Global Insulin Glargine Market Size, Share, and COVID-19 Impact Analysis, By Type (Lantus, Basaglar, Toujeo, Soliqua, Rezvoglar, and Others), By Diabetes Type (Type 2 Diabetes, Type 1 Diabetes), By Distribution Channel (Hospital Pharmacies, Online Pharmacies and Retail Pharmacies), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Insulin Glargine Market Insights Forecasts to 2033

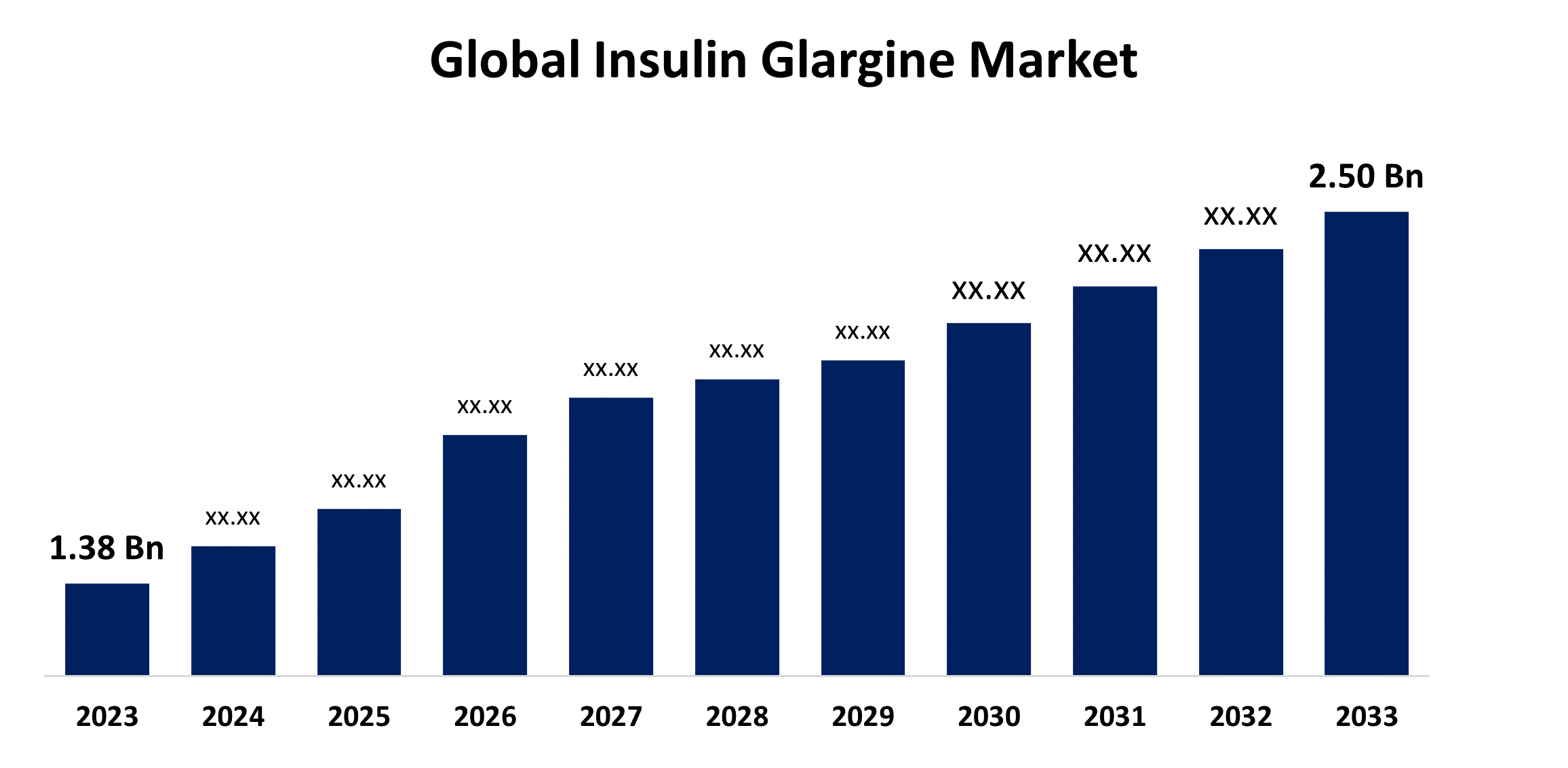

- The Global Insulin Glargine Market Size was Valued at USD 1.38 Billion in 2023

- The Market Size is Growing at a CAGR of 6.12% from 2023 to 2033

- The Worldwide Insulin Glargine Market Size is Expected to Reach USD 2.50 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Insulin Glargine Market Size is Anticipated to Exceed USD 2.50 Billion by 2033, Growing at a CAGR of 6.12% from 2023 to 2033.

