Global Inertial Measurement Unit Market Size, Share, and COVID-19 Impact Analysis, By Component (Accelerometer, Gyroscope, Magnetometer), By Technology (Mechanical Gyro, Ring Laser Gyro, Fiber Optics GYRO, MEMS, Others), By Platform (Airborne, Ground, Maritime), By End-user (Aerospace and Defense, Consumer Electronics, Marine/Naval, Automotive, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Inertial Measurement Unit Market Insights Forecasts to 2033

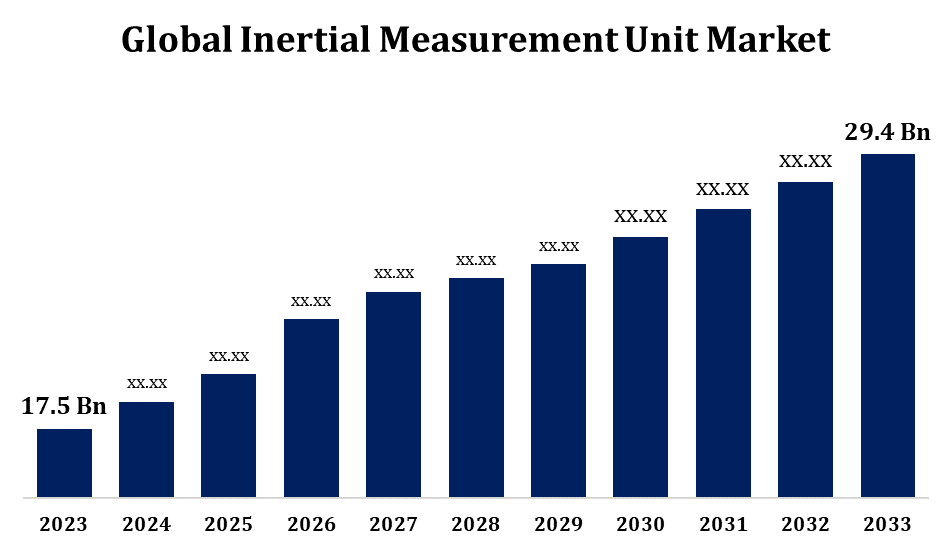

- The Inertial Measurement Unit Market was valued at USD 17.5 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.32% from 2023 to 2033.

- The Worldwide Inertial Measurement Unit Market Size is Expected to reach USD 29.4 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Inertial Measurement Unit Market Size is Expected to reach USD 29.4 Billion by 2033, at a CAGR of 5.32% during the forecast period 2023 to 2033.

The Inertial Measurement Unit market is experiencing significant growth, driven by advancements in aerospace, defense, automotive, and consumer electronics. IMUs, which combine accelerometers, gyroscopes, and sometimes magnetometers, play a crucial role in navigation, motion tracking, and stabilization systems. The increasing adoption of autonomous vehicles, drones, and wearable devices is fueling demand for high-precision IMUs. Miniaturization and the integration of MEMS (Micro-Electro-Mechanical Systems) technology are enhancing IMU performance while reducing costs. Additionally, industries such as robotics and marine navigation are leveraging IMUs for improved control and positioning. North America and Asia-Pacific are leading regions due to strong technological development and manufacturing capabilities. However, challenges like sensor drift and high costs in high-end IMUs persist. Overall, the Inertial Measurement Unit market is poised for steady expansion with continued technological advancements.

Inertial Measurement Unit Market Value Chain Analysis

The Inertial Measurement Unit market value chain consists of multiple stages, from raw material suppliers to end users. It begins with component manufacturers producing accelerometers, gyroscopes, and magnetometers, often utilizing MEMS (Micro-Electro-Mechanical Systems) or fiber-optic technology. These components are then integrated by IMU manufacturers into complete systems, ensuring precision and reliability. The next stage involves software and firmware development to enhance signal processing, calibration, and data fusion. IMUs are then distributed through OEMs (Original Equipment Manufacturers) and system integrators who embed them in applications like aerospace, automotive, robotics, and consumer electronics. End users range from defense organizations to industrial automation firms. Key challenges in the value chain include sensor accuracy, production costs, and the need for continuous innovation to meet evolving industry demands.

Inertial Measurement Unit Market Opportunity Analysis

The Inertial Measurement Unit market presents numerous opportunities driven by technological advancements and expanding applications. The rising demand for autonomous vehicles, drones, and robotics is fueling the need for high-precision IMUs. In aerospace and defense, IMUs are crucial for navigation in GPS-denied environments, offering growth potential. The increasing adoption of IMUs in wearable devices, industrial automation, and marine navigation further expands market opportunities. Advancements in MEMS technology are enabling miniaturization, cost reduction, and improved performance, making IMUs more accessible for consumer electronics. Emerging markets, particularly in Asia-Pacific, offer lucrative prospects due to rapid industrialization and increased investments in smart technologies. Additionally, the integration of AI and sensor fusion in IMU systems presents new possibilities for enhanced motion tracking and real-time data analysis.

Inertial Measurement Unit Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 17.5 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.32% |

| 2033 Value Projection: | USD 29.4 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 236 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Component, By Technology, By Platform, By End-user |

| Companies covered:: | General Electric Company (US), Gladiator Technologies Inc. (US), Honeywell International Inc. (US), Lord Microstrain (US), Northrop Grumman Corporation (US), Safran Electronics & Defense (France), Robert Bosch GmbH (Germany), Teledyne Technologies Inc. (US), Thales Group (France), Trimble Navigation Ltd (US), and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Market Dynamics

Inertial Measurement Unit Market Dynamics

The growing demand for unmanned systems has driven a surge in the need for the product

The growing demand for unmanned systems, including drones, autonomous vehicles, and robotic platforms, is significantly driving the growth of the Inertial Measurement Unit market. IMUs play a critical role in navigation, stabilization, and motion tracking, making them essential for the precise operation of unmanned systems, especially in GPS-denied environments. The defense and aerospace sectors are witnessing increased adoption of IMUs for surveillance drones and unmanned ground vehicles. Similarly, the rise of self-driving cars and industrial automation is boosting demand for high-performance IMUs. Advancements in MEMS technology are further enhancing IMU capabilities while reducing size and cost, making them more accessible across industries. As the deployment of unmanned systems continues to expand, the IMU market is expected to experience sustained growth and innovation.

Restraints & Challenges

One key issue is sensor drift, which affects long-term accuracy and requires frequent recalibration. High manufacturing costs, especially for high-precision IMUs used in aerospace and defense, limit affordability and mass adoption. The complexity of integrating IMUs with other navigation systems, such as GPS and AI-based algorithms, poses technical challenges. Additionally, the miniaturization of IMUs for consumer electronics and wearable devices demands continuous innovation in MEMS technology. Market fragmentation and intense competition among manufacturers also create pricing pressures. Supply chain disruptions and dependency on raw materials for sensor production can impact availability. Overcoming these challenges requires advancements in sensor fusion, improved calibration techniques, and cost-effective production methods to enhance performance and accessibility.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Inertial Measurement Unit Market from 2023 to 2033. North America holds a significant share in the Inertial Measurement Unit (IMU) market, driven by advancements in aerospace, defense, automotive, and industrial automation. The presence of major IMU manufacturers, along with strong research and development initiatives, contributes to market growth. The U.S. Department of Defense heavily invests in high-precision IMUs for military applications, including drones, missiles, and navigation systems. Additionally, the region is at the forefront of autonomous vehicle development, increasing demand for IMUs in self-driving cars. The growing adoption of IMUs in industrial robotics and marine applications further strengthens market expansion.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. China, Japan, and South Korea are leading in IMU production and adoption, fueled by advancements in MEMS technology and increasing defense investments. The rising demand for autonomous vehicles, drones, and robotics further accelerates market expansion. Additionally, the region’s strong manufacturing capabilities and cost-effective production enhance its competitive edge. In consumer electronics, IMUs are widely used in smartphones, gaming devices, and wearables, contributing to significant market demand. With continued investments in AI-driven navigation and smart technologies, Asia-Pacific is poised to be a dominant player in the global Inertial Measurement Unit market.

Segmentation Analysis

Insights by Component

The accelerometer segment accounted for the largest market share over the forecast period 2023 to 2033. Accelerometers are crucial for motion detection, navigation, and vibration monitoring, making them essential in aerospace, defense, automotive, and consumer electronics applications. The rising demand for autonomous vehicles and drones has fueled the need for high-precision accelerometers to enhance stability and positioning accuracy. Additionally, the growing use of MEMS-based accelerometers in smartphones, wearables, and industrial automation is expanding market opportunities. Miniaturization, cost reduction, and advancements in multi-axis accelerometers are further boosting segment growth.

Insights by Technology

The ring laser gyro segment accounted for the largest market share over the forecast period 2023 to 2033. Ring laser gyroscopes are widely used in aerospace, defense, and marine industries, where accuracy in inertial navigation systems is critical, especially in GPS-denied environments. The increasing adoption of unmanned aerial vehicles, submarines, and spacecraft has further driven demand for ring laser gyroscope-based IMUs. Unlike mechanical gyroscopes, ring laser gyroscopes offer longer operational life, low drift, and minimal maintenance, making them ideal for high-end applications. With ongoing advancements in laser technology and cost optimization, the ring laser gyroscope segment is expected to maintain a strong position in the IMU market.

Insights by Platform

The space segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is driven by increasing satellite launches, deep-space exploration, and advancements in space navigation technologies. IMUs play a critical role in spacecraft attitude control, orbital positioning, and interplanetary missions, where precise motion tracking is essential. The rising demand for small satellites and the expansion of commercial space programs by private players like SpaceX and Blue Origin are further fueling market expansion. Additionally, government investments in space exploration and defense applications are boosting the adoption of high-performance IMUs. Fiber optic and ring laser gyroscopes are commonly used in space-grade IMUs due to their high accuracy and reliability.

Insights by End User

The aerospace and defence segment accounted for the largest market share over the forecast period 2023 to 2033. IMUs are essential in aircraft, missiles, unmanned aerial vehicles (UAVs), and military-grade navigation systems, particularly in GPS-denied environments. The rise in defense budgets, modernization of military equipment, and the growing use of autonomous systems are accelerating IMU adoption. High-precision IMUs, including fiber optic and ring laser gyroscopes, are preferred for their reliability in demanding conditions. Additionally, the expansion of commercial aviation and space exploration programs is further boosting market growth.

Recent Market Developments

- In January 2022, EMCORE Corporation secured an ongoing development award from a U.S. contractor to finalize the design and establish a manufacturing process for high-end inertial measurement units used in tactical-grade pods.

Competitive Landscape

Major players in the market

- General Electric Company (US)

- Gladiator Technologies Inc. (US)

- Honeywell International Inc. (US)

- Lord Microstrain (US)

- Northrop Grumman Corporation (US)

- Safran Electronics & Defense (France)

- Robert Bosch GmbH (Germany)

- Teledyne Technologies Inc. (US)

- Thales Group (France)

- Trimble Navigation Ltd (US)

- Others

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Inertial Measurement Unit Market, Component Analysis

- Accelerometer

- Gyroscope

- Magnetometer

Inertial Measurement Unit Market, Technology Analysis

- Mechanical Gyro

- Ring Laser Gyro

- Fiber Optics GYRO

- MEMS

- Others

Inertial Measurement Unit Market, Platform Analysis

- Airborne

- Ground

- Maritime

Inertial Measurement Unit Market, End Use Analysis

- Aerospace and Defense

- Consumer Electronics

- Marine/Naval

- Automotive

- Others

Inertial Measurement Unit Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Inertial Measurement Unit Market?The global Inertial Measurement Unit Market is expected to grow from USD 17.5 billion in 2023 to USD 29.4 billion by 2033, at a CAGR of 5.32% during the forecast period 2023-2033.

-

2. Who are the key market players of the Inertial Measurement Unit Market?Some of the key market players of the market are the General Electric Company (US), Gladiator Technologies Inc. (US), Honeywell International Inc. (US), Lord Microstrain (US), Northrop Grumman Corporation (US), Safran Electronics & Defense (France), Robert Bosch GmbH (Germany), Teledyne Technologies Inc. (US), Thales Group (France), Trimble Navigation Ltd (US).

-

3. Which segment holds the largest market share?The aerospace and defence segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?