Italy E-bike Market Size, Share, and COVID-19 Impact Analysis, By Propulsion Type (Pedal Assist and Throttle), By Battery Type (Lead Acid, Lithium-ion, Nickel Metal Hydride, and Others), and Italy E-bike Market Insights, Industry Trend, Forecasts to 2033

Industry: Automotive & TransportationItaly E-bike Market Insights Forecasts to 2033

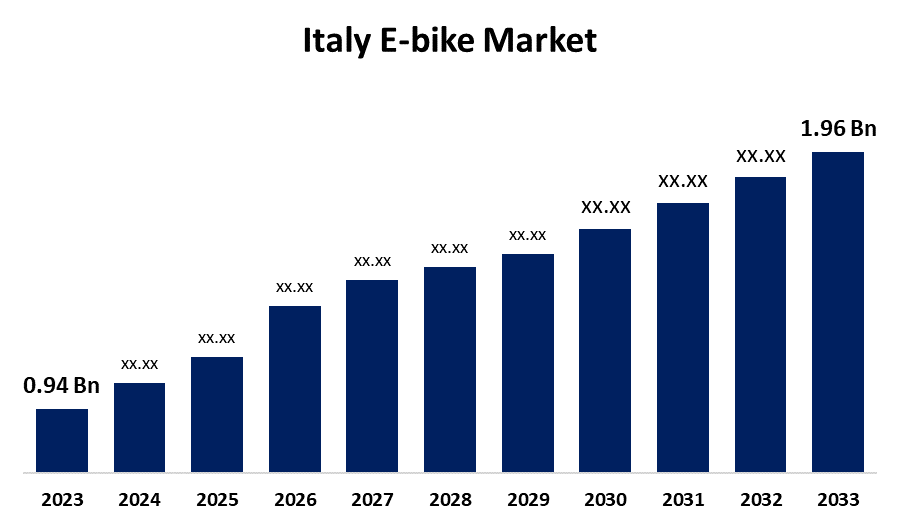

- The Italy E-bike Market Size was valued at USD 0.94 Billion in 2023

- The Market is Growing at a CAGR of 7.62% from 2023 to 2033

- The Italy E-bike Market Size is Expected to Reach USD 1.96 Billion by 2033

Get more details on this report -

The Italy E-bike Market Size is Anticipated to Reach USD 1.96 Billion by 2033, Growing at a CAGR of 7.62% from 2023 to 2033.

Market Overview

An electric bike is a bicycle equipped with a motor and rechargeable batteries to assist the rider and relieve some of the strain of pedaling. These bikes are intended to assist or augment the rider's pedaling power, offering varying levels of electric assistance to make cycling more accessible, particularly in difficult terrain or over long distances. The pedal-assist e-bike is the most popular type of electric bicycle. They supplement the rider's pedaling effort, providing an extra boost when necessary. Throttle-controlled e-bikes can be powered solely by an electric motor, with a motorcycle-style throttle. Increased fuel costs due to supply shortages are expected to drive the electric bike market forward. Italy is a leading region in Europe's e-bike market. Innovative product features, fully integrated batteries and drives, appealing designs, and high-quality materials are all major drivers of sales in the Italian e-bike market. The market is also being driven by a growing recognition of the importance of taking action to reduce personal vehicle usage, transition to zero-emission vehicles, and decarbonize the freight industry and public transportation. Italy's government and citizens are expected to shift to electric vehicles as gasoline prices rise and people become more environmentally conscious. The speed pedelec will soon overtake the pedal-assisted bicycle as the most practical mode of transportation, even if it is best suited for shorter trips. Speed pedelecs will likely gain popularity as power and speed capabilities improve.

Report Coverage

This research report categorizes for the Italy e-bike market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Italy e-bike market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Italy e-bike market.

Italy E-bike Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 0.94 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.62% |

| 2033 Value Projection: | USD 1.96 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 191 |

| Tables, Charts & Figures: | 103 |

| Segments covered: | By Propulsion Type, By Battery Type and COVID-19 Impact Analysis. |

| Companies covered:: | Askoll EVA SpA, Atala SpA, Atala SpA (Whistle), BOTTECCHIA CICLI SRL, CICLI LOMBARDO SpA, Colnago Ernesto & C SRL, DECATHLON (B-Twin), Fabbrica Italiana Velocipedi Edoardo Bianchi SpA (Bianchi), Giant Manufacturing Co. Ltd., Merida Industry Co. Ltd., Trek Bicycle Corporation, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

While city populations grow, new investments are being made in high-speed intracity public transportation networks such as metros and BRTS systems to meet the growing demand for efficient transit options. This mode of transportation provides economy, comfort, and speed, significantly increasing urban mobility. One common subject with these systems is first- and last-mile mobility, which occurs when commuters struggle to reach their final destinations from transit hubs. Micromobility solutions, particularly e-bikes, are critical for bridging the gap. Electric bikes benefit public transportation by offering convenient and adaptable short-distance mobility options. As cities improve their transit systems, the demand for e-bikes increases.

Restraining Factors

E-bikes have been shown to allow more people to ride their bicycles for longer distances, despite difficult terrain, physical limitations, and the presence of cargo. However, due to high purchase costs, overall e-bike adoption remains low.

Market Segmentation

The Italy e-bike market share is classified into product and glass type

- The pedal assist segment is expected to hold the largest market share through the forecast period.

The Italy e-bike market is segmented by propulsion type into pedal assist and throttle. Among these, the pedal assist segment is expected to hold the largest market share through the forecast period. The dominance is attributed to several benefits offered by this propulsion type such as lower servicing needs and enhanced battery life. In addition, it offers users the ability to choose from three to five pedal assist modes, depending on the model.

- The lithium- ion segment is expected to dominate the Italy e-bike market during the forecast period.

Based on the battery type, the Italy e-bike market is divided into lead acid, lithium-ion, nickel metal hydride, and others. Among these, the lithium-ion segment is expected to dominate the Italy e-bike market during the forecast period. Lithium-ion batteries are the most popular and efficient type of battery for e-bikes, accounting for the majority of the market. It has the optimal balance of total weight and capacity. They provide higher efficiency batteries with adequate capacity. Lithium-ion batteries have twice the voltage and triple the capacity of lead-acid batteries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Italy e-bike market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Askoll EVA SpA

- Atala SpA

- Atala SpA (Whistle)

- BOTTECCHIA CICLI SRL

- CICLI LOMBARDO SpA

- Colnago Ernesto & C SRL

- DECATHLON (B-Twin)

- Fabbrica Italiana Velocipedi Edoardo Bianchi SpA (Bianchi)

- Giant Manufacturing Co. Ltd.

- Merida Industry Co. Ltd.

- Trek Bicycle Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In December 2022, The B-twin Elops LD500E e-bike launches for urban rides with a range of 115 kilometers. The Decathlon Elops LD500E e-bike has been launched in European countries, including France and Germany

Market Segment

This study forecasts revenue at Italy, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Italy e-bike market based on the below-mentioned segments:

Italy E-bike Market, By Propulsion Type

- Pedal Assist

- Throttle

Italy E-bike Market, By Battery Type

- Lead Acid

- Lithium-ion

- Nickel Metal Hydride

- Others

Need help to buy this report?