Global IoT In Agriculture Market Size, Share, and COVID-19 Impact Analysis, By Applications (Livestock Monitoring, Precision Farming, Fish Farm Monitoring, Smart Greenhouse, and Others), By Offerings (Software, Hardware, and Services), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: AgricultureGlobal IoT In Agriculture Market Insights Forecasts to 2033

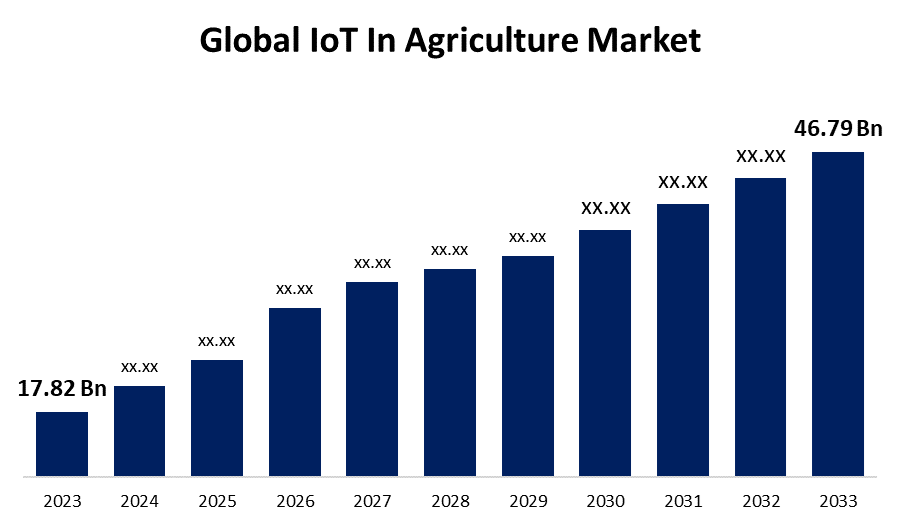

- The Global IoT In Agriculture Market Size was Valued at USD 17.82 Billion in 2023

- The Market Size is Growing at a CAGR of 10.13% from 2023 to 2033

- The Worldwide IoT In Agriculture Market Size is Expected to Reach USD 46.79 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global IoT In Agriculture Market Size is Anticipated to Exceed USD 46.79 Billion by 2033, Growing at a CAGR of 10.13% from 2023 to 2033.

Market Overview

A new wave of innovation in agriculture has developed with the Internet of Things (IoT), promising better production, sustainability, and efficiency. IoT in Agriculture will improve agricultural cultivation and animal management through a network of linked devices and sensors that collect and transmit data, promoting efficiency and predictability. Farmers and agribusinesses might monitor crop health, optimize resource utilization, automate numerous operations, and make data-driven choices by utilizing the Internet of Things in the agriculture sector.

For Instance, in April 2024, through the Regional Conservation Partnership Program (RCPP) Investing in America agenda, the Agriculture Secretary announced the availability of an unprecedented $1.5 billion in fiscal year 2024 to invest in partner-driven conservation and climate solutions. Project applications that would assist farmers, ranchers, and forest landowners in adopting and expanding conservation practices to improve natural resources while addressing the climate problem are being accepted by the U.S. Department of Agriculture (USDA) through July 2, 2024. In turn, these initiatives have the potential to boost production, generate new sources of income, and save farmers money.

The growth of the agribusiness IoT market is being driven by the increased adoption of the Internet of Things (IoT) and computerized reasoning (AI) by ranchers and cultivators, the expanded focus on the observation and diagnosis of diseases in domesticated animals, the demand for new produce, population growth, the loss of arable land, the increasing use of hydroponics monitoring and feed improvement devices in emerging economies, and strong government support for precise cultivating practices.

Report Coverage

This research report categorizes the market for the IoT in the agriculture market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the IoT in the agriculture market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the IoT in the agriculture market.

