Global Integrated Delivery Networks Market Size, Share, and COVID-19 Impact Analysis, By Integration Model (Vertical and Horizontal), By Service Type (Acute Care, Primary Care, Long-Term Health, Specialty Care, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Integrated Delivery Networks Market Insights Forecasts to 2033

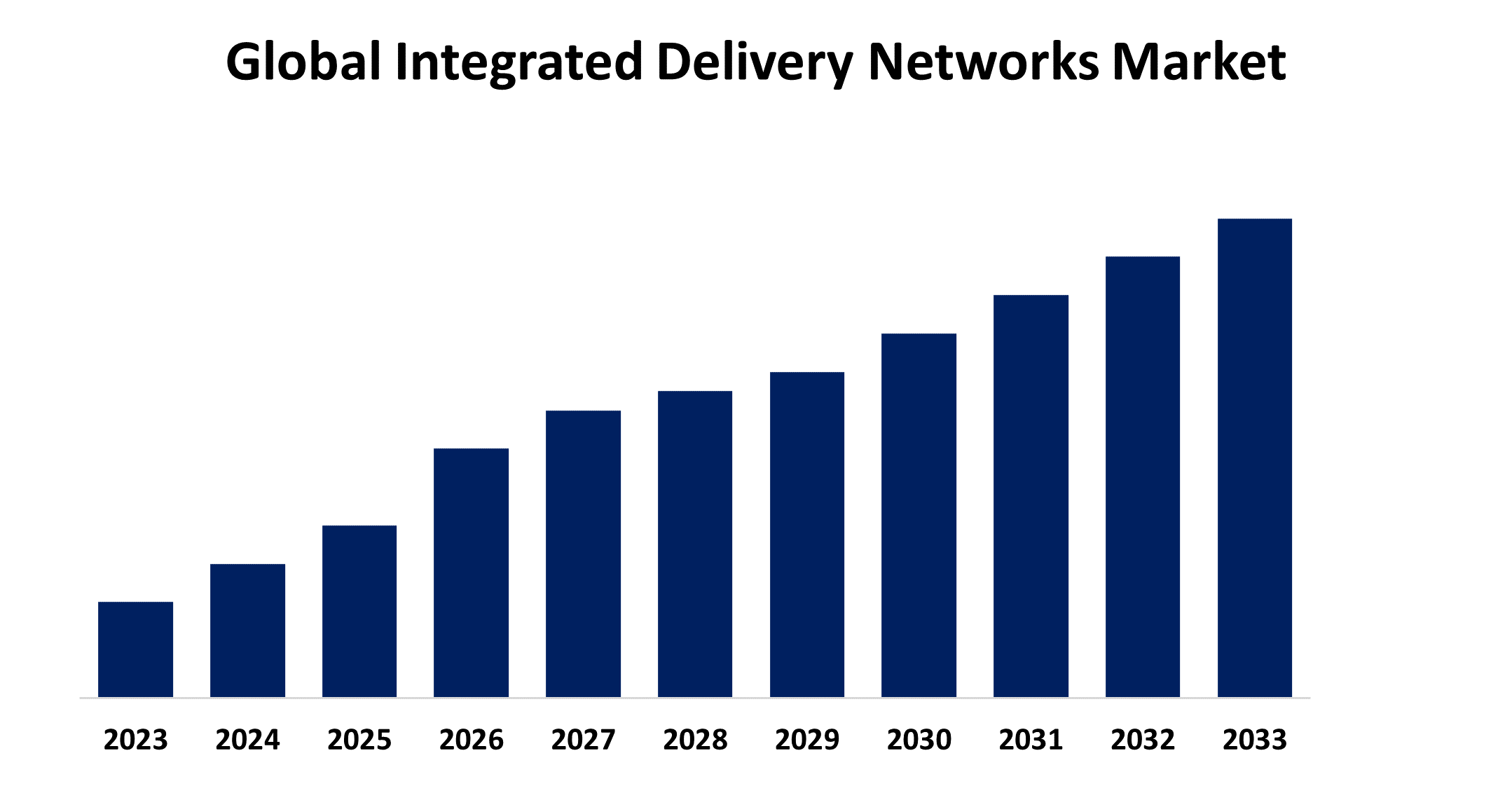

- The Market Size is Growing at a CAGR of 9.60% from 2023 to 2033

- The Worldwide Integrated Delivery Networks Market Size is Expected to Reach Significant Share by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Integrated Delivery Networks Market Size is Anticipated to Exceed Significant Share by 2033, Growing at a CAGR of 9.60 % from 2023 to 2033.

