Global Industrial and Commercial LED Lighting Market Size, Share, and COVID-19 Impact Analysis, By Product (Lamps and Luminaires), By Application (Indoor and Outdoor), By End User (Industrial and Commercial), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Semiconductors & ElectronicsGlobal Industrial and Commercial LED Lighting Market Insights Forecasts to 2033

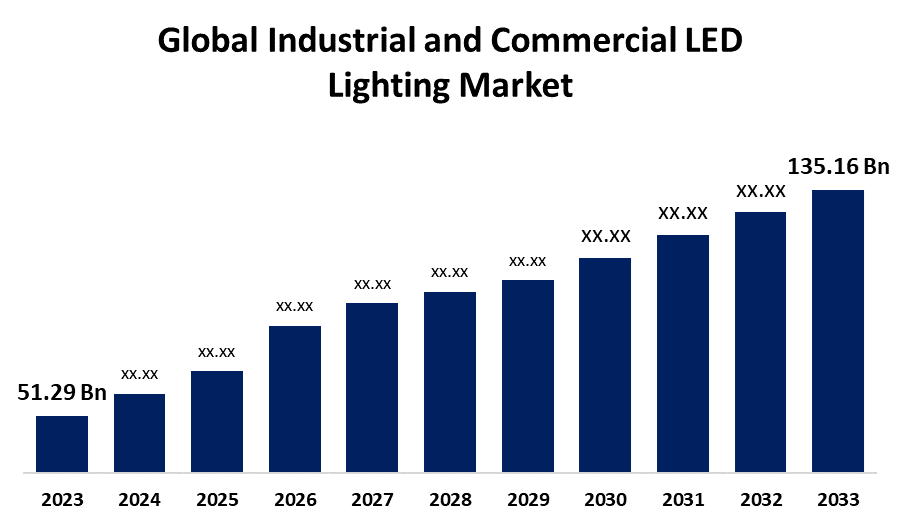

- The Global Industrial and Commercial LED Lighting Market Size was Valued at USD 51.29 Billion in 2023

- The Market Size is Growing at a CAGR of 10.17% from 2023 to 2033

- The Worldwide Industrial and Commercial LED Lighting Market Size is Expected to Reach USD 135.16 Billion by 2033

- Latin America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Industrial and Commercial LED Lighting Market Size is Anticipated to Exceed USD 135.16 Billion by 2033, Growing at a CAGR of 10.17% from 2023 to 2033.

Market Overview

LED lighting, also known as industrial and commercial lighting, is a category of energy-efficient lighting options intended for usage in large-scale like factories, warehouses, offices, and retail stores. When compared to conventional lighting systems, these LED lights offer better illumination, a longer lifespan, and cheaper maintenance expenses. An LED is a type of light source that uses semiconductors to directly transform electrical energy into light energy. These components frequently place of incandescent light sources in lamps. One of the lighting technologies with the fastest rate of development and energy efficiency on the worldwide market is anticipated to be LED lighting. The primary factors that are favorably influencing the industrial and commercial LED lighting market are the growing need for reasonably priced and energy-efficient LED lighting, an increasing number of government initiatives to promote LED adoption, and the growing need to replace conventional lighting systems.

For instance, in January 2024, Japanese-designed fog lamp projectors were launched by Lumax Auto Technologies. With minimal power usage, these projectors produce an 800-meter light throw due to an 80-watt LED.

Report Coverage

This research report categorizes the global industrial and commercial LED lighting market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global industrial and commercial LED lighting market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global industrial and commercial LED lighting market.

Global Industrial and Commercial LED Lighting Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 51.29 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 10.17% |

| 2033 Value Projection: | USD 135.16 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Product, By Application, By End User, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Advanced Lighting Technologies, LLC, AIXTRON, Dialight, Lumax Auto Technologies, MetroLED, Emerson Electric Co., OSRAM SYLVANIA Inc, Signify Holding, AV Modular India Pvt. Ltd., SiteWorx Software, TOYODA GOSEI Co., Ltd., Zumtobel Group, PANGEA Global Technologies, Inc, Eaton, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The global market for industrial and commercial LED lighting is anticipated to rise due to the high efficiency and durability of LED lights. Due to its increased energy-saving potential and longer lifespan than conventional lighting, LED is considered to be a viable substitute. A growing number of LED lighting products are taking the place of traditional lighting products owing to their many advantages, including increased energy efficiency, strong environmental friendliness, compact size, and reduced heat production. Compared to small fluorescent lamps, LED bulbs have a life anticipation that is around ten times longer than that of incandescent lamps.

Restraining Factors

The high starting costs will likely restrict the growth of the industrial and commercial LED lighting market. One of the main factors keeping back the market for LEDs is their initial installation and maintenance costs. Compared to LED light, a compact fluorescent lamp's (CFL) lifespan is lower.

