Global Industrial Energy Efficiency Services Market Size, Share, and COVID-19 Impact Analysis, By Type (Energy Auditing or Consulting, Product and System Optimization, and Monitoring and Verification), By Application (Petrochemical, Chemical Industry, Electric Power, Building Materials, Mining and Others), By End-use (Commercial, and Industrial), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Energy & PowerGlobal Industrial Energy Efficiency Services Market Insights Forecasts to 2033

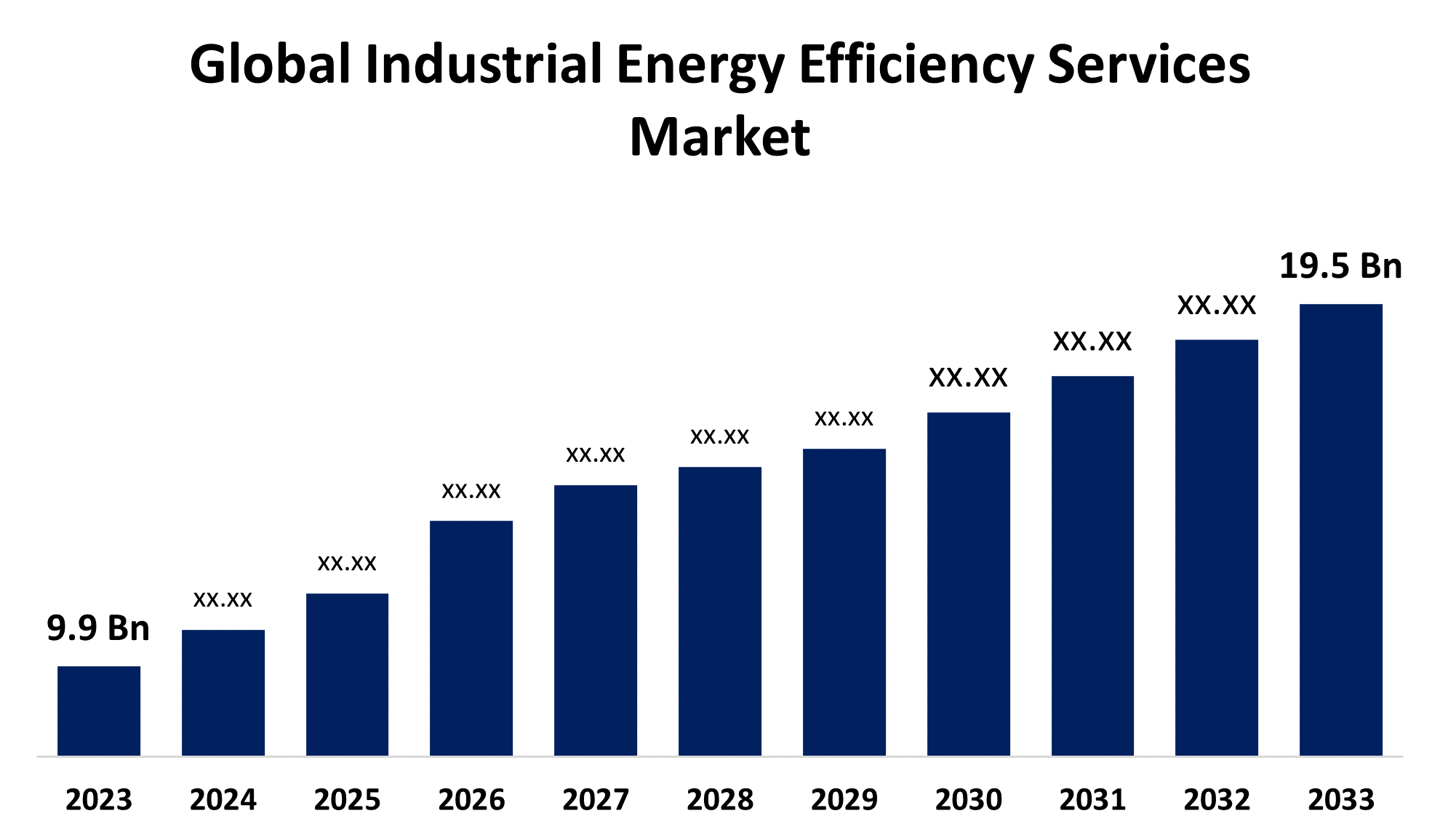

- The Global Industrial Energy Efficiency Services Market Size was Valued at USD 9.9 Billion in 2023

- The Market Size is Growing at a CAGR of 7.01% from 2023 to 2033

- The Worldwide Industrial Energy Efficiency Services Market Size is Expected to Reach USD 19.5 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Industrial Energy Efficiency Services Market Size is Anticipated to Exceed USD 19.5 Billion by 2033, Growing at a CAGR of 7.01% from 2023 to 2033.

