Italy Used Car Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Hybrid, Conventional, and Electric), By Vendor Type (Organized and Unorganized), and Italy Used Car Market Insights, Industry Trend, Forecasts to 2033

Industry: Automotive & TransportationItaly Used Car Market Insights Forecasts to 2033

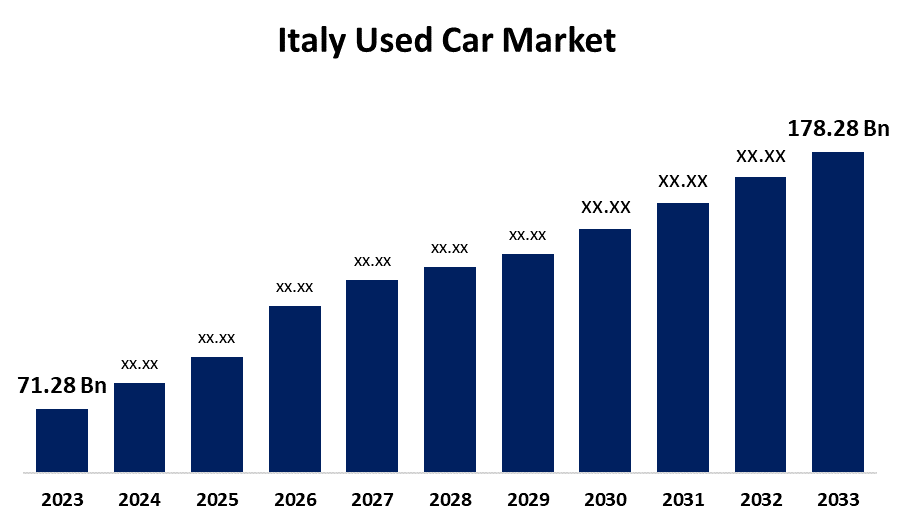

- The Italy Used Car Market Size was valued at USD 71.28 Billion in 2023.

- The Market Size is Growing at a CAGR of 9.6% from 2023 to 2033

- The Italy Used Car Market Size is Expected to Reach USD 178.28 Billion by 2033

Get more details on this report -

The Italy Used Car Market Size is Anticipated to Reach USD 5.38 Billion by 2033, Growing at a CAGR of 4.3% from 2023 to 2033

Market Overview

A used car also referred to as a pre-owned vehicle, has had one or more previous owners. These cars are sold through a variety of channels, including dealerships, online platforms, and private sellers. Compared to new vehicles, used cars are typically less expensive, making them an appealing option for budget-conscious consumers. The used car market in Italy has grown significantly in recent years, owing to factors such as increased consumer demand, a growing preference for low-cost transportation options, and the availability of a diverse range of models and brands. As a result, the market has become extremely competitive, with numerous players competing for a larger market share. The demand for used cars has increased due to shifting consumer preferences. More people are choosing pre-owned vehicles to save money without sacrificing quality. This demand is also fueled by a growing interest in sustainable consumption, as purchasing a used car is frequently regarded as an environmentally friendly alternative. Also, economic uncertainty motivates consumers to seek out more affordable transportation options. The used car market has enormous potential for growth, particularly through digital transformation. Online marketplaces and mobile apps give buyers more options and make transactions more transparent.

Report Coverage

This research report categorizes for the Italy used car market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Italy used car market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Italy used car market.

Italy Used Car Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 71.28 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 9.6% |

| 2033 Value Projection: | USD 178.28 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 155 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Vehicle Type, By Vendor Type |

| Companies covered:: | Penske Automotive Italy, Italy Blue Auto Sales LLC, CAVAUTO Group, Auto1.Com, Carvago, Denicar FCA, GoodBuyAuto, TrueCar Inc., Autoquattro Srl., Schiatti Group, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

One of the primary factors driving the expansion of the used car market is the rising demand for affordable vehicles. As new car prices rise due to inflation and rising production costs, more consumers are turning to used cars as a more affordable option. This shift in purchasing behavior is benefiting the market. Advances in technology have increased vehicle reliability and lifespan, making used cars a more appealing option for buyers. Customers are now more confident in purchasing pre-owned vehicles that will perform reliably for years. This has greatly increased the popularity of used cars. Another factor driving growth is the increased use of digital platforms. Online marketplaces and mobile apps have made the buying and selling experience more transparent and convenient. Consumers can now easily compare prices, look up vehicle histories, and complete transactions remotely.

Restraining Factors

One of the major impediments to the growth of the used car market is the high maintenance cost associated with older vehicles. As cars age, they often require more frequent repairs and part replacements, which can put off potential buyers.

Market Segmentation

The Italy used car market share is classified into vehicle type and vendor type

- The conventional segment is expected to hold the largest market share through the forecast period.

The Italy used car market is segmented by vehicle type into hybrid, conventional, and electric. Among these, the conventional segment is expected to hold the largest market share through the forecast period. Conventional gasoline vehicles with a large inventory provide numerous options at a reasonable price. This segment of vehicles had the highest share in all sizes, including compact, mid-size, and SUV cars. Also, growing concerns about climate change and rising pollution have created a high demand for an alternative to traditional gasoline vehicles. As a result, the market has grown significantly due to the popularity of electric used cars.

- The organized segment is expected to dominate the Italy used car market during the forecast period.

Based on the vendor type, the Italy used car market is divided into organized and unorganized. Among these, the organized segment is expected to dominate the Italy used car market during the forecast period. This is attributed to the growing number of franchised dealers in the market. The market's growth has been fueled by the entry of new players and the introduction of new retail models.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Italy used car market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Penske Automotive Italy

- Italy Blue Auto Sales LLC

- CAVAUTO Group

- Auto1.Com

- Carvago

- Denicar FCA

- GoodBuyAuto

- TrueCar Inc.

- Autoquattro Srl.

- Schiatti Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Italy, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Italy used car market based on the below-mentioned segments:

Italy Used Car Market, By Vehicle Type

- Hybrid

- Conventional

- Electric

Italy Used Car Market, By Vendor Type

- Organized

- Unorganized

Need help to buy this report?