Global Industrial Control & Factory Automation Market Size, Share, and COVID-19 Impact Analysis, By Component (Industrial PC, Industrial Sensors, Field Instruments, Vibration Monitoring, Industrial Robots, Machine Vision, Process Analyzer, Human Machine Interface, Industrial 3D Printing, Others), By Solution (SCADA, PLC, DCS, MEMS, Industrial Safety, PAM, Others), By Industry Vertical (Manufacturing, Mining & Metal, Oil & Gas, Transportation, Aerospace & Defense, Automotive, Chemical, Energy & Utilities, Food & Beverage, Healthcare, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Semiconductors & ElectronicsGlobal Industrial Control & Factory Automation Market Insights Forecasts to 2032

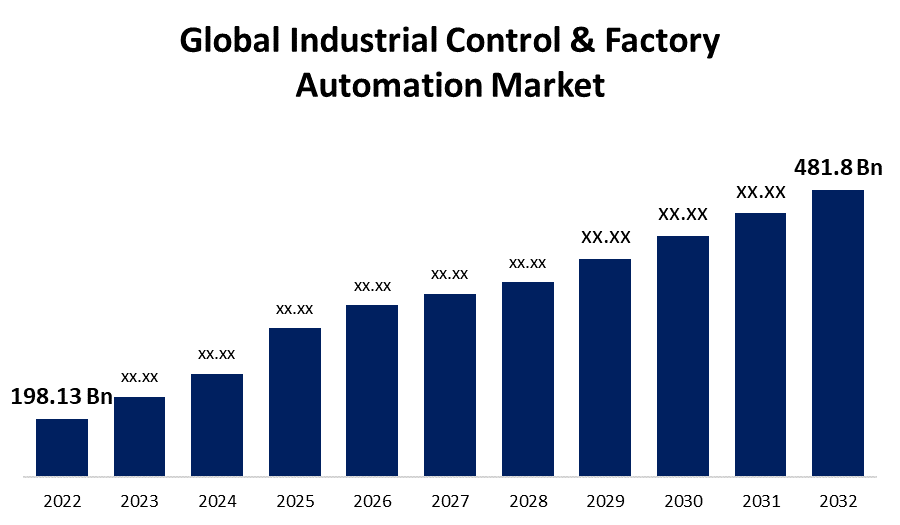

- The Global Industrial Control & Factory Automation Market Size was valued at USD 198.13 Billion in 2022.

- The Market Size is Growing at a CAGR of 9.2% from 2022 to 2032

- The Worldwide Industrial Control & Factory Automation Market Size is expected to reach USD 481.8 Billion by 2032

- North America is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Industrial Control & Factory Automation Market Size is expected to reach USD 481.8 Billion by 2032, at a CAGR of 9.2% during the forecast period 2022 to 2032.

Industrial control and factory automation incorporate the application of several automation systems, computer programs, and technologies to streamline the manufacturing process in different industries. In a manufacturing facility, this system is crucial for overseeing and controlling many different kinds of machinery, procedures, and the surrounding environment. The overall objective of industrial control and factory automation is to increase manufacturing process effectiveness, precision, and productivity while eliminating human intervention and consequently decreasing expenditures and enhancing safety. Some of the primary advantages include increased worker efficiency, higher quality goods, more effective utilization of resources, improved safety, and more consistent production timelines. With breakthroughs in fields like the use of machine learning, artificial intelligence (AI), the Internet of Things (IoT), and other technical systems, the market for industrial control and factory automation is continuously growing. The long-term objective of industrial control and factory automation is a completely unified and dynamic ecosystem that is self-monitoring, versatile, and cost-effective, propelling industries closer to smart factories and Industry 4.0.

Industrial Control & Factory Automation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 198.13 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 9.2% |

| 2032 Value Projection: | USD 481.8 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 125 |

| Segments covered: | By Component, By Solution, By Industry Vertical, By Region |

| Companies covered:: | Rockwell Automation, General Electric, Schneider Electric, Siemens, ABB, Emerson, Dwyer, Honeywell, Mitsubishi Electric, Yokogawa Electric Corporation, Endress+Hauser, OMRON Corporation, Kawasaki Heavy Industries, Ltd., 3D Systems, Wika, Fanuc, Stratasys And other key venders |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The manufacturing industry has been rapidly transforming as advanced technology such as robotics, artificial intelligence, and others have been introduced. likewise, the utilization of automated industrial infrastructure allows for faster manufacturing and material handling processes. In order to boost production and reduce labor expenses, industries are installing industrial automation and control systems. In addition, since the introduction of Industry 4.0, the manufacturing industry has undergone swift implementation of emerging technologies and upgraded networking frameworks, which is expected to offer major potential for industrial control and factory automation market expansion in the coming years.