Market Overview

Insulin glargine is a synthetic form of human insulin approved by the FDA for the treatment of type 1 diabetes in adults and children, as well as type 2 diabetes in adults, to enhance and maintain glycemic control. Insulin glargine is a long-acting basal insulin that is administered to diabetic patients daily to manage blood sugar levels. It is a synthetic insulin that the body naturally produces and aids in the removal of sugar from the blood in diabetics. It is also used to limit the liver's ability to produce sugar. It has a longer duration of action than 24 hours, making it appropriate for once-daily administration. The global insulin glargine market is predicted to increase steadily over the forecast period due to an increase in the diabetic population. The patent expiration of major insulin brands, along with the advent of inexpensive biosimilar insulin glargine solutions, will increase market volume. Furthermore, technical advances in drug delivery systems, such as wearable and smart insulin pens and pumps, will bolster this trend. However, strict rules for the approval of insulin products may significantly hinder market growth during the anticipated years.

Report Coverage

This research report categorizes the market for the global insulin glargine market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global insulin glargine market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global insulin glargine market.

Global Insulin Glargine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.38 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.12% |

| 2033 Value Projection: | USD 2.50 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Diabetes Type, By Distribution Channel, By Region |

| Companies covered:: | Biocon, Gan & Lee, Sanofi, Kalbe Pharma, Nova Nordisk AS, Cipla Inc., Lupin Ltd, Pfizer Inc., Ypsomed AG, Wockhardt, Elli Lilly, Biogenomics Ltd., Polus Biopharm, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The insulin glargine market has experienced substantial growth due to several key drivers. Firstly, the increasing prevalence of diabetes both type 1 and type 2 globally has fueled demand for insulin glargine therapies, which effectively manage blood sugar levels. Secondly, advancements in insulin formulations, particularly the long-acting basal insulin analog glargine, have improved glycemic control, driving market expansion. Additionally, the preference for insulin analogs over traditional insulins among physicians and patients, attributed to their predictable absorption and reduced hypoglycemia risk, has boosted glargine demand. Moreover, the growing geriatric population, particularly in developed countries, and expansion in emerging markets with improving healthcare infrastructure and rising disposable incomes have contributed to increased glargine penetration and demand. Lastly, efforts to raise awareness about diabetes management and insulin therapy through patient education initiatives have led to greater diagnosis and treatment-seeking behavior, fostering broader acceptance and uptake of insulin glargine. These combined factors are driving the ongoing evolution and expansion of the insulin glargine market.

Restraining Factors

The global insulin glargine market faces several challenges that impede its growth. These include stringent regulatory processes delaying market entry, competition from generic alternatives after patent expiry, and the presence of alternative insulin products and biosimilars. Cost concerns and limited insurance coverage inhibit widespread adoption, while logistical challenges in storage and distribution further complicate accessibility. Additionally, technological advancements and safety concerns pose barriers to market acceptance.

Market Segmentation

The Global Insulin Glargine Market share is classified into type, diabetes type, and distribution channel.

- The Lantus segment dominates the market with the largest market share through the forecast period.

Based on the type, the global insulin glargine market is categorized into Lantus, Basaglar, toujeo, soliqua, rezvoglar, and others. Among these, the Lantus segment dominates the market with the largest market share through the forecast period. Lantus has developed strong brand recognition among patients and physicians over the years. Its ability to manage blood sugar levels throughout the day with a single dose has made it the preferred treatment option for many diabetic patients. The availability of Lantus in prefilled pen devices has greatly increased adherence and usability compared to vials. Lantus is likely to maintain its dominant position through strong patient loyalty and preferences formed throughout the long brand lifecycle.

