Global Insurance Fraud Detection Market Size, Share, and COVID-19 Impact Analysis, By Component (Solutions, Services), By Deployment (Cloud, On-Premise), Organization Size (SMB, Large Organization), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Banking & FinancialGlobal Insurance Fraud Detection Market Insights Forecasts to 2033

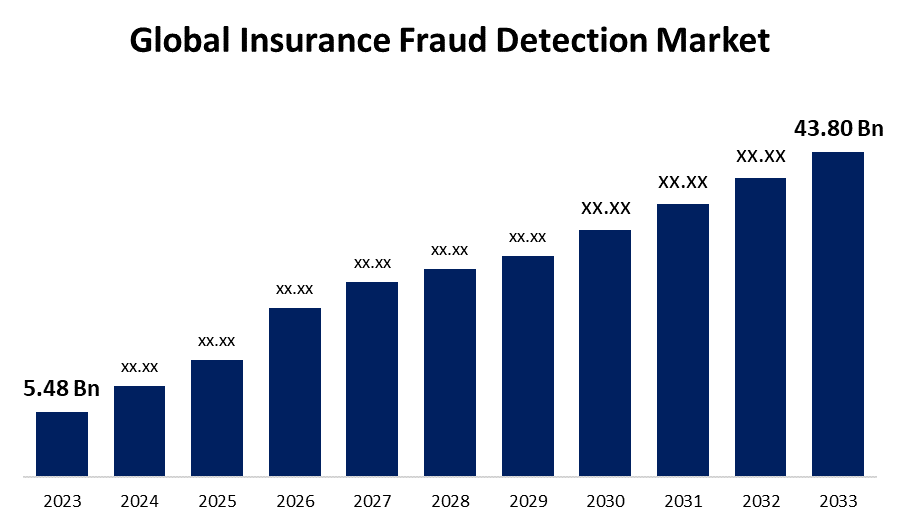

- The Global Insurance Fraud Detection Market Size Was Estimated at USD 5.48 Billion in 2023

- The Market Size is expected to grow at a CAGR of around 23.10% from 2023 to 2033

- The Worldwide Insurance Fraud Detection Market Size is Expected to Reach USD 43.80 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Insurance Fraud Detection Market size was valued at USD 5.48 billion in 2023 and is slated to reach USD 43.80 billion by 2033, growing at a CAGR of 23.10% from 2023 to 2033. The global market of insurance fraud detection, is expanding due to mainly the increasing instances of insurance fraud cases, the advancing adoption of technology resulting in greater risks, and the user-friendly features provided by the service and solutions suppliers. Also, IT companies are partnering with insurance companies to enhance customer experiences. This adoption of new technology by insurance companies enhances the security and protection of data, and financials as well as reducing threats of cybercrime or financial frauds. This high need for technological integrations enhances the industry growth during the forecasting period.

Market Overview

The insurance fraud detection sector consists of businesses that develop and offer software and services aimed at assisting insurance firms in recognizing and preventing fraud. This process is a core part of insurance operation methods designed to identify and prevent duplicitous activities that may cause major financial losses. These types of fraud cases can be detected in various conditions such as counterfeit claims, fraudulent claims, exaggerated claims, exaggerated damages, or fabricated incidents, during the process of fraud detection which is integrated with advanced technology such as AI, Machine learning, and other advanced technological features to identify the pattern and mark doubtful cases.

The growing insurance market across the world is demanding insurance fraud detection, in 2023 there were 719 life insurance companies and 3,968 property, casualty, and direct insurance businesses stood alone in the United States, these increasing number of insurance companies as well as U.S. costing insurers major annually. Also, rising digitalization has become an opportunity for cyber-criminals, and increased fraud cases, these increasing cases are raising demands for sophisticated fraud detection solutions. As insurance processes become more digitized, the opportunities for fraud have also increased, making sophisticated fraud detection solutions more crucial. This market includes a wide range of insurance fraud solutions with simple systems that detect anomalies to complex AI-powered platforms that analyze massive datasets to find patterns suggestive of fraudulent activity.

Report Coverage

This research report categorizes the global insurance fraud detection market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global insurance fraud detection market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global insurance fraud detection market.