The control systems vary from minor autonomous components to a huge number of interconnected large-scale operations units dispersed across the manufacturing base. Analytics, cloud, and mobile technologies are assisting companies in reaching their objectives with greater effectiveness. Additionally, the rise in Internet of Things (IoT) penetration in factory automation has fueled the expansion of automated manufacturing that recognizes and capitalizes on the advantageous features of Internet connectivity. Furthermore, technological advancements, expanding economic and infrastructural potential, and the growing demands for high productivity are all impacting factory automation. The automated manufacturing sector is predicted to rise throughout the forecast period due to increased knowledge of cloud-based computing technologies and technological advancements in semiconductors and electronic gadgets.

The roll-out of Industry 4.0 concepts in the production, petroleum & natural gas, food and beverages, chemical, and automotive industries is driving significant growth in the industry control market. Furthermore, industries such as automotive, aerospace, and heavy machinery are digitizing and modernizing their manufacturing processes. The inclusion of IIoT in manufacturing plants is critical for integrating devices and infrastructure into a connected system. Artificial Intelligence (AI), machine learning, cloud computing, and other advancements are helping to develop new automation innovations, which are expected to increase market growth during the projection period.

Market Segmentation

By Component Insights

The industrial sensors segment is dominating the market with the largest revenue share over the forecast period.

On the basis of component, the global industrial control & factory automation market is segmented as industrial PC, industrial sensors, field instruments, vibration monitoring, industrial robots, machine vision, process analyzer, human machine interface, industrial 3D printing, and others. Among these, the industrial sensors segment is dominating the market with the largest revenue share of 38.6% over the forecast period. The increased adoption of the Industrial 4.0 paradigm and IIoT, as well as the growing popularity of the internet-connected sensors market, are driving the continued expansion of the industrial sensors segment. Sensors are compact and provide immediate and precise measurements and assessments, which are critical in automation operations. Temperature sensors, humidity sensors, torque sensors, and numerous other types of sensors are available in the marketplace. These types of sensors help factories with automation systems to make manufacturing processes and operations smarter and more efficient, which is projected to drive market expansion even further. Moreover, over the projected period, predictive maintenance is anticipated to provide attractive possibilities to companies in the industrial sensors market.

By Solution Insights

The DCS segment is expected to hold the largest share of the Global Industrial Control & Factory Automation Market during the forecast period.

Based on the solution, the global industrial control & factory automation market is classified into SCADA, PLC, DCS, MEMS, Industrial Safety, PAM, and others. Among these, the DCS segment is expected to hold the largest share of the industrial control & factory automation market during the forecast period. The rapidly occurring industrialization of developing nations can be linked to the expansion of this category. Several developing nations have strategies to promote power sector expansion and capacity augmentation, which are projected to fuel demand for DCS over the period of forecasting. Furthermore, the introduction of 5G and its widespread deployment in the power generation sector is projected to accelerate the incorporation of IoT and DCS utilizing 5G technology for improved output efficiency.

By Industry Vertical Insights

The manufacturing segment accounted for the largest revenue share of more than 31.4% over the forecast period.

On the basis of industry vertical, the global industrial control & factory automation market is segmented into manufacturing, mining & metal, oil & gas, transportation, aerospace & defense, automotive, chemical, energy & utilities, food & beverage, healthcare, and others. Among these, the manufacturing segment is dominating the market with the largest revenue share of 31.4% over the forecast period. This is due to the continuing proliferation of automated methodologies in manufacturing facilities and industries that use automated processes and technologies. Automation in manufacturing can expedite processes, reduce labor requirements, improve clarity, and enhance quality assurance. It has applications in production facilities, product inspection, packing, and shipping.

Regional Insights

Asia Pacific dominates the market with the largest market share over the forecast period.

Get more details on this report -

Asia Pacific is dominating the market with more than 43.7% market share over the forecast period. The flourishing manufacturing industries in nations such as China, Japan, South Korea, and India have fostered tremendous development in the fields of industrial control and factory automation in Asia Pacific. With its developing industrial sector and the government's attempts to boost automation, India is additionally contributing to the region's market development. Some of the drivers fueling the expansion of this region are rapid population growth, higher investments in infrastructure and manufacturing industries, and government measures boosting industrial automation. Furthermore, the emergence of Industry 4.0 principles and the deployment of Internet of Things (IoT) technology in the manufacturing sector have increased demand in the region for automation solutions.

