Global Infusion Pump Market Size, Share, and COVID-19 Impact Analysis, By Product (Accessories & Consumables and Devices), By Application (Chemotherapy/Oncology, Diabetes Management, Gastroenterology, Pain Management/ Analgesia, Pediatrics/ Neonatology, Hematology, and Others), By End-User (Hospitals, Home Care Settings, Ambulatory Care Settings, and Academic & Research Institutes), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: HealthcareGlobal Infusion Pump Market Insights Forecasts to 2032

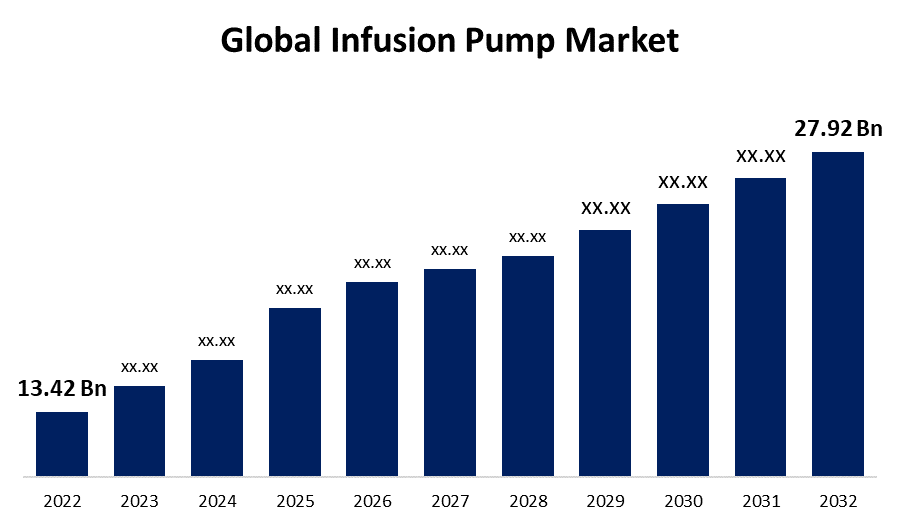

- The Global Infusion Pump Market Size was valued at USD 13.42 Billion in 2022.

- The Market Size is Growing at a CAGR of 7.6% from 2022 to 2032

- The Worldwide Infusion Pump Market Size is expected to reach USD 27.92 Billion by 2032

