Global Industrial Sensors Market Size, Share, and COVID-19 Impact Analysis, By Sensor (level sensors, temperature sensors, pressure sensors, flow sensors, position sensors, force sensors, image sensors, gas sensors, and others), By Type (Contact, Non-Contact), By Industrial Vertical (Energy and Power, Oil and Gas, Mining, Chemical, Automotive, Others), By End User (Discrete Process), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 – 2030

Industry: Semiconductors & ElectronicsGlobal Industrial Sensors Market Insights Forecasts to 2030

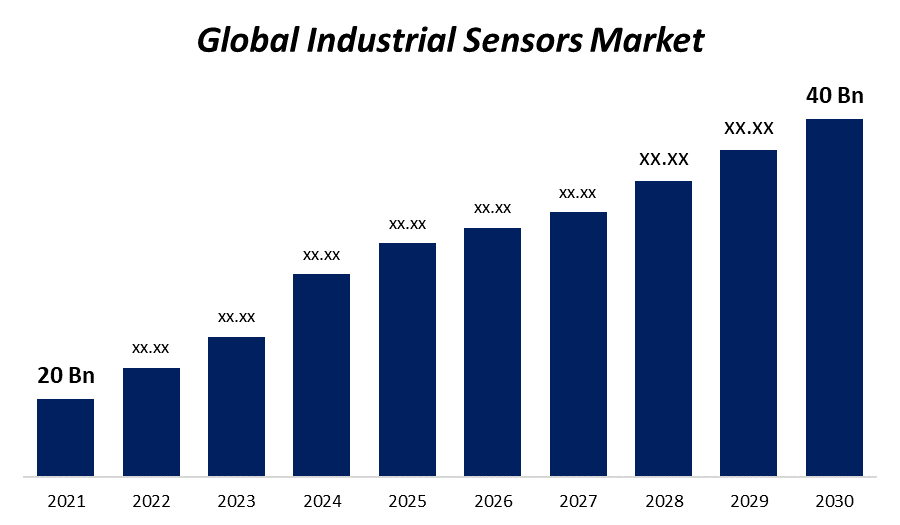

- The Industrial Sensors market was valued at USD 20 billion in 2021.

- The market is growing at a CAGR of 9.2% from 2022 to 2030

- The global Industrial Sensors market is expected to reach USD 40 billion by 2030

- North America is expected to grow the fastest during the forecast period

Get more details on this report -

The global Industrial Sensors market is expected to reach USD 40 billion by 2030, at a CAGR of 9.2% during the forecast period 2022 to 2030. Industry 4.0 and IIoT are being adopted more frequently in production, wearable devices with smart sensors are in high demand, and industrial sensors are advancing technologically, all of which are contributing to this market's growth. Additional aspects that are anticipated to provide substantial potential for the growth of this market include the use of smart sensors for predictive maintenance and the rising adoption of smart sensors in the automotive industry.

Market Overview

Devices known as industrial sensors produce an output (signal) in response to a certain physical quantity (input). In industrial automation, sensors are used to determine the extrinsic characteristics of objects, such as position, distance, temperature, colour, and closeness. Industries as diverse as manufacturing, infrastructure, and healthcare use industrial sensors. Industrial Automation (IA) can be defined as the process of automating Sensors are input devices that turn physical quantities into an output (signal) (input). Among the sensors used in automation are: Sensors are crucial to industrial automation because they enable the development of intelligent, highly automated devices. Industrial pressure sensors are crucial because they are usually used to keep an eye on process flows where fluid must be precisely filtered and calibrated. Using industrial flow sensors can also aid in accurately measuring flow rates and dosing any gas.

Report Coverage

This research report categorizes the market for Industrial Sensors market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Industrial Sensors market. Recent market developments and competitive strategies such as expansion, product launch and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Industrial Sensors market.

Driving Factors

Smart sensors are in high demand in a number of other industries, including petrochemical, semiconductor, food processing, and transportation, due to their capacity to monitor and process vibration and noise data. Smart sensors have the capacity to distribute, process, and store data. As a result, they are able to identify machine health and anticipate malfunction, helping the industrial sector save money by minimising maintenance expenses and downtime. In addition, the rising use of wireless sensors and increased demand for industrial robots are anticipated to favour the global market for industrial sensors.

Global Industrial Sensors Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 20 Billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 9.2% |

| 2030 Value Projection: | USD 40 Billion |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 204 |

| Tables, Charts & Figures: | 127 |

| Segments covered: | By Sensor, By Type, By Industrial Vertical, By End User, By Region, COVID-19 Impact Analysis |

| Companies covered:: | Rockwell Automation, Honeywell, Texas Instruments, Siemens, Bosch Sensortec, Panasonic, STMicroelectronics, Amphenol Corporation, Omega Engineering, Teledyne Technologies Incorporated, Amphenol Corporation, Infineon Technologies AG, NXP Semiconductors N.V., Renesas Electronics, Corporation, Rockwell Automation, Inc., Siemens AG, STMicroelectronics International, N.V. TE Connectivity Ltd., Texas Instruments Incorporated, Dwyer Instruments Ltd. |

| Pitfalls & Challenges: | Due to the increasing number of COVID-19 cases |

Get more details on this report -

Restraining Factors

The COVID-19 pandemic has hampered the expansion of a number of industries, including manufacturing, automotive, oil and gas, and others, by disrupting the supply chain and manufacturing process. This will probably prevent the market from growing. In the next years, the industrial sensors market's expansion is anticipated to be constrained by the high cost of installing sensors in devices.

Segmentation

- In 2021, the Image Sensors is anticipated to hold the fastest CAGR over the forecast period.