Market Overview

Integrated Delivery Networks are health system organization that owns and operates a network of one or more healthcare facilities. IDNs are designed to provide a wide variety of care services, they often contain many different types of inpatient and outpatient care facilities such as hospitals, physician groups, health clinics, ambulatory surgery centers, and imaging centers. IDNs use their vast networks of healthcare providers to deliver high-quality, coordinated care to patients, offering a wide range of care services to the patients without seeking out-of-network referrals comprising greater communication and care collaborations and preventing revenue loss from network leakage. The Mayo Clinic, The Cleveland Clinic, Memorial Sloan Kettering Cancer Center, and The Huntsman Cancer Center are some of the most well-known integrated delivery networks. IDN aims to provide patients with high-quality, coordinated treatment by utilizing a vast network of healthcare professionals. Thus, IDNs organize and improve chronic disease care while reducing costs. Providers can typically fulfill the most of their patients’ healthcare needs without referring them to an out-of-network physician because many health system offer a wide spectrum of care services, from preventative to urgent/acute to post-acute care. This allows for greater communication, collaboration, and care coordination across the care continuum while preventing revenue loss from network leakage.

Report Coverage

This research report categorizes the market for the global integrated delivery networks market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global integrated delivery networks market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global integrated delivery networks market.

Global Integrated Delivery Networks Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 9.60 % |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Integration Model, By Service Type, By Region |

| Companies covered:: | Ascension, AdventHealth, CommonSpirit Health, Kaiser Foundation Health Plan, Inc., HCA Healthcare, UNITEDHEALTH GROUP, University of Pittsburgh Medical Center, CHI Health, Cardinal Health, Inc, Tenet Healthcare Medical, Mayo Clinic Health System, McKesson Corporation, Medline Industries, Trinity Health, Providence St Joseph Health, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Strengthening the capacity of health systems to prevent chronic diseases has worked through multiagency, multilevel networks. Such networks have emerged as important vehicles in the pursuit of more integrated care that involves both horizontally and vertically. Health systems are evolving to include networks for preventing chronic diseases and providing more integrated services to patients receiving chronic care. The growing prevalence of chronic disease is enhancing the need for value-based healthcare services to deliver high-quality and coordinated patient care across hospitals and clinics to. The increased demand for accountable care and clinical integration to provide coordinated care to patients to limit unnecessary spending for the improvement of patient care, decrease cost, and demonstrate value to the market.

Restraining Factors

The laydown of some level of control and decision-making to IDNs by hospitals leads to a loss of autonomy. The rise in complexity in governance and management is also hampering the market growth. The increased scrutiny and compliance requirements across different healthcare settings and services are impeding the market of integrated delivery networks. In addition, the lack of experienced and skilled medical staff or healthcare professionals and interoperability issues with different stakeholders are responsible for restraining the global integrated networks market.

Market Segmentation

The global integrated delivery networks market share is classified into integration model and service type.

- The vertical IDNs segment accounted for the largest share of the global integrated delivery networks market in 2023.

Based on the integration model, the global integrated delivery networks market is categorized into vertical and horizontal. Among these, the vertical IDNs segment accounted for the largest share of the global integrated delivery networks market in 2023. The patient care continuum via vertical integration of healthcare services, from primary care to tertiary care facilities, helps in enhancing care coordination and quality. The increasing prevalence of chronic diseases surges the demand for disease-specific management programs to improve the quality of treatments. The post-acute care also surges the demand for vertical IDNs.

- The acute care segment dominated the market with the largest revenue share in 2023.

Based on the service type, the global integrated delivery networks market is categorized into acute care, primary care, long-term health, specialty care, and others. Among these, the acute care segment dominated the market with the largest revenue share in 2023. The acute care segment involves specialized medical expertise including emergency physicians, trauma surgeons, and critical care specialists. The development of advanced medical technologies to enhance the accuracy and treatment capabilities of diagnosis is driving the market growth in the acute care segment.

Regional Segment Analysis of the Global Integrated Delivery Networks Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

