Global Isobutanol Market Size, Share, and COVID-19 Impact Analysis, By Type (Synthetic and Bio-based), By Application (Pharmaceuticals, Chemicals and Textiles, Paint and Coating, and Oil and Gas), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Specialty & Fine ChemicalsGlobal Isobutanol Market Insights Forecasts to 2033

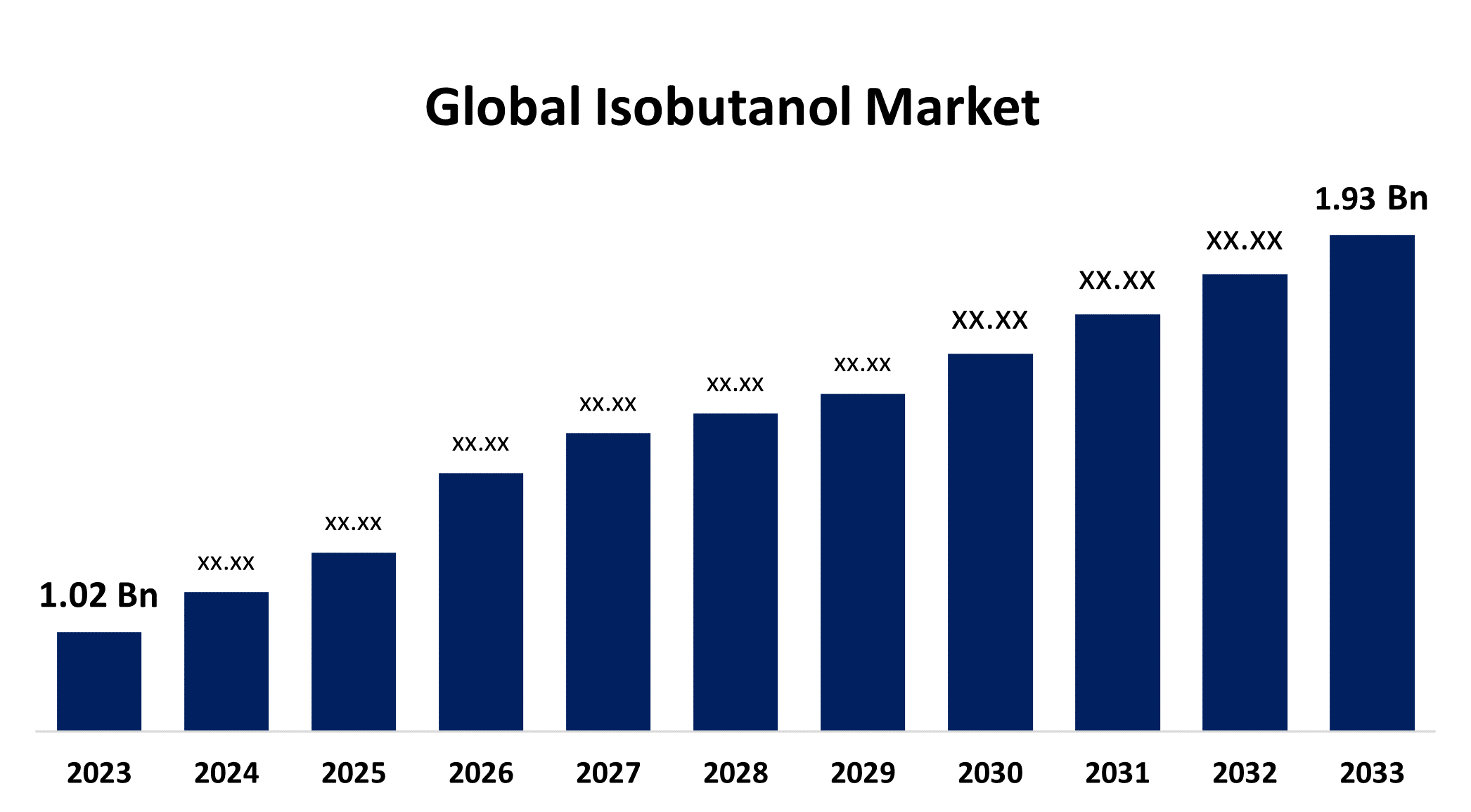

- The Global Isobutanol Market Size was Valued at USD 1.02 Billion in 2023

- The Market Size is Growing at a CAGR of 6.58 % from 2023 to 2033

- The Worldwide Isobutanol Market Size is Expected to Reach USD 1.93 Billion by 2033

- Latin America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Isobutanol Market Size is Anticipated to Exceed USD 1.93 Billion by 2033, Growing at a CAGR of 6.58 % from 2023 to 2033.