Market Overview

The objective of the rapidly expanding industrial energy-efficiency services market is to optimize industrial energy use in order to boost output, reduce costs, and mitigate environmental repercussions. In an effort to reduce carbon emissions and promote business energy efficiency, governments everywhere are enacting stringent laws and regulations, such as the US Department of Energy's Better Plants initiative and the EU's Energy Efficiency Directive. More effective energy monitoring and optimization are made possible by developments in energy management systems, smart grids, and the Internet of Things (IoT).

The focus on cost-cutting and sustainability will drive the market's growth, making it a crucial area of investment for industrial sectors globally. These technologies are expected to enhance energy management systems by increasing their flexibility, predictability, and optimization potential. The growth of distributed energy resources and microgrids, which give enterprises greater resilience and control over their energy supply, will bolster the market for industrial energy-efficiency services. For the market to boost, industrial firms, service providers, and technology providers must collaborate more closely to develop comprehensive energy efficiency solutions. Nevertheless, several areas and sectors of the economy continue to lack knowledge and understanding of the benefits and future possibilities related to energy efficiency services. It will be crucial to close this knowledge gap by educating people and providing examples of successful case studies in order to promote the global adoption of industrial energy efficiency programs. As per the U.S. Energy Information Administration i.e. EIA's yearly report on electric power sales, revenue, and energy efficiency (Form EIA-861), efficiency programs implemented by 448 electric utilities in 2022 led to an approximate reduction of 28,167,459 megawatt-hours (MWh) or approximately 28.2 billion kWh in total annual electricity consumption. Of the entire annual reduction in electricity use, residential consumers accounted for roughly 48% and commercial customers for 44%.

Report Coverage

This research report categorizes the market for industrial energy efficiency services based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the industrial energy efficiency services market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the industrial energy efficiency services market.

Global Industrial Energy Efficiency Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 9.9 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.01% |

| 2033 Value Projection: | USD 19.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 202 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By End-use |

| Companies covered:: | Siemens, Honeywell, TERI, DuPont, Dalkia, ENGIE, Getec, ISTA, Johnson Controls, Schneider Electric, SGS, Wood, Veolia Environnement SA, GE Power, a part of General Electric Co., and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The industrial sector's adoption of energy efficiency services is being driven by strict rules and targets pertaining to energy efficiency and carbon emissions reductions. In order to save operating expenses, enterprises are being encouraged by rising energy prices to optimize their energy use and invest in efficiency services. The necessity to reduce carbon footprints and the growing emphasis on corporate sustainability are driving sectors to adopt energy-efficient practices. Advanced and efficient energy-saving services are being made possible by innovations in fields like automation, data analytics, and the Internet of Things. The execution of industrial energy efficiency projects is being aided by creative finance alternatives, government and utility incentives, and both.

Restraining Factors

The initial investment required for implementing energy efficiency services can be a barrier, especially for small and medium-sized enterprises. Limited understanding of energy efficiency benefits and access to skilled personnel can hamper the adoption of these services. Resistance to change and a focus on short-term profits rather than long-term savings can discourage industries from investing in energy efficiency. Tight budgets and competing priorities within industrial facilities can make it challenging to allocate funds for efficiency projects.

Market Segmentation

The industrial energy efficiency services market share is classified into type, application, and end-use.

- The energy auditing or consulting segment is estimated to hold the highest market revenue share through the projected period.

Based on the type, the industrial energy efficiency services market is classified into energy auditing or consulting, product and system optimization, and monitoring and verification. Among these, the energy auditing or consulting segment is estimated to hold the highest market revenue share through the projected period. Due to these services are vital in helping industrial establishments find and take advantage of energy-saving potential. In order to optimize energy consumption and lower operating costs, energy audits and consulting services offer a thorough evaluation of a plant's energy usage, pinpoint inefficient areas, and make customized recommendations for remedies. Expert consulting services are in greater demand as industries become more cost-conscious and focused on sustainability to direct their energy-efficiency projects. Moreover, the industrial sector is adopting energy auditing and consulting services due to the increasing complexity of energy systems and the requirement for specialist knowledge to handle a variety of rules and technologies. As industries prioritize data-driven decision-making and look to optimize the returns on their energy efficiency expenditures, this category is anticipated to continue to dominate.

- The petrochemical segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the industrial energy efficiency services market is divided into petrochemical, chemical industry, electric power, building materials, mining, and others. Among these, the petrochemical segment is anticipated to hold the largest market share through the forecast period. The petrochemical industry's energy-intensive nature, which necessitates substantial resources to power production processes and infrastructure, is credited with its dominance. Petrochemical firms are investing in energy efficiency services as a result of mounting pressure to lower their operational costs and environmental effects. These services, which include equipment upgrades, process optimization, and energy audits, can assist petrochemical companies in determining and putting into practice strategies to reduce energy consumption, increase energy efficiency, and cut greenhouse gas emissions. Furthermore, because the petrochemical sector contributes significantly to the world's energy demand, governments and regulatory agencies that are putting regulations into place to support industrial energy efficiency have made it a top priority. Because businesses in this industry continue to place a high priority on energy optimization and sustainability activities, it is anticipated that the petrochemical category will continue to represent the largest market for industrial energy efficiency services.