On the basis of sensor type, the global industrial sensors market is segmented into level sensors, temperature sensors, pressure sensors, flow sensors, position sensors, force sensors, image sensors, gas sensors, and others. The image sensors is anticipated to grow at the fastest CAGR over the foreseen period. The market for industrial image sensors is expanding thanks to the machine vision application. Image sensors are anticipated to be crucial in emerging fields like the Internet of Things, smart homes, cities, automated vehicles, and medical devices. Additionally, some of the most crucial biometric procedures, like fingerprint and iris scanning, are increasingly using image sensors. A few industries that use image sensors include manufacturing, pharmaceuticals, chemicals, oil and gas, and energy and power.

- In 2021, the Non-Contact segment is estimated to witness the fastest CAGR over the forecast period.

On the basis of type, the global industrial sensors market is segmented into Contact, Non-Contact. Among these, the non-contact segment is anticipated to witness the fastest CAGR over the forecast period. The type of sensor employed depends on the technology being utilised; for instance, in level sensors, the non-contact level sensing technologies that are most frequently used are ultrasonic, microwave/radar, optical, laser, MEMS, capacitive, conductivity, nuclear, and load cells. Non-contact temperature sensors use the concepts of convection and radiation to gauge temperature changes. They pick up infrared radiation, which is a sort of heat radiation that an item emits.

- In 2021, the Manufacturing segment dominates the market with the largest market share over the forecast period.

On the basis of industry vertical, the global industrial sensors market is segmented into Energy and Power, Oil and Gas, Mining, Chemical, Automotive, and Others. Among these manufacturing segment dominates the market with the largest market share. The growth of the market is attributed to the increasing adoption of IoT sensors in processing and manufacturing facilities. Additionally, IoT-based industrial sensors help businesses monitor plants remotely, increase the security of workers and industrial assets, and improve operational effectiveness. By achieving early failure detection, the usage of these industrial sensors in manufacturing services helps to reduce maintenance expenses. segment dominates the market with the largest market share over the forecast period.

- In 2021, the Discrete Industry segment is dominating the market with the largest market share.

Based on end user, the global industrial sensors market is segmented into discrete, process industry. Among these, discrete industry segment is dominating the market with the largest market share due to the fastest expansion of electronics and automotive industry globally.

Regional Segment Analysis of the Industrial Sensors Market

Get more details on this report -

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

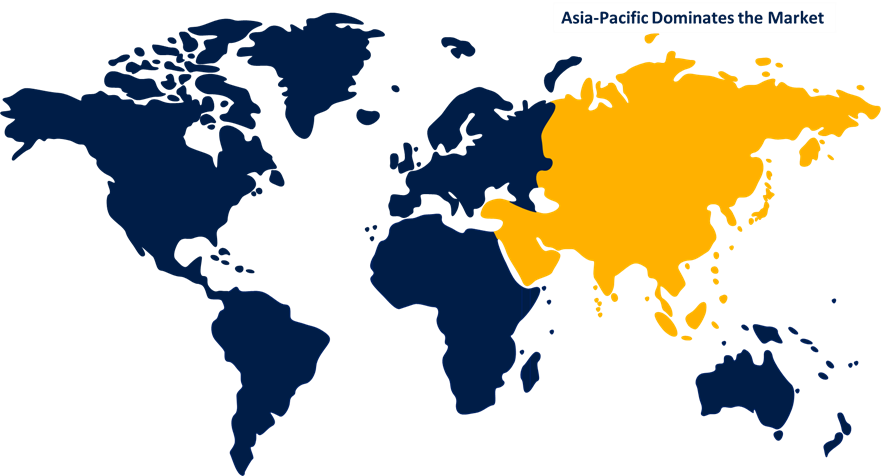

Asia Pacific is anticipated to hold the highest market share over the forecast period.

The Asia Pacific market is anticipated to account for a significant share of sales throughout the forecast period. The expansion of the target market during the forecast period is being fueled by the existence of sizable manufacturing hubs in the area. Furthermore, the Asia Pacific Industrial Sensors Market is anticipated to increase due to China's status as a significant producer of consumer electronics and vehicles.

Recent Developments

- In October 2021, By Texas Instruments, the 3D Hall-effect position sensor was unveiled. The TMAG5170 allows engineers to get uncalibrated ultra-high precision at rates of up to 20 kSPS for quicker and more precise real-time control in motor-drive and factory automation applications.

- In June 2021, Rockwell Automation has launched a new brand called LifecycleIQ Services. With the help of Rockwell Automation technology and highly qualified staff, customers can improve their performance and reimagine what is possible throughout their industrial value chain, as highlighted by the new brand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global Industrial Sensors market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Rockwell Automation

- Honeywell

- Texas Instruments

- Siemens

- Bosch Sensortec

- Panasonic

- STMicroelectronics

- Amphenol Corporation

- Omega Engineering

- Teledyne Technologies Incorporated

- Amphenol Corporation

- Infineon Technologies AG

- NXP Semiconductors N.V.

- Renesas Electronics, Corporation

- Rockwell Automation, Inc.

- Siemens AG

- STMicroelectronics International

- N.V. TE Connectivity Ltd.

- Texas Instruments Incorporated

- Dwyer Instruments Ltd.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2030. Spherical Insights has segmented the global Industrial Sensors market based on the below-mentioned segments:

Industrial Sensors Market, By Sensor Type

- Level Sensors

- Temperature Sensor

- Pressure sensors

- Flow sensors

- Position sensors

- Force sensors

- Image sensors

- Gas sensors

- Others

Industrial Sensors Market, By Type

- Contact

- Non-Contact

Industrial Sensors Market, By Industry Vertical

- Energy and Power

- Oil and Gas

- Mining

- Chemical

- Automotive

- Others

Industry Sensors Market, By End User

- Discrete

- Process

Industrial Sensors Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?