Global Integrated Passive Devices Market Size, Share, and COVID-19 Impact Analysis, By Application (EMS & EMI Protection, Radio Frequency Protection, LED Lighting, and Digital & Mixed Signal), By End User (Automotive, Consumer Electronics, Healthcare, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Semiconductors & ElectronicsGlobal Integrated Passive Devices Market Insights Forecasts to 2033

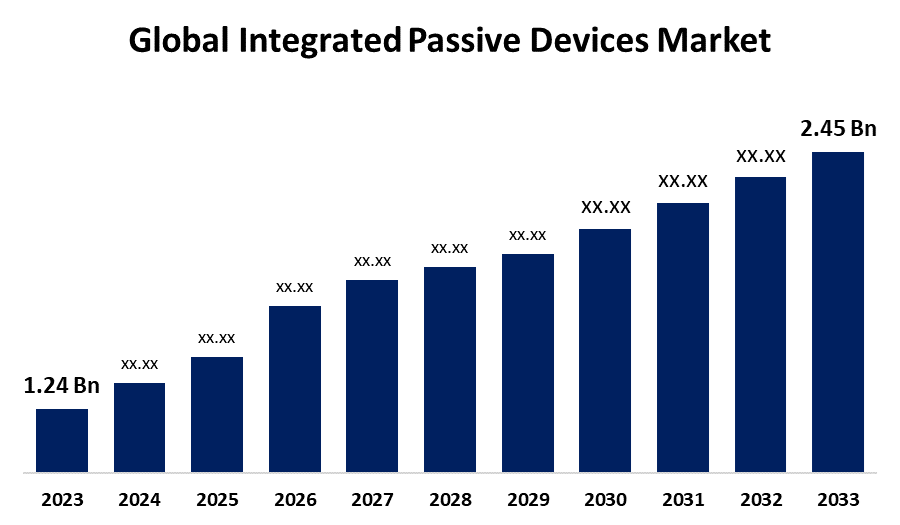

- The Global Integrated Passive Devices Market Size was Valued at USD 1.24 Billion in 2023

- The Market Size is Growing at a CAGR of 7.05% from 2023 to 2033

- The Worldwide Integrated Passive Devices Market Size is Expected to Reach USD 2.45 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Integrated Passive Devices Market Size is anticipated to exceed USD 2.45 Billion by 2033, Growing at a CAGR of 7.05% from 2023 to 2033. With the growing need for high-speed mobile connectivity, significant businesses in the integrated devices market are seeing more opportunities as part of the deployment of 5G networks.

Market Overview

The term "Integrated Passive Device" (IPD) refers to monolithic microwave integrated circuits (MMICs) that primarily comprise passive components like resistors, capacitors, and inductors and lack active components of transistors. These devices do not require DC power to function, and unlike frequency multipliers or mixers, they do not convert frequencies. Wearable and wearable technology, smart TVs, and smart appliances are all using IPDs more and more. Moreover, they are used in consumer electronics like gaming systems, routers, wireless speakers, set-top boxes, and drones. For Instance, in February 2023, Nine RF-integrated passive devices (RF IPDs) that include antenna impedance-matching, balun, and harmonic-filter circuitry designed for STM32WL wireless microcontrollers (MCUs) were launched by STMicroelectronics. The industry is expanding due to the adoption of 5G and the Internet of Things (IoT). The growing demand for high-performance, compact electronic devices, the integration of IPDs into RF applications, and the increasing use of IPDs in consumer durables are all driving the market for integrated passive devices. The global integrated passive device market is being driven by an increase in demand for thin and powerful electronic devices.

Challenges

RF tuning of IPDs, manufacturers demand a lengthy product design cycle, which severely restricts the IPD market. Discrete components are significantly simpler to tune. It is difficult to replace or modify them during RF tuning, which lengthens the product design cycle in IPD.

Report Coverage

This research report categorizes the integrated passive devices market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the integrated passive devices market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the integrated passive devices market.

