Global Iron Oxide Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Natural, Synthetic), By Color (Red, Yellow, Black, Orange, Other Blends), By Application (Construction, Paper and Pulp Manufacturing, Paint & Coatings, Plastics, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Specialty & Fine ChemicalsGlobal Iron Oxide Market Insights Forecasts to 2033

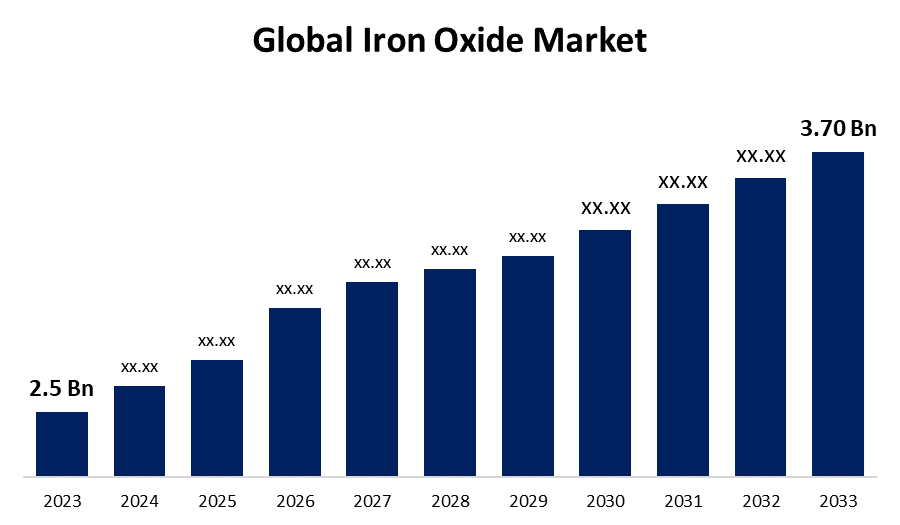

- The Global Iron Oxide Market Size was Valued at USD 2.5 Billion in 2023

- The Market Size is Growing at a CAGR of 4.00% from 2023 to 2033

- The Worldwide Iron Oxide Market Size is Expected to Reach USD 3.70 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Iron Oxide Market Size is Anticipated to Exceed USD 3.70 Billion by 2033, Growing at a CAGR of 4.00% from 2023 to 2033.

Market Overview

Iron oxide, also called ferric oxide is an inorganic compound with the chemical formula Fe2O3. It occurs abundantly and widely across nature. Iron oxide is essential to humans and helps in most geological and biological processes. It is one of the three principal oxides of iron, iron (II) oxide (FeO), and rare iron (II, and III) oxide (Fe3O4) that also occurs naturally as the mineral magnetite. Fe2O3, or hematite, is the principal source of iron for the steel industry and is easily damaged by acids. The rapidly expanding construction industry in emerging countries is likely to be the primary growth driver for the market during the projected period. Furthermore, the increasing use of iron oxide pigments in the coating industry, due to their excellent dispersibility and high strength, which make them suitable for use in various types of paints and coatings under extreme atmospheric and weather conditions, is expected to drive market growth over the forecast period.

Report Coverage

This research report categorizes the market for iron oxide market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the iron oxide market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the iron oxide market.

Global Iron Oxide Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.5 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.00% |

| 2033 Value Projection: | USD 3.70 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Color, By Application, By Region |

| Companies covered:: | Lanxess AG, BASF SE, Raveshia Group, Xinxiang Rongbo Pigment Science & Technology Co.Ltd, Huntsman International LLC, Cathey Industries, Golccha Pigments Pvt. Ltd., Tata Pigments Company, Toda Kogyo Corporation, Hunan Three-Ring Pigments Co.Ltd., Yaroslavsky Pigment Company, Jiangsu Yuxing Industry and Trade Co.Ltd., Shenghua Group Deqing Huayuan Pigment Co.Ltd., Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The iron oxide market is primarily driven by the construction industry's need for pigments in concrete, bricks, and tiles. Furthermore, the paints and coatings industry is significantly reliant on iron oxide for color and durability, owing to expansion in the construction and automotive industries. Iron oxide pigments are commonly utilized in a variety of plastic items, such as auto parts, fenders, soda bottles, food packaging, toys, and vinyl siding and serve as colorants and UV protection in the aforementioned products. Increased worldwide vehicle manufacturing, as well as a shift toward sustainable pigments, drive demand. Asia-Pacific, particularly China and India, is an important driver of market growth, driven by robust construction and infrastructure development.

Restraining Factors

The iron oxide market faces several restraining factors including fluctuating raw material costs, and competition from alternative pigments, which pose substantial hurdles. Market fragmentation among many firms, sluggish adoption of sustainable practices, and economic uncertainty all complicate the market landscape. Rising environmental concerns have resulted in the introduction of severe laws governing the manufacturing of iron oxides around the world. Effluents produced during the synthesis of iron oxides pose serious disposal issues for industries.

Market Segmentation

The iron oxide market share is classified into product type, color, and application.

- The synthetic segment is estimated to hold the highest market revenue share through the projected period.

