Global Ink Resin Market Size By Type (Modified Rosin, Hydrocarbon, Modified Cellulose, Acrylic, Polyamide, Polyurethane, Others), By Application (Flexible Packaging, Printing & Publication, Corrugated Cardboards & Cartons, Others), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Chemicals & MaterialsGlobal Ink Resin Market Insights Forecasts to 2033

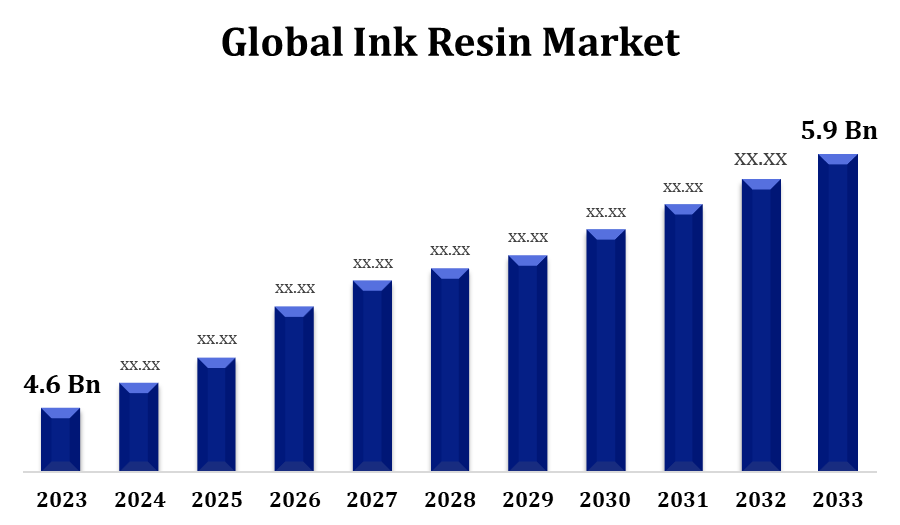

- The Global Ink Resin Market Size was valued at USD 4.6 Billion in 2023

- The Market Size is growing at a CAGR of 2.52% from 2023 to 2033

- The Worldwide Ink Resin Market Size is expected to reach USD 5.9 Billion by 2033

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Ink Resin Market Size is expected to reach USD 5.9 Billion by 2033, at a CAGR of 2.52% during the forecast period 2023 to 2033.

The ink resins market has been steadily growing, and it appears that this trend will continue. The growing need for high-quality printing in areas such as packaging, textiles, and publishing necessitates the development of improved ink formulations. UV-curable resins and water-based resins, for example, are boosting market expansion by providing increased performance, environmental benefits, and versatility. Furthermore, the rising packaging business, driven by e-commerce and consumer goods, adds significantly to the demand for inks and, by extension, ink resins. As sustainability becomes more important in all industries, there is a growing preference for eco-friendly and low-VOC (volatile organic compound) ink formulations, leading manufacturers to spend in R&D to match these changing market demands.

Ink Resin Market Value Chain Analysis

Suppliers of raw materials such as petrochemicals, monomers, and polymers start the value chain. These components serve as the base for the manufacturing of ink resin. The raw components are used by chemical firms to make ink resins via polymerization or other chemical processes. In this stage, the base resins that would subsequently be formed into inks are created. The base ink resins are blended with various components such as pigments, solvents, additives, and crosslinking agents by ink makers or formulators. This phase is critical for adjusting the ink characteristics to suit application needs. When the ink formulations are finished, they are packed and distributed. Depending on the end-use, packaging may differ, such as bulk containers for industrial usage or smaller containers for commercial and retail use. Distributors are critical in getting ink resins to end users. They may provide printing firms, packaging makers, or other industries that use inks in their processes directly. The last stage involves a variety of end-users from a variety of industries, including packaging, publishing, textiles, and others. These customers employ the ink in their own processes, such as printing on packaging materials, textiles, or paper.

Ink Resin Market Opportunity Analysis

The development of new ink resin technology presents opportunities. UV-curable resin, water-based resin, and bio-based resin innovations provide opportunities for increased performance, reduced environmental impact, and compliance with demanding standards. The rise of digital printing technology gives ink resin makers with a huge potential. Digital inks frequently necessitate specialised formulations, and tailoring ink resins to the specific needs of digital printing might open up new industries. The thriving packaging business, fueled by e-commerce and consumer goods, provides numerous prospects. Manufacturers of ink resins can modify formulas to satisfy the specific needs of packaging applications, such as adhesion to diverse surfaces and resistance to external influences such as abrasion and moisture. Differentiation is possible by tailoring ink resins for specialised purposes such as food packaging, medicinal labelling, or industrial printing. Meeting the various needs of various sectors and applications can result in niche market penetration. Exploring prospects in emerging areas and broadening one's worldwide reach can be part of a growth plan.