- The type 2 diabetes segment is anticipated to hold the highest market share through the forecast period.

On the basis of diabetes type, the global insulin glargine market is divided into type 2 diabetes and type 1 diabetes. Among these, the type 2 diabetes segment is anticipated to hold the highest share through the forecast period. Insulin glargine is commonly prescribed for type 2 diabetes management due to its long-acting nature and effectiveness in controlling blood sugar levels over an extended period. People with Type 2 diabetes can generally manage their condition with oral drugs and lifestyle adjustments in the early stages. However, as the condition advances, insulin supplementation becomes necessary for many people. Type 2 diabetes affects multiple essential organs, including the heart, blood vessels, nerves, eyes, and kidneys. Furthermore, the risk factors connected with diabetes also increase the risk of a variety of other serious disorders. Effective diabetes treatment and blood sugar regulation can significantly reduce the possibility of these consequences while also lowering the risk of other medical issues. Although type 2 diabetes typically affects people over the age of 45, there is a noticeable trend in its frequency among children, adolescents, and young adults.

- The retail pharmacies segment had the highest revenue share during the projection period.

Based on the distribution channel, the global insulin glargine market is classified into hospital pharmacies, online pharmacies, and retail pharmacies. Among these, the retail pharmacies segment had the highest revenue share during the projection period. Retail pharmacies are increasingly becoming the preferred choice for Type 2 diabetes patients to fill their insulin prescriptions due to their convenience. Busy people find it easier to pick up insulin supplies and other drugs at local pharmacies during their weekly visits. This saves them time compared to visiting hospitals or specialty pharmacies. Retail chains also keep their doors open for extended hours and have multiple locations, which improves accessibility. From the patient's standpoint, reducing the risk of consequences from inappropriate insulin storage or administration is critical. Retail pharmacies offer expert advice and monitoring during the initiation phase to guarantee safe use. This plays a significant role in increasing adherence to insulin therapy, minimizing health risks and disease development in the long term.

Regional Segment Analysis of the Global Insulin Glargine Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

