India Used Car Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Hatchbacks, Sedans, and Sports Utility Vehicles), By Fuel Type (Petrol and Diesel), and India Used Car Market Insights, Industry Trend, Forecasts to 2033.

Industry: Automotive & TransportationIndia Used Car Market Insights Forecasts to 2033

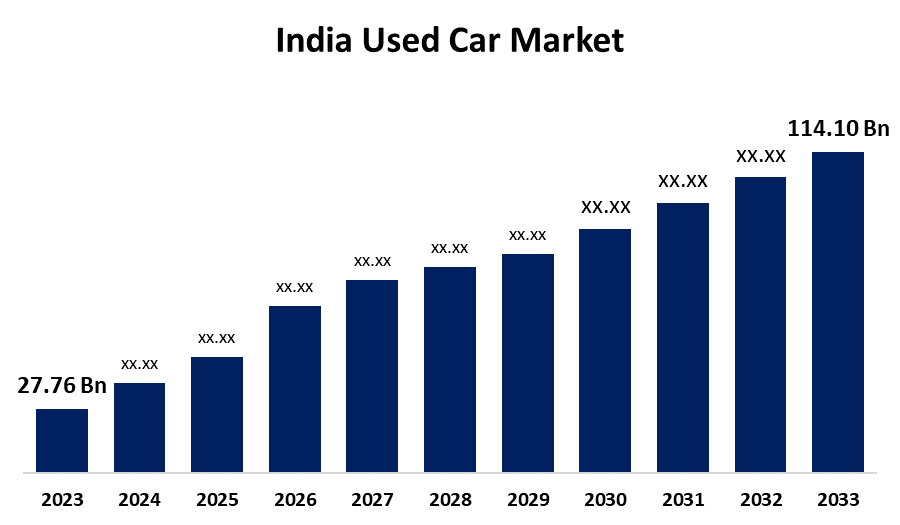

- The India Used Car Market Size was valued at USD 27.76 Billion in 2023.

- The Market Size is Growing at a CAGR of 15.18% from 2023 to 2033

- The India Used Car Market Size is Expected to Reach USD 114.10 Billion by 2033

Get more details on this report -

The India Used Car Market Size is Anticipated to Reach USD 114.10 Billion by 2033, growing at a CAGR of 15.18% from 2023 to 2033.

Market Overview

The India used car market is a growing segment of the automotive industry, encompassing buying, selling, and trading pre-owned vehicles. The market is driven by rising disposable incomes, increased awareness of pre-owned vehicles, and the need for cost-effective transportation. Urbanization and changing lifestyle preferences have led to greater acceptance of used cars, particularly among first-time buyers. The expansion of online platforms for buying and selling used cars has made the process more convenient and transparent. The availability of certified pre-owned cars with warranties boosts consumer confidence. Government initiatives, such as scrapping old vehicles, creating a structured and regulated market, incentives for vehicle recycling, and financial schemes for used car loans, have also contributed to the market's growth. Regulatory measures to ensure the quality and safety standards of used vehicles are expected to improve the overall market environment.

Report Coverage

This research report categorizes the market for the India used car market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India used car market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India used car market.

India Used Car Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 27.76 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 15.18% |

| 2033 Value Projection: | USD 114.10 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Vehicle Type, By Fuel Type |

| Companies covered:: | Maruti Suzuki True Value, Tata Motors Assured, CarTrade, Cars24, Ford Assured, Audi Approved Plus, Spinny, Hyundai H Promise, CarDekho, Big Boy Toyz, Mahindra First Choice Wheels, BMW Premium Selection, Droom, Toyota U Trust, Honda Auto Terrace, and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Rising disposable incomes, which allow a greater percentage of the population to consider buying a vehicle, are one of the main drivers driving the rise of the used automobile industry in India. Second-hand automobiles are becoming a popular option, particularly for first-time purchasers because of their price and convenience, as well as growing knowledge and acceptability. The emergence of online marketplaces that link consumers and sellers has further stimulated market expansion by offering transparency, convenience, and access to a greater range of options. Furthermore, the availability of guaranteed certified pre-owned cars boosts consumer confidence and helps the market grow.

Restraining Factors

The lack of regulation in the used automobile industry raises concerns about the reliability and quality of vehicles. Buyers may feel uneasy due to inconsistent prices and lack of transparency about a vehicle's history. Additionally, fewer financing options for used cars may deter some buyers. The perception that used cars may not provide long-term reliability and gradual devaluation affects demand in specific market sectors.

Market Segmentation

The India used car market share is classified into vehicle type and fuel type.

- The hatchbacks segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The India used car market is segmented by vehicle type into hatchbacks, sedans, and sports utility vehicles. Among these, the hatchbacks segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. Indian buyers prefer hatchbacks because of their cost, fuel efficiency, and small size, which makes them perfect for cities and semi-urban areas. First-time purchasers and consumers on a tight budget find them to be an appealing alternative because of their comparatively cheaper price points when compared to sedans and SUVs.

- The petrol segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the fuel type, the India used car market is divided into petrol and diesel. Among these, the petrol segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period. Petrol cars are increasingly popular due to their affordability, maintenance, and widespread availability at gas stations, especially in cities where fuel efficiency and affordability are crucial, and rising fuel prices have increased awareness of their cost-effectiveness.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within India used car market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Maruti Suzuki True Value

- Tata Motors Assured

- CarTrade

- Cars24

- Ford Assured

- Audi Approved Plus

- Spinny

- Hyundai H Promise

- CarDekho

- Big Boy Toyz

- Mahindra First Choice Wheels

- BMW Premium Selection

- Droom

- Toyota U Trust

- Honda Auto Terrace

- Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2025, Toyota Mobility Solutions and Services India Pvt. Ltd. (TMSS), which offers certified pre-owned Toyota automobiles, was recently introduced by Toyota Kirloskar Motor. TMSS prioritizes dependability, quality, and longevity and has the first "One Price for All" policy in the industry.

Market Segment

This study forecasts revenue at India, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the India used car market based on the below-mentioned segments:

India Used Car Market, By Vehicle Type

- Hatchbacks

- Sedans

- Sports Utility Vehicles

India Used Car Market, By Fuel Type

- Petrol

- Diesel

Need help to buy this report?