Global IoT in Banking and Financial Services Market Size, Share, and COVID-19 Impact Analysis, By Component (Services, Solutions), By Solution (Data Management, Security, Monitoring, Customer Experience Management), By Application (Insurance, Banking), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Information & TechnologyGlobal IoT in Banking and Financial Services Market Insights Forecasts to 2033

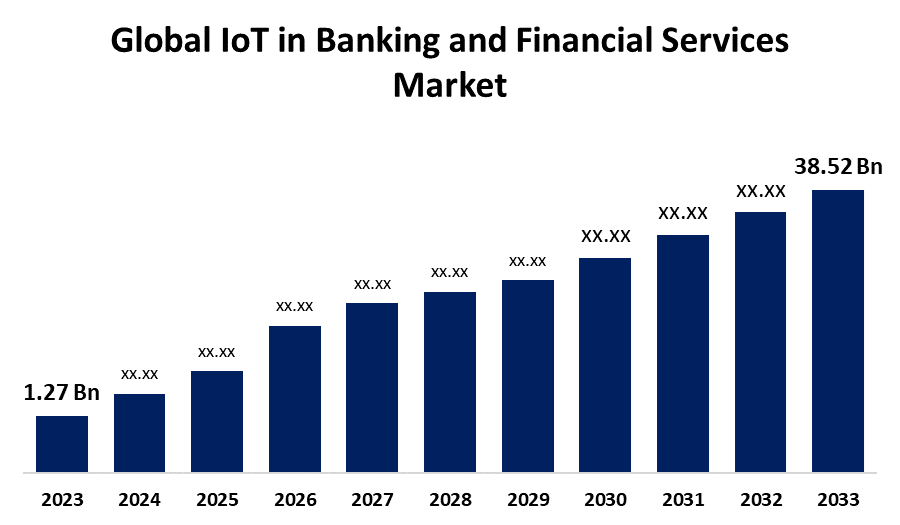

- The Global IoT in Banking and Financial Services Market Size was Valued at USD 1.27 Billion in 2023

- The Market Size is Growing at a CAGR of 40.67% from 2023 to 2033

- The Worldwide IoT in Banking and Financial Services Market Size is Expected to Reach USD 38.52 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global IoT in Banking And Financial Services Market Size is Anticipated to Exceed USD 38.52 Billion by 2033, Growing at a CAGR of 40.67% from 2023 to 2033.

Market Overview

The term "IoT" stands for the Internet of Things. It refers to the interconnection of physical things, such as appliances and cars, that are equipped with sensors, software, and connections that allow them to communicate and share data. This technology offers new opportunities for improved automation and efficient processes by enabling the gathering and exchange of information from a wide range of devices.

The introduction of the IoT in banking and financial services has streamlined various processes and allows financial service providers to do real-time data analysis. IoT has substantially revolutionized the banking and financial industries by improving operational effectiveness and redefining client experiences. This shift has enabled the BFSI industry to harness IoT-connected devices and networks that have transformed conventional banking operations. As per the data provided by the Government of India, the worldwide number of Internet-connected devices is predicted to range from 26 billion to 50 billion by 2022.

Report Coverage

This research report categorizes the market for the global IoT in the banking and financial services market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global IoT in banking and financial services market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global IoT in banking and financial services market.

Global IoT in Banking and Financial Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.27 Billion |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 40.67% |

| 2033 Value Projection: | USD 38.52 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Component, By Solution, By Application, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Oracle Corporation, Cisco Systems, Inc., Capgemini, Qualcomm Technologies, Inc., Huawei Technologies Co., Ltd., Microsoft Corporation, Infosys Limited, Dell Technologies, IBM Corporation, TIBCO Software Inc., Intel Corporation, Accenture, Honeywell International Inc., Siemens AG, SAP SE,AND Others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Several factors will contribute to the greater utilization of IoT for banking and financial services. They play a vital role in improving the customer experience by acquiring and analyzing customer information such as frequent payment trends, consumer preferences, and even behavioral patterns like driving habits to offer personalized financial services to clients. IoT devices offer transparency and security by instantly alerting users regarding account activities, including balance updates, detection of fraud, and transaction alerts. IoT automates repetitive tasks like data entry, transaction processes, and account management reducing operational expenses and human errors while streamlining banking operations.

