Global Industrial Fasteners Market Size Share, and COVID-19 Impact Analysis By Raw Material (Metal and Plastic), By Product (Externally Threaded fasteners, Internally threaded fasteners, Non-threaded fasteners, and Aerospace grade fasteners), By Application (Automotive, Aerospace, Building and Construction, Industrial Machinery, Home Appliances, and Plumbing Products) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 - 2030

Industry: Advanced MaterialsGlobal Industrial Fasteners Market Insights Forecasts to 2030

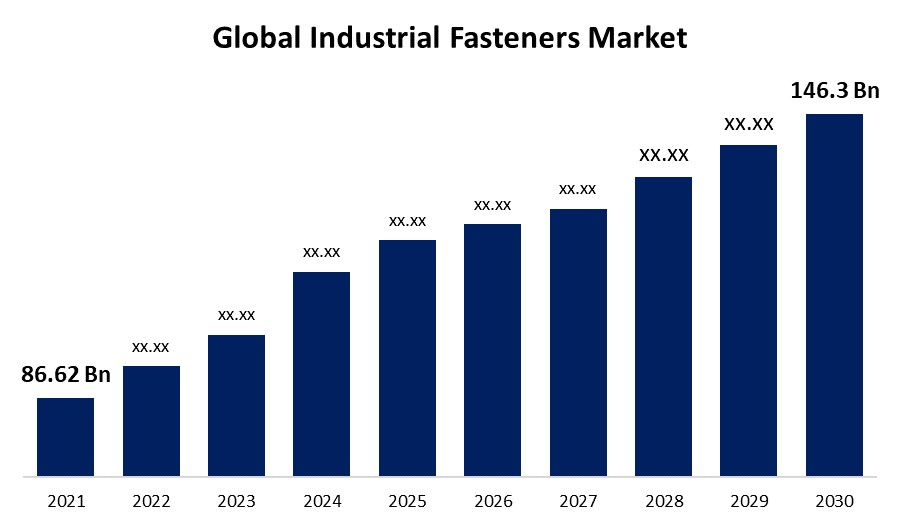

- The Global Industrial Fasteners Market Size was valued at USD 86.62 billion in 2021.

- The Market Size is Growing at a CAGR of 6% from 2021 to 2030

- The Worldwide Industrial Fasteners Market Size is Expected to reach USD 146.3 billion by 2030

- Europe is Expected to Grow the fastest during the forecast period

Get more details on this report -

The global industrial fasteners market is expected to reach USD 146.3 billion by 2030, at a CAGR of 6% during the forecast period 2021 to 2030. A fastener is used to join, fix, or connect two or more things. They are often made of stainless steel and are used in many different industries. Most of the time, steels like carbon steel, alloy steel, and stainless steel are used to build them. They are protected from the weather by a corrosion-resistant paint or coating. Some of these businesses are in the fields of aerospace, industrial machinery, plumbing goods, motors, and pumps. Some of the main things that are likely to drive growth in the global industrial fasteners market over the next few years are the growth of the automotive and construction industries and the increase in the number of custom fasteners being made.

Market Overview:

"Industrial fasteners" are high-quality fasteners that are used in a wide range of industries and projects, from the auto industry to the marine industry to building projects. Industrial fasteners are used in many different fields, including construction. When it comes to fasteners, you need to know the basics so you know what kind of industrial fastener to use for each project. For example, people often use the terms "industrial screws" and "industrial bolts" interchangeably. Both terms refer to fasteners that are used in factories. But there are some important differences between these different kinds of fasteners that you should know. A bolt is a type of fastener that is similar to a screw. However, unlike a screw, a bolt has either a nut or a threaded hole on the other side to keep it in place. Fasteners are needed in a lot of important industries, like making cars, building, making machinery, making electronics, building ships, and making railroads. The most important things to think about when making these fasteners and putting them to use in a variety of ways are the technical requirements and the quality of the product. The rise in the production of commercial aircraft, which is directly linked to the rise in the number of airline passengers around the world, has led to a rise in the need for specialty-grade fasteners. A rise in the production of cars, especially electric vehicles (EVs), is also expected to help the market grow. Manufacturers must make sure that the application-specific fasteners they sell meet a number of different standards, such as those set by the American Society for Testing and Materials (ASTM), the American Society of Mechanical Engineers (ASME), the British Standards (BS), the Deutsches Institut für Normung (DIN), and the Japanese Industrial Standards (JIS).