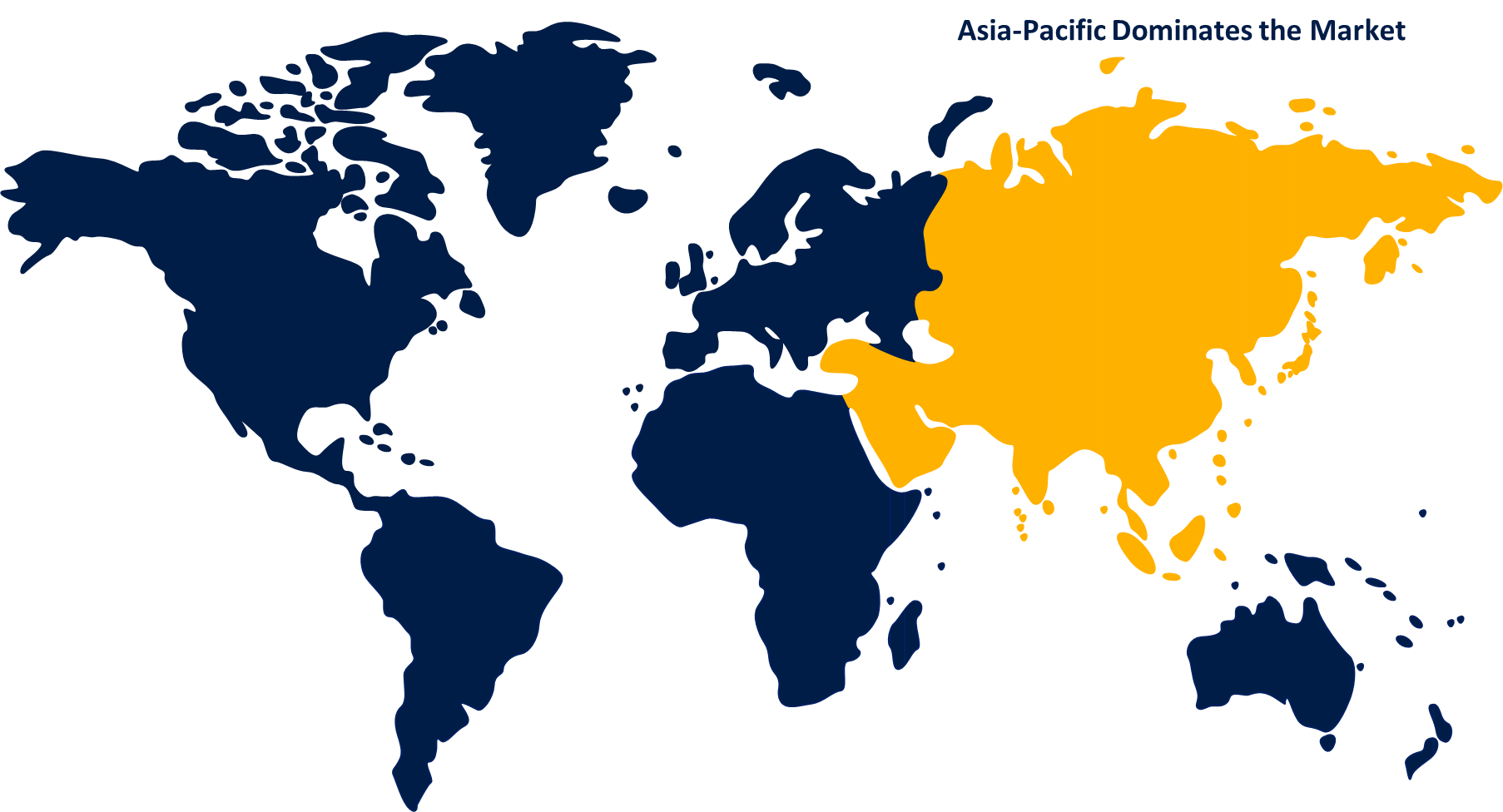

- Asia-Pacific is expected to grow significant during the forecast period

Get more details on this report -

The Global Infusion Pump Market Size is expected to reach USD 27.92 Billion by 2032, at a CAGR of 7.6% during the forecast period 2022 to 2032.

Market Overview

An infusion pump is a vital medical device used to deliver fluids, such as medications, nutrients, or blood products, directly into a patient's bloodstream in controlled and precise amounts. These devices play a crucial role in modern healthcare settings, ensuring accurate and constant administration of fluids, eliminating the risk of human error. Infusion pumps are programmable and adjustable, allowing healthcare professionals to tailor dosages to each patient's specific needs. They are commonly used in hospitals, clinics, and home care settings, facilitating treatments for a wide range of conditions, including pain management, chemotherapy, and critical care interventions. The infusion pump's reliability, safety features, and ability to deliver various fluids make it an indispensable tool in modern medical practice.

Report Coverage

This research report categorizes the market for infusion pump market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the infusion pump market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the infusion pump market.

Global Infusion Pump Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022 : | USD 13.42 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 7.6% |

| 2032 Value Projection: | USD 27.92 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Application, By End-User , By Region |

| Companies covered:: | Tandem Diabetes Care, Inc., Smith Medical, Terumo Corporation, Becton, Dickinson & Company, Fresenius SE & Co. KGaA, F. Hoffmann-La Roche Ltd., B. Braun Holding GmbH & Co. KG, Baxter International, Inc., Medtronic, ICU Medical, Inc., and other key venders |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The infusion pump market is influenced by several key drivers that impact its growth and demand. Increasing prevalence of chronic diseases, such as diabetes, cancer, and cardiovascular disorders, drives the need for continuous and accurate drug delivery, boosting the demand for infusion pumps. The growing aging population globally is contributing to a rise in the number of patients requiring long-term therapies, further propelling the market. Additionally, advancements in technology have led to the development of smart infusion pumps with enhanced features like wireless connectivity, dose error reduction systems, and real-time monitoring, attracting healthcare providers and boosting market growth. Moreover, the rising adoption of home healthcare services and the shift towards patient-centric treatment options have increased the usage of infusion pumps outside of traditional hospital settings. The increasing number of surgeries and the use of anesthesia during medical procedures require precise and controlled infusion delivery, which is facilitated by infusion pumps. The COVID-19 pandemic has highlighted the significance of infusion pumps in administering crucial medications to critically ill patients, thus fostering market growth. The supportive government initiatives and reimbursement policies for medical devices, including infusion pumps, encourage their adoption and positively impact the market. Overall, the continuous efforts of key market players to innovate and introduce user-friendly, cost-effective, and efficient infusion pumps also contribute to market expansion.

Restraining Factors

The infusion pump market faces several restraints that hinder its growth and adoption, concerns regarding the potential risks associated with the improper use of infusion pumps, such as dosing errors and drug interactions, lead to hesitancy among healthcare professionals to rely solely on these devices. The high cost of advanced infusion pumps and their maintenance can limit their accessibility, particularly in developing regions with limited healthcare budgets. Additionally, the complexity of operating sophisticated infusion systems may lead to resistance among healthcare staff, affecting their widespread implementation.

