Global Insulin Pumps Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Pumps and Consumables), By Disease Indication (Type 1 Diabetes and Type 2 Diabetes), By Distribution Channel (Hospital Pharmacy and Retail & Online Pharmacy), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Insulin Pumps Market Insights Forecasts to 2033

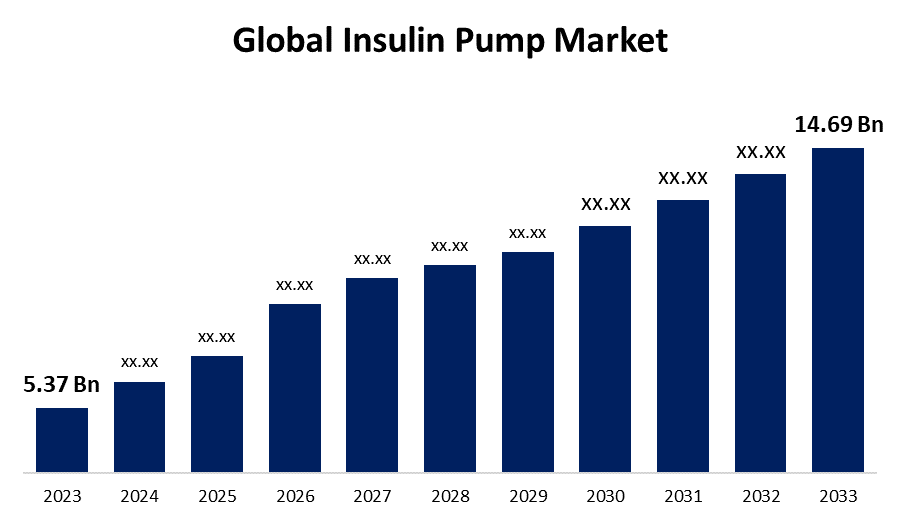

- The Global Insulin Pumps Market Size was Valued at USD 5.37 Billion in 2023

- The Market Size is Growing at a CAGR of 10.59% from 2023 to 2033

- The Worldwide Insulin Pumps Market Size is Expected to Reach USD 14.69 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Insulin Pumps Market Size is Anticipated to Exceed USD 14.69 Billion by 2033, Growing at a CAGR of 10.59% from 2023 to 2033.

Market Overview

Insulin pumps are compact, electronic devices that are created and programmed to provide diabetics amounts of insulin that are predetermined. Insulin pumps are small, automated drug delivery systems that help patients with diabetes take their prescribed doses of insulin. Because insulin pumps offer consistent and timely insulin dosages, they are becoming increasingly effective in treating and controlling diabetes, which has led to their wider acceptance. The market for insulin pumps is heavily dependent on the older population. The insulin pumps are connected to the blood glucose monitoring system and adhere to the skin using an adhesive layer to provide continuous blood sugar monitoring and insulin delivery. Patients with type 1 diabetes are growing at an alarming pace as a result of lifestyle issues. Among the benefits of insulin pumps over multiple daily injections (MDIs) are improved glucose monitoring and continuous insulin infusion. Insulin pumps enable patients to be flexible in using different insulin delivery modalities whenever they desire. Insulin pumps are multipurpose tools that can be carried in a pocket, fastened to clothing with a strap, fastened to a belt, or applied to the arm or stomach using adhesive. Due to the insulin pump's attachment to the body, patients can benefit greatly from not having to remember to inject insulin at regular intervals something they almost certainly forget to do. The insulin pump industry is growing at a rapid rate due to increased government initiatives for diabetes care management. In response to the growing worldwide diabetes burden, there is a significant demand for care.

Report Coverage

This research report categorizes the market for the insulin pumps market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the insulin pumps market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the insulin pumps market.

Driving Factors

By lowering the cost, increasing accessibility, and making the insulin pump available to all patients who desire to use it, greater product developments will promote the usage of the device. These pumps use cutting-edge technologies and provide remarkable therapeutic benefits. These consist of integrated CGM sensors, smartphone connectivity, and other features for efficient diabetes management. Insulin benefits are increasing the popularity of insulin pumps among diabetic patients and healthcare providers worldwide.

Restraining Factors

The restrictive regulatory environment and other political concerns, pharmaceutical companies can set high prices without having accountability or examination. Due to their high cost, insulin pumps are not offered to most people. The cost of maintenance afterward is similarly significant, preventing most people from purchasing insulin pumps. Therefore, the high cost of insulin pumps is going to hamper the market's growth.

