Italy Ceramic Tiles Market Size, Share, and COVID-19 Impact Analysis, By Application (Wall Tiles, Floor Tiles, and Others), By End-use (Residential and Commercial), and Italy Ceramic Tiles Market Insights, Industry Trend, Forecasts to 2033

Industry: Advanced MaterialsItaly Ceramic Tiles Market Insights Forecasts to 2033

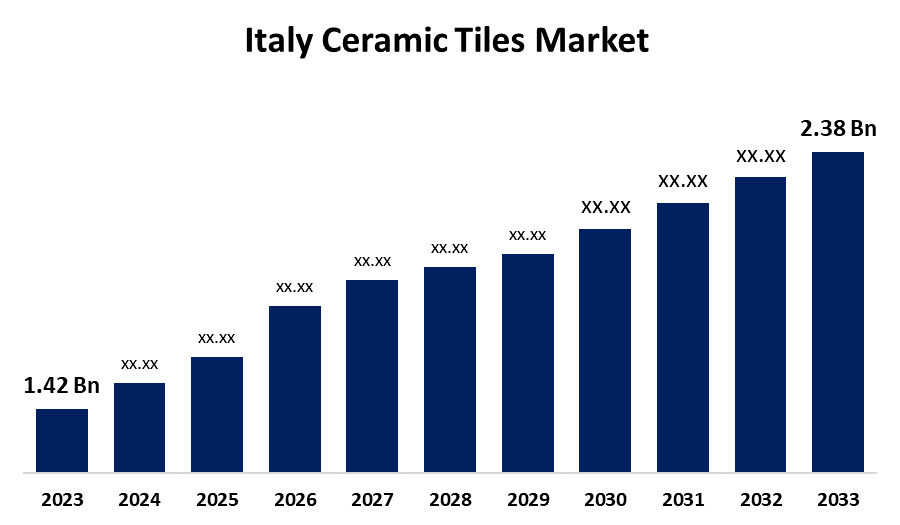

- The Italy Ceramic Tiles Market Size was valued at USD 1.42 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.3% from 2023 to 2033

- The Italy Ceramic Tiles Market Size is Expected to Reach USD 2.38 Billion by 2033

Get more details on this report -

The Italy Ceramic Tiles Market Size is Anticipated to Reach USD 2.38 Billion by 2033, Growing at a CAGR of 5.3% from 2023 to 2033

Market Overview

Ceramic tiles are made of clays and other natural materials like sand, quartz, and water. They are commonly used as bathroom wall and kitchen floor surfaces in homes, restaurants, offices, and shops, among other places. They are easy to install, clean, and maintain, and are reasonably priced. Ceramics have good strength and can withstand high temperatures and acids, but they are brittle and weak in tension and shearing. Floor tiles, pipes, bricks, cookware, tableware, sanitary ware, pottery products, gas and fire radiants, kiln linings, glass and steel crucibles, knife blades, vehicle disc brakes, watch cases, and biomedical implants are all examples of applications. The growth of the Italian ceramic tile industry has been largely driven by technological changes that include process invention, adoption, and diffusion of new techniques in the sector. The fact that skilled workers and salespeople move around frequently has also aided the growth of the Italian ceramic tile industry. A number of key trends are driving significant growth in the market. The growing demand for three-dimensional (3D) tiles, which have distinct textures and designs, is propelling market growth. Also, the ongoing renovation and construction of buildings in Italy, particularly in urban areas, is driving market growth.

Report Coverage

This research report categorizes for the Italy ceramic tiles market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Italy ceramic market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Italy ceramic market.

Italy Ceramic Tiles Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 1.42 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.3% |

| 2033 Value Projection: | USD 2.38 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 167 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Application, By End-use |

| Companies covered:: | Gruppo Concorde, Marazzi, Iris Ceramica Group, Panariagroup Industrie Ceramiche S.p.A., Florim, Casalgrande Padana S.p.A, Ceramica Faetano S.p.A. - Del Conca, Gresmalt Group, Gruppo Romani S.p.A. Industrie Ceramiche, Abk Group Industrie Ceramiche S.P.A., Rondine S.p.A., Onetile.it, Cooperativa Ceramica dImola, Gruppo Ceramiche Ricchetti Spa, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The expansion of the construction industry in developing countries is one of the market drivers. Governments are increasing their investments in infrastructure for national public welfare. The expansion of public recreation areas, schools, hospitals, and public transportation has resulted in increased product consumption. The government's increased spending on improving public places such as train stations and airports to meet premium standards has resulted in an increase in demand. This improves the visual appearance of the infrastructure. Also, developing countries will benefit from rapid industrialization and increased commercial building construction during the forecast period. Aditionally, urbanization is regarded as a major driver of building material consumption. In recent years, the population has grown at an exponential rate. Governments in various countries are collaborating with private firms to improve residential infrastructure in order to provide housing for the growing population.

Restraining Factors

The market faces challenges due to fluctuations in raw material prices for ceramic tiles, which can have an impact on manufacturers' cost competitiveness.

Market Segmentation

The Italy ceramic tiles market share is classified into application and end-use

- The floor tiles segment is expected to hold the largest market share through the forecast period.

The Italy ceramic tiles market is segmented by application into wall tiles, floor tiles, and others. Among these, floor tiles segment is expected to hold the largest market share through the forecast period. Consumers are rapidly shifting away from traditional marble and stone floors and toward low-cost, maintenance-free ceramic tiles. Ceramic tiles are stain-resistant and keep their appearance for a longer time. Technological advancements, such as improved digital printing processes, are helping to drive industry demand.

- The commercial segment is expected to dominate the Italy ceramic tiles market during the forecast period.

Based on the end-use, the Italy ceramic tiles market is divided into residential, and commercial. Among these, the commercial segment is expected to dominate the Italy ceramic tiles market during the forecast period. Rising demand for highly durable and cost-effective ceramic flooring for high-traffic commercial and industrial applications is expected to drive industry growth during the forecast period. The introduction of new products and simple installation techniques has significantly accelerated the growth of the ceramic tile industry.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Italy ceramic tiles market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Gruppo Concorde

- Marazzi

- Iris Ceramica Group

- Panariagroup Industrie Ceramiche S.p.A.

- Florim

- Casalgrande Padana S.p.A

- Ceramica Faetano S.p.A. - Del Conca

- Gresmalt Group

- Gruppo Romani S.p.A. Industrie Ceramiche

- Abk Group Industrie Ceramiche S.P.A.

- Rondine S.p.A.

- Onetile.it

- Cooperativa Ceramica dImola

- Gruppo Ceramiche Ricchetti Spa

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2022, Confindustria Ceramica, the Italian ceramic manufacturer's association, and BKRI, the German organization of raw material producers for ceramics and industrial minerals, signed a Memorandum of Understanding in Munich. This agreement calls for an increase in mineral flows to the Italian ceramic industry of up to 10% by the end of August and up to 30% by December 2022.

Market Segment

This study forecasts revenue at Italy, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Italy ceramic tiles market based on the below-mentioned segments:

Italy Used Car Market, By Application

- Wall tiles

- Floor tiles

- Others

Italy Used Car Market, By End-use

- Residential

- Commercial

Need help to buy this report?