Global Industrial Fasteners Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 86.62 Billion |

| Forecast Period: | 2021 - 2030 |

| Forecast Period CAGR 2021 - 2030 : | 6% |

| 2030 Value Projection: | USD 146.3 Billion |

| Historical Data for: | 2017 - 2020 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 137 |

| Segments covered: | By Raw Material, By Product, By Application, By Region |

| Companies covered:: | Arconic Fastening Systems and Rings, Acument Global Technologies, Inc., ATF, Inc., Dokka Fasteners A S, LISI Group - Link Solutions for Industry, Nippon Industrial Fasteners Company (Nifco), Nippon Industrial Fasteners Company (Nifco), Hilti Corporation, MW Industries, Inc., Birmingham Fastener and Supply, Inc., SESCO Industries, Inc., Elgin Fastener Group LLC, Rockford Fastener, Inc., Slidematic Precision Components, Inc., Manufacturing Associates, Inc., Eastwood Manufacturing |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Report Coverage

This research report categorizes the market for global industrial fasteners market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global industrial fasteners market. Recent market developments and competitive strategies such as expansion, product launch and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each global industrial fasteners market sub-segments.

Segmentation Analysis

- In 2021, the metal segment dominated the market with the largest market share of 57% and market revenue of 49.3 billion.

Based on raw material, the industrial fasteners market is categorized into Metal and Plastic. In 2021, the metal segment dominated the market with the largest market share of 57% and market revenue of 49.3 billion. Metal goods are used in industrial bonding because they can be pulled apart and put back together without breaking. Metal goods are so popular because they have these qualities. Some of the metals that are used to make metal fasteners are stainless steel, nylon, aluminum, carbon steel, nickel, silicon bronze, copper, brass, alloy steel, bronze, and titanium. For equipment or machines to do their main jobs, they need to be made of materials that can handle both heavy and light work.

- In 2021, the internally threaded fasteners segment accounted for the largest share of the market, with 30% and market revenue of 25.9 billion.

Based on product, the industrial fasteners market is categorized into Externally Threaded fasteners, Internally threaded fasteners, Non-threaded fasteners, and Aerospace grade fasteners. In 2021, internally threaded fasteners dominated the market with the largest market share of 30% and market revenue of 25.9 billion. Bolts and screws are the most common types of fasteners that have threads on the outside. These goods are used a lot in making cars, electronics, ships, railroads, and heavy equipment. Internally threaded fasteners are mostly nuts, which are usually used with bolts to stack two or more parts of a structure on top of each other. The most common kind of nut is hexagonal, and it is used in a wide range of businesses, such as those that make cars, motorcycles, trains, industrial equipment, and construction equipment.

- In 2021, the automotive segment accounted for the largest share of the market, with 25% and market revenue of 21.6 billion.

Based on application, the industrial fasteners market is categorized into Automotive, Aerospace, Building and Construction, Industrial Machinery, Home Appliances, and Plumbing Products. In 2021, automotive dominated the market with the largest market share of 25% and market revenue of 21.6 billion. The fact that cars are made everywhere in the world, both for business and for personal use, has helped the market grow. Also, more people are becoming interested in electric cars, which is likely to lead to more cars being made all over the world. This is likely to lead to more demand for fasteners in the years to come.

Regional Segment Analysis of the Industrial Fasteners Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Get more details on this report -

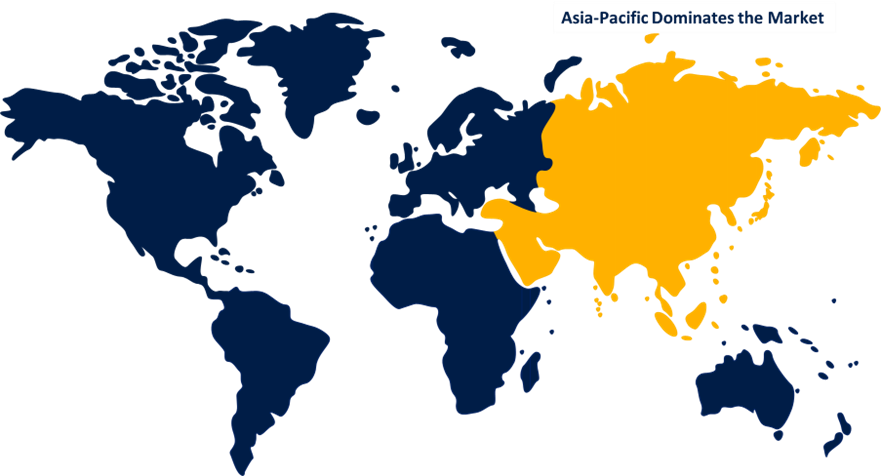

Among all regions, Asia-Pacific emerged as the largest market for the global industrial fasteners market, with a market share of around 37.1% and 86.62 billion of market revenue in 2021.