Market Segmentation

The insulin pumps market share is classified into product type, disease indication, and distribution channel.

- The pumps segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the product type, the insulin pumps market is categorized into pumps and consumables. Among these, the pumps segment is anticipated to grow at the fastest CAGR growth through the forecast period. The growth can be attributed to increased awareness and acceptance of insulin pump therapy, as more patients prefer pumps to older injectable procedures, resulting in increased demand for new devices.

- The type 1 diabetes segment dominates the market with the highest market share through the forecast period.

Based on the disease indication, the insulin pumps market is categorized into type 1 diabetes and type 2 diabetes. Among these, the type 1 diabetes segment dominates the market with the largest market share through the forecast period. As type 1 diabetes is a chronic condition, regular insulin administration is vital for the patient's survival. The body produces minimal or no insulin from the pancreas.

- The retail & online pharmacy segment accounted for the largest revenue share through the forecast period.

Based on the distribution channel, the insulin pumps market is categorized into hospital pharmacy and retail & online pharmacy. Among these, the retail & online pharmacy segment accounted for the largest revenue share through the forecast period. This is due to the increasing availability of diabetes management equipment and supplies in developed and developing countries' retail and online medical businesses. Retail pharmacies improve consumer accessibility by providing a variety of brands and their devices in a single place.

Regional Segment Analysis of the Insulin Pumps Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the insulin pumps market over the predicted timeframe.

Get more details on this report -

North America is projected to hold the largest share of the insulin pumps market over the forecast period. The increased incidence of diabetes and the growing public need for cutting-edge medication delivery systems, along with several major industry participants in the area, have all contributed to the growth of the insulin pump market in North America. Because there are several popular brands of insulin pumps market. Furthermore, the region's market is expanding due to rising healthcare spending and an increase in FDA approvals. The research findings for the insulin pump market in North America are impacted by several variables, including a high prevalence of diabetes, mostly type 1 diabetes that has created a demand for insulin pump therapy as an efficient treatment option.

Asia Pacific is expected to grow at the fastest CAGR growth of the insulin pumps market during the forecast period. A growing number of people with diabetes are rising quickly, and people in the area are becoming more aware of cutting-edge diabetes care options. The International Diabetes Federation reports that the majority of diabetes patients worldwide are found in China and India. The majority of the countries in this region are developing nations, and the prevalence of type I and type II diabetes has increased due to increasing levels of obesity and expanding economic changes. Furthermore, it is anticipated that growing product releases and technological developments in the insulin patch pump market will contribute to regional growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the insulin pumps market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Animas Corporation

- Johnson & Johnson

- Debiotech S.A.

- Zealand Pharma

- Terumo Corporation

- Medtronic

- Vicentra B.V.

- Insulet Corporation

- Nipro Diagnostic Inc.

- Jiangsu Delfu Co. Ltd.

- Cellenovo

- Tandem Diabetes Care

- Ypsomed

- Sooil Development

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2024, Insulet Corp declared that it had acquired CE mark approval using the Insulet Omnipod 5 Automated Insulin Delivery System in combination with the Abbott FreeStyle Libre 2 Plus sensor.

- In January 2024, PharmaSens, a Switzerland-based medical device company, provided an application to apply for the FDA's approval of its new insulin pump. In November, the business obtained ISO 13485 certification.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the insulin pumps market based on the below-mentioned segments:

Global Insulin Pumps Market, By Product Type

- Pumps

- Consumables

Global Insulin Pumps Market, By Disease Indication

- Type 1 Diabetes

- Type 2 Diabetes

Global Insulin Pumps Market, By Distribution Channel

- Hospital Pharmacy

- Retail & Online Pharmacy

Global Insulin Pumps Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global insulin pump market over the forecast period?The global insulin pump market is to expand at 10.59% during the forecast period.

-

2. Which region is expected to hold the highest share in the global insulin pump market?The North America region is expected to hold the largest share of the global insulin pump market.

-

3. Who are the top key players in the insulin pump market?The key players in the global insulin pump market are Animas Corporation, Johnson & Johnson, Debiotech S.A., Zealand Pharma, Terumo Corporation, Medtronic, Vicentra B.V., Insulet Corporation, Nipro Diagnostic Inc., Jiangsu Delfu Co. Ltd., Cellenovo, Tandem Diabetes Care, Ypsomed, Sooil Development.

Need help to buy this report?