Japan Adhesives Market Size, Share, and COVID-19 Impact Analysis, By Technology (Hot Melt, Reactive, Solvent-Borne, UV Cured Adhesives, and Water-Borne), By End User (Aerospace, Automotive, Building & Construction, Footwear & Leather, Healthcare, Packaging, Woodworking & Joinery, and Others), and Japan Adhesives Market Insights, Industry Trend, Forecasts to 2033

Industry: Chemicals & MaterialsJapan Adhesives Market Insights Forecasts to 2033

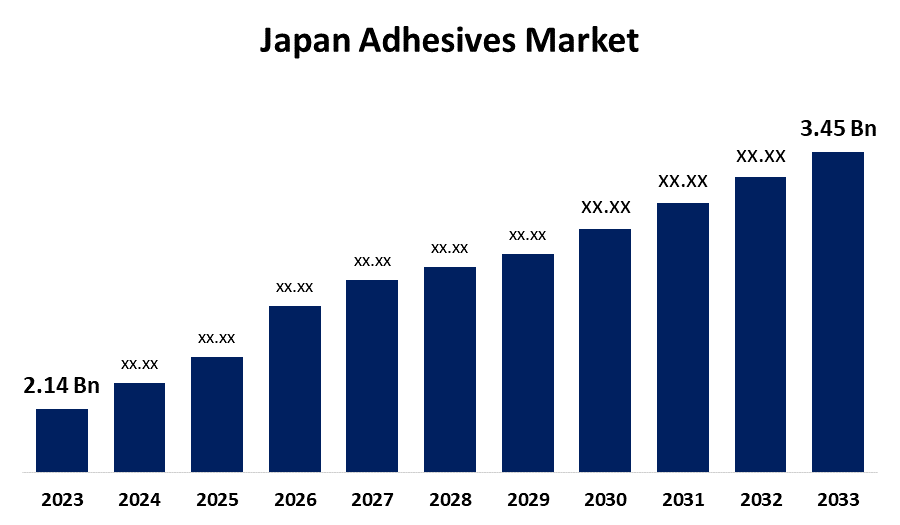

- The Japan Adhesives Market Size was valued at USD 2.14 Billion in 2023.

- The Market is growing at a CAGR of 4.89% from 2023 to 2033

- The Japan Adhesives Market Size is expected to reach USD 3.45 Billion by 2033

Get more details on this report -

The Japan Adhesives Market is anticipated to exceed USD 3.45 Billion by 2033, growing at a CAGR of 4.89% from 2023 to 2033. The growing demand from the medical field, use in packaging, building & construction, and automotive applications, as well as the adoption of new technologies, are driving the growth of the adhesives market in the Japan.

Market Overview

Adhesives are used in many stages of the production process, from the preparation of raw materials to the final assembly of paper and packaging goods. To ensure the strength and stability of corrugated boards, adhesives are utilized to firmly join the various layers together. The superior bonding qualities of these adhesive formulations allow for the effective assembly of packaging components while preserving resilience to temperature and humidity variations. Because they are essential for bonding plastics, metals, and paper and cardboard packaging applications, adhesives are mostly used in the nation's packaging sector. Further, in the construction sector, including waterproofing, weather-sealing, crack-sealing, and bonding, adhesives are frequently employed. They are frequently employed in the car sector as adhesives may be applied to surfaces including glass, metal, plastic, and painted surfaces. They are used in engines and automotive gaskets because of their beneficial qualities, which include great weather resistance, durability, and long-lastingness.

Report Coverage

This research report categorizes the market for the Japan adhesives market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan adhesives market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan adhesives market.

Japan Adhesives Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.14 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.89% |

| 2033 Value Projection: | USD 3.45 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 187 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Technology, By End User |

| Companies covered:: | Aica Kogyo Co..Ltd., 3M, Arkema Group, H.B. Fuller Company, Oshika, CEMEDINE Co.,Ltd., Henkel AG & Co. KGaA, Sika AG, TOYOCHEM CO., LTD., THE YOKOHAMA RUBBER CO., LTD., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

In the medical field, adhesives are employed in tasks including joining components of medical devices. The demand is anticipated to rise in response to the increase in healthcare investments. Based on the factors influencing adhesive use in packaging, building and construction, and automotive applications, as well as the adoption of new technologies and the reduction of curing time, are responsible for driving the adhesives market.

Restraining Factors

The emergence and use of substitute adhesive technology including welding and mechanical fasteners are limiting the market growth. Further, price fluctuations for raw materials, including petrochemicals, can affect businesses' profit margins and costs of manufacturing.

Market Segmentation

The Japan Adhesives Market share is classified into technology and end user.

- The reactive segment dominated the Japan adhesives market during the forecast period.

The Japan adhesives market is segmented by technology into hot melt, reactive, solvent-borne, UV cured adhesives, and water-borne. Among these, the reactive segment dominated the Japan adhesives market during the forecast period. As reactive adhesive material is less sensitive to pressure, it is perfect for usage in computers, blood-glucose meters, and cell phones. The excellent and durable bond of the reactive adhesives in the event of temperature changes and extreme moisture as well as the rising need for high-tech devices is responsible for driving the market.

- The building & construction segment dominates the Japan adhesives market with the largest market share during the forecast period.

Based on the end user, the Japan adhesives market is divided into aerospace, automotive, building & construction, footwear & leather, healthcare, packaging, woodworking & joinery, and others. Among these, the building & construction segment dominates the Japan adhesives market with the largest market share during the forecast period. The building and construction industry mostly relies on these materials for application in insulation, panel bonding, and structural bonding, starting with flooring and roofing. The ongoing development of urban infrastructure and buildings is driving the market expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan adhesives market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aica Kogyo Co..Ltd.

- 3M

- Arkema Group

- H.B. Fuller Company

- Oshika

- CEMEDINE Co.,Ltd.

- Henkel AG & Co. KGaA

- Sika AG

- TOYOCHEM CO., LTD.

- THE YOKOHAMA RUBBER CO., LTD.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In December 2021, As part of the 'Responsibly for Hygiene' programme, Bostik, the adhesive solutions division of Arkema, announced the launch of NuplavivaTM, a new range of adhesive solutions formulated with renewable content.

- In November 2021, The Yokohama Rubber Co. Ltd. completed the sale of its sealing and adhesive materials business, Hamatite, to Swiss-based specialty chemicals company Sika Group.

- In October 2021, 3M announced its next generation of the 3M Scotch-Weld Structural Acrylic Adhesives portfolio, which includes the following new products: 3M Scotch-Weld Low Odor Acrylic Adhesive 8700NS Series, 3M Scotch-Weld Flexible Acrylic Adhesive 8600NS Series and 3M Scotch-Weld Nylon Bonder Structural Adhesive DP8910NS.

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Japan Adhesives Market based on the below-mentioned segments:

Japan Adhesives Market, By Technology

- Hot Melt

- Reactive

- Solvent-Borne

- UV Cured Adhesives

- Water-Borne

Japan Adhesives Market, By End User

- Aerospace

- Automotive

- Building & Construction

- Footwear & Leather

- Healthcare

- Packaging

- Woodworking & Joinery

- Others

Need help to buy this report?