Global Industrial Services on Electrical Equipment Market Size, Share, and COVID-19 Impact Analysis, By Equipment Type (Busbars and Buducts, Circuit Breakers, Electrical Panels & Enclosures, HVDC systems, Motors and Generators, Relays and Protection Devices, Switchgear, Substations, Transformers, Uninterruptible Power Supplies (Ups), Cables and Conductors), By Service Type (Inspection Services, Installation Services, Maintenance Services, Repair Services, Retrofitting and Upgrading Services, Testing & Commissioning Services. And Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Electronics, ICT & MediaGlobal Industrial Services on Electrical Equipment Market Insights Forecasts to 2033

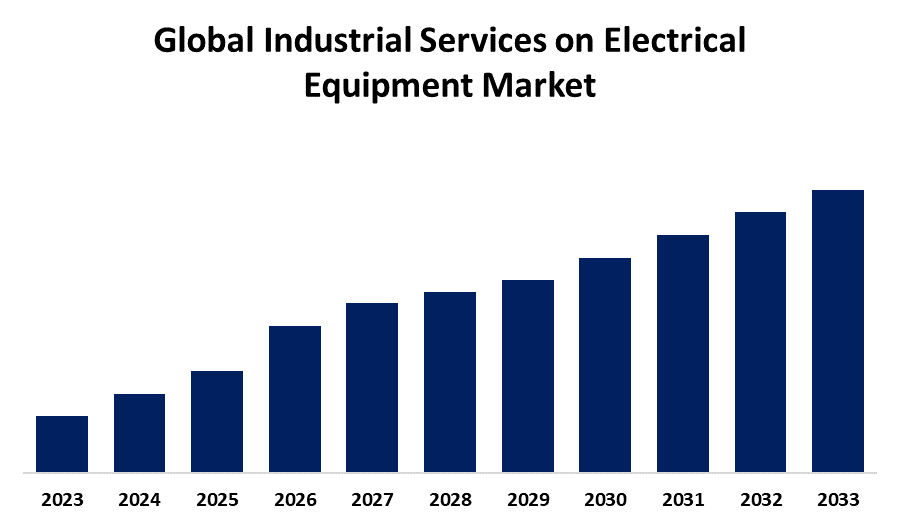

- The Market Size is Growing at a CAGR of 8.4% from 2023 to 2033

- The Worldwide Industrial Services on Electrical Equipment Market Size is Anticipated to Hold a Significant Share by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Industrial Services on Electrical Equipment Market Size is Anticipated to Hold a Significant Share by 2033, at 8.4% CAGR from 2023 to 2033.

Market Overview

The industrial electricity grid is crucial to the operation of most modern plants that perform industrial production. Industrial electrical equipment services are increasing in demand due to the strong demand for output. An "extension arm" of the industrial electricity system, industrial electrical equipment services works to maintain the power source's steady functioning while also creating an acceptable, safe, and effective transmission system for production-related operations. The primary functions of industrial electrical equipment services are switching, regulating, adjusting, safeguarding, converting, regulating, and checking all grid system and electric machine operations. Industrial electrical equipment is also utilized in many other non-crazy manufacturing processes in industrial parks for testing, adjusting, and transforming measurement.

For Instance, in January 2024, A portfolio business of Black Bay Energy Capital ("Black Bay"), Advanced Industrial Devices ("AID") is pleased to announce the purchase of R.S. Integrators, Inc. ("RSI"). Designing and producing power distribution panels and electric motor control systems for the water utility, wastewater, and other industrial markets, RSI has its headquarters in Pineville, North Carolina. An important step toward AID's ongoing, quick growth in these end markets is this highly strategic acquisition of RSI, which establishes a bellwether brand that provides customers with unrivalled product quality and customer support.

The demand for strong electrical infrastructure and services is driven by an increase in manufacturing activity and the requirement for efficient production systems.

Report Coverage

This research report categorizes the market for the industrial services on electrical equipment market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the industrial services in the electrical equipment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of industrial services in the electrical equipment market.

