India Whey Protein Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Whey Protein Concentrate, Whey Protein Isolate, and Hydrolyzed Whey Protein), By Application (Sports & Performance Nutrition, Infant Formula, and Functional/Fortified Food), and India Whey Protein Market Insights, Industry Trend, Forecasts to 2033.

Industry: Food & BeveragesIndia Whey Protein Market Insights Forecasts to 2033

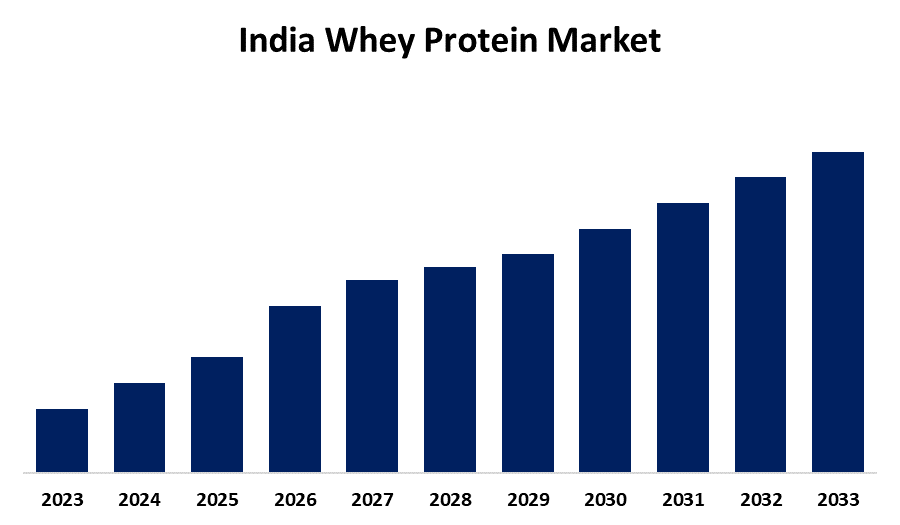

- The India Whey Protein Market is Growing at a CAGR of 5.50% from 2023 to 2033

- The India Whey Protein Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The India Whey Protein Market is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of 5.50% from 2023 to 2033.

Market Overview

The India whey protein market is a growing industry that manufactures, distributes, and consumes whey protein, a protein obtained from milk while producing cheese. It is widely used in supplements, sports nutrition, and other food and beverage items, targeting health-conscious consumers, athletes, and fitness enthusiasts. The market is dominated by growing health and fitness awareness, with gym users and health-focused consumers significantly increasing whey protein consumption. The movement towards plant-based and protein-fortified foods has expanded the applications of whey protein, including functional foods, beverages, and snacks. The increasing disposable income drives consumers to spend on high-end protein offerings for muscle building, weight control, and well-being. The Indian government's support in the dairy sector and nutrition programs have indirectly boosted the supply of whey protein. These factors, along with product formulation and packaging innovation, are expected to drive the growth of the India whey protein market in the coming years.

Report Coverage

This research report categorizes the market for the India whey protein market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India whey protein market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India whey protein market.

India Whey Protein Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 5.50% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 108 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Saputo Inc, Glanbia PLC, Olam Group Ltd, Nestle SA, Danone SA, Abbott Laboratories, Sanofi SA, Hilmar Cheese Company, Fonterra Co-operative Group, ALPAVIT, DMK Group, Milk Specialties Group, Carbery Group, Lactalis Ingredients, Davisco Foods International, Maple Island, Others, and |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

Growing consumer awareness of fitness and health is the primary driver of the whey protein market in India. The need for high-protein supplements, such whey protein, has grown dramatically among athletes and fitness enthusiasts as consumers become more active. This phenomenon has also been influenced by a rise in gym memberships, athletic participation, and a greater emphasis on physical health. Additionally, the expanding middle class in India has more disposable means, which enables them to purchase high-quality whey protein products for weight loss, muscle growth, and overall health. The increasing use of whey protein in functional foods and beverages, which appeal to customers seeking quick and healthful snack options, is another factor propelling the market.

Restraining Factors

The market for premium whey protein products faces limitations due to its high cost, which may limit access for price-conscious consumers, particularly in rural areas. The lack of knowledge about whey protein's benefits and the presence of plant proteins may shift focus away from whey protein, particularly among vegans or lactose-intolerant consumers.

Market Segmentation

The India whey protein market share is classified into product type and application.

- The whey protein concentrate segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The India whey protein market is segmented by product type into whey protein concentrate, whey protein isolate, and hydrolyzed whey protein. Among these, the whey protein concentrate segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The affordability, superior nutritional profile, and comparatively reduced manufacturing cost of whey protein concentrate make it a popular product. WPC has a moderate protein content (about 70–80%) and contains healthy components including fat and lactose. Additionally, it is a well-liked product among athletes, bodybuilding enthusiasts, and others looking to up their protein intake.

- The sports & performance nutrition segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the India whey protein market is divided into sports & performance nutrition, infant formula, and functional/fortified food. Among these, the sports & performance nutrition segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The growing fitness culture, gym memberships, and awareness of protein's importance for muscle gain, recovery, and athletic performance have led to the rise in the demand for whey protein supplements. These products, including powders, bars, and shakes, are essential for athletes, bodybuilders, and fitness enthusiasts seeking high-quality protein for quick and efficient consumption.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India whey protein market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Saputo Inc

- Glanbia PLC

- Olam Group Ltd

- Nestle SA

- Danone SA

- Abbott Laboratories

- Sanofi SA

- Hilmar Cheese Company

- Fonterra Co-operative Group

- ALPAVIT

- DMK Group

- Milk Specialties Group

- Carbery Group

- Lactalis Ingredients

- Davisco Foods International

- Maple Island

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2024, 100% Performance Whey was introduced by Avvatar and comes in 1kg and 2kg packets. Both the Avvatar website and well-known e-commerce sites like Amazon and Flipkart offer this product. Customers could replace the brand's logo on the box with their names as part of an exclusive launch offer.

Market Segment

- This study forecasts revenue at India, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the India whey protein market based on the below-mentioned segments

India Whey Protein Market, By Product Type

- Whey Protein Concentrate

- Whey Protein Isolate

- Hydrolyzed Whey Protein

India Whey Protein Market, By Application

- Sports & Performance Nutrition

- Infant Formula

- Functional/Fortified Food

Need help to buy this report?