Global Iron and Steel Market Size, Share, and COVID-19 Impact By Product (Flat Products, Long Products, Tubular Products, Semi-finished Products, Others), By Application (Building & Construction, Automotive & Transportation, Heavy Industry, Consumer Goods, Others), by Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032.

Industry: Chemicals & MaterialsGlobal Iron and Steel Market Insights Forecasts to 2032.

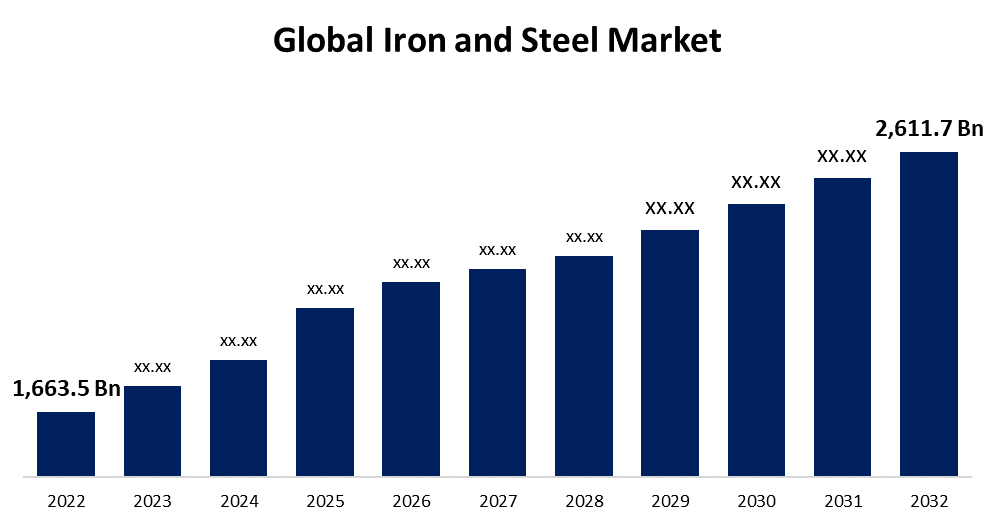

- The Iron and Steel Market Size was valued at USD 1,663.5 Billion in 2022.

- The Market Size is Growing at a CAGR of 4.6% from 2022 to 2032.

- The Worldwide Iron and Steel Market Size is expected to reach USD 2,611.7 Billion by 2032.

- Asia Pacific is expected To Grow the fastest during the forecast period.

Get more details on this report -

The Global Iron and Steel Market Size is expected to reach USD 2,611.7 Billion by 2032, at a CAGR of 4.6% during the forecast period 2022 to 2032.

Construction, automotive, infrastructure, and manufacturing are just a few of the industries that have a significant impact on the demand for iron and steel. Higher demand for steel goods is frequently a result of economic expansion in nations or areas. The availability of iron ore and other raw materials, as well as the steel mills' capacity for production, determine the supply. A small number of significant players, including businesses from China, India, Japan, and other nations, dominate the iron and steel market. These businesses run integrated steel mills where they are in charge of both the initial manufacturing of steel from iron ore and the production of iron from iron ore.

Impact of COVID-19 On Global Iron and Steel Market

Many nations imposed restrictions and other limitations during the pandemic's early phases to stop the virus from spreading. Due to this, the demand for steel in sectors including manufacturing, construction, and the automobile industry fell. A decrease in steel usage was caused, in part, by the closure of manufacturing facilities for cars and buildings. Global supply chains were interrupted by the epidemic, which had an impact on raw material availability and logistical issues. The movement of iron ore and other raw materials needed for steel manufacturing was hindered by transportation constraints, border closures, and manpower shortages in some areas. The pandemic's unpredictability intensified the price turbulence in the iron and steel market. Steel prices were impacted by rapidly shifting demand and supply dynamics, as well as currency swings and trade uncertainty. The pandemic brought home how crucial sustainability and environmental issues are. As part of their long-term objectives, certain steel companies stepped up their attempts to adopt greener technology and lessen their carbon impact.

