Italy Cold Chain Logistics Market Size, Share, and COVID-19 Impact Analysis, By Type (Refrigerated Warehouses and Refrigerated Transportation), By Application (Fruits & Vegetables, Fish, Meat, & Seafood, Dairy & Frozen Desserts, Bakery & confectionery, Processed Food, Pharmaceuticals, and Others), and Italy Cold Chain Logistics Market Insights, Industry Trend, Forecasts to 2033.

Industry: Automotive & TransportationItaly Cold Chain Logistics Market Insights Forecasts to 2033

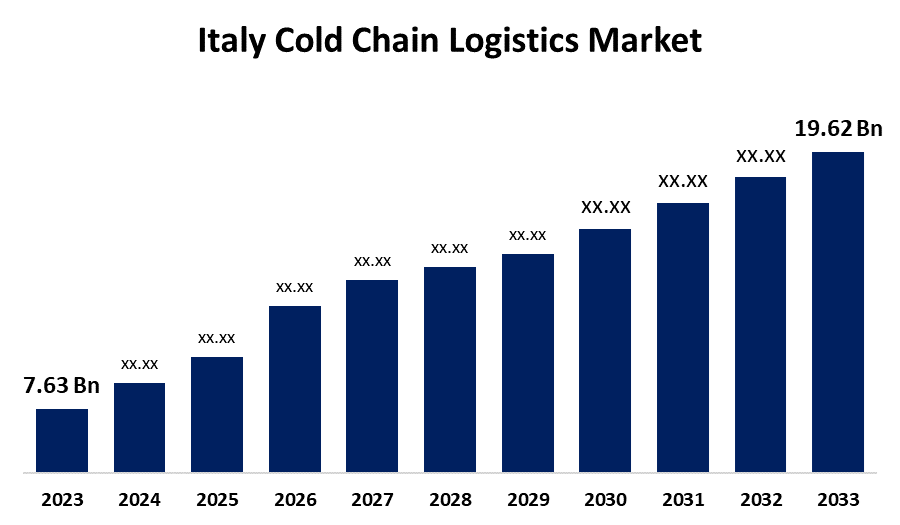

- The Italy Cold Chain Logistics Market Size was valued at USD 7.63 Billion in 2023.

- The Market is Growing at a CAGR of 9.9% from 2023 to 2033

- The Italy Cold Chain Logistics Market Size is Expected to Reach USD 19.62 Billion by 2033

Get more details on this report -

The Italy Cold Chain Logistics Market is Anticipated to Reach USD 19.62 Billion by 2033, growing at a CAGR of 9.9% from 2023 to 2033.

Market Overview

Cold chain logistics is the handling and transportation of temperature-sensitive products in a temperature-controlled environment. Perishable goods, such as food and pharmaceuticals, must be stored, handled, and distributed within specific temperature ranges in order to maintain product quality and safety. The Italy cold chain logistics market is an important part of the country's supply chain infrastructure, ensuring the safe and efficient transport and storage of temperature-sensitive goods. Cold chain logistics is critical in industries like food and pharmaceuticals, ensuring product quality and compliance with strict regulatory requirements. This market's expansion is being driven by rising demand for perishable goods, globalization of supply chains, and the need for advanced cold storage and transportation solutions. The Italy cold chain logistics market is expanding due to the growing importance of preserving the integrity of perishable products throughout the supply chain. Investments in advanced cold storage facilities, refrigerated transportation, and regulatory compliance are critical to the market's success.

Report Coverage

This research report categorizes for the Italy cold chain logistics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Italy cold chain logistics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Italy cold chain logistics market.

Italy Cold Chain Logistics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 7.63 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 9.9% |

| 2033 Value Projection: | USD 7.63 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Bomi Group, Safim Logistics, Frigocaserta SRL, Eurofrigo Vernate SRL, Frigoscandia SPA, DRS Depositi Regionali Surgelati SRL, Frigogel SRL, Soluzioni Logistiche Freddo SRL In Breve SL Freddo SRL, Sodele Magazzini Generali Frigoriferi SRL, Horigel SRL, Fridocks General Warehouses and Frigoriferi SRL, and Others key vendors, |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Italy is a major player in the market, and its exhibit combines tradition, volume, and quality. The most advanced technology for processing milk has made it a popular beverage (fresh, UHT, LSL), suitable for specific diets, and accessible to consumers with intolerances. Also, the pharmaceutical chain logistics industry is a massive and complex enterprise. The cold chain logistics industry requires coordinated handling protocols, precise transport equipment, and strict regulatory compliance. Pharmaceutical medications have evolved to contain more high-value active chemicals with a shorter shelf life and stricter temperature requirements, increasing the demand for temperature control and monitoring across the entire supply chain process in Italy cold chain logistics market.

Restraining Factors

The cold chain market, which is critical for preserving perishable goods such as food and pharmaceuticals, faces significant challenges due to high energy costs and the large capital investments required.

Market Segmentation

The Italy cold chain logistics market share is classified into type and application

- The refrigerated warehouses segment is expected to hold the largest market share through the forecast period.

The Italy cold chain logistics market is segmented by type into refrigerated warehouses and refrigerated transportation. Among these, the refrigerated warehouses segment is expected to hold the largest market share through the forecast period. Consumers' dietary habits and lifestyles are changing, driving up demand for frozen foods. This is expected to boost demand for refrigerated warehouses in the Italy cold chain logistic market.

- The dairy & frozen desserts segment is expected to dominate the Italy cold chain logistics market during the forecast period.

Based on the application, the Italy cold chain logistics market is divided into fruits & vegetables, fish, meat, & seafood, dairy & frozen desserts, bakery & confectionery, processed food, pharmaceuticals, and others. Among these, the dairy & frozen desserts segment is expected to dominate the Italy cold chain logistics market during the forecast period. This is attributable to the increasing demand for animal protein products such as cheese, and milk in Italy.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Italy cold chain logistics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bomi Group

- Safim Logistics

- Frigocaserta SRL

- Eurofrigo Vernate SRL

- Frigoscandia SPA

- DRS Depositi Regionali Surgelati SRL

- Frigogel SRL

- Soluzioni Logistiche Freddo SRL In Breve SL Freddo SRL

- Sodele Magazzini Generali Frigoriferi SRL

- Horigel SRL

- Fridocks General Warehouses and Frigoriferi SRL

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2022, Bomi Group, a multinational leader in integrated logistics operating in the healthcare sector, announced the acquisition of Tendron Pharma by its French branch, a division of Tendron Transports, an independent company founded in 1963 dedicated to pharmaceutical product transportation.

Market Segment

This study forecasts revenue at Italy, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Italy cold chain logistics market based on the below-mentioned segments:

Italy Cold Chain Logistics Market, By Type

- Refrigerated Warehouses

- Refrigerated Transportation

Italy Cold Chain Logistics Market, By Application

- Fruits & Vegetables

- Fish

- Meat, & Seafood

- Dairy & Frozen Desserts

- Bakery & confectionery

- Processed Food

- Pharmaceuticals

- Others

Need help to buy this report?