Market Segmentation

- In 2022, the insulin pump segment accounted for around 42.5% market share

On the basis of the product, the global infusion pump market is segmented into accessories & consumables and devices. The insulin pump segment dominated the infusion pump market for several reasons. The prevalence of diabetes is increasing worldwide, leading to a growing number of patients requiring insulin therapy. Insulin pumps offer a convenient and efficient method for delivering insulin, allowing for better glucose management and improved patient outcomes. The pumps can be programmed to provide precise dosages throughout the day, replicating the natural insulin release in the body. Moreover, advancements in insulin pump technology, such as integration with continuous glucose monitoring systems, have further boosted their popularity among diabetes patients, consolidating the insulin pump segment's dominant position in the market.

- Oncology segment is expected to grow at the fastest CAGR of around 7.5% during the forecast period

Based on the application, the global infusion pump market is segmented into chemotherapy/oncology, diabetes management, gastroenterology, pain management/ analgesia, pediatrics/ neonatology, hematology, and others. The oncology segment is expected to grow at the fastest rate during the forecast period in the infusion pump market due to several compelling reasons. Cancer treatments, such as chemotherapy and immunotherapy, often require continuous and precise drug administration, which infusion pumps excel at providing. As the incidence of cancer cases continues to rise globally, the demand for infusion pumps in oncology settings is expected to increase significantly. Moreover, ongoing research and development efforts to improve cancer therapies and the introduction of novel drugs will further fuel the adoption of infusion pumps in oncology, driving rapid growth in this segment.

- The hospitals segment held the largest market revenue share around 38.2% in 2022.

Based on the end-user, the global infusion pump market is segmented into hospitals, home care settings, ambulatory care settings, and academic & research institutes. The hospitals segment held the largest market revenue share in the infusion pump market due to several key factors. Hospitals are major healthcare facilities that witness a high volume of patient admissions, surgeries, and critical care treatments. The demand for infusion pumps in hospitals is driven by the need for precise and continuous drug delivery to patients undergoing various medical procedures and therapies. Additionally, the rising prevalence of chronic diseases and an aging population further augment the demand for infusion pumps in hospital settings, solidifying the hospitals segment's dominant position in generating substantial revenue within the market.

Regional Segment Analysis of the Infusion Pump Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America dominated the market with more than 42.7% revenue share in 2022.

Get more details on this report -

Based on region, North America holds the largest market share in the infusion pump market due to boasts a highly developed healthcare infrastructure and advanced medical facilities, driving the adoption of modern medical technologies like infusion pumps. The prevalence of chronic diseases and the aging population contribute to a substantial demand for continuous and accurate drug delivery systems. Moreover, the presence of prominent market players and robust research and development activities in the region foster innovation and drive market growth.

Europe secured the second-largest market share in the infusion pump market due to several factors. The region's well-established healthcare infrastructure, increasing prevalence of chronic diseases, and aging population contribute to the demand for infusion pumps. Moreover, Europe's focus on technological advancements, rigorous regulatory standards, and reimbursement policies support the adoption of modern medical devices, including infusion pumps, further consolidating its significant market share in the industry

Recent Developments

- In March 2022, Fresenius Kabi (Germany) has acquired US FDA clearance for the wireless Agilia Connect Infusion System, which combines the Agilia Volumetric Pump and the Agilia Syringe Pump with Vigilant Software Suite-Vigilant Master Med technology.

- In July 2022, Capillary Biomedical (US) has been bought by Tandem Diabetes Care (US). Tandem Diabetes Care's product range in the infusion pump business area has grown as a result.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global infusion pump market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Tandem Diabetes Care, Inc.

- Smith Medical

- Terumo Corporation

- Becton, Dickinson & Company

- Fresenius SE & Co. KGaA

- F. Hoffmann-La Roche Ltd.

- B. Braun Holding GmbH & Co. KG

- Baxter International, Inc.

- Medtronic

- ICU Medical, Inc.

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the Global Infusion Pump Market based on the below-mentioned segments:

Infusion Pump Market, By Product

- Accessories & Consumables

- Devices

Infusion Pump Market, By Application

- Chemotherapy/Oncology

- Diabetes Management

- Gastroenterology

- Pain Management/ Analgesia

- Pediatrics/ Neonatology

- Hematology

- Others

Infusion Pump Market, By End-User

- Hospitals

- Home Care Settings

- Ambulatory Care Settings

- Academic & Research Institutes

Infusion Pump Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?