Global Insurance Fraud Detection Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.48 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 23.10% |

| 023 – 2033 Value Projection: | USD 43.80 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 235 |

| Tables, Charts & Figures: | 107 |

| Segments covered: | By Component, By Deployment, By Region |

| Companies covered:: | Lexisnexis Risk Solutions Inc. (RELX Group plc) BAE Systems plc SAP SE Fiserv Inc. Equifax Inc. Experian plc SAS Institute Inc. Fair Isaac Corporation International Business Machines Corporation FRISS ACI Worldwide Inc Others |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing disposable income in developing nations resulted in the growth of financial awareness and demand for long-term financial strategies, which are majorly demanding for insurance such as motor insurance, life insurance, and home insurance. Particularly, life insurance is becoming more popular due to consumers are seeking options to protect their family members and family and making surety about their financial stability. These rapidly growing insurance demand and the growth of the insurance sector demand the security of their claimed insurance policies or funds with the help of identification of fraud activities, that fuelling the insurance fraud detection industry.

Moreover, insurance firms are progressively directing their attention towards digital platforms with the help of easy internet access to launch innovative products, enhance consumer connections, and grow their portion of client financial portfolios, resulting in an improved application of sophisticated threat solutions. Also, it is useful to avoid the threats posed by advanced technological tools that are used in fraudulent practices. Due to the increasing fraud cases across the industry, many companies are investing in new technological development and uses of advanced technology-based tools, which are able to detect fraud activities, with the help of a strong system featuring state-of-the-art technology. This technological adoption by operating companies has empowered the insurance fraud detection industry's growth.

Restraints and Challenges

Insurance companies face the dual challenges of evolving fraud threats and the substantial cost of advanced detection technologies. These expenses can be especially challenging for smaller insurance firms, restricting their capacity to implement vital solutions and leaving them vulnerable to fraud. The ongoing demand for enhanced security solutions in the industry poses significant technical difficulties and financial burdens. As a result, smaller insurance companies might find it challenging to stay competitive and retain customer confidence. This highlights the slowing down in the growth of smaller companies and the overall negative impact on industry growth.

Market Segmentation

The global insurance fraud detection market share is classified into component, deployment, and organization size.

- The solutions segment secured a dominant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the component, the global insurance fraud detection market is divided into solutions and services. Among these, the solutions segment accounted for the highest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The segmental dominance is attributed to the growing implementation of cutting-edge technological solutions by insurance firms seeking to improve their fraud detection abilities. Moreover, insurance firms are adopting authentication measures to improve secure interaction between clients and organizations. Consequently, authentication is expected to provide an additional layer to verify payments, alterations to accounts, dispatch authentication notifications, and customer acknowledgments or approvals regarding policies. This adoption increasing continuously and fuelling the segmental dominance of solutions.

- The on-premise segment accounted largest market share in 2023 and is projected to grow at a notable CAGR during the forecast period.

Based on the deployment, the global insurance fraud detection market is classified into cloud and on-premise. Among these, the on-premise segment largest market share in 2023 and is anticipated to grow at a notable CAGR during the forecast period. The major shareholding is mainly driven by the growing need for data protection and compliance with stringent regulations, numerous insurance companies are opting for on-premises solutions. These solutions provide businesses with complete oversight of their sensitive information, minimizing the likelihood of breaches and unauthorized access. Moreover, the customization and integration features of on-premises deployment allow for a personalized strategy in fraud detection, fitting seamlessly with the organization’s specific needs and current systems.

- The large organization segment held a major share in 2023 and is expected to grow at a remarkable CAGR during the forecast period.

Based on the organization size, the global insurance fraud detection market is separated into SMBs and large organizations. Among these, the large organization segment held a major share in 2023 and is anticipated to grow at a notable CAGR during the forecast period. This dominant holding is attributed to various factors, chiefly the magnitude of the financial and reputational risks tied to insurance fraud that big companies encounter. As a result, the rising prevalence of frauds like damage claims, vehicle theft, unnecessary procedures, and fraudulent health insurance billing has compelled insurers to adopt advanced solutions to tackle these misleading activities. The capacity of large companies and fraud detection services significantly contributes to the growth of this sector.