- In 2021, Asia-Pacific emerged as the largest market for the global industrial fasteners market, with a market share of around 37.1% and 86.62 billion of the market revenue. Product demand in this region can be explained by the fact that both local and international actors are involved in the production of cars, machines, and parts. Since the number of manufacturing businesses in India and China is growing quickly, it is expected that the major manufacturing centers in these two countries will continue to drive the market.

- The Europe market is expected to grow at the fastest CAGR between 2022 and 2030. The market's growth has been helped by the presence of multinational automakers in the area, as well as by improving production facilities and introducing cutting-edge manufacturing processes. It is expected that using automation technology in manufacturing plants will help the market grow even more. It is expected that the growth of the construction and manufacturing industries in Germany will lead to a steady rise in the demand for goods over time. Germany was the most important country in Europe for manufacturing, making up more than 20% of the market. People know that the country is good at making cars, electronics, and things. In the past, the auto industry has been the biggest user of fasteners in the country, and this is likely to stay the case during the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global industrial fasteners market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Market Players:

- Arconic Fastening Systems and Rings

- Acument Global Technologies, Inc.

- ATF, Inc.

- Dokka Fasteners A S

- LISI Group - Link Solutions for Industry

- Nippon Industrial Fasteners Company (Nifco)

- Hilti Corporation

- MW Industries, Inc.

- Birmingham Fastener and Supply, Inc.

- SESCO Industries, Inc.

- Elgin Fastener Group LLC

- Rockford Fastener, Inc.

- Slidematic Precision Components, Inc.

- Manufacturing Associates, Inc.

- Eastwood Manufacturing

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Third-party knowledge providers

- Value-Added Resellers (VARs)

Recent Development

- In January 2022, Norwegian Dokka Fasteners, a company that makes industrial fasteners worldwide, decided that it would be a good idea to build a production plant iKlaipedada, which is in the country of Lithuania, to expand its operations in Europe.

- In September 2021, it was announced that Trifast plc, a global manufacturer and distributor of industrial fastenings and related parts, would buy North American specialist fastenings distributor Falcon Fastening Solutions Inc.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2030. Spherical Insights has segmented the global industrial fasteners market based on the below-mentioned segments:

Global Industrial Fasteners Market, By Raw Material

- Metal

- Plastic

Global Industrial Fasteners Market, By Product

- Externally Threaded fasteners

- Internally threaded fasteners

- Non-threaded fasteners

- Aerospace grade fasteners

Global Industrial Fasteners Market, By Application

- Automotive

- Aerospace

- Building and Construction

- Industrial Machinery

- Home Appliances

- Plumbing Products

Global Industrial Fasteners Market, Regional Analysis

- North America

- THE US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- The Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the market size of the Industrial Fasteners market?As per Spherical Insights, the size of the Industrial Fasteners market was valued at USD 86.62 billion in 2021 to USD 146.3 billion by 2030.

-

What is the market growth rate of the Industrial Fasteners market?The Industrial Fasteners market is growing at a CAGR of 6% from 2021 to 2030.

-

Which country dominates the Industrial Fasteners market?Asia- Pacific emerged as the largest market for Industrial Fasteners.

-

Who are the key players in the Industrial Fasteners market?Key players in the Industrial Fasteners market are Arconic Fastening Systems and Rings, Acument Global Technologies, Inc., ATF, Inc., Dokka Fasteners A S, LISI Group - Link Solutions for Industry, Nippon Industrial Fasteners Company (Nifco), Hilti Corporation, MW Industries, Inc., Birmingham Fastener and Supply, Inc., SESCO Industries, Inc., Elgin Fastener Group LLC, Rockford Fastener, Inc., Slidematic Precision Components, Inc., Manufacturing Associates, Inc., and Eastwood Manufacturing

-

Which factor drives the growth of the Industrial Fasteners market?Construction expansion is expected to drive the market's growth over the forecast period.

Need help to buy this report?