Industrial Services on Electrical Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.4% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 117 |

| Segments covered: | By Equipment Type, By Service Type, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Schneider Electric, Siemens, General Electric (GE), Eaton Corporation, ABB, Mitsubishi Electric, Emerson Electric, Honeywell, Rockwell Automation, Cummins, Toshiba, RWE, Legrand, Nidec, Schweitzer Engineering Laboratories (SEL), and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Technological advancements including maintenance planning, control, and monitoring are improved by IoT, automation, and smart technologies integrated into electrical systems. The need for services linked to the installation and upkeep of cutting-edge equipment is fueled by this. Artificial intelligence (AI) is used in many of everyday tasks, including personal assistants and chatbots. Artificial intelligence is used in the electrical industry to link data from many sources and utilize data analytics to identify possible risks, reduce downtime, and control energy consumption. AI assists utilities in optimizing their energy mix to reduce costs, enhance dependability, and lessen their environmental impact.

For instance, in July 2024, The AI-driven field service and asset management suite from IFS, a supplier of industrial AI and enterprise software for businesses that manage complex assets, operations, and service-focused activities, was added to Siemens Smart Infrastructure's network of partners in the Siemens Xcelerator program. The robust SaaS solution allows for enhanced resource utilization and asset service uptime in electrical substations with AI-enabled asset monitoring and a scheduling and optimization engine.

Restraining Factors

The industrial services market for electrical equipment, while promising, faces several challenges. A primary constraint is the cyclical nature of industrial activity. Economic downturns often lead to reduced capital expenditure, impacting the demand for maintenance and upgrade services. Additionally, the market is characterized by intense competition, forcing service providers to operate on thin margins. Skilled labor shortages, particularly for specialized technicians, pose a significant hurdle in delivering efficient and quality services.

Market Segmentation

The industrial services on electrical equipment market share is classified into equipment type and service type.

- The transformers segment is estimated to hold the highest market revenue share through the projected period.

Based on the equipment type, the industrial services on the electrical equipment market are classified into busbars and buducts, circuit breakers, electrical panels & enclosures, HVDC systems, motors and generators, relays and protection devices, switchgear, substations, transformers, uninterruptible power supplies (ups), cables and conductors. Among these, the transformers segment is estimated to hold the highest market revenue share through the projected period. Changes in regulations, changing energy demands, and technical improvements are all contributing to a massive revolution in the transformer business. Smart transformers are increasingly popular. They are outfitted with sensors and communication technology. The real-time monitoring and diagnostics offered by these transformers increase the efficiency and dependability of the grid. Predictive maintenance, which lowers downtime and operating costs, is made possible by digitalization. This pattern is consistent with the industry-wide shift in the power industry toward smart grids and the Internet of Things (IoT).

For instance, in April 2024, an USD 18 million funding opportunity for Flexible Innovative Transformer Technologies (FITT) was announced by the U.S. Department of Energy (DOE). To improve grid reliability and lessen supply chain constraints for transformers, DOE will choose up to nine awardees through this funding opportunity announcement (FOA) who can conduct research, develop, and demonstrate advanced transformers across a range of distribution to transmission scale applications.

- The maintenance services segment is anticipated to hold the largest market share through the forecast period.

Based on the service type, the industrial services on the electrical equipment market are classified into inspection services, installation services, maintenance services, repair services, retrofitting and upgrading services, testing & commissioning services, and others. Among these, the maintenance services segment is anticipated to hold the largest market share through the forecast period. The electric maintenance service cooperative aims to provide service-oriented solutions for electrical appliance repair and maintenance. Particularly in semi-urban and rural areas, there is a great deal of potential for the growth of repair and servicing centers for electrical items and appliances.