Based on the product type, the iron oxide market is classified into natural and synthetic. Among these, the synthetic segment is estimated to hold the highest market revenue share through the projected period. This is related to their prominence over natural iron oxide pigments due to their great strength and stability. They are resistant to UV rays and all types of atmospheric conditions, thus they are utilized in a variety of applications such as coatings, plastics, paper, and construction. The coatings sector is the most common application for synthetic iron oxide pigments, particularly for exterior and industrial coatings where durability, stability, and anti-corrosion qualities are critical. Increasing demand for coatings from various industries, such as building and construction, oil and gas, is likely to have a favorable impact on the demand for synthetic iron oxide pigments over the forecast period.

- The red segment is anticipated to hold the largest market share through the forecast period.

Based on the color, the iron oxide market is divided into red, yellow, black, orange, and other blends. Among these, the red segment is anticipated to hold the largest market share through the forecast period. Red iron oxide is one of the most important minerals, utilized in a variety of applications including cement, concrete, pavers, blocks, flooring, roofing tiles, polymers, and rubber.

Red iron oxide is also used in glasses to provide red coloring and UV protection, which are essential for residential, commercial, automotive, and architectural applications. It is also used as a primer for wood and metal, as it forms a solid layer that prevents rust. Red iron oxide is used in the personal care and cosmetics industry to make lipsticks, blushes, eye shadows, lotions, soaps, creams, and powders in hues ranging from lighter red to pink. The rise of the building and cosmetics sectors is expected to increase the use of red iron oxide over the forecasting period.

- The construction segment dominates the market with the largest market share through the forecast period.

Based on the application, the iron oxide market is categorized into construction, paper and pulp manufacturing, paint & coatings, plastics, and others. Among these, the construction segment dominates the market with the largest market share through the forecast period. Iron oxide pigments are commonly used in the construction industry to add color and improve the visual appeal of a variety of materials, including concrete, bricks, tiles, pavers, and coatings. Rapid urbanization, population growth, and infrastructure development projects have contributed to the rising demand for the construction segment.

Regional Segment Analysis of the Iron Oxide Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the iron oxide market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the iron oxide market over the predicted timeframe. Asia's rapid growth in iron oxide consumption might be linked to several important factors fueling regional demand. Firstly, the construction industry, a significant user of iron oxide, is expanding rapidly across Asia region through urbanization, industrialization, and infrastructure development initiatives. The growing demand for housing, commercial spaces, and infrastructural facilities in countries such as China, India, and Southeast Asia drives the demand for iron oxide in building materials such as concrete, tiles, and paint. Furthermore, the expansion of Asia's automotive and manufacturing sectors drives demand for iron oxide, used in coatings, pigments, and manufacturing processes. The expanding middle-class population, increasing disposable income, and increased spending on construction all contribute to the growing demand for iron oxide-based products in diverse applications.

North America is expected to grow at the fastest CAGR growth of the iron oxide market during the forecast period. The iron oxide market in North America is predicted to grow rapidly with increased use in various sectors such as construction, paints and coatings, and polymers. USA Construction activity in the United States is continuously increasing, with the residential construction sector leading the way due to high demand for homes and a lack of housing inventory in the country. Furthermore, the United States government is increasing its investment in infrastructure development, which is likely to boost the country's building activity. Furthermore, paint and coating consumption in the United States is expanding with the rapid growth of several end-use industries such as automotive, marine, aerospace, and construction. The iron oxide market is expected to grow significantly over the forecast period as infrastructure modernization, construction activity, and the growing paints and coatings industry in the United States.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the iron oxide market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lanxess AG

- BASF SE

- Raveshia Group

- Xinxiang Rongbo Pigment Science & Technology Co.Ltd

- Huntsman International LLC

- Cathey Industries

- Golccha Pigments Pvt. Ltd.

- Tata Pigments Company

- Toda Kogyo Corporation

- Hunan Three-Ring Pigments Co.Ltd.

- Yaroslavsky Pigment Company

- Jiangsu Yuxing Industry and Trade Co.Ltd.

- Shenghua Group Deqing Huayuan Pigment Co.Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, LANXESS and IBU-tec advanced materials announced a groundbreaking research cooperation. The partnership aims to develop high-performance iron oxides for lithium iron phosphate (LFP) cathode materials, potentially increasing the capacities of batteries used in electric vehicles and stationary energy storage devices.

- In November 2022, CATHAY INDUSTRIES a prominent global maker of iron oxide pigments, has announced further expansion with a new iron oxide pigment plant in Batam, Indonesia.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the iron oxide market based on the below-mentioned segments:

Global Iron Oxide Market, By Product Type

- Natural

- Synthetic

Global Iron Oxide Market, By Color

- Red

- Yellow

- Black

- Orange

- Other Blends

Global Iron Oxide Market, By Application

- Construction

- Paper and Pulp Manufacturing

- Paint & Coatings

- Plastics

- Others

Global Iron Oxide Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the iron oxide market over the forecast period?The iron oxide market is projected to expand at a CAGR of 3.70% during the forecast period.

-

2.What is the market size of the iron oxide market?The Global Iron Oxide Market Size is Expected to Grow from USD 2.5 Billion in 2023 to USD 3.70 Billion by 2033, at a CAGR of 4.00% during the forecast period 2023-2033.

-

3.Which region holds the largest share of the iron oxide market?Asia Pacific is anticipated to hold the largest share of the iron oxide market over the predicted timeframe.

Need help to buy this report?