Global Integrated Passive Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.24 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 7.05% |

| 2033 Value Projection: | USD 2.45 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 234 |

| Tables, Charts & Figures: | 107 |

| Segments covered: | By Application, By End User, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | STMicroelectronics, X-FAB Silicon Foundries SE, NXP Semiconductors, TSMC, Qorvo, Inc., CTS Corporation, Murata Manufacturing Co., Ltd., Infineon Technologies AG, MACOM, Broadcom, Johanson Technology, Inc., Texas Instruments Incorporated, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing use of filters and diplexers in wireless system applications is driving market expansion. Further, the growing integration of entertainment and navigation technologies, such as GPS, by autos is driving the market growth. Applications of passive electrical components like capacitors, resistors, and inductors in the Internet of Things (IoT) are creating growth opportunities for producers, thereby driving market expansion. The market for integrated passive devices is predicted to be driven by the growing use of integrated passive components in bluetooth, GPS systems, WLAN, RF modules, and LEDs.

Restraining Factors

The market growth for integrated passive devices is being restricted by the high cost of IPDs in comparison to discrete components. Since major companies in this industry are working to lower the cost of IPDs, the impact is anticipated to be minimal in the long run.

Market Segmentation

The integrated passive devices market share is classified into application and end user.

- The EMS & EMI protection segment is estimated to hold the largest market revenue share through the projected period.

Based on the application, the integrated passive devices market is classified into EMS & EMI protection, radio frequency protection, LED lighting, and digital & mixed-signal. Among these, the EMS & EMI protection segment is estimated to hold the largest market revenue share through the projected period. Opportunities in the EMS and EMI protection categories contribute to reducing signal loss and improving signal strength, which presents the market with huge potential for expansion.

- The automotive segment is anticipated to hold the largest market share through the forecast period.

Based on the end user, the integrated passive devices market is divided into automotive, consumer electronics, healthcare, and others. Among these, the automotive segment is anticipated to hold the largest market share through the forecast period. The automotive industry is concerned with the extensive usage of passive integrated devices for wireless communication in automobile electronics. In ADAS applications, which require compact and reliable passive devices, IPDs such as radar, lidar, and camera modules are key components.

Regional Segment Analysis of the Integrated Passive Devices Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the integrated passive devices market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the integrated passive devices market over the predicted timeframe. The growing use of IPDs in 5G technology is responsible for the growth of the North American integrated passive devices market. In addition, the growing number of IoT-based devices and the flourishing consumer electronics sector present promising opportunities for the market's growth. Moreover, a robust semiconductor industry with sizable production facilities and a solid manufacturing infrastructure can be found in North America.

Asia Pacific is expected to grow at the fastest CAGR growth of the integrated passive devices market during the forecast period. The growing use of IPDs in portable medical devices, due to their small size and remarkable performance capabilities, is responsible for the growth of the Asia Pacific integrated passive devices market. Moreover, prominent IPD manufacturers are establishing facilities in the Asia Pacific due to the region's huge industrial base and reduced production costs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the integrated passive devices market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- STMicroelectronics

- X-FAB Silicon Foundries SE

- NXP Semiconductors

- TSMC

- Qorvo, Inc.

- CTS Corporation

- Murata Manufacturing Co., Ltd.

- Infineon Technologies AG

- MACOM

- Broadcom

- Johanson Technology, Inc.

- Texas Instruments Incorporated

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2023, X-FAB Silicon Foundries SE announced that it expanded its already broad RF competence by adding new integrated passive device (IPD) fabrication capabilities. The launch of the XIPD process came just before European Microwave Week (17–22 September, Berlin).

- In August 2023, a new generation of wafer-level integrated passive device (IPD) technology was launched by TSMC and would be used in 5G mobile devices. According to reports from international media, TSMC has been studying and creating wafer-level integrated passive devices for a long time. The most recent generation of technologies has also been released.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the integrated passive devices market based on the below-mentioned segments:

Global Integrated Passive Devices Market, By Application

- EMS & EMI Protection

- Radio Frequency Protection

- LED Lighting

- Digital & Mixed Signal

Global Integrated Passive Devices Market, By End User

- Automotive

- Consumer Electronics

- Healthcare

- Others

Global Integrated Passive Devices Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the integrated passive devices market over the forecast period?The integrated passive devices market is projected to expand at a CAGR of 7.05% during the forecast period.

-

2. What is the market size of the integrated passive devices market?The Global Integrated Passive Devices Market Size is Expected to Grow from USD 1.24 Billion in 2023 to USD 2.45 Billion by 2033, at a CAGR of 7.05% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the integrated passive devices market?North America is anticipated to hold the largest share of the integrated passive devices market over the predicted timeframe.

Need help to buy this report?