North America, on the contrary, is expected to grow the fastest during the forecast period. This region's market is driven by the presence of major multinational companies and technological corporations, as well as a solid manufacturing sector. The region has been inclined to adopt cutting-edge technologies such as the Internet of Things, artificial intelligence (AI), and the use of machine learning (ML), which are having an enormous effect on the industrial control and factory automation industry.

The Europe market is expected to register a substantial CAGR growth rate during the forecast period, bolstered by its robust technological and manufacturing industries. The region's dedication to Industry 4.0, as well as its emphasis on efficiency and reduction of energy consumption, has boosted the usage of automation technologies in its manufacturing sector. Germany, highlighted because of its Industry 4.0 program, dominates the European Union in the use of factory automation, followed by France, the United Kingdom, and Italy.

List of Key Market Players

- Rockwell Automation

- General Electric

- Schneider Electric

- Siemens

- ABB

- Emerson

- Dwyer

- Honeywell

- Mitsubishi Electric

- Yokogawa Electric Corporation

- Endress+Hauser

- OMRON Corporation

- Kawasaki Heavy Industries, Ltd.

- 3D Systems

- Wika

- Fanuc

- Stratasys

Key Market Developments

- On May 2023, Software Defined Automation delivers a complete solution for control engineers to overcome factory automation's tight coupling of hardware and software, as well as the restricted spillover of advancements from information technology to industrial real-time control. SDA DevOps delivers Git-based version management for PLCs to make the move to modern developer collaboration as simple as possible. SDA Through virtualization, virtual PLC decouples real-time control from proprietary hardware. SDA collaborates with VMware to operate virtual PLCs on any x86 server with cycle times as short as 10ms.

- On March 2023, Continental's tire division and Siemens have established a strategic supplier partnership. Siemens announced on the sidelines of the Tire Expo trade show in Hannover (Germany) that the corporation will deliver automation and drive technology for Continental's tire facilities worldwide as a preferred supplier. The collaboration aims to further optimize Continental's global tire production through advanced control and automation technology. Siemens will supply Continental tire facilities with Simatic controllers, I/O systems, WinCC Unified operator control units, and industrial PCs. Siemens will also teach personnel at Continental tire manufacturers in TIA Portal.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Industrial Control & Factory Automation Market based on the below-mentioned segments:

Industrial Control & Factory Automation Market, Component Analysis

- Industrial PC

- Industrial Sensors

- Field Instruments

- Vibration Monitoring

- Industrial Robots

- Machine Vision

- Process Analyzer

- Human Machine Interface

- Industrial 3D Printing

- Others

Industrial Control & Factory Automation Market, Solution Analysis

- SCADA

- PLC

- DCS

- MEMS

- Industrial Safety

- PAM

- Others

Industrial Control & Factory Automation Market, Industry Vertical Analysis

- Manufacturing

- Mining & Metal

- Oil & Gas

- Transportation

- Aerospace & Defense

- Automotive

- Chemical

- Energy & Utilities

- Food & Beverage

- Healthcare

- Others

Industrial Control & Factory Automation Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Industrial Control & Factory Automation market?The Global Industrial Control & Factory Automation Market is expected to grow from USD 198.13 billion in 2022 to USD 481.8 billion by 2032, at a CAGR of 9.2% during the forecast period 2022-2032.

-

2. Which are the key companies in the market?Rockwell Automation, General Electric, Schneider Electric, Siemens, ABB, Emerson, Dwyer, Honeywell, Mitsubishi Electric, Yokogawa Electric Corporation, Endress+Hauser, OMRON Corporation, Kawasaki Heavy Industries, Ltd., 3D Systems, Wika, Fanuc, Stratasys

-

3. Which segment dominated the Industrial Control & Factory Automation market share?The manufacturing segment in industrial vertical type dominated the Industrial Control & Factory Automation market in 2022 and accounted for a revenue share of over 31.4%.

-

4. What are the elements driving the growth of the Industrial Control & Factory Automation market?The growing need for mass/bulk production in the manufacturing industry, as well as the growing utilization of factory robots for production automation, are the major factors boosting the industrial automation & control systems market growth.

-

5. Which region is dominating the Industrial Control & Factory Automation market?Asia Pacific is dominating the Industrial Control & Factory Automation market with more than 43.7% market share.

-

6. Which segment holds the largest market share of the Industrial Control & Factory Automation market?The industrial sensors segment based on components type holds the maximum market share of the Industrial Control & Factory Automation market.

Need help to buy this report?