Market Overview

Iso butanol, an alcohol in its primary form and organic molecule, with the chemical formula (CH3)2CHCH2OH. It is a colorless, flammable liquid with a distinctive sweet, musty odor that is utilized primarily in agricultural chemical preparations. It is insoluble in water but is highly soluble in other solvents such as ethers and alcohol. Isobutanol is highly flammable, with a flash point of 26-29º C. It has characteristics equivalent to n-butyl alcohol and could be used as a supplement or alternative in a wide range of applications. Isobutanol, a solvent, is frequently utilized to decrease viscosity in a variety of formulations while additionally improving leveling and flow. It is commonly used as a solvent, solubilizer, cumulative, extractive agent, additive, and intermediate in a variety of end-use sectors such as coatings and paints, oil and gas, medicines, textiles, chemicals, and others. Coatings can be utilized for a wide range of applications, including industrial servicing, shipping, transportation, can and coil, and wood. The global isobutanol market is being propagated by increased automotive manufacturing and exports, increasing coating utilization in woodworking and marine applications, and the textile industry's continuous expansion. In addition, increased isobutanol usage in the manufacturing of antibiotics, vitamins, and camphor, as well as the worldwide growth of the pharma and medical industries, are expected to drive isobutanol demand throughout the forecast period. In January 2023, an organization of researchers from the University of Queensland, in partnership with the Technical University of Munich, disclosed their creation of a unique technique to convert sugarcane into isobutanol.

Report Coverage

This research report categorizes the market for the global isobutanol market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global isobutanol market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global isobutanol market.

Global Isobutanol Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 1.02 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.58 % |

| 2033 Value Projection: | USD 1.93 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 208 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | LyondellBasell Industries N.V., Formosa Plastics Corporation, Braskem S.A., Sinopec, Sibur Holding PJSC, China National Petroleum Corporation, Repsol S.A., YNCC, TotalEnergies, Ineos Group Holdings S.A., Mitsubishi Chemical Holdings Corporation, Oq Chemicals Gmbh, Petronas Chemicals Group Berhad, Sasol Limited, The Andhra Petrochemicals Limited, The Dow Chemical Company, ExxonMobil, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Isobutanol is added to petroleum fuels to prevent knocking. This isobutanol-based fuel could replace gasoline, which is destroying the environment. Isobutanol biofuel is environmentally benign, which can propel the isobutanol industry forward. Isobutanol is an essential component of coatings and solvents used in the building materials and construction sectors. Building and construction operations are expanding rapidly over the world as the global population grows. The market for isobutanol is being driven by rising expenditure in building and construction activities. Isobutyl acetate is becoming more widely accepted in several consumer product industries, including food manufacturing and lacquer. These are some of the factors responsible for the rising demand of the global isobutanol market during the forecast period.

Restraining Factors

Polypropylene, a common raw material used in the production of isobutanol, is obtained from crude oil. As a result, fluctuations in crude oil prices have a negative impact on the price of isobutanol raw materials.

Market Segmentation

The global isobutanol market share is classified into type and application.

- The synthetic segment dominates the market during the forecast period.

Based on the type, the global isobutanol market is classified into synthetic and bio-based. Among these segments, the synthetic segment dominates the market during the forecast period. Synthetic isobutanol has long been the dominant source of isobutanol production, accounting for a sizable portion of the total market. Its broad use across industries, combined with well-established production methods and infrastructure, has solidified its market leadership. Chemical, automotive, and paint & coating industries primarily depend on synthetic isobutanol due to its continuous accessibility and quality.

- The chemicals and textiles segment is anticipated to hold the largest market share during the forecast period.

Based on the application, the global isobutanol market is classified into pharmaceuticals, chemicals and textiles, paint and coating, and oil and gas. Among these segments, the chemicals and textiles segment is anticipated to hold the largest market share during the forecast period. Isobutanol is used extensively as a chemical intermediary and solvent in a variety of industries. It is commonly utilized in the manufacture of isobutyl acetate, isobutyl methacrylate, and other compounds. Isobutane’s adaptability and importance in these industries' production processes have strengthened its position as the market's dominating segment. Isobutanol can be used as a solubilizer in the textile sector, such as an additive in spinning baths or a carrier for coloring polymers. These are some of the factors responsible for increased demand in the global isobutanol market.

