Global Iso-Butyl Acetate Market Size, Share, and COVID-19 Impact Analysis, By Grade (98% Purity, 99% Purity), By Application (Paints & Coatings, Personal Care & Cosmetics, Pharmaceuticals, Adhesives, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Specialty & Fine ChemicalsGlobal Iso-Butyl Acetate Market Insights Forecasts to 2033

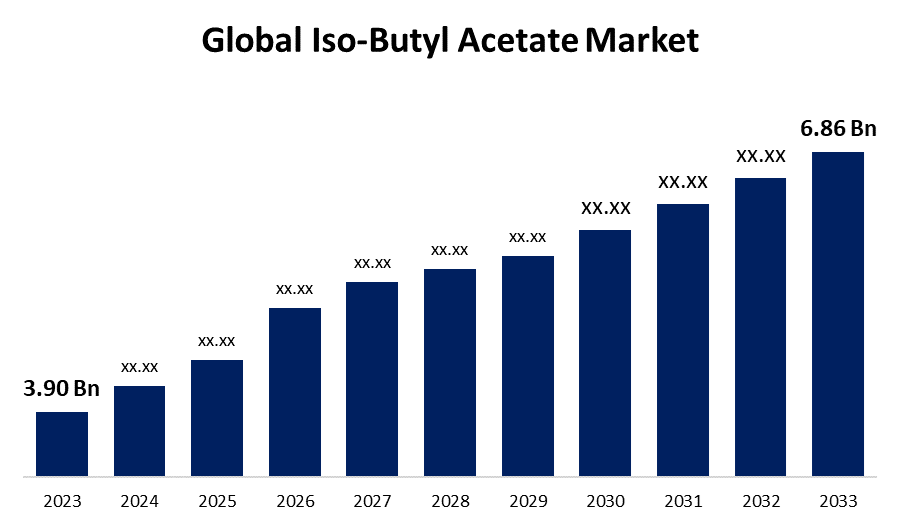

- The Global Iso-Butyl Acetate Market Size was Valued at USD 3.90 Billion in 2023

- The Market Size is Growing at a CAGR of 5.81% from 2023 to 2033

- The Worldwide Iso-Butyl Acetate Market Size is Expected to Reach USD 6.86 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Iso-Butyl Acetate Market Size is Anticipated to Exceed USD 6.86 Billion by 2033, Growing at a CAGR of 5.81% from 2023 to 2033.

Market Overview

Iso-butyl acetate is an inorganic compound with the molecular formula C6H12O2. It belongs to the ester group of compounds, specifically the acetate esters. Its structure consists of an iso-butyl group (a branched-chain alkyl derived from butane) attached to an acetate group (CH3COO-). Iso-butyl acetate is commonly used as a solvent in various industries, including paints, coatings, and adhesives. It is known for its fruity odor, similar to that of pears, and is sometimes used as a flavoring agent in foods and beverages. The market growth is mostly attributable to the rising demand for isobutyl acetate as a solvent in the paint and coatings sector. Isobutyl acetate has high solubility capabilities, making it an ideal constituent in different paint formulas.

Report Coverage

This research report categorizes the market for iso-butyl acetate market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the iso-butyl acetate market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the iso-butyl acetate market.

Global Iso-Butyl Acetate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.90 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.81% |

| 2033 Value Projection: | USD 6.86 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Grade, By Application, By Region |

| Companies covered:: | Eastman, Zhejiang Jianye Chemical Co., Ltd., Sahastraa Exports Pvt Ltd., Dow Chemical Company, Celanese Corporation, BASF, OXEA Chemicals, Comet Chemicals Company, Novasol Chemicals, NIPPON Paints, RPM Inc., AXALTA, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The iso-butyl acetate market is driven by several key factors that shape its dynamics and growth. Demand from industries such as coatings, adhesives, and pharmaceuticals plays a crucial role, influenced by economic growth and technological advancements in production. Raw material availability and prices, alongside competitive pressures and global trade policies, further influence market trends. Iso-butyl acetate is also preferred over other solvents in consumer items like paints and coatings due to its low toxicity and attractive fruity odor. Furthermore, with rising environmental laws aimed at lowering volatile organic compound (VOC) emissions, solvents with lower VOC concentrations, such as iso-butyl acetate, are becoming more popular. This regulatory environment promotes the demand for iso-butyl acetate market worldwide.