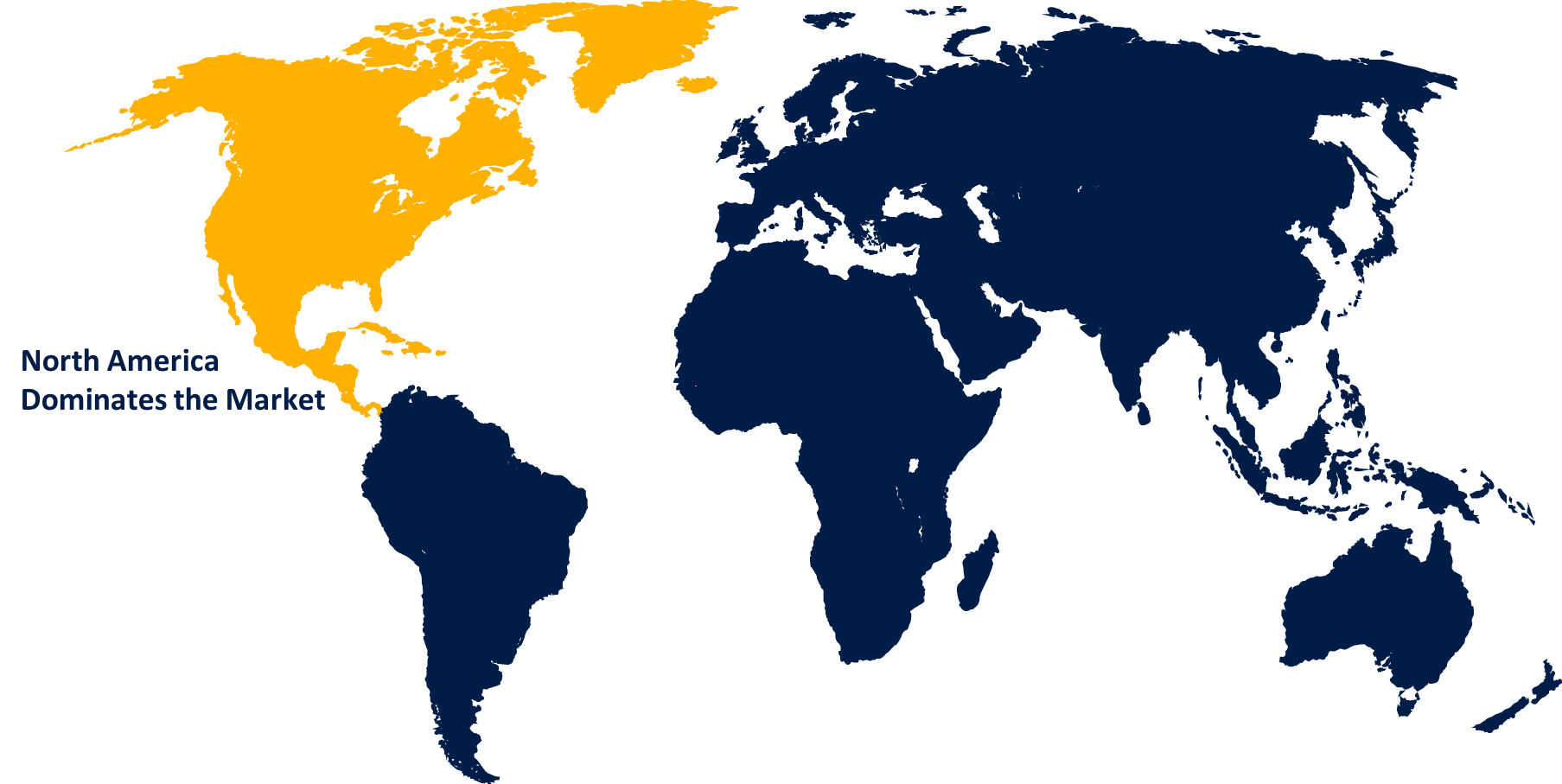

North America is anticipated to hold the largest share of the global integrated delivery networks market over the predicted timeframe.

Get more details on this report -

North America is projected to hold the largest share of the global integrated delivery networks market over the forecast period. The growing demand for value-based care in countries like the US is upsurging the market growth. The rising awareness and significant shift from the fee-for-service model of healthcare infrastructure to value-based care assisted in improved investment in the IDN infrastructure of the country, reducing the financial burden of medical care on the patients owing to the emphasis on preventive care, and population health management strategies. The prevalence of chronic diseases such as diabetes, cardiovascular diseases, and respiratory disorders resulted in increasing market demand for integrated delivery networks in the region.

Asia Pacific is expected to grow at the fastest CAGR growth of the global integrated delivery networks market during the forecast period. Rapid digitization across the continent is fueling internet usage and cloud service adoption. This creates a pressing demand for reliable and high-speed data delivery networks. The burgeoning e-commerce sector further necessitates robust logistics infrastructure to ensure fast and dependable product movement. Additionally, the widespread use of mobile devices necessitates optimized content delivery solutions, a challenge that IDNs are adept at addressing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global integrated delivery networks market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ascension

- AdventHealth

- CommonSpirit Health

- Kaiser Foundation Health Plan, Inc.

- HCA Healthcare

- UNITEDHEALTH GROUP

- University of Pittsburgh Medical Center

- CHI Health

- Cardinal Health, Inc

- Tenet Healthcare Medical

- Mayo Clinic Health System

- McKesson Corporation

- Medline Industries

- Trinity Health

- Providence St Joseph Health

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In December 2023, Jefferson Health merger with Lehigh Valley Health Network would make it Philly’s largest employer, with a 30-hospital network. If the two healthcare providers combine, the integrated healthcare system would control 30 hospitals and employ 62,000 workers.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global integrated delivery networks market based on the below-mentioned segments:

Global Integrated Delivery Networks Market, By Integration Model

- Vertical

- Horizontal

Global Integrated Delivery Networks Market, By Service Type

- Acute Care

- Primary Care

- Long-Term Health

- Specialty Care

- Others

Global Integrated Delivery Networks Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the global integrated delivery networks market over the forecast period?The global integrated delivery networks market is projected to expand at a CAGR of 9.60% during the forecast period.

-

2.Which region is expected to hold the highest share in the global integrated delivery networks market?The North America region is expected to hold the highest share of the global integrated delivery networks market.

Need help to buy this report?