Global Ink Resin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.6 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.52% |

| 2033 Value Projection: | USD 5.9 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Region, By Geographic Scope |

| Companies covered:: | IGM Resins, Lawter B.V., Royal DSM N.V., The Dow Chemical Company, Indulor Chemie GmbH, Arakawa Chemical, Arizona Chemical, BASF SE, Evonik Tego Chemie GmbH, Hydrite Chemical and Other Key Vendors. |

| Growth Drivers: | Increasing demand for UV-cured inks |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Ink Resin Market Dynamics

Increasing demand for UV-cured inks

When compared to ordinary inks, UV-cured inks cure faster. When exposed to ultraviolet (UV) radiation, the curing process occurs extremely instantly. This quick curing function improves production efficiency, particularly in high-speed printing applications. UV inks attach well to a wide range of substrates, including paper, plastics, metals, and glass. Because of their adaptability, they are suited for a wide range of applications, including packaging, labels, and industrial printing. UV-cured inks produce prints that are vivid and high-quality, with sharp pictures and colours. The technology enables precise control of the curing process, resulting in higher print resolution and uniformity. UV curing uses less energy than other drying or curing procedures. The capacity of UV light to cure quickly decreases energy consumption and operational expenses for printers.

Restraints & Challenges

Price fluctuations in raw materials, such as petrochemicals and specialised chemicals, can have an impact on production costs. Manufacturers of ink resin may experience difficulties in maintaining steady pricing and profitability. It might be difficult to develop and implement modern ink resin technologies such as UV-curable polymers or water-based resins. Like many other industries, the ink resins market is vulnerable to interruptions in the global supply chain. Natural disasters, geopolitical tensions, and pandemics can all have an impact on raw material supply and logistics, influencing production timelines. Traditional ink resin makers face a challenge with the emergence of digital printing technology. Digital inks provide advantages such as quicker print runs, variable data printing, and decreased waste, undermining traditional printing processes' dominance.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Ink Resin Market from 2023 to 2033. Demand from diverse industries, including as packaging, publishing, textiles, and others, influences the region's market size. Because of continual improvements in ink resin technology, the market is likely to rise steadily. The packaging industry contributes significantly to the need for ink resins in North America. With the region's powerful industrial sector and consumer-driven marketplaces, high-quality printing on packaging materials is always in demand. The publishing industry, which includes commercial printing and newspapers, is also important. The region is a technological innovation hotspot, and this includes the printing industry. The use of modern technologies such as UV-curable inks, water-based inks, and digital printing is altering the sorts of ink resins that are in demand.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. This region's market size is significant, reflecting the numerous and expanding businesses that use printing and packaging materials. The region's expanding economies help to drive up demand for inks and ink resins. The rapid industrialization and urbanisation of countries such as China, India, and Southeast Asian nations is increasing demand for printed items such as packaging, labels, and publications. As a result, the demand for ink resins increases. The burgeoning packaging business in Asia Pacific, driven by e-commerce, population growth, and shifting consumer preferences, is a primary driver of ink resin demand. The Asia Pacific area is seeing an increase in the use of modern printing technologies such as digital printing and UV-curable inks.

Segmentation Analysis

Insights by Type

The Modified Rosin segment accounted for the largest market share over the forecast period 2023 to 2033. Natural resources, especially pine trees, are used to create modified rosin. The renewable and sustainable character of rosin-based resins corresponds with the growing need in the ink industry for eco-friendly and bio-based alternatives. To improve its performance, modified rosin can be chemically changed. This adaptability enables formulators to customise resin qualities such as adhesion, flexibility, and compatibility to fit the needs of various ink applications. Ink formulations using modified rosin resins can help improve print quality by providing bright colours and increased gloss. This is especially true in applications where visual appeal and print aesthetics are critical.

Insights by Application

The printing & publication segment accounted for the largest market share over the forecast period 2023 to 2033. Despite the digitalization of information, the printing and publishing sector remains in high demand, particularly for books, periodicals, newspapers, and promotional materials. The demand for ink resins to facilitate high-volume printing contributes to the segment's growth. Print quality, clarity, and colour vibrancy are all highly valued in the printing and publishing industries. Ink resins play a critical role in meeting these quality criteria, fueling demand for formulas with great colour reproduction and clear pictures. Printing methods such as offset printing, flexography, and gravure printing are included in the printing and publication category. To suit the diversified needs of publishers and printers, ink resins that are adaptable and compatible with various printing methods are in high demand.

Recent Market Developments

- In 2021, Bodo Moller Chemie South Africa expanded its exclusive sales and distribution agreement with BASF for resins and additives.

Competitive Landscape

Major players in the market

- IGM Resins

- Lawter B.V.

- Royal DSM N.V.

- The Dow Chemical Company

- Indulor Chemie GmbH

- Arakawa Chemical

- Arizona Chemical

- BASF SE

- Evonik Tego Chemie GmbH

- Hydrite Chemical

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Ink Resin Market, Type Analysis

- Modified Rosin

- Hydrocarbon

- Modified Cellulose

- Acrylic

- Polyamide

- Polyurethane

- Others

Ink Resin Market, Application Analysis

- Flexible Packaging

- Printing & Publication

- Corrugated Cardboards & Cartons

- Others

Ink Resin Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Ink Resin Market?The Global Ink Resin Market is expected to grow from USD 4.6 Billion in 2023 to USD 5.9 Billion by 2033, at a CAGR of 2.52% during the forecast period 2023-2033.

-

2. Who are the key market players of the Ink Resin Market?Some of the key market players of market are IGM Resins, Lawter B.V., Royal DSM N.V., The Dow Chemical Company, Indulor Chemie GmbH, Arakawa Chemical, Arizona Chemical, BASF SE, Evonik Tego Chemie GmbH, Hydrite Chemical.

-

3. Which segment holds the largest market share?The modified foam segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Ink Resin Market?North America is dominating the Ink Resin Market with the highest market share.

Need help to buy this report?