Restraining Factors

The iso-butyl acetate market faces several challenges that can hinder its growth. Factors such as fluctuating raw material prices, stringent environmental regulations, competition from alternative solvents, economic cycles affecting demand, and technological advancements impacting usage patterns all play significant roles. Additionally, geopolitical tensions and evolving consumer preferences towards sustainability further complicate market dynamics.

Market Segmentation

The iso-butyl acetate market share is classified into grade and application.

- The 99% purity segment is estimated to hold the highest market revenue share through the projected period.

Based on the grade, the iso-butyl acetate market is classified into 98% purity and 99% purity. Among these, the 99% purity segment is estimated to hold the highest market revenue share through the projected period. This segment is attributed to stringent quality standards in a variety of applications, including coatings, adhesives, and paints, where purity has a direct impact on performance and consistency. Manufacturers and customers alike favor the 99% purity segment for its higher quality and reliability, demonstrating its market leadership despite potential cost repercussions compared to lower purity alternatives.

- The paints & coatings segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the iso-butyl acetate market is divided into paints & coatings, personal care & cosmetics, pharmaceuticals, adhesives, and others. Among these, the paints & coatings segment is anticipated to hold the largest market share through the forecast period. The paints & purity segment is attributed to Its properties, including excellent solvency power, low volatility, and compatibility with different types of resins and polymers, make it an ideal choice for enhancing the performance and application characteristics of coatings. The paints & coatings industry benefits significantly from iso-butyl acetate's ability to contribute to the durability, gloss, adhesion, and drying speed of coatings used in architectural, automotive, industrial, and marine applications.

Regional Segment Analysis of the Iso-Butyl Acetate Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Aisa Pacific is anticipated to hold the largest share of the iso-butyl acetate market over the predicted timeframe.

Get more details on this report -

Aisa Pacific is anticipated to hold the largest share of the iso-butyl acetate market over the predicted timeframe. The Asia Pacific area is the most dominant market for isobutyl acetate due to increased production in China and India's adhesives and paints and coatings industries. Furthermore, government efforts to encourage the manufacturing of chemical products are important factors for market growth in this region. Rapid urbanization, infrastructural development, and increased automotive production drive up demand for paints and coatings, which are important users of iso-butyl acetate. Furthermore, the existence of significant manufacturing hubs, favorable government policies that promote industrial expansion, and a wide customer base all contribute to Asia Pacific's dominant position in the iso-butyl acetate market.

North America is expected to grow at the fastest CAGR growth of the iso-butyl acetate market during the forecast period. Strong economic conditions and ongoing infrastructure projects in the North American region have driven demand for iso-butyl acetate in industries such as paints, coatings, adhesives, and pharmaceuticals. Furthermore, technological developments and creativity in solvent applications are boosting the use of iso-butyl acetate in a variety of industrial processes. Furthermore, rigorous environmental rules encourage the use of eco-friendly solvents such as iso-butyl acetate, which drives up demand in North America. Additionally, investments in R&D to improve product performance and expand application areas are helping to drive market expansion in the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the iso-butyl acetate market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Eastman

- Zhejiang Jianye Chemical Co., Ltd.

- Sahastraa Exports Pvt Ltd.

- Dow Chemical Company

- Celanese Corporation

- BASF

- OXEA Chemicals

- Comet Chemicals Company

- Novasol Chemicals

- NIPPON Paints

- RPM Inc.

- AXALTA

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2024, Eastman Chemical Company announced a price increase of 0.06/lb (USD 0.13/kg) for isobutyl acetate ester in North America and Latin America.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the iso-butyl acetate market based on the below-mentioned segments:

Global Iso-Butyl Acetate Market, By Offer Grade

- 98% Purity

- 99% Purity

Global Iso-Butyl Acetate Market, By Application

- Paints & Coatings

- Personal Care & Cosmetics

- Pharmaceuticals

- Adhesives

- Others

Global Iso-Butyl Acetate Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the iso-butyl acetate market over the forecast period?The iso-butyl acetate market is projected to expand at a CAGR of 5.81% during the forecast period.

-

2.What is the market size of the iso-butyl acetate market?The Global Iso-Butyl Acetate Market Size is Expected to Grow from USD 3.90 Billion in 2023 to USD 6.86 Billion by 2033, at a CAGR of 5.81% during the forecast period 2023-2033.

-

3.Which region holds the largest share of the iso-butyl acetate market?Aisa Pacific is anticipated to hold the largest share of the iso-butyl acetate market over the predicted timeframe.

Need help to buy this report?