Regional Segment Analysis of the Global Insurance Fraud Detection Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

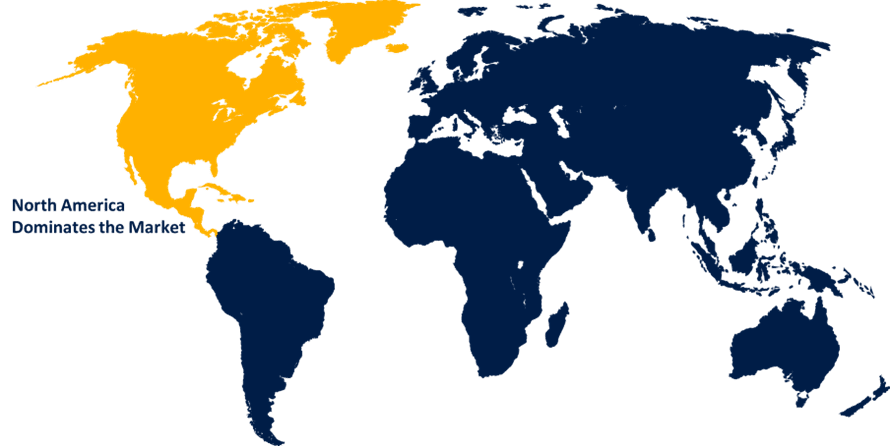

North America region is expected to hold the largest share of the global insurance fraud detection market during the forecast period.

Get more details on this report -

North America region is expected to hold the largest share of the global insurance fraud detection market during the forecast period. Regional growth is attributed to the high adoption of advanced technology such as the emergence of AI, machine learning, and big data analytics to enable more effective fraud detection, aligning with the tech-savvy market. Also, the attraction towards digital transformation in the insurance sector, while becoming an opportunity for potential fraud, demands fraud-preventing technology.

Additionally, strict regulatory structures and significant investments in fraud detection technologies propel the market ahead. North American insurance companies are required to establish strong fraud detection systems to adhere to government regulations designed to safeguard consumer rights and maintain market integrity. This regulatory pressure drives ongoing enhancements in fraud detection abilities, subsequently stimulating market expansion.

Asia-Pacific is anticipated to fastest growth during the forecasting period. This regional development is driven by the rapidly growing insurance industry due to the growing middle-class population they invest for family security purposes which helps to drive insurance industries. consequently, these operating insurers are making high investments in cutting-edge technologies designed to reduce occurrences of insurance fraud. Nations such as India are experiencing growth in their life insurance industries, which may greatly influence the demand forecast for insurance fraud detection. In addition, the operating companies are working together or making partnerships with insurance companies to enhance customer experiences. For instance; In December 2024, Neysa partnered with DSW to launch an advanced Insurance AI Cloud Platform for the Indian insurance sector. These types of collaborations are fuelling the insurance fraud detection market expansion across the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global insurance fraud detection market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers and acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lexisnexis Risk Solutions Inc. (RELX Group plc)

- BAE Systems plc

- SAP SE

- Fiserv Inc.

- Equifax Inc.

- Experian plc

- SAS Institute Inc.

- Fair Isaac Corporation

- International Business Machines Corporation

- FRISS

- ACI Worldwide Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2023, Shippo and Cover Genius joined forces to introduce Shippo Total Protection, an innovative solution designed to provide merchants with comprehensive coverage, global protection, and streamlined claims processing to enhance their experience.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global insurance fraud detection market based on the below-mentioned segments:

Global Insurance Fraud Detection Market, By Component

- Solutions

- Services

Global Insurance Fraud Detection Market, By Deployment

- Cloud

- On-Premise

Global Insurance Fraud Detection Market, By Organization Size

- SMB

- Large Organization

Global Insurance Fraud Detection Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East and Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East and Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global insurance fraud detection market over the forecast period?The global insurance fraud detection market size was valued at USD 5.48 Billion in 2023 and is slated to cross USD 43.80 Billion by 2033, growing at a CAGR of 23.10% from 2023 to 2033

-

2. Which region holds the largest share of the global insurance fraud detection market?The North America region holds the largest share of the global insurance fraud detection market during the forecast period.

-

3. Who are the top key players in the global insurance fraud detection market?Lexisnexis Risk Solutions Inc. (RELX Group plc), BAE Systems plc, SAP SE, Fiserv Inc., Equifax Inc., Experian plc, SAS Institute Inc., Fair Isaac Corporation, International Business Machines Corporation, FRISS, ACI Worldwide Inc., and Others.

Need help to buy this report?