Global Iron and Steel Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 1,663.5 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 4.6% |

| 2032 Value Projection: | USD 2,611.7 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Application, by Region, and COVID-19 Impact Analysis. |

| Companies covered:: | Bridon International Ltd., ArcelorMittal S.A., Tata Steel Ltd., N.V. Bekaert SA, Kobe Steel Ltd., Rio Tinto, Tree Island Industries Ltd., BHP, Insteel Industries Inc., Leggett & Platt Incorporated., Vale, Steel Authority of India Ltd. POSCO, and Other Key Venders. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Key Market Drivers

Due to the fact that iron and steel are utilized in the construction of buildings, bridges, roads, and other infrastructure projects, this sector is a significant consumer of these materials. Increased demand for construction materials may result from rapid urbanization and industrialization. Steel is extensively used in the automotive and manufacturing sectors to create a variety of products, including cars, machines, appliances, and more. These industries' demand may fuel market expansion for iron and steel. The demand for iron and steel tends to increase as nations become more urbanized and industrialized because of the increased need for consumer products, housing, and infrastructure. The iron and steel industry is a worldwide one, with manufacturing frequently taking place in one area while raw materials are acquired from another. The price of producing steel is significantly influenced by the cost and availability of raw materials like iron ore and coking coal. Dynamics of the market may be impacted by changes in these prices.

Key Market Challenges

The overcapacity problem—where the production capacity exceeds the demand—has frequently plagued the iron and steel sector. The profitability of businesses in the industry may be impacted by the resultant fierce global rivalry and pricing pressure. Energy-intensive processes that frequently result in the manufacturing of steel also produce other pollutants and greenhouse gases. Adopting cleaner and more sustainable production techniques is difficult because of the requirement to comply with stringent environmental rules and the industry's obligation to reduce its carbon footprint. Changes in the price of raw materials like iron ore and coking coal can affect how much it costs to make steel. Geopolitical considerations that affect the availability of these commodities or supply chain interruptions might pose problems for the sector.

Market Segmentation

Product Insights

Flat products segment holds the largest market share over the forecast period

On the basis of product, the global iron and steel market is segmented into Flat Products, Long Products, Tubular Products, Semi-finished Products, Others. Among these, flat products segment holds the largest market share over the forecast period. Products made of flat steel are frequently utilized in the construction industry, notably for building framework, roofing, and cladding. The demand for flat steel products has grown as infrastructure and urbanization projects have spread around the globe. Home appliances including refrigerators, ovens, and washing machines are made with flat steel items. The demand for these products has increased as a result of the expansion of the consumer goods market. For the production of automobile bodywork, chassis parts, and other parts, the automotive industry is a significant user of flat steel goods. Demand for superior, lightweight, and long-lasting flat steel products has increased as a result of the expansion of the automobile sector. International trade trends and market dynamics have an impact on the flat products market category.

Application Insights

Building and construction segment is dominating the market over the forecast period

Based on the application, the global iron and steel market is segmented into Building & Construction, Automotive & Transportation, Heavy Industry, Consumer Goods, Others. Among these, building and construction segment is dominating the market over the forecast period. Global urbanization is booming, which has boosted demand for infrastructure, housing, and new structures. Skyscrapers, bridges, roads, airports, and other critical infrastructure projects are built with steel. The need for residential and commercial space is driven by expanding populations, which boosts construction activity and the use of steel in structural elements. Commercial structures, industrial facilities, and warehouses frequently need roomy interiors and sturdy structural support. Steel is a great material because it can span a lot of space without requiring a lot of columns or supports. Steel demand in construction may rise as a result of public policies and private funding for infrastructure projects including ports, transportation networks, and urban redevelopment.

