Global Industrial FDM 3D Printer Market Size, Share, and COVID-19 Impact Analysis, By Printer Type (Desktop, Industrial), By Material (Plastics, Metals, Ceramics, Composites, and Others), By Application (Prototyping, Tooling, Manufacturing, and Others), By End-Use Industry (Aerospace, Automotive, Healthcare, Consumer Goods, and Others), and By Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Advanced MaterialsGlobal Industrial FDM 3D Printer Market Insights Forecasts to 2033

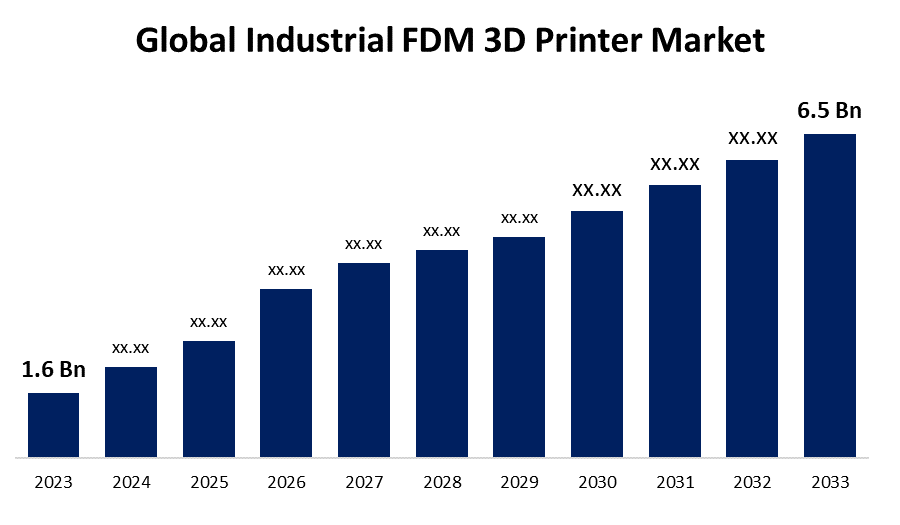

- The Global Industrial FDM 3D Printer Market Size was Valued at USD 1.6 Billion in 2023

- The Market Size is Growing at a CAGR of 15.05% from 2023 to 2033

- The Worldwide Industrial FDM 3D Printer Market Size is Expected to Reach USD 6.5 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Industrial FDM 3D Printer Market Size is Anticipated to Exceed USD 6.5 Billion by 2033, Growing at a CAGR of 15.05% from 2023 to 2033. The global industrial FDM 3D printer market has been achieving significant growth due to advancements in materials, the increasing demand for prototyping, and growing applications in the aerospace, healthcare, and automotive sectors.

Market Overview

The global industrial FDM 3D printer market is the production and usage of FDM 3D printers for industrial applications. These printers produce functional prototypes, tools, and end-use parts from thermoplastics, which include ABS, PLA, and polycarbonate. Precise and scalable, it is used by aerospace, automotive, healthcare, and manufacturing industries. Furthermore, growing demand for lightweight and customized parts, aerospace and automotive, plus healthcare, drives growth for the industrial FDM 3D Printer market, as does cost-efficient prototyping and small volume production. Advancements in durable thermoplastics, improved precision, and sustainability benefits further drive adoption. Rapid industrialization in developing regions plus on-demand manufacturing also accelerates growth.

Key participants in the industrial FDM 3D printer market are seeing significant strides through innovation, strategic investment, and recent launches. For instance, in January 2024, Nexa3D acquired Essentium, a high-speed extrusion 3D printer manufacturer, along with its associated materials. The acquisition expanded Nexa3D's offerings to include faster printing technology while gaining deeper insight into super polymers; it also positioned the company better to serve an expanding universe of industrial, healthcare, and government customers. As well as in March 2024, Stratasys Ltd. acquired the technology portfolio of Arevo, along with its IP estate. This would provide Stratasys access to patents that cover the specifics of carbon fiber printing, methods of improving Z-strength, and build monitoring through AI. Its capabilities will help broaden the manufacturing applications that Stratasys provides in FDM 3D printing systems to customers.

Opportunities and Trends in the Industrial FDM 3D Printer Market:

Opportunities in lightweight, custom parts drive the Industrial FDM 3D printer market, besides cost-efficient prototyping for the aerospace and automotive industries. Trends include the adoption of composite materials, AI-driven quality control, and multi-material printing capabilities. Growth accelerates with expanded use in healthcare for custom implants and prosthetics and growing demand in emerging markets.

Report Coverage

This research report categorizes the global industrial FDM 3D printer market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global industrial FDM 3D printer market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global industrial FDM 3D printer market.

Global Industrial FDM 3D Printer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.6 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 15.05% |

| 2033 Value Projection: | USD 6.5 Billion |

| Historical Data for: | 2021-2022 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Printer Type, By Material, By Application, By Region, By End-Use |

| Companies covered:: | SLM Solutions Group AG, GE Additive, HP Inc., ExOne Company, Voxeljet AG, EnvisionTEC GmbH, Ultimaker BV, Markforged Inc., Stratasys Ltd., 3D Systems Corporation, EOS GmbH, Materialise NV, and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The driving factors for the industrial FDM 3D printer market are the rising demand for lightweight and customized parts in aerospace and automotive sectors along with cost efficiency in prototyping, high performance in thermoplastics, and growing trends related to sustainability. Emerging economies and increased adoption of AI-driven quality control and multi-material printing further boost growth potential for this market during the forecast period. In Addition, factors driving the industrial FDM 3D printer market are aerospace and automotive demand for lightweight, customized parts, cost-efficient prototyping, and sustainability trends. The innovations of the F3300 Fused Deposition Modeling (FDM) 3D printer from Stratasys Ltd. in November 2023, supports reduced labor cost, maximized uptime, and increased part quality and yield.