Market Segmentation

The global industrial and commercial LED lighting market share is classified into product, application, and end user.

- The luminaires segment is expected to hold the largest share of the global industrial and commercial LED lighting market during the forecast period.

Based on the product, the global industrial and commercial LED lighting market is divided into lamps and luminaires. Among these, the luminaires segment is expected to hold the largest share of the global industrial and commercial LED lighting market during the forecast period. LED luminaire systems use less energy, which lowers energy usage and lowers power bills this increases demand in the commercial and industrial sectors. Longer lifespans, improved color, and more luminosity output are the effects of these technological developments.

- The indoor segment is expected to hold the largest share of the global industrial and commercial LED lighting market during the forecast period.

Based on the application, the global industrial and commercial LED lighting market is divided into indoor and outdoor. Among these, the indoor segment is expected to hold the largest share of the global industrial and commercial LED lighting market during the forecast period. This section covers a range of indoor lighting applications, including those in industries, schools, and enterprises. In modern workspaces, smart indoor lighting solutions for conference rooms, hallways, and cabins are crucial.

- The commercial segment is expected to hold the largest share of the global industrial and commercial LED lighting market during the forecast period.

Based on the end user, the global industrial and commercial LED lighting market is divided into industrial and commercial. Among these, the commercial segment is expected to hold the largest share of the global industrial and commercial LED lighting market during the forecast period. Government energy efficiency laws, healthcare applications, and an increase in development and construction activities are driving the demand in this commercial category.

Regional Segment Analysis of the Global Industrial and Commercial LED Lighting Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the global industrial and commercial LED lighting market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the industrial and commercial LED lighting market over the predicted timeframe. The Increasing urbanization in the Asia-Pacific region is resulting in a rise in the creation of public infrastructure, commercial structures, and industrial facilities. LED lighting solutions are becoming more common in these new development due to their energy efficiency, long lifespan, and low maintenance costs in the region.

Latin America is expected to grow at the fastest pace in the industrial and commercial LED lighting market during the forecast period. LED lighting from Latin America helps businesses satisfy environmental standards and achieve corporate sustainability goals due to its great energy efficiency and decreased emissions of greenhouse gases. To support commercial and industrial operations, there is an increasing demand for dependable and efficient lighting systems as the economies in the region continue to grow.

North America is anticipated to hold a significant share of the global industrial and commercial LED lighting market over the predicted timeframe. Cities and towns across North America are starting smart city projects and upgrading their infrastructure, with a greater focus on integrating sustainable and energy-efficient technologies. LED lights provide better illumination, less energy usage, and fewer maintenance costs for the general population in this region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global industrial and commercial LED lighting market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Advanced Lighting Technologies, LLC

- AIXTRON

- Dialight

- Lumax Auto Technologies

- MetroLED

- Emerson Electric Co.

- OSRAM SYLVANIA Inc

- Signify Holding

- AV Modular India Pvt. Ltd.

- SiteWorx Software

- TOYODA GOSEI Co., Ltd.

- Zumtobel Group

- PANGEA Global Technologies, Inc

- Eaton

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2024, MetroLED, a company that has been at the forefront of creative LED lighting solutions for more than 15 years, recently announced the growth of Pixel LED Displays, a division that was founded to improve its popular line of LED displays. Pixel LED Displays' exclusive focus will be on providing premium LED display solutions to satisfy the growing demand from a range of sectors.

- In January 2023, PANGEA Global Technologies, Inc. subsidiary Rapid Grow LED launched SOLITE, its most recent high-efficiency LED light created especially for licensed cannabis farmers and operators. UV and blue light are used in SOLITE to promote resin synthesis and genetic expression.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global industrial and commercial LED lighting market based on the below-mentioned segments:

Global Industrial and Commercial LED Lighting Market, By Product

- Lamps

- Luminaires

Global Industrial and Commercial LED Lighting Market, By Application

- Indoor

- Outdoor

Global Industrial and Commercial LED Lighting Market, By End User

- Industrial

- Commercial

Global Industrial and Commercial LED Lighting Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?Advanced Lighting Technologies, LLC, AIXTRON, Dialight, Lumax Auto Technologies, MetroLED, Emerson Electric Co., OSRAM SYLVANIA Inc., Signify Holding, AV Modular India Pvt. Ltd., SiteWorx Software, TOYODA GOSEI Co., Ltd., Zumtobel Group, PANGEA Global Technologies, Inc, Eaton, and Others.

-

2. What is the size of the global industrial and commercial LED lighting market?The global industrial and commercial LED lighting market is expected to grow from USD 51.29 Billion in 2023 to USD 135.16 Billion by 2033, at a CAGR of 10.17% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?Asia Pacific is anticipated to hold the largest share of the global industrial and commercial LED lighting market over the predicted timeframe.

Need help to buy this report?