBACH, Voestalpine, Hitachi Metals Ltd., Tiangong International, Nachi-Fujikoshi Corp., Samuel, Son & Co. Ltd., Sandvik Eramet SA, BOHLER, Buderus Edelstahl GmbH, Baosteel Group, Dongbei Special Steel Group Co. Ltd. and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Indian tool market is driven by rapid industrialization, infrastructure development, and the expanding manufacturing sector. Government initiatives like Make in India and increased foreign direct investments boost demand. The rise of automation, precision engineering, and technological advancements enhances tool efficiency, driving market growth. Growing construction, automotive, and aerospace industries further propel demand for high-quality tools. The surge in e-commerce and digital platforms facilitates tool accessibility. Additionally, the increasing adoption of electric and cordless tools, along with a rising focus on sustainability and energy efficiency, contributes to market expansion. Competitive pricing and innovation also play a crucial role.

Restraining Factors

The Indian tool market faces restraints such as high initial investment costs, fluctuating raw material prices, and import dependency. Limited skilled labor, inadequate infrastructure, and slow adoption of advanced technologies hinder growth. Additionally, competition from low-cost alternatives affects profitability and market expansion.

Market segmentation

The India tool steel market share is classified into material and application.

- The chromium segment is expected to hold the largest market share through the forecast period.

The India tool steel market is segmented by material into chromium, molybdenum, vanadium, and others. Among these, the chromium segment is expected to hold the largest market share through the forecast period. Chromium is a key alloying element in tool steels, enhancing properties such as hardness, strength, and corrosion resistance. These attributes make chromium-containing tool steels particularly suitable for applications requiring durability and precision, such as cutting and pressing tools. The widespread use of chromium in various tool steel applications contributes to its dominant market position

- The automotive segment is expected to hold the largest market share through the forecast period.

The India tool steel market is segmented by application into automotive, shipbuilding, aerospace, manufacturing, and others. Among these, the automotive segment is expected to hold the largest market share through the forecast period. This dominance is attributed to the automotive industry's extensive use of advanced tools and technologies that require materials with superior strength, durability, and reliability, qualities inherent in tool steels. The growing automotive manufacturing capabilities in India, bolstered by initiatives like 'Make in India', further drive the demand for tool steels in this sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India tool steel market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SCHMOLZ + BICKENBACH

- Voestalpine

- Hitachi Metals Ltd.

- Tiangong International

- Nachi-Fujikoshi Corp.

- Samuel

- Son & Co. Ltd.

- Sandvik Eramet SA

- BOHLER, Buderus Edelstahl GmbH

- Baosteel Group

- Dongbei Special Steel Group Co. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at India, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the India tool steel market based on the below-mentioned segments:

India Tool Steel Market, By Material

- Chromium

- Molybdenum

- Vanadium

- Others

India Tool Steel Market, By Application

- Automotive

- Shipbuilding

- Aerospace

- Manufacturing

- Others

Need help to buy this report?