Restraints & Challenges

Industrial FDM 3D printing is a domain that has various challenges like high costs of setting up, small scope for material variety, and slower speed than conventional manufacturing. The precision constraints needed for post-processing, and competition by technologies like SLA and SLS are challenging its growth.

Market Segmentation

The global industrial FDM 3D printer market share is classified into printer type, material, application, and end-use industry.

• The industrial segment is expected to hold the largest share of the global industrial FDM 3D printer market during the forecast period.

Based on printer type, the global industrial FDM 3D printer market is categorized as desktop, and industrial. Among these, the industrial segment is expected to hold the largest share of the global industrial FDM 3D printer market during the forecast period. Such kind of printers are heavily used in sectors such as aerospace, automotive, and healthcare because they offer the capability of producing high-quality, functional prototypes, and end-use parts. They are highly accurate, scalable, and have better compatibility with advanced materials compared to desktop printers and are suitable in various large-scale industrial applications.

• The composites segment is expected to grow at the fastest CAGR during the forecast period.

Based on the material, the global industrial FDM 3D printer market is categorized as plastics, metals, ceramics, composites, and others. Among these, the composites segment is expected to grow at the fastest CAGR during the forecast period. A series of composite materials, including carbon-fibre-reinforced and glass-fiber-reinforced filaments, are increasingly being used because of their superior strength-to-weight ratio, thermal stability, and suitability for demanding applications in aerospace, automotive, and defence industries. These materials combine the ease of printing with FDM with enhanced mechanical properties, allowing the rapid generation of parts that are lightweight, strong, and functional.

• The prototyping segment is expected to grow at the fastest CAGR during the forecast period.

Based on the application, the lobal industrial FDM 3D printer market is categorized as prototyping, tooling, manufacturing, and others. Among these, the prototyping segment is expected to grow at the fastest CAGR during the forecast period. The cost-effectiveness and speed of prototyping also give a chance to various industries, such as the aerospace industry, the automotive industry, and healthcare, to develop designs before mass production. FDM printers are very much in favour of prototyping due to their ability to rapidly iterate using durable and affordable materials.

• The healthcare segment is expected to hold the largest share of the global industrial FDM 3D Printer market during the forecast period.

Based on the end-use industry, the global industrial FDM 3D printer market is categorized as aerospace, automotive, healthcare, consumer goods, and others. Among these, the healthcare segment is expected to hold the largest share of the global industrial FDM 3D printer market during the forecast period. Growing demand for customized medical devices, prosthetics, surgical tools, and implants, coupled with the increasing adoption of patient-specific solutions made with FDM 3D printers at minimal costs while reducing their turnaround times, are driving this market. Biocompatible materials have also gained acceptance, and precision printing for healthcare applications strengthens this segment of growth.

Regional Segment Analysis of the Global Industrial FDM 3D Printer Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is projected to hold the largest share of the global industrial FDM 3D printer market over the forecast period.

Get more details on this report -

North America is projected to hold the largest share of the global industrial FDM 3D printer market over the forecast period. Dominant lead is given by the presence of leading companies for 3D printing in the region, as well as highly advanced manufacturing infrastructure and wide adoption in sectors like aerospace, automotive, and healthcare. The United States has been leading the way with innovation and investments in 3D printing technologies and gets supplemented support from Government initiatives in advanced manufacturing. The domination of the market by this region is further blessed with high demand for prototyping, tooling, and end-use parts in aerospace and healthcare.

Asia Pacific is expected to grow at the fastest CAGR growth of the global industrial FDM 3D printer market during the forecast period. The region has been driven by rapid industrialization, an expansion of manufacturing sectors, and a rising need to adopt advanced technologies in countries such as China, Japan, and South Korea. The growth of the automotive and healthcare industries and government support for 3D printing initiatives further drive the growth of the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global industrial FDM 3D printer market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SLM Solutions Group AG

- GE Additive

- HP Inc.

- ExOne Company

- Voxeljet AG

- EnvisionTEC GmbH

- Ultimaker BV

- Markforged Inc.

- Stratasys Ltd.

- 3D Systems Corporation

- EOS GmbH

- Materialise NV

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Key Market Developments

- In October 2023, CurifyLabs (Finland) introduced the world's first GMP (good manufacturing practice)-produced Pharma Inks for 3D printing medications, responding to the growing need for individualized medicine in healthcare.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global industrial FDM 3D printer market based on the below-mentioned segments:

Global Industrial FDM 3D Printer Market, By Printer Type

- Desktop

- Industrial

Global Industrial FDM 3D Printer Market, By Material

- Plastics

- Metals

- Ceramics

- Composites

- Others

Global Industrial FDM 3D Printer Market, By Application

- Prototyping

- Tooling

- Manufacturing

- Others

Global Industrial FDM 3D Printer Market, By End-Use Industry

- Aerospace

- Automotive

- Healthcare

- Consumer Goods

- Others

Global Industrial FDM 3D Printer Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global industrial FDM 3D printer market over the forecast period?The global industrial FDM 3D printer market size is expected to grow from USD 1.6 Billion in 2023 to USD 6.5 Billion by 2033, at a CAGR of 15.05% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share of the global industrial FDM 3D printer market?North America is projected to hold the largest share of the global industrial FDM 3D printer market over the forecast period.

-

3. Who are the top key players in the global industrial FDM 3D printer market?SLM Solutions Group AG, GE Additive, HP Inc., ExOne Company, Voxeljet AG, EnvisionTEC GmbH, Ultimaker BV, Markforged Inc., Stratasys Ltd., 3D Systems Corporation, EOS GmbH, Materialise NV, and Others.

Need help to buy this report?