Restraining Factors

IoT devices gather an enormous amount of financial and personal information. Sensitive data could be revealed if these devices are compromised, resulting in serious privacy violations and identity theft. Also, these devices are often considered vulnerable points and are frequently targeted by cyberattacks, hacking, and malware. Also, these devices are highly dependent on secure and reliable internet connections. Their performance can be greatly affected in locations with poor connectivity or during network failure causing disruptions in banking operations and customer service.

Market Segmentation

The global IoT in banking and financial services market share is classified into component, solution, and end-user.

- The service segment is expected to hold the largest share of the global IoT in banking and financial services market during the forecast period.

Based on the component, the global IoT in banking and financial services market is divided into services and solutions. Among these, the services segment is expected to hold the largest share of the global IoT in banking and financial services market during the forecast period. Banks that adopt IoT solutions frequently require continuous assistance, surveillance, and administration of these systems. So, there is a necessity for contracted services that will assist in upgrades, maintenance, and security management for the smooth functioning of IoT devices.

- The security segment is expected to grow at the fastest CAGR in the global IoT in banking and financial services market during the forecast period.

Based on the solution, the global IoT in banking and financial services market is divided into data management, security, monitoring, and customer experience management. Among these, the security segment is expected to grow at the fastest CAGR in the global IoT banking and financial services market during the forecast period. The increased adoption of IoT solutions by banks and financial institutions leads to a growth in the number of connected devices, consequently expanding the field of attack for hackers. Strong security measures have become increasingly essential to safeguard critical financial details, client information, and transactional data.

- The banking segment is expected to grow at the fastest CAGR in the global IoT in banking and financial services market during the forecast period.

Based on the application, the global IoT in banking and financial services market is divided into insurance and banking. Among these, the banking segment is expected to grow at the fastest CAGR in the global IoT in banking and financial services market during the forecast period. IoT solutions are being adopted by banks more often to boost their digital transformation initiatives. To improve client satisfaction, increase operational efficiency, and provide innovative services these devices are utilized in a variety of banking operations.

Regional Segment Analysis of the Global IoT in Banking and Financial Services Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the global IoT in banking and financial services market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the global IoT in banking and financial services market over the predicted timeframe. Rapid urbanization in Asia-Pacific is driving up demand for digital banking services. IoT technologies have become popular in countries like China, India, and Japan to meet the demands of a growing tech-savvy population. Governments in this region are promoting the deployment of IoT and smart technology. China's "Made in China 2025" policy, along with India's "Digital India" effort is encouraging financial institutions to utilize IoT that will improve efficiency and customer service.

North America is expected to grow at the fastest pace in the global IoT in banking and financial services market during the forecast period. This region is a pioneer in technological innovation and early adoption of Internet of Things technologies. Financial institutions in the United States are among the first to use advanced IoT technology to improve customer experience, security, and operational efficiency. U.S. banks and financial services firms are making significant investments in digital transformation initiatives that include IoT to remain competitive.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global IoT in banking and financial services market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Oracle Corporation

- Cisco Systems, Inc.

- Capgemini

- Qualcomm Technologies, Inc.

- Huawei Technologies Co., Ltd.

- Microsoft Corporation

- Infosys Limited

- Dell Technologies

- IBM Corporation

- TIBCO Software Inc.

- Intel Corporation

- Accenture

- Honeywell International Inc.

- Siemens AG

- SAP SE

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, Microsoft Corp. and Vodafone Group Plc announced a ten-year agreement with an investment of USD 1.5 billion to advance several commercial domains such as digital payments, artificial intelligence, and the Internet of Things.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global IoT in banking and financial services market based on the below-mentioned segments:

Global IoT in Banking and Financial Services Market, by Component

- Services

- Solutions

Global IoT in Banking and Financial Services Market, By Solution

- Data Management

- Security

- Monitoring

- Customer Experience Management

Global IoT in Banking and Financial Services Market, By Application

- Insurance

- Banking

Global IoT in Banking and Financial Services Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?Oracle Corporation, Cisco Systems, Inc., Capgemini, Qualcomm Technologies, Inc., Huawei Technologies Co, Ltd, Microsoft Corporation, Infosys Limited, Dell Technologies, IBM Corporation, TIBCO Software Inc., Intel Corporation, Accenture, Honeywell International Inc., Siemens AG, SAP SE, and Others.

-

2. What is the size of the global IoT in banking and financial services market?The Global IoT in banking and financial services Market is expected to grow from USD 1.27 Billion in 2023 to USD 38.52 Billion by 2033, at a CAGR of 40.67% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?Asia Pacific is anticipated to hold the largest share of the global IoT in banking and financial services market over the predicted timeframe.

Need help to buy this report?