Global Industrial Wax Market Size, Share, and COVID-19 Impact, By Type (fossil based wax, synthetic wax, bio based wax), By Application (candles, coatings and polishes, packaging, food, tires and rubber, cosmetics and personal care, hot melt adhesives, and others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032.

Industry: Chemicals & MaterialsGlobal Industrial Wax Market Insights Forecasts to 2032

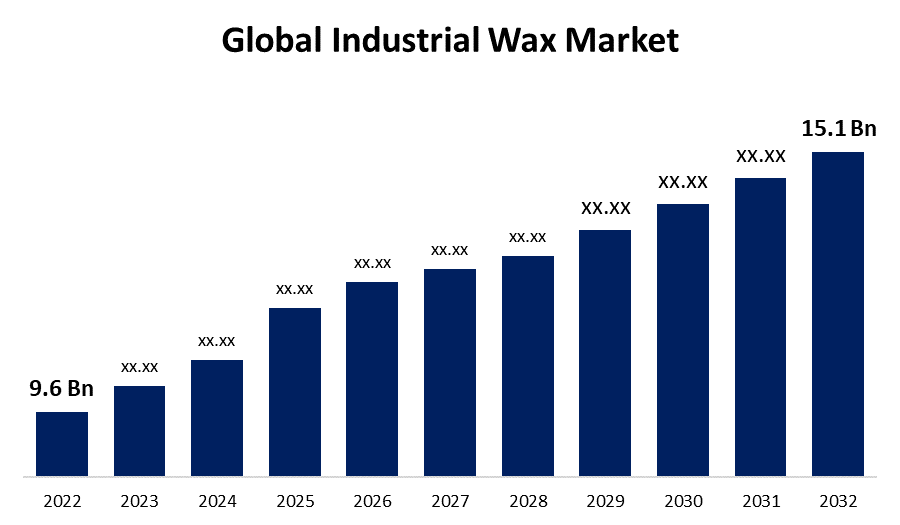

- The Industrial Wax Market Size was valued at USD 9.6 Billion in 2022.

- The Market Size is Growing at a CAGR of 6.2% from 2022 to 2032

- The Worldwide Industrial Wax Market Size is expected to reach USD 15.1 Billion by 2032

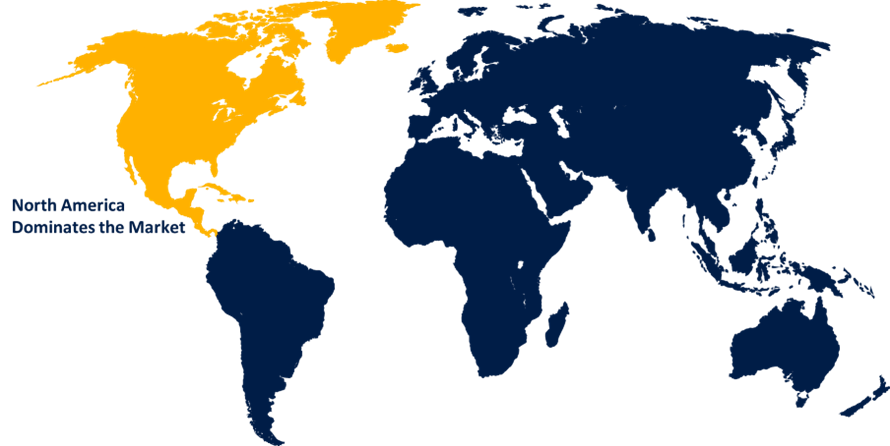

- North America is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Industrial Wax Market Size is expected to reach USD 15.1 Billion by 2032, at a CAGR of 6.2% during the forecast period 2022 to 2032.

