Italy Freight and Logistics Market Size, Share, and COVID-19 Impact Analysis, By Functions (Freight Forwarding, Courier, Value Added Services, Last Mile Logistics, Freight Transport, Warehousing, Express, Parcel, Cold Chain Logistics, Return Logistics, and Others), By End Users (Oil & Gas, Agriculture, Forestry, Automotive, Construction, Quarrying, Fishing, Manufacturing, Distributive Trade, and Others), and Italy Freight and Logistics Market Insights, Industry Trend, Forecasts to 2033.

Industry: Automotive & TransportationItaly Freight and Logistics Market Insights Forecasts to 2033

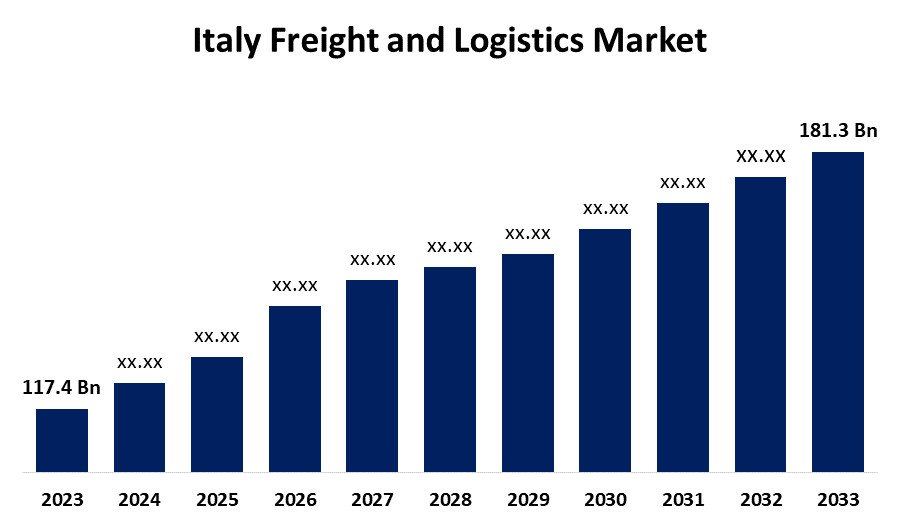

- The Italy Freight and Logistics Market Size was valued at USD 117.4 Billion in 2023.

- The Market is Growing at a CAGR of 4.44% from 2023 to 2033

- The Italy Freight and Logistics Market Size is Expected to Reach USD 181.3 Billion by 2033

Get more details on this report -

The Italy Freight and Logistics Market is Anticipated to Reach USD 181.3 Billion by 2033, growing at a CAGR of 4.44% from 2023 to 2033.

Market Overview

Freight and logistics refer to the process of transporting goods and commodities by road, rail, airplane, large vessel, and truck. It provides a variety of services, including warehousing, contract logistics, value-added services, and logistics solutions for complex supply chains. The cost-effectiveness of operations lies in their management and oversight. It aids in the negotiation of terms and conditions as well as rates for the transportation of goods. It also ensures that all necessary insurances are in place to protect goods while in transit. It is constantly looking for new ways to improve delivery performance while reducing environmental impact and saving time and money. The expansion of the freight and logistics industries demonstrates Italy's commitment to improving its transportation infrastructure. The Italian government's National Recovery and Resilience Plan initiative. This investment is critical for modernizing and expanding the current infrastructure, which includes ports, highways, and bridges. These advancements increase Italy's appeal to both domestic and foreign businesses by shortening transit times, improving efficiency, and lowering logistics costs, which will boost the Italy freight and logistics market.

Report Coverage

This research report categorizes for the Italy freight and logistics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Italy freight and logistics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Italy freight and logistics market.

Italy Freight and Logistics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 117.4 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.44% |

| 2033 Value Projection: | USD 181.3 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Functions, By End Users |

| Companies covered:: | Kuehne + Nagel, Arcese Group, DB Schenker, DHL Group, DSV A/S (De Sammensluttede Vognmænd af Air and Sea), FedEx, Fercam, GRUBER Logistics, Italsempione, Italtrans, Savino Del Bene SpA, Transmec Group, United Parcel Service of America, Inc. (UPS), and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increase in global trade has been the primary driving force behind the growth of the freight and logistics markets. People use the freight and logistics industry for a variety of reasons, including quick delivery and a continuous supply chain. The increase in infrastructure and construction is one of the primary reasons for the freight and logistics market's value growth. The advancements in e-commerce and digital marketing resulted in some changes that increased their market value. These changes were implemented with the consumer's needs and expectations in mind. They offer fast delivery, free shipping, and competitive pricing. All of this paved the way for the expansion of the freight and logistics market.

Restraining Factors

Rising pollution levels are major challenges that may limit the market growth of freight and logistics market during the forecast period.

Market Segmentation

The Italy freight and logistics market share is classified into functions and end users

- The freight transport segment is expected to hold the largest market share through the forecast period.

The Italy freight and logistics market is segmented by functions into freight forwarding, courier, value added services, last mile logistics, freight transport, warehousing, express, parcel, cold chain logistics, return logistics, and others. Among these, freight transport segment is expected to hold the largest market share through the forecast period. Access to databases and resources increases storage capacity while saving valuable time, are the reasons of freight transport segments growth.

- The manufacturing segment is expected to dominate the Italy freight and logistics market during the forecast period.

Based on the end users, the Italy freight and logistics market is divided into oil & gas, agriculture, forestry, automotive, construction, quarrying, fishing, manufacturing, distributive trade, and others. Among these, the manufacturing segment is expected to dominate the Italy freight and logistics market during the forecast period, Due to the need, goods and services must be produced at the appropriate time, place, and quantity.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Italy freight and logistics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Kuehne + Nagel

- Arcese Group

- DB Schenker

- DHL Group

- DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- FedEx

- Fercam

- GRUBER Logistics

- Italsempione

- Italtrans

- Savino Del Bene SpA

- Transmec Group

- United Parcel Service of America, Inc. (UPS)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, Kuehne+Nagel has announced its Book & Claim in setting solution for electric vehicles. Kuehne+Nagel is the first logistics service provider to implement this solution, which was previously limited to low-emission fuels.

Market Segment

This study forecasts revenue at Italy, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Italy freight and logistics market based on the below-mentioned segments:

Italy Freight and Logistics Market, By Functions

- Freight Forwarding, Courier

- Value Added Services

- Last Mile Logistics

- Freight Transport

- Warehousing

- Express

- Parcel

- Cold Chain Logistics

- Return Logistics

- Others

Italy Freight and Logistics Market, By End Users

- Oil & Gas

- Agriculture

- Forestry

- Automotive

- Construction

- Quarrying

- Fishing

- Manufacturing

- Distributive Trade

- Others

Need help to buy this report?