Regional Segment Analysis of the Global Isobutanol Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

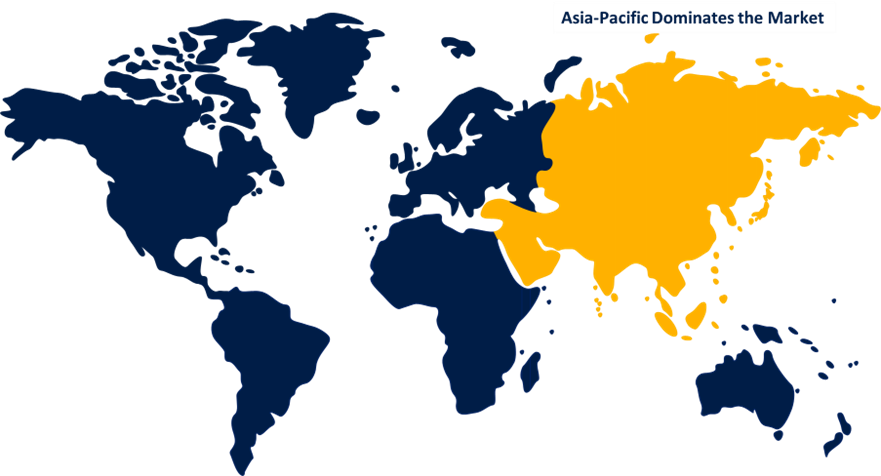

Asia-Pacific is projected to hold the largest share of the global isobutanol market over the forecast period.

Get more details on this report -

Asia-Pacific is projected to hold the largest share of the global isobutanol market over the forecast period. The Asia Pacific region dominates the market due to its blooming industrial and commercial activities. The region includes countries such as China, India, and South Korea are big manipulators of isobutanol for their increasing automotive, construction, and chemical industries. Moreover, the region's growing population and rising disposable incomes drive up demand for pharmaceuticals, paints, coatings, and other isobutanol applications. Furthermore, favorable government regulations, industrial expansion, and technical advancements in the Asia-Pacific region contribute to this segment's dominance in the worldwide isobutanol market. The strong base of industrialization, rising pharmaceuticals, and a strong base of major players in the market have enhanced the dominance of this region over the forecast period.

Latin America is expected to grow at the fastest pace in the global isobutanol market during the forecast period. Isobutanol use in the region is widely accepted across a wide range of applications. Improved industrialization, suburbanization, and infrastructure development are driving demand for paints and coatings, chemicals, and automotive components in Latin America. Additionally, the region's importance on using sustainable and bio-based alternatives drives up demand for bio-based isobutanol.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global isobutanol market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- LyondellBasell Industries N.V.

- Formosa Plastics Corporation

- Braskem S.A.

- Sinopec

- Sibur Holding PJSC

- China National Petroleum Corporation

- Repsol S.A.

- YNCC

- TotalEnergies

- Ineos Group Holdings S.A.

- Mitsubishi Chemical Holdings Corporation

- Oq Chemicals Gmbh

- Petronas Chemicals Group Berhad

- Sasol Limited

- The Andhra Petrochemicals Limited

- The Dow Chemical Company

- ExxonMobil

- Others

Key Market Developments

- In February 2023, Axens and Praj signed a memorandum of understanding to collaborate on projects in India for the generation of sustainable aviation fuel from low-carbon alcohols using the alcohol-to-jet (AJT) pathway.

- In May 2021, OQ Chemicals GmbH announced the completion of its carboxylic acid unit in Oberhausen, Germany. The facility aims to bolster OQ Chemicals' position as a major supplier of isobutyric acid and other chemical intermediates.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global isobutanol market based on the below-mentioned segments:

Global Isobutanol Market, By Type

- Synthetic

- Bio-based

Global Isobutanol Market, By Application

- Pharmaceuticals

- Chemicals and Textiles

- Paint and Coating

- Oil and Gas

Global Isobutanol Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the global isobutanol market over the forecast period?The global isobutanol market size is expected to grow from USD 1.02 billion in 2023 to USD 1.93 billion by 2033, at a CAGR of 6.58% during the forecast period 2023-2033.

-

2.Which region is expected to hold the highest share in the global isobutanol market?Asia-Pacific is projected to hold the largest share of the global isobutanol market over the forecast period.

-

3.Who are the top key players in the isobutanol market?LyondellBasell Industries N.V, Formosa Plastics Corporation, Braskem S.A., Sinopec, Sibur Holding PJSC, China National Petroleum Corporation, Repsol S.A., YNCC, TotalEnergies, Ineos Group Holdings S.A., Mitsubishi Chemical Holdings Corporation, Oq Chemicals Gmbh, Petronas Chemicals Group Berhad, Sasol Limited, The Andhra Petrochemicals Limited, The Dow Chemical Company, ExxonMobil, Others.

Need help to buy this report?