- The commercial segment dominates the market with the largest market share through the forecast period.

Based on the end uses, the industrial energy efficiency services market is divided into commercial and Industrial. Among these, the commercial segment dominates the market with the largest market share through the forecast period. This is driven by the high energy consumption and financial strain that commercial and institutional buildings like office buildings, retail centers, hospitals, and educational institutions face. These facilities are excellent candidates for efficiency increases because they frequently have intricate energy systems and large energy footprints. Owners and managers of commercial buildings are realizing more and more the benefits of using energy efficiency services to find and apply strategies that can cut energy use, minimize operating costs, and improve sustainability. Adoption of energy efficiency services in the business sector is also being fueled by government programs, financial incentives, and a greater emphasis on corporate environmental, social, and governance (ESG) goals. The demand for thorough energy audits, infrastructure upgrades, and performance optimization services is expected to remain high in the commercial segment, maintaining its position as the largest market for industrial energy efficiency services over the forecast period as businesses and institutions continue to prioritize cost savings and emissions reductions.

Regional Segment Analysis of the Industrial Energy Efficiency Services Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the industrial energy efficiency services market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the industrial energy efficiency services market over the predicted timeframe. A number of factors, including the expansion of government energy-related initiatives and laws, the expansion of the industrial sector, and increased public awareness of the advantages of energy-efficient products and services, are responsible for this growth. In order to lower energy consumption, operating expenses, and carbon emissions, North American industries particularly the manufacturing and energy sectors—are embracing energy efficiency services on a growing basis. Energy auditing, retrofitting, monitoring, and verification firms, among other efficiency-related service providers, are major players in the North American industrial energy efficiency services market. Since the US has strict energy efficiency regulations and a number of significant service providers, it is expected to be the largest market in North America for industrial energy efficiency services. Since the economies of Canada and Mexico are more oriented toward sustainability and energy efficiency, these two nations should also help to expand the North American market. Over the course of the next several years, the North American market for industrial energy efficiency services is expected to develop at a rate primarily due to favorable regulatory conditions, rising energy costs, and growing attention to lowering carbon footprint.

Europe is expected to grow the fastest during the forecast period. Europe's industrial sector is subject to strict government laws and policies aimed at enhancing energy efficiency and cutting carbon emissions. Utilizing intelligent solutions and cutting-edge technologies more often to maximize energy use in industrial operations. Growing attention on sustainability and rising energy costs in European businesses, especially in manufacturing, chemicals, and power generation. The European Union and national governments offer financial schemes and incentives to encourage industrial energy efficiency projects. Existence of significant industrial energy efficiency service providers in the area that supply businesses with all-encompassing solutions. The region's leading users of these services are expected to be the automobile, steel, cement, and chemical industries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the industrial energy efficiency services market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Siemens

- Honeywell

- TERI

- DuPont

- Dalkia

- ENGIE

- Getec

- ISTA

- Johnson Controls

- Schneider Electric

- SGS

- Wood

- Veolia Environnement SA

- GE Power, a part of General Electric Co.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, Jordan's attempts to improve industrial energy efficiency took a big step ahead with a ceremony held at the Jordan Chamber of Industry. The Renewable Energy and Energy Efficiency Fund (JREEEF) Chairman, Dr. Saleh Al-Kharabsheh, Minister of Energy and Mineral Resources, hosted the event, which resulted in the signing of 66 agreements with industrial enterprises that will benefit from the Energy Efficiency Technologies Implementation Program.

- In July 2024, Origin Energy purchased a 20% share in Climatech Zero, a company that offers decarbonization solutions to the manufacturing, food processing, and mining sectors.

- In June 2024, ComEd aims to advance the energy-efficiency industry in Illinois by introducing the new Market Development Initiative (MDI) and providing individuals with the education and skills necessary to compete for jobs in that field.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the industrial energy efficiency services market based on the below-mentioned segments:

Global Industrial Energy Efficiency Services Market, By Type

- Energy Auditing Or Consulting

- Product And System Optimization

- Monitoring & Verification

- Energy Management Software

Global Industrial Energy Efficiency Services Market, By Application

- Petrochemical

- Chemical Industry

- Electric Power

- Building Materials

- Mining

- Others

Global Industrial Energy Efficiency Services Market, By End-Use

- Commercial

- Industrial

Global Industrial Energy Efficiency Services Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the industrial energy efficiency services market over the forecast period?The industrial energy efficiency services market is projected to expand at a CAGR of 7.01% during the forecast period.

-

2.What is the market size of the industrial energy efficiency services market?The Global Industrial Energy Efficiency Services Market Size is Expected to Grow from USD 9.9 Billion in 2023 to USD 19.5 Billion by 2033, at a CAGR of 7.01% during the forecast period 2023-2033.

-

3.Which region holds the largest share of the industrial energy efficiency services market?North America is anticipated to hold the largest share of the industrial energy efficiency services market over the predicted timeframe.

Need help to buy this report?