Global Insulated Packaging Market Size By Material (Plastic, Wood, Corrugated Cardboards, and Others), By Packaging Type (Boxes & Containers, Bags & Pouches, Wraps, and Others), By Application (Food & Beverages, Industrial, Pharmaceutical, and Cosmetic), By Region, And Segment Forecasts, By Geographic Scope And Forecast 2022-2032.

Industry: Advanced MaterialsGlobal Insulated Packaging Market Insights Forecasts to 2032

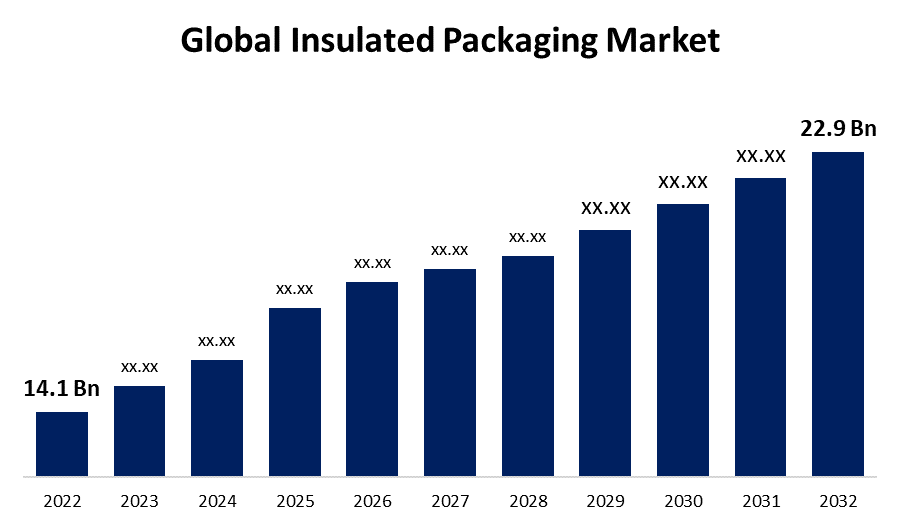

- The Insulated Packaging Market Size was valued at USD 14.1 Billion in 2022.

- The Market Size is Growing at a CAGR of 3.1% from 2022 to 2032

- The Worldwide Insulated Packaging Market Size is expected to reach USD 22.9 Billion by 2032

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The global Insulated Packaging Market Size is expected to reach USD 22.9 Billion by 2032, at a CAGR of 3.1% during the forecast period 2022 to 2032.

Insulated packaging refers to materials and containers created for product protection against temperature changes and thermal insulation. In order to guarantee that delicate products maintain their appropriate temperature during shipping and storage, it is frequently employed in industries like food and medicines. Insulated packaging's major objective is to regulate and preserve the products' internal temperatures. Depending on the needs of the items, it can maintain either a hot or cold environment for them. Because of the expense of insulating materials and the intricacy of design, insulated packaging can be more expensive than normal packaging materials. However, it can save money when securing expensive or temperature-sensitive goods. Since online retailers need efficient ways to ship perishable goods like food, beverages, and medications while preserving temperature control, the Growth of e-commerce has increased demand for insulated packaging. Products are delivered to customers in the best possible condition due to insulated packaging. For the transportation of temperature-sensitive pharmaceuticals, vaccines, and biologics, the healthcare and pharmaceutical industries significantly rely on insulated packaging. The demand for insulated packaging solutions is being driven by the expansion of the cold chain logistics sector, which is crucial for moving perishable goods. This encompasses pallet covers, temperature-controlled shipping containers, and other speciality packaging. As the infrastructure for healthcare and food distribution in developing nations develops, so does demand for insulated packaging solutions. Manufacturers of insulated packaging both locally and internationally will benefit from these Growth prospects.

Insulated Packaging Market Price Analysis

Cost is strongly influenced by the type of insulation used. Common insulation materials with a range of prices include vacuum-insulated panels, polyurethane foam, and expanded polystyrene (EPS). Costs will vary depending on the outer packaging material selected, whether it be cardboard, plastic, or another material. Customised insulated packaging choices may be more expensive than options that are pre-made to fit a particular product or set of measurements. The price may go up if you add logos, branding, or printing to the package. Larger orders frequently qualify for volume discounts, which has a major impact on the price of insulated packaging per item. Higher unit prices may apply to smaller volumes. Price hikes may result from a region's or industry's high demand for insulated packaging. On the other hand, decreasing demand may lead to competitive pricing. Depending on the particular sector or application, prices can change. For instance, the pharmaceutical business may have stricter quality and regulatory standards for insulated packaging, which could result in greater costs.