Regional Insights

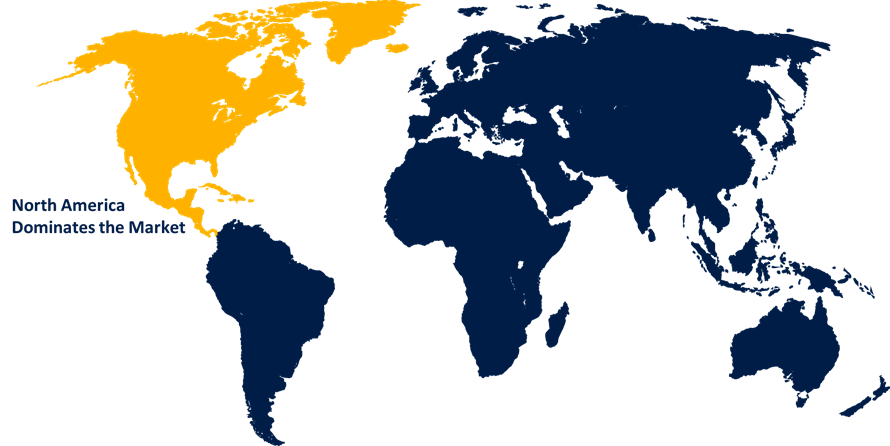

North America is dominating the market over the forecast period

Get more details on this report -

North America holds the largest market share and is dominating the market over the forecast period. In North America, the automotive industry is a big consumer of steel. Steel is used extensively throughout the manufacture of automobiles for a variety of pieces, including the body, chassis, and other structural elements. Steel is widely used in the construction business in North America for a variety of purposes, such as building structures, bridges, and infrastructure projects. Trends in urbanization and infrastructure development have an impact on the demand for steel products in the building industry. Like in other parts of the world, economic cycles can have an impact on the iron and steel market in North America. Changes in the economy and industrial activities might have an impact on the demand for steel goods.

Asia Pacific is witnessing the fastest market growth over the forecast period. China dominates the Asia-Pacific iron and steel market as both a producer and consumer of steel on a worldwide scale. Steel products are in high demand due to the nation's quick industrialization, urbanization, and construction boom. Asia-Pacific nations see active infrastructure development and building projects. The need for steel products is fueled by the need for homes, offices, and factories as well as for transportation systems. Asia-Pacific nations are well-known for their shipbuilding and industrial sectors, which use large amounts of steel for a variety of uses.

Recent Market Developments

- In April 2022, The World Steel Association has named Tata Steel Limited and Tata Steel Europe as the 2022 Steel Sustainability Champions.

- In November 2021, China Baowu Steel Group Corp. Ltd. announces the formation of a global alliance to reduce emissions and pollutants by lowering the level of crude steel manufacturing.

List of Key Companies

- Bridon International Ltd.

- ArcelorMittal S.A.

- Tata Steel Ltd.

- N.V. Bekaert SA

- Kobe Steel Ltd.

- Rio Tinto

- Tree Island Industries Ltd.

- BHP

- Insteel Industries Inc.

- Leggett & Platt Incorporated.

- Vale

- Steel Authority of India Ltd. POSCO

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global Iron and Steel Market based on the below-mentioned segments:

Iron and Steel Market, Product Analysis

- Flat Products

- Long Products

- Tubular Products

- Semi-finished Products

- Others

Iron and Steel Market, Application Analysis

- Building & Construction

- Automotive & Transportation

- Heavy Industry

- Consumer Goods

- Others

Iron and Steel Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the market size of Iron and Steel Market?The global Iron and Steel Market is expected to grow from USD 18.3 Billion in 2022 to USD 25.9 Billion by 2032, at a CAGR of 6.2% during the forecast period 2022-2032.

-

2.Who are the key market players of Iron and Steel Market?Some of the key market players of Bridon International Ltd., ArcelorMittal S.A., Tata Steel Ltd., N.V. Bekaert SA, Kobe Steel Ltd., Rio Tinto, Tree Island Industries Ltd., BHP, Insteel Industries Inc., Leggett & Platt Incorporated., Vale, Steel Authority of India Ltd. POSCO.

-

3.Which segment hold the largest market share?Building and construction segment holds the largest market share is going to continue its dominance.

-

4.Which region is dominating the Iron and Steel Market?North America is dominating the Iron and Steel Market with the highest market share.

Need help to buy this report?