Industrial wax is a form of wax made specifically for industrial uses rather than for personal or cosmetic use. Due to its favourable qualities, it is a versatile substance with a wide range of applications in many industries. Petroleum or natural materials including plants, animals, and minerals are commonly used to make industrial wax. Depending on the intended usage and the employed source material, industrial wax might have a different particular composition and set of characteristics. Paraffin wax, microcrystalline wax, beeswax, carnauba wax, and synthetic waxes are a few examples of common industrial wax kinds. In several casting and moulding operations, industrial wax is frequently utilised as a mould release agent. It facilitates the damage-free removal of the finished product from the mould. Water is repelled by many industrial waxes because they are hydrophobic. Due to this characteristic, they are beneficial in processes that need for water protection, such as the creation of waterproof coatings, polishes, and sealants.

Impact of COVID 19 On Global Industrial Wax Market

Lockdowns, travel bans, and decreased manufacturing output caused by the epidemic caused disruptions in the world's supply networks. This led to delays in manufacturing and delivery by affecting the supply and distribution of industrial wax. The pandemic-induced downturn in the economy led to a decline in the demand for industrial wax across a number of industries. Major consumers of industrial wax, like the automotive, aerospace, and construction industries, saw large declines. This drop in demand has a detrimental effect on the industrial wax market as a whole. The pandemic led to a focus on health and safety precautions in industrial settings that was increased. Industrial waxes with antibacterial qualities or those that can be utilised as protective coatings for surfaces to stop the virus from spreading saw a surge in demand as a result. The industrial wax market recovered as a result of the implementation of vaccination programmes and the easing of prohibitions in several nations. Industrial wax demand increased as industries started to grow again. However, the rate of recovery differed between industries and geographical areas.

Global Industrial Wax Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022 : | USD 9.6 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 6.2% |

| 2032 Value Projection: | USD 15.1 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | Gandhar Oil refinery, Numaligarh Refinery Limited, Petróleo Brasileiro, THE PJSC Lukoil Oil Company, HCI Wax (China), Lukoil PJSC Oil Co. (Russia), Royal Dutch Shell (Netherlands), International Group (Canada), Numaligarh Refinery (India), Exxon Mobil (USA), Sasol (South Africa), Petroleo Brasileiro (Brazil) |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Key Market Drivers

Packaging, adhesives, rubber, cosmetics, and candles are just a few of the industries that use industrial wax. The development of these businesses and the expansion of industrial wax's uses have boosted the market. One of the biggest consumers of industrial wax is the packaging sector. The demand for packing materials has increased along with e-commerce, which has also increased demand for industrial wax for coatings, laminations, and sealing applications. Industrial wax now performs better due to ongoing improvements in wax production methods such product compositions and refining methods. These developments have increased the industrial wax's potential applications and boosted market expansion. Rapid urbanisation and industrialization in developing nations, particularly in Asia-Pacific and Latin America, have raised demand for industrial wax. Market expansion has been further spurred by the expansion of these regions' manufacturing industries.

Key Market Challenges

Trade disputes, natural disasters, and political unrest are just a few examples of global supply chain disruptions that can have an effect on the price and availability of raw materials, logistics, and transportation. The general production and distribution of industrial wax may be impacted by these interruptions. The need for industrial wax may change as consumer preferences change, such as a move towards natural and eco-friendly products. To stay competitive, manufacturers must adjust to these shifting consumer desires and create environmentally safe and sustainable wax solutions. Alternative items that have comparable features or can be used as substitutes for industrial wax compete with it. For instance, in some situations, synthetic waxes, polymers, and other additives can take the place of conventional waxes. The demand for industrial wax may change depending on how the market reacts to various substitutes.

Market Segmentation

Type Insights

Fossil based wax segment is dominating the market with the largest market share

On the basis of type, the global industrial wax market is segmented into fossil based wax, synthetic wax, bio based wax. Among these, fossil based wax segment is dominating the market with the largest market share over the forecast period. Due to their widespread availability, variety of characteristics, and affordability, fossil-based waxes have always held a major market share. They have been extensively employed in processes like packaging, adhesives, coatings, making candles, and processing rubber. The segment for fossil-based wax may eventually encounter some difficulties due to rising environmental awareness and the demand for sustainable solutions. Consumer preferences and regulatory frameworks that support ecologically friendly alternatives have led to a growing interest in bio-based and renewable waxes within the business.