Insulated Packaging Market Distribution Analysis

Some makers of insulated packaging offer their goods directly to clients, particularly when handling sizable orders or specialised solutions. This strategy enables more flexible customization and direct contact. Through wholesalers who buy in bulk and then resell to smaller retailers or businesses, insulated packaging products can be distributed to retailers and end users. Distributors who specialise in a particular industry, such as the food service or pharmaceuticals, may represent manufacturers to end users in that industry. There may be some insulated packaging products in physical retail establishments like supermarkets, department stores and specialty kitchenware stores, particularly those intended for consumer uses like coolers and lunch bags. Many insulated packaging products are now sold through online merchants and marketplaces as a result of the expansion of e-commerce. Customers may quickly shop online, compare products, and read reviews.

Global Insulated Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 14.1 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 3.1% |

| 2032 Value Projection: | USD 22.9 Billion |

| Historical Data for: | 2020-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Material, By Packaging Type, By Application By Region and COVID 19 Impact. |

| Companies covered:: | Deutsche Post DHL, E.I. Du Pont De Nemours and Co., Huhtamaki OYJ, Sonoco Products Company, Amcor Limited, Constantia Flexibles, Greiner Group, Innovia Films, Sofrigam, Winpak, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth & Analysis. |

Get more details on this report -

Market Dynamics

Insulated Packaging Market Dynamics

Rising urbanisation across the world to propel the market

Greater population density in cities is frequently a result of urbanisation, which makes it easier for e-commerce businesses to launch and Grow their services. Insulated packaging is increasingly necessary as more city dwellers use online shopping to ensure the safe delivery of perishable commodities, such as food and beverages. The expansion of food delivery services is closely related to urbanisation. Food delivery services are frequently used by urban residents to get their meals. The preservation of hot or cold food's temperature and quality throughout transit is essential because of insulated packaging. Fast-paced urban lifestyles increase consumer demand for convenient and fresh cuisine. Delivering ready-to-eat or heat-and-eat meals, salads, and other foods is made easier by insulated packaging for shops and food service providers. Hospitals, pharmacies, and other healthcare facilities are more prevalent in urban areas. Insulated packaging is used by the pharmaceutical and healthcare industries to ship biologics, vaccines, and pharmaceuticals that must maintain specific temperatures. The demand for various packaging options may be influenced by the concentration of healthcare services in urban areas.

Restraints & Challenges

Fluctuating crude oil prices hamper the market

Expanded polystyrene (EPS) foam and certain polymers, which are commonly used in insulated packaging, are made from petroleum. These basic commodities typically cost more when crude oil prices rise. Manufacturers of insulated packaging may incur greater production expenses as a result, which could push up client pricing. Crude oil price fluctuations can be unpredictable, making it difficult for manufacturers of insulated packaging to plan their production and pricing plans. Rapid pricing changes can affect profitability and disrupt supply systems. In response to rising prices, consumers might become more price-sensitive, thereby lowering their willingness to pay for goods that employ insulating materials derived from petroleum. This may have an impact on insulated packaging demand.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Insulated Packaging market from 2023 to 2032. Due to a number of causes, including the development of e-commerce, the rise in popularity of food delivery services, and the rising need for pharmaceutical and healthcare products, the North American insulated packaging market has been expanding steadily. In North America, the food and beverage sector is a significant consumer of insulated packaging. When being transported and delivered, perishable goods and beverages are kept at the proper temperatures using insulated containers, coolers, and thermal bags. The need for insulated packaging has significantly increased as a result of the expansion of e-commerce in North America. Insulated packaging is used by businesses that ship perishable goods, like meal delivery services and specialised merchants, to preserve product quality while in transit. The North American insulated packaging business is cutthroat, with a mixture of major producers, smaller regional competitors, and startups providing a range of goods and services.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market Growth between 2023 to 2032. The Asia-Pacific area has a big population, a Growing middle class, and an increase in e-commerce and food delivery services, all of which have contributed to the market's rapid rise. In the APAC area, the food and beverage industry is a significant consumer of insulated packaging. There is an increasing need for insulated packaging to transport fresh and perishable foods, especially ready-to-eat meals, due to the region's unique cuisine and increased urbanisation. Insulated packaging is essential to the pharmaceutical and healthcare sectors in APAC in order to protect temperature-sensitive drugs, vaccines, and biologics during distribution. The need for insulated packaging has increased dramatically as a result of the APAC region's explosive e-commerce expansion.