Regional Segment Analysis of the Industrial Services on The Electrical Equipment Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the industrial services on the electrical equipment market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the industrial services on the electrical equipment market over the predicted timeframe. These include ongoing technological advancements driven by the region's commitment to energy efficiency and sustainability, particularly in the areas of smart grid infrastructure and renewable energy integration. Sustained growth momentum is also bolstered by robust commercial and industrial sectors and increasing spending on infrastructure modernization projects. Additionally, supportive policies that encourage innovation and the use of renewable energy sources drive market expansion, making North America a key region for the global electrical equipment industry's expansion.

AsiaAsia Pacific is expected to grow at the fastest CAGR growth of the industrial services on the electrical equipment market during the forecast period. The recent Regional Comprehensive Economic Partnership (RCEP) trade agreement between China and ASEAN countries, along with rising disposable income in emerging economies like Vietnam, Malaysia, and Indonesia, is expected to make smart devices more affordable for consumers, driving growth in the electronic equipment market over the forecast period. This is due to the rising demand for smart wearables as well as favorable government expenditure to boost smart city projects. For instance, the electrical and industrial electronics sector saw a historic double-digit increase of 13 percent in FY23, according to IEEMA, the leading trade association. The sector has revived due to the industry's thirst for growth, favorable legislative reforms, and numerous initiatives implemented by both the government and industry. The Indian Electrical & Electronics Manufacturers' Association, or IEEMA, calculated the growth rate based on the real performance of its member companies, which account for about 90% of the industry.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the industrial services on electrical equipment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Schneider Electric

- Siemens

- General Electric (GE)

- Eaton Corporation

- ABB

- Mitsubishi Electric

- Emerson Electric

- Honeywell

- Rockwell Automation

- Cummins

- Toshiba

- RWE

- Legrand

- Nidec

- Schweitzer Engineering Laboratories (SEL)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, At PowerTest24, the International Electrical Testing Association's annual electrical power system safety and reliability conference, which was recently held at the Hilton Anatole in Dallas, Texas, the organization unveiled its new Qualified Electrical Equipment Maintenance Contractor and Worker Program. As stated by NETA, the new qualification program is a reaction to the recently authorized NFPA 70B Standard by ANSI, which requires and enforces adequate maintenance of electrical equipment. Through a process of corporate assessment and testing of electrical maintenance equipment workers hired by contractors, the new program aims to meet the anticipated need for skilled, vetted contractors for electrical equipment maintenance.

- In May 2024, The General Mechanical and Electrical Services (GMES) Framework for the supply of ATEX and Electrical Services was recently secured by Z-Tech, a division of M Group Services' Water Division.

- In April 2021, A framework agreement for electrical equipment has been agreed by ABB and Equinor; it is good until February 2029. Life-cycle information (LCI), digital services, including remote diagnostics and round-the-clock phone and technical assistance, studies, engineering, testing, installations, commissioning, maintenance, repair, training, documentation, and equipment and spare part supply are all included.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the industrial services on the electrical equipment market based on the below-mentioned segments:

Global Industrial Services on Electrical Equipment Market, By Equipment Type

- Busbars and Buducts

- Circuit Breakers

- Electrical Panels and Enclosures

- HVDC Systems

- Motors and Generators

- Relays and Protection Devices

- Switchgear

- Substations

- Transformers

- Uninterruptible Power Supplies (Ups)

- Cables and Conductors

Global Industrial Services on Electrical Equipment Market, By Service Type

- Inspection Services

- Installation Services

- Maintenance Services

- Repair Services

- Retrofitting and Upgrading Services

- Testing & Commissioning Services

- Others

Global Industrial Services on Electrical Equipment Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the industrial services on the electrical equipment market over the forecast period?The industrial services on electrical equipment market is projected to expand at a CAGR of 8.4% during the forecast period.

-

2. What is the market size of the industrial services on the electrical equipment market?The Global Industrial Services on Electrical Equipment Market Size is Anticipated to Hold a Significant Share by 2033, at 8.4% CAGR from 2023 to 2033.

-

3. Which region holds the largest share of the industrial services on the electrical equipment market?North America is anticipated to hold the largest share of the industrial services on the electrical equipment market over the predicted timeframe.

Need help to buy this report?