Application Insights

Candles segment holds the highest market share over the forecast period

Based on the application, the global industrial wax market is segmented into candles, coatings and polishes, packaging, food, tires and rubber, cosmetics and personal care, hot melt adhesives, and others. Among these, candles segment holds the highest market share over the forecast period. Consumers are becoming increasingly aware of how things, particularly candles, affect the environment. As a result, there is an increase in demand for eco-friendly and natural candle solutions. Candles made of soy wax, beeswax, coconut wax, and other ecological and renewable ingredients are now available from manufacturers in response. These candles are seen as more eco-friendly substitutes for conventional paraffin wax candles. The market for candles has been greatly impacted by the advent of e-commerce. Consumers now find it simpler to browse and buy a variety of candles from different brands and craftsmen thanks to online platforms. Online shopping's accessibility and convenience have increased the client base and helped the candles market flourish.

Regional Insights

North America is dominating the market over the forecast period

Get more details on this report -

Among all other regions, North America is dominating the market over the forecast period. Throughout North America, industrial wax is used in a variety of industries. Packaging, adhesives, cosmetics, rubber, and the auto industry are a few of the major sectors in the area that are driving demand for industrial wax. Industrial wax has been used in these industries for a variety of purposes, including coatings, adhesives, mould releasing agents, and sealants. Throughout North America, industrial wax is used in a variety of industries. Packaging, adhesives, cosmetics, rubber, and the auto industry are a few of the major sectors in the area that are driving demand for industrial wax. Industrial wax has been used in these industries for a variety of purposes, including coatings, adhesives, mould releasing agents, and sealants.

Asia Pacific is witnessing the fastest market growth over the forecast period. The Asia Pacific region has seen tremendous growth in a number of end-use industries, including textiles, automotive, construction, personal care, and building materials. Industrial wax is used in these sectors for a variety of purposes, from surface coatings to wax emulsions. The expansion of these sectors has significantly boosted the demand for industrial wax in the area.

Recent Market Developments

- In March 2020, acqusition of Paralogics, LLC by Calumet Specialty Products Partners, L.P., expanding speciality wax business

List of Key Companies

- Gandhar Oil refinery

- Numaligarh Refinery Limited

- Petróleo Brasileiro

- THE PJSC Lukoil Oil Company

- HCI Wax (China)

- Lukoil PJSC Oil Co. (Russia)

- Royal Dutch Shell (Netherlands)

- International Group (Canada)

- Numaligarh Refinery (India)

- Exxon Mobil (USA)

- Sasol (South Africa)

- Petroleo Brasileiro (Brazil)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global Industrial Wax Market based on the below-mentioned segments:

Industrial Wax Market, Type Analysis

- Fossil based wax

- Synthetic wax

- Bio based wax

Industrial Wax Market, Application Analysis

- Candles

- Coatings and polishes

- Packaging

- Food

- Tires and rubber

- Cosmetics and personal care

- Hot melt adhesives

- Others

Industrial Wax Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of Industrial Wax Market?The global Industrial Wax Market is expected to grow from USD 9.6 Billion in 2022 to USD 15.1 Billion by 2032, at a CAGR of 6.2% during the forecast period 2022-2032.

-

2. Who are the key market players of Industrial Wax Market?Some of the key market players of HCI Wax (China), Lukoil PJSC Oil Co. (Russia), Royal Dutch Shell (Netherlands), International Group (Canada), Numaligarh Refinery (India), Exxon Mobil (USA), Sasol (South Africa), and Petroleo Brasileiro (Brazil).

-

3. Which segment hold the largest market share?Candles segment holds the largest market share is going to continue its dominance.

-

4. Which region is dominating the Industrial Wax Market?Asia Pacific is dominating the Industrial Wax Market with the highest market share.

Need help to buy this report?