Segmentation Analysis

Insights by Material

The plastic segment accounted for the largest market share over the forecast period 2023 to 2032. When compared to traditional insulation materials like metal or glass, plastics, especially expanded polystyrene (EPS) foam in particular, are frequently more economical. Plastic is a desirable alternative due to its low cost, which appeals to both consumers and manufacturers. Because plastic products are lightweight and can be transported more cheaply, such as EPS foam and polyethylene foam, they can also assist save on shipping expenses and fuel. E-commerce and food delivery companies will find this efficiency particularly tempting. Effective thermal insulation can be achieved using plastic materials when they are constructed properly. They are appropriate for carrying pharmaceuticals and perishable items because they can maintain temperature stability and shield things from temperature changes.

Insights by Packaging Type

The boxes and containers segment is witnessing the fastest market Growth over the forecast period 2023 to 2032. The need for insulated boxes and containers has increased due to the rapid expansion of e-commerce and online shopping. These packaging options are necessary for delivering temperature-sensitive goods, including food, cosmetics, medicines, and more, to consumers' doorsteps in a secure manner. The market for boxes and containers in the insulated packaging category is Growing into new industries, such as gourmet and specialty foods, biotechnology, and cosmetics, as more companies come to understand the advantages of insulated packaging for product quality and consumer happiness.

Insights by Application

The cosmetics segment accounted for the largest market share over the forecast period 2023 to 2032. Many beauty and cosmetics products, including creams, lotions, serums, and some types of makeup, are sensitive to temperature changes. Insulated packaging aids in maintaining the proper temperature range, assuring the efficacy and quality of these products. Cosmetic companies are Growing internationally, which frequently requires exporting goods to different climes and areas. Regardless of the destination's temperature conditions, insulated packaging is essential for guaranteeing that products remain stable and secure. Product presentation and quality are given priority by luxury and high-end cosmetics brands. Insulated packaging guarantees product quality while also enhancing the client experience's perceived value.

Recent Market Developments

- In August 2020, Sonoco purchased Can Packaging Firm based in Habsheim.

Competitive Landscape

Major players in the market

- Deutsche Post DHL

- E.I. Du Pont De Nemours and Co.

- Huhtamaki OYJ

- Sonoco Products Company

- Amcor Limited

- Constantia Flexibles

- Greiner Group

- Innovia Films

- Sofrigam

- Winpak

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

Insulated Packaging Market, Packaging Type Analysis

- Boxes & Containers

- Bags & Pouches

- Wraps

- Others

Insulated Packaging Market, Material Analysis

- Plastic

- Wood

- Corrugated Cardboards

- Others

Insulated Packaging Market, Application Analysis

- Food & Beverages

- Industrial

- Pharmaceutical

- Cosmetic

Insulated Packaging Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

What is the market size of the Insulated Packaging Market?The global Insulated Packaging Market is expected to Grow from USD 14.1 Billion in 2023 to USD 22.9 Billion by 2032, at a CAGR of 3.1% during the forecast period 2023-2032

-

Who are the key market players of the Insulated Packaging Market?Some of the key market players of market are Deutsche Post DHL, E.I. Du Pont De Nemours and Co., Huhtamaki OYJ, Sonoco Products Company, Amcor Limited, Constantia Flexibles, Greiner Group, Innovia Films, Sofrigam, Winpak.

-

Which segment holds the largest market share?Cosmetic segment holds the largest market share and is going to continue its dominance.

-

Which region is dominating the Insulated Packaging Market?North America is dominating the Insulated Packaging Market with the highest market share.

Need help to buy this report?