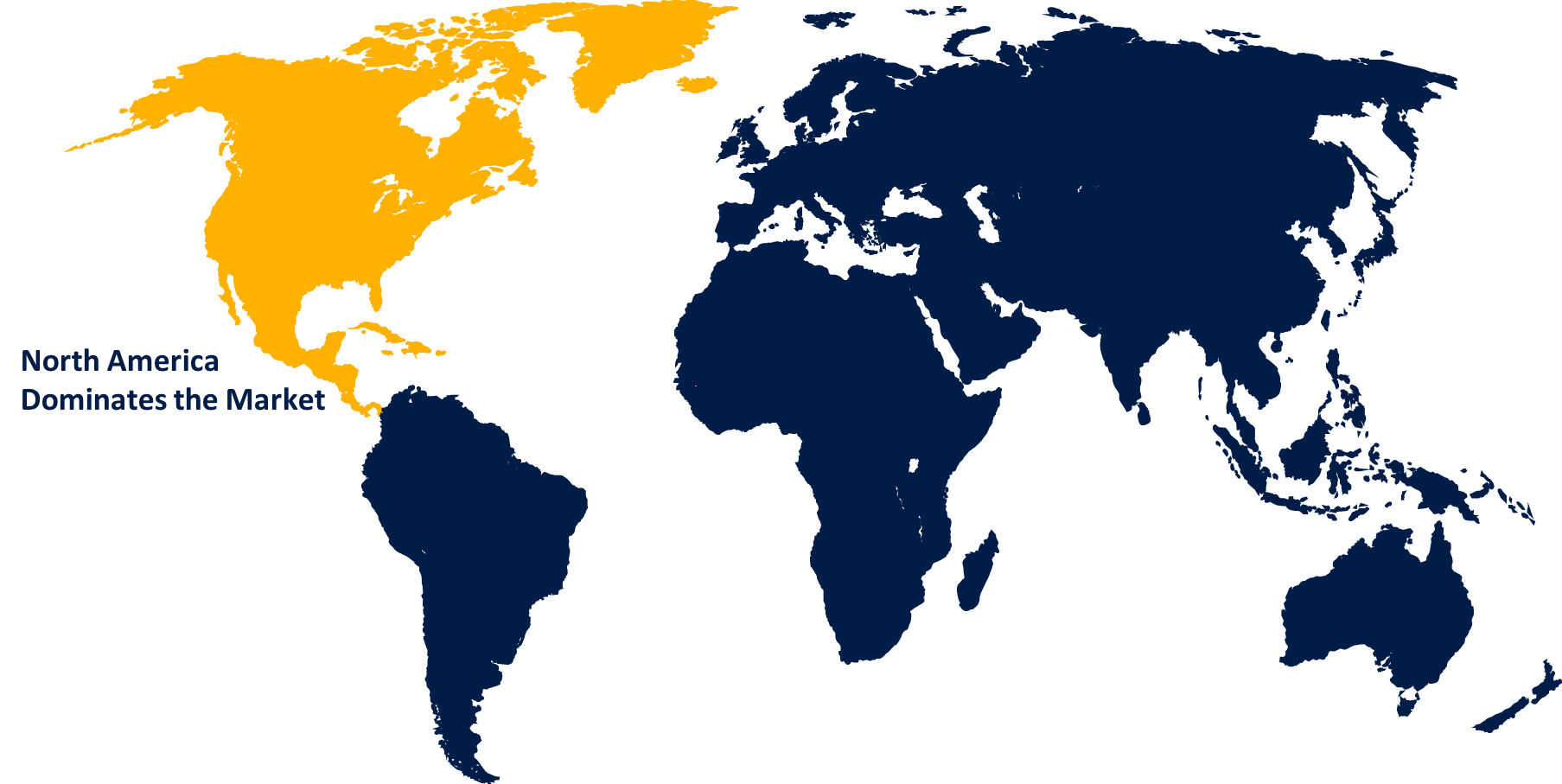

North America is anticipated to hold the largest share of the global insulin glargine market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global insulin glargine market over the predicted timeframe. The vast diabetic population in the United States contributes significantly to its leadership position. With approximately one in ten Americans suffering from diabetes, there is a high need for long-acting insulin treatments such as insulin glargine. Furthermore, North America is home to leading insulin producers such as Sanofi, Eli Lilly, and Novo Nordisk, all of whom have created strong production and distribution infrastructure to serve the regional market. These firms have heavily pushed insulin glargine medicines such as Lantus and Basaglar through patient and physician-targeted marketing campaigns. This has increased awareness and use of insulin glargine as an effective therapy choice for diabetic patients who require basal insulin.

The Asia Pacific area, particularly China and India, is expected to be the fastest-expanding market for insulin glargine. Several socioeconomic variables contribute to this rise. Rapid urbanization, rising economic levels, and an aging population in Asia Pacific countries all contribute to the region's rising diabetes prevalence. Furthermore, increased healthcare access and coverage allow more diabetes patients to choose patented drugs such as insulin glargine. Their reasonable prices make glargine therapy more accessible to Asian patients. Furthermore, regional trade agreements improve market access and product movement among Asia-Pacific countries. This will encourage regional suppliers to invest more in the manufacturing, distribution, and marketing of insulin glargine products across the rapidly increasing Asia Pacific healthcare markets.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global insulin glargine market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Biocon

- Gan & Lee

- Sanofi

- Kalbe Pharma

- Nova Nordisk AS

- Cipla Inc.

- Lupin Ltd

- Pfizer Inc.

- Ypsomed AG

- Wockhardt

- Elli Lilly

- Biogenomics Ltd.

- Polus Biopharm

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2023, Sanofi, a pharmaceutical and healthcare business, said that it would lower the list price of Lantus (insulin glargine injection) by 100 Units/mL, its most often prescribed insulin in the United States, by 78%.

- In December 2021, the FDA approved Rezvoglar, an Eli Lilly insulin glargine second biosimilar to Lantus was approved to promote glycemic control in adults and children with diabetes.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global insulin glargine market based on the below-mentioned segments:

Global Insulin Glargine Market, By Type

- Lantus

- Basaglar

- Toujeo

- Soliqua

- Rezvoglar

- Others

Global Insulin Glargine Market, By Diabetes Type

- Type 2 Diabetes

- Type 1 Diabetes

- Others

Global Insulin Glargine Market By Distribution Channel

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

Global Insulin Glargine Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?