Global IoT In Agriculture Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 17.82 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 10.13% |

| 2033 Value Projection: | USD 46.79 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 270 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Applications, By Offerings, By Region |

| Companies covered:: | IBM Corporation, Cisco Systems, Inc., SAP SE, Trimble Inc., Deere & Company, Agco Corporation, Hexagon AB, Telit Communications PLC, Decisive Farming Corp., Raven Industries, Inc., Ag Leader Technology, Climate Corporation, The, Farmers Edge Inc., Precision Planting LLC, SemiosBio Technologies Inc., Topcon Corporation, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, and Analysis |

Get more details on this report -

Driving Factors

With the use of sensors, precision farming enables farmers to collect data and analyze it to quickly and intelligently make decisions. A multitude of precision farming techniques, including vehicle monitoring, livestock management, and irrigation management, are essential for boosting productivity and effectiveness. Farmers can improve operational efficiency by analyzing soil conditions and other relevant characteristics with the use of precision farming. To determine the amounts of water and nutrients, farmers can also observe the operational conditions in real time of the linked equipment. End-to-end data storage on the cloud and IoT platform solutions are seen to be crucial in enabling better performance of tasks. Sensors are the main means of large-scale data collection in the Internet of Things. The examination of crop, livestock, and meteorological conditions is aided by data analytics. By collecting data from sensors, farmers can ascertain the current condition of their crops. Farmers can acquire information to help them make better harvesting decisions by using predictive analytics. The trend analysis aids farmers in anticipating future weather patterns and crop harvests. IoT in agriculture has improved product volume and quality by assisting farmers in maintaining the fertility of the ground and the quality of their crops.

Restraining Factors

The need for large initial investments is one of the main things holding back the agriculture loT industry's expansion. At the moment, most farmers in emerging nations and smaller farmers in industrialized regions cannot afford the high cost of agricultural loT devices and instruments. In addition to a substantial upfront financial outlay for the deployment of GPS, drones, GIS, VRT, and satellite equipment, precision farming needs a workforce with the necessary skills to operate these technologically advanced tools. Technologies used in precision livestock farming include highly expensive set-up costs for automated milking and feeding robots, monitoring and sensing equipment, and herd management software.

Market Segmentation

The IoT in agriculture market share is classified into applications and offerings.

- The precision farming segment is estimated to hold the highest market revenue share through the projected period.

Based on the application, the IoT in the agriculture market is classified into livestock monitoring, precision farming, fish farm monitoring, smart greenhouse, and others. Among these, the precision farming segment is estimated to hold the highest market revenue share through the projected period. With the use of IoT, farmers might practice precision farming by precisely calculating the quantity of chemicals, herbicides, and fertilizers required for a given field. It also aids in the most efficient use of power, water, and fuel. All of this lessens the quantity of hazardous trash produced and helps the environment. Additionally, farmers are now able to examine their sites' processes more thoroughly owing to precision agriculture's IoT technology. Improved knowledge of all agricultural operations will result from the instantaneous data transmission provided by Internet of Things (IoT) sensors and devices deployed on the farm regarding crop status, soil quality, weather, and labor performance. Latest developments and trends will further propel the market of IoT in precision farming.

For instance, in July 2024, the British Design Fund invested £150,000 in the London-based agritech business Permia Sensing. With the help of IoT, AI, sensors, robotics, and precision farming techniques, this Imperial College London spinout is revolutionizing the management of palm plantations. This involves utilizing sensors to detect harmful pests early on and assisting in the improvement of harvests. Although palm plantations are essential to world agriculture, issues like disease, nutrient shortages, and drought can all have a significant negative influence on productivity. Permia sensing makes farming more productive while allowing for a less harmful method of pest management.

- The hardware segment is anticipated to hold the largest market share through the forecast period.

Based on the offering, the IoT in the agriculture market is divided into software, hardware, and services. Among these, the hardware segment is anticipated to hold the largest market share through the forecast period. The expansion of this market is being driven by the adoption of different hardware components, including sensors, monitoring devices, and networking solutions. To enable real-time monitoring and analysis, these hardware devices are essential for collecting data from livestock operations, greenhouses, and agricultural areas. The demand for IoT hardware in the agriculture industry has been driven by the growing need for accurate and efficient data collecting, as well as the growing availability of cost-effective hardware solutions. This pattern is a reflection of the industry's move toward data-driven decision-making and the incorporation of cutting-edge technologies to maximize productivity, support sustainable farming techniques, and optimize agricultural practices.

Regional Segment Analysis of the IoT In Agriculture Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the IoT in the agriculture market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the IoT in the agriculture market over the predicted timeframe. Top of FormThis dominance can be attributed to the region's growing population and the resulting spike in food consumption. Demand growth is also anticipated as a result of government initiatives to use satellite data and remote sensing technologies to monitor agricultural conditions across various regions. The need to increase production, make the best use of available resources, and ensure food security for the growing population in the Asia Pacific area is driving the use of IoT solutions in agriculture.

For instance, in Indian agriculture, Agri-tech is predicted to reach a US$ 13.5 billion valuation by 2023, and the agribusiness sector expects a spike in digital usage. Initiatives from the government, including the National Agriculture Market (e-NAM) Scheme, Digital Agriculture Mission, and Digital Public Agriculture Infrastructure, are designed to encourage agri-entrepreneurs and promote farmer-centric solutions, thus accelerating the growth of agri-tech. To increase farmer productivity and profitability, the government will work to promote the use of agri-tech solutions including drone-based agriculture, IoT-based real-time data collecting systems, and AI-based precision agriculture.

North America is expected to grow at the fastest CAGR growth of the IoT in the agriculture market during the forecast period. Rapid changes in the agricultural sector have been brought about by the interrelated and potent effects of population shifts, unequal economic expansion, and climate change. Mechanization, breeding, irrigation, fertilization, and mechanization advances have allowed the North American agriculture sector to keep up with the world's population explosion, but with great environmental and health consequences. Additionally, as a result of growing laws and government programs aimed at boosting the area's agricultural sector. A partnership of several agricultural groups developed the North America Climate Smart Agriculture Alliance (NACSAA), a platform for teaching and equipping growers to enhance agricultural productivity sustainably.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the IoT in agriculture market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- IBM Corporation

- Cisco Systems, Inc.

- SAP SE

- Trimble Inc.

- Deere & Company

- Agco Corporation

- Hexagon AB

- Telit Communications PLC

- Decisive Farming Corp.

- Raven Industries, Inc.

- Ag Leader Technology

- Climate Corporation, The

- Farmers Edge Inc.

- Precision Planting LLC

- SemiosBio Technologies Inc.

- Topcon Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

• In July 2024, Taranis, a pioneer in crop intelligence globally, unveiled its Ag Assistant, a game-changer in artificial intelligence for the agriculture industry. Ag Assistant, a first for agricultural retailers and producers, is driven by a generative AI model with deep agronomic understanding that integrates data sources from multiple modalities, including photos, text, and audio.

• In May 2024, A Memorandum of Understanding (MoU) was inked by the National Skill Development Corporation (NSDC) and AVPL International to build 70 Skills and Incubation Hubs for global employment in drone, IoT, agriculture, and related industries across India. This program is a major step in the right direction toward improving skill development and vocational training in the state.

• In February 2024, the owner-operator of the AMOS satellite fleet and provider of satellite communication systems and services, Spacecom Ltd., has announced the successful launch of its Satellite IoT-as-a-Service, which is intended to transform digital agriculture in Sub-Saharan Africa. Spacecom presents a dependable, independent, and sustainable off-grid solution to deliver effective IoT services to rural communities across Africa in partnership with Ayecka, utilizing the capabilities of AMOS GEO satellites and Ayecka AR-1100 satcom terminals.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the IoT in the agriculture market based on the below-mentioned segments:

Global IoT In Agriculture Market, By Applications

- Livestock Monitoring

- Precision Farming

- Fish Farm Monitoring

- Smart Greenhouse

- Others

Global IoT In Agriculture Market, By Offerings

- Software

- Hardware

- Services

Global IoT In Agriculture Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?