Global Inflight Retail and Advertising Market Size, Share, and COVID-19 Impact Analysis, By Mode (Advertising, Retail), By Operation (Stored and Streamed), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Inflight Retail and Advertising Market Insights Forecasts to 2033

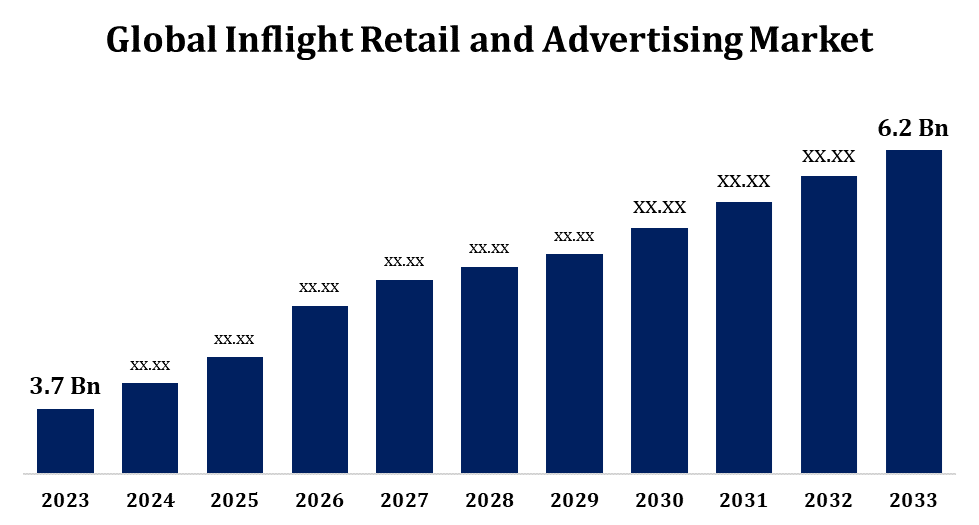

- The Global Inflight Retail and Advertising Market Size was valued at USD 3.7 Billion in 2023.

- The Market is Growing at a CAGR of 5.30% from 2023 to 2033.

- The Worldwide Inflight Retail and Advertising Market Size is expected to reach USD 6.2 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Inflight Retail and Advertising Market Size is Expected to reach USD 6.2 Billion by 2033, at a CAGR of 5.30% during the forecast period 2023 to 2033.

The inflight retail and advertising market is a dynamic sector that capitalizes on the captive audience of air travelers. Airlines increasingly leverage inflight entertainment systems, digital platforms, and traditional print media to offer targeted advertisements and shopping opportunities. The market is driven by rising air travel demand, growing consumer spending power, and advancements in digital connectivity onboard. Key trends include personalized advertising, integration of e-commerce, and partnerships with luxury and local brands to enhance passenger experience. Challenges such as limited space, stringent regulations, and varying consumer preferences across regions shape market strategies. However, innovations like augmented reality shopping, subscription-based inflight services, and tailored content are poised to unlock new growth avenues. This market is a significant revenue stream, blending advertising, technology, and convenience for airlines and brands alike.

Inflight Retail and Advertising Market Value Chain Analysis

The inflight retail and advertising market value chain involves multiple stakeholders, each contributing to the delivery of onboard services. Airlines act as the central node, partnering with technology providers, advertisers, and suppliers. Technology providers enable inflight entertainment systems, Wi-Fi connectivity, and e-commerce platforms that facilitate advertising and shopping. Advertisers leverage these platforms to target the captive audience of air travelers with tailored promotions. Suppliers, including luxury brands, local artisans, and duty-free operators, provide a curated selection of products. Content creators and marketing agencies craft engaging campaigns optimized for inflight viewing. Logistics partners ensure timely delivery and stocking of products onboard. Consumer data analysis and feedback loops inform product selection and campaign strategies, driving continuous improvement. This ecosystem fosters collaboration, creating value for passengers, airlines, and brands alike.

Inflight Retail and Advertising Market Opportunity Analysis

The inflight retail and advertising market presents significant growth opportunities driven by technological advancements, rising air travel, and shifting consumer behaviors. Increased adoption of inflight Wi-Fi and entertainment systems enables personalized and interactive advertising, creating new revenue streams. Airlines can capitalize on growing e-commerce trends by integrating online shopping platforms with exclusive inflight offers, particularly targeting premium and international travelers. Partnerships with luxury brands, local artisans, and sustainable product suppliers can enhance passenger experiences and differentiate airlines. Emerging markets, especially in Asia-Pacific and the Middle East, offer untapped potential due to expanding aviation networks and increasing passenger volumes. Furthermore, innovations such as augmented reality shopping, cryptocurrency payments, and AI-driven recommendations promise to revolutionize the sector, offering seamless, engaging, and highly targeted retail and advertising experiences onboard.

Global Inflight Retail and Advertising Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.7 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.30% |

| 2033 Value Projection: | USD 6.2 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 248 |

| Tables, Charts & Figures: | 114 |

| Segments covered: | By Mode, By Operation, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Spotlight Media, Inmarsat, Media in Air, Airline Advertising Network, In-flight Media, Routehappy, Eagle Entertainment, TAM Integration, AIM Altitude, SkyMedia, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Inflight Retail and Advertising Market Dynamics

Increasing numbers of passengbers to boost the market growth

The inflight retail and advertising market is poised for growth, driven by the increasing number of air travelers worldwide. Rising disposable incomes, expanding middle-class populations, and the rebound of the travel and tourism sector post-pandemic have significantly boosted passenger volumes. This surge creates a larger captive audience for airlines to monetize through targeted retail and advertising initiatives. Long-haul and premium travelers, in particular, offer lucrative opportunities for luxury product sales and high-value advertising. Additionally, advancements in inflight connectivity allow airlines to provide personalized shopping and advertising experiences, increasing passenger engagement. Emerging markets in Asia-Pacific, the Middle East, and Africa are witnessing robust growth in aviation, further amplifying the market’s potential. The growing traveler base thus provides a fertile ground for airlines and brands to enhance revenues through innovative inflight strategies.

Restraints & Challenges

The inflight retail and advertising market faces several challenges that impact its growth and operational efficiency. Limited cabin space restricts the range of physical products available, while stringent aviation regulations add complexity to onboard sales and advertising. The high cost of inflight connectivity can deter both airlines and passengers from fully utilizing digital platforms. Variations in consumer preferences across regions and demographics make it challenging to offer universally appealing products and campaigns. Additionally, logistical hurdles in restocking and supply chain management for perishable or luxury items can increase operational costs. The shift toward sustainability also pressures airlines and advertisers to minimize waste and carbon footprints, potentially raising costs. Balancing passenger comfort with promotional efforts without appearing intrusive further complicates market dynamics, requiring innovative yet passenger-centric solutions.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Inflight Retail and Advertising Market from 2023 to 2033. With the U.S. and Canada as key markets, the region benefits from a large base of frequent flyers, including business travelers and affluent consumers, making it a lucrative arena for premium product sales and targeted advertising. Airlines increasingly leverage advanced inflight entertainment systems and high-speed Wi-Fi to offer personalized shopping experiences and digital ad placements. The market is also influenced by the region's focus on sustainability, prompting airlines to adopt eco-friendly products and reduce single-use packaging. Partnerships with leading tech companies and luxury brands further enhance offerings. As connectivity improves, North America continues to lead in integrating cutting-edge solutions in inflight retail and advertising.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Key markets like China, India, Japan, and Southeast Asia drive the region’s prominence as air travel demand surges. With a diverse and culturally rich consumer base, airlines tailor product offerings and advertising campaigns to suit regional preferences. Increased adoption of inflight connectivity and digital platforms enables personalized shopping and targeted advertising experiences. Duty-free and luxury goods remain popular, while growing interest in local and sustainable products enhances market appeal. Budget carriers and premium airlines alike are leveraging these trends to boost ancillary revenues. The Asia-Pacific region presents vast opportunities, making it a focal point for innovation and investment in inflight retail and advertising.

Segmentation Analysis

Insights by Mode

The advertising segment accounted for the largest market share over the forecast period 2023 to 2033. Airlines are increasingly adopting digital inflight entertainment systems, providing advertisers with diverse platforms to deliver personalized and immersive campaigns. Targeted advertising benefits from data analytics, enabling brands to reach specific demographics, such as frequent travelers or premium passengers, with tailored messages. Interactive and video-based advertisements are gaining traction, enhancing passenger engagement during flights. The shift toward sustainability also drives demand for eco-conscious advertising practices, including digital over print media. Growth in global air travel, particularly in emerging markets, expands the audience base, while partnerships with tech companies and media agencies fuel innovation. This segment continues to evolve, offering lucrative opportunities for advertisers and airlines alike.

Insights by Operation

The stored segment accounted for the largest market share over the forecast period 2023 to 2033. This growth is driven by increasing air passenger volumes, particularly on long-haul and international routes where duty-free shopping is a key attraction. Airlines are expanding product portfolios to include luxury items, regional specialties, and sustainable goods, appealing to diverse consumer preferences. Partnerships with renowned brands and local artisans enhance the exclusivity and appeal of onboard offerings. However, space constraints onboard and logistical challenges require efficient inventory management and streamlined supply chains. The rise of hybrid models, combining stored goods with pre-order and delivery options, further boosts sales. As passenger expectations evolve, the stored segment remains integral to enhancing inflight retail experiences and generating ancillary revenues.

Recent Market Developments

- In December 2023, Icelandair (Iceland) has chosen Panasonic Avionics Corporation's Astrova IFE solution for its new Airbus A321neo LR fleet. The agreement features 4K OLED displays, Bluetooth audio support, and advanced digital offerings, including Marketplace eCommerce, OneMedia, Arc Moving Map, and ZeroTouch capabilities.

Competitive Landscape

Major players in the market

- Spotlight Media

- Inmarsat

- Media in Air

- Airline Advertising Network

- In-flight Media

- Routehappy

- Eagle Entertainment

- TAM Integration

- AIM Altitude

- SkyMedia

- Others

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Inflight Retail and Advertising Market, Mode Analysis

- Advertising

- Retail

Inflight Retail and Advertising Market, Operation Analysis

- Stored

- Streamed

Inflight Retail and Advertising Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Inflight Retail and Advertising Market?The Global Inflight Retail and Advertising Market Size is expected to grow from USD 3.7 billion in 2023 to USD 6.2 billion by 2033, at a CAGR of 5.30% during the forecast period 2023-2033.

-

2. Who are the key market players of the Inflight Retail and Advertising Market?Some of the key market players of the market are Spotlight Media, Inmarsat, Media in Air, Airline Advertising Network, In-flight Media, Routehappy, Eagle Entertainment, TAM Integration, AIM Altitude, SkyMedia.

-

3. Which segment holds the largest market share?The stored segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Inflight Retail and Advertising Market?North America dominates the Inflight Retail and Advertising